Cheapest Insurance Health

In today's world, finding affordable and comprehensive health insurance is a top priority for many individuals and families. With rising healthcare costs, it's essential to explore options that offer the best value for money. This article aims to delve into the realm of affordable health insurance, uncovering the secrets to securing the cheapest yet effective coverage.

Understanding the Basics of Health Insurance

Health insurance is a vital aspect of modern life, providing financial protection against the high costs of medical care. It is a contract between an individual and an insurance company, where the insurer agrees to cover a portion of the policyholder’s medical expenses in exchange for regular premium payments.

The affordability of health insurance is determined by various factors, including the policy's premium, deductibles, copayments, and the overall coverage provided. It is crucial to strike a balance between cost and coverage to ensure adequate protection without straining your budget.

Factors Affecting Health Insurance Costs

Several elements contribute to the overall cost of health insurance. Understanding these factors can help you make informed decisions when choosing a plan.

- Age: Generally, younger individuals tend to pay lower premiums as they are considered less risky. However, this varies with the insurance provider and the specific plan.

- Tobacco Usage: Smoking or using tobacco products often leads to higher premiums due to increased health risks.

- Geographic Location: Health insurance costs can vary significantly based on your state or region, influenced by factors like healthcare costs in the area and the local population’s health needs.

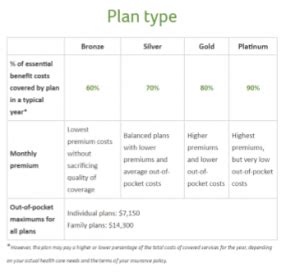

- Plan Type: Different types of health insurance plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), offer varying levels of coverage and come with different price tags.

- Deductibles and Copayments: Plans with higher deductibles (the amount you pay before insurance coverage kicks in) often have lower premiums. Copayments, the fixed amount you pay for services, also impact the overall cost.

- Family Size: The number of family members covered by the insurance plan affects the premium, as more individuals mean higher potential costs for the insurer.

Strategies to Find the Cheapest Health Insurance

Securing the cheapest health insurance requires a combination of research, understanding your needs, and negotiating skills. Here are some strategies to help you find the most affordable coverage:

1. Shop Around and Compare Plans

Don’t settle for the first insurance plan you come across. Take the time to explore various options from different providers. Compare premiums, deductibles, and the scope of coverage to identify the most cost-effective plan for your needs.

| Insurance Provider | Premium (Monthly) | Deductible | Coverage Highlights |

|---|---|---|---|

| Provider A | $350 | $1,500 | Comprehensive coverage, including mental health services |

| Provider B | $280 | $2,000 | Focuses on primary care and preventive services |

| Provider C | $320 | $1,000 | Specializes in chronic disease management |

Consider using online comparison tools or consulting insurance brokers who can provide personalized recommendations based on your circumstances.

2. Explore Government-Subsidized Options

In many countries, governments offer subsidies or programs to make health insurance more affordable, especially for low-income individuals and families. These programs often provide quality coverage at reduced costs.

For instance, in the United States, the Affordable Care Act (ACA) offers financial assistance to eligible individuals through the Health Insurance Marketplace. This assistance can significantly lower the cost of premiums, making insurance more accessible.

3. Utilize Employer-Provided Insurance

If you are employed, check if your employer offers health insurance benefits. Many companies provide insurance plans as part of their employee benefits package. These plans are often more affordable due to group rates and may include additional perks or discounts.

4. Opt for High-Deductible Plans with an HSA

High-deductible health plans (HDHPs) often come with lower premiums. To make the most of these plans, consider opening a Health Savings Account (HSA). HSAs allow you to save pre-tax dollars to cover eligible medical expenses, providing a tax-efficient way to manage your healthcare costs.

5. Negotiate and Ask for Discounts

Don’t hesitate to negotiate with insurance providers. Many companies offer discounts for various reasons, such as loyalty, good health, or even for paying annually instead of