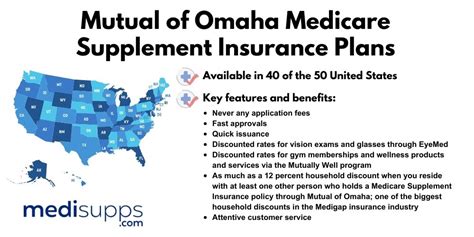

Insurance Mutual Of Omaha

Mutual of Omaha is a well-known insurance company with a rich history and a strong presence in the industry. With a focus on providing comprehensive insurance solutions, Mutual of Omaha has earned a reputation for reliability and customer satisfaction. In this in-depth article, we will explore the various aspects of Mutual of Omaha's insurance offerings, their impact on the industry, and their commitment to serving policyholders. By delving into their products, services, and unique features, we aim to provide valuable insights for those seeking to understand the world of insurance and make informed decisions.

A Legacy of Service: The History of Mutual of Omaha

Mutual of Omaha’s journey began in 1909, founded by J.A. “Gus” Grigsby and C.C. Crestin. From its humble beginnings in Omaha, Nebraska, the company has grown into a nationally recognized insurer. Over the past century, Mutual of Omaha has weathered economic shifts and evolved with the changing landscape of the insurance industry, always prioritizing the needs of its policyholders.

One of the key strengths of Mutual of Omaha lies in its diverse product portfolio. The company offers a wide range of insurance solutions, catering to individuals, families, and businesses. From life insurance and health insurance to long-term care and disability coverage, Mutual of Omaha strives to provide comprehensive protection for its clients.

In recent years, Mutual of Omaha has expanded its reach and influence, acquiring several other insurance companies and strengthening its position in the market. This strategic growth has allowed the company to offer an even broader array of services and gain a deeper understanding of the diverse needs of its customers.

Key Milestones in Mutual of Omaha’s Journey

Throughout its history, Mutual of Omaha has achieved numerous milestones, solidifying its reputation as a trusted insurer. Here are some notable achievements:

- 1926: Mutual of Omaha introduced its first group insurance policy, a groundbreaking move that expanded access to coverage for employees and their families.

- 1947: The company launched its first Medicare supplement insurance plan, providing crucial support to seniors during a time when healthcare options were limited.

- 1977: Mutual of Omaha entered the international market, offering insurance solutions to expatriates and global businesses, thus expanding its reach beyond the United States.

- 2010: The company celebrated its 100th anniversary, a testament to its enduring commitment to serving policyholders and adapting to the changing insurance landscape.

The Comprehensive Insurance Portfolio: What Mutual of Omaha Offers

Mutual of Omaha’s insurance portfolio is designed to cater to a wide range of needs, ensuring that individuals and businesses can find tailored solutions. Here’s an overview of their key insurance offerings:

Life Insurance

Mutual of Omaha offers a comprehensive range of life insurance policies, including term life, whole life, and universal life insurance. These policies provide financial protection for policyholders and their beneficiaries, ensuring peace of mind during uncertain times.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specific term, typically 10, 20, or 30 years, with flexible premium options. |

| Whole Life Insurance | Provides lifetime coverage with fixed premiums and cash value accumulation over time. |

| Universal Life Insurance | Offers flexibility in premium payments and coverage amounts, allowing policyholders to adjust their policies based on changing needs. |

Health Insurance

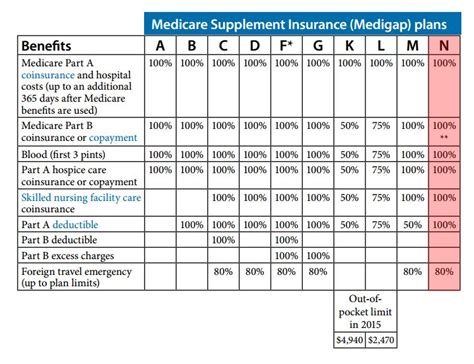

Mutual of Omaha’s health insurance plans focus on providing accessible and affordable healthcare coverage. Their plans include individual and family health insurance, Medicare supplement insurance, and dental and vision plans.

Additionally, Mutual of Omaha offers critical illness insurance, which provides a lump-sum benefit upon the diagnosis of specified critical illnesses, helping policyholders cover the costs of treatment and manage financial burdens.

Long-Term Care Insurance

Recognizing the growing need for long-term care, Mutual of Omaha offers policies that provide coverage for extended care services, including nursing home care, assisted living, and home health care. These policies aim to alleviate the financial strain often associated with long-term care needs.

Disability Insurance

Mutual of Omaha’s disability insurance policies protect individuals from the financial impact of an unexpected disability. These policies provide income replacement, ensuring policyholders can maintain their standard of living even if they are unable to work due to an injury or illness.

Mutual of Omaha’s Unique Approach: Customer-Centric Services

Mutual of Omaha sets itself apart by adopting a customer-centric approach. The company understands that insurance is not a one-size-fits-all solution, and it strives to provide personalized experiences for each policyholder.

One of the unique features of Mutual of Omaha is its focus on education and financial literacy. The company offers resources and tools to help policyholders understand their insurance options and make informed decisions. Through educational webinars, articles, and personalized guidance, Mutual of Omaha empowers its customers to navigate the complex world of insurance with confidence.

Digital Innovation and Convenience

In today’s digital age, Mutual of Omaha recognizes the importance of technology in enhancing the customer experience. The company has invested in developing user-friendly online platforms and mobile applications, allowing policyholders to manage their policies, make payments, and access their insurance information conveniently from anywhere.

The Mutual of Omaha mobile app, for instance, offers features such as policy management, claim tracking, and access to digital ID cards, ensuring policyholders have instant access to their insurance details when needed.

Community Engagement and Giving Back

Beyond its insurance offerings, Mutual of Omaha is committed to making a positive impact on the communities it serves. The company actively engages in philanthropic initiatives, supporting causes that align with its values and the needs of its policyholders.

Mutual of Omaha's corporate social responsibility efforts focus on education, healthcare, and community development. Through partnerships with local organizations and charitable initiatives, the company strives to create a lasting positive change in the lives of those it serves.

The Future of Insurance: Mutual of Omaha’s Innovation and Growth

As the insurance industry continues to evolve, Mutual of Omaha remains at the forefront, embracing innovation and adapting to changing consumer needs. The company’s commitment to research and development ensures that its products and services remain relevant and competitive in the market.

Expanding Digital Capabilities

Mutual of Omaha recognizes the importance of digital transformation in the insurance industry. The company is continuously enhancing its digital infrastructure, investing in cutting-edge technology, and leveraging data analytics to improve customer experiences and streamline processes.

By embracing digital tools, Mutual of Omaha aims to provide policyholders with efficient and convenient access to their insurance information, allowing them to make informed decisions and manage their policies with ease.

Diversifying Product Offerings

In response to the evolving needs of its customers, Mutual of Omaha is actively expanding its product portfolio. The company is exploring new insurance solutions, such as cyber insurance, pet insurance, and travel insurance, to cater to the diverse lifestyles and risks faced by individuals and businesses today.

By diversifying its offerings, Mutual of Omaha aims to become a one-stop shop for all insurance needs, providing comprehensive coverage and peace of mind to its policyholders.

Collaborative Partnerships

Mutual of Omaha understands the value of collaboration and has established strategic partnerships with other industry leaders. These partnerships allow the company to leverage expertise, share resources, and enhance its ability to serve customers effectively.

Through collaborative efforts, Mutual of Omaha can offer its policyholders access to a wider range of services and specialized insurance solutions, ensuring that their needs are met with the highest level of expertise and support.

Conclusion: A Trusted Companion in the Insurance Journey

Mutual of Omaha’s rich history, comprehensive insurance portfolio, and customer-centric approach have solidified its position as a trusted insurer. With a focus on education, innovation, and community engagement, the company continues to thrive in a highly competitive industry.

Whether it's protecting families through life insurance policies, supporting seniors with Medicare supplement plans, or providing financial security through disability coverage, Mutual of Omaha strives to be a reliable companion throughout the insurance journey. Its commitment to excellence and its dedication to serving policyholders make it a preferred choice for those seeking comprehensive insurance solutions.

How can I find the best insurance plan for my specific needs?

+Finding the right insurance plan requires careful consideration of your unique circumstances. Start by assessing your needs, whether it’s protecting your family’s financial future, ensuring access to quality healthcare, or covering long-term care expenses. Research different insurance providers, compare their offerings, and seek advice from insurance professionals. Mutual of Omaha, with its comprehensive portfolio, can offer tailored solutions to meet your specific requirements.

What sets Mutual of Omaha apart from other insurance companies?

+Mutual of Omaha stands out for its customer-centric approach, dedication to education and financial literacy, and its commitment to innovation. The company’s focus on personalized experiences and its diverse product offerings make it a trusted partner for individuals and businesses seeking comprehensive insurance solutions. Its history of community engagement and giving back further solidifies its reputation as a responsible and caring insurer.

How can I access my insurance policy information and manage my account with Mutual of Omaha?

+Mutual of Omaha offers convenient online and mobile access to your insurance policy information. You can log in to your account through their user-friendly website or mobile app. From there, you can view policy details, make payments, track claims, and access digital ID cards. These digital tools provide efficient and secure access to your insurance information, ensuring you have the necessary details at your fingertips when needed.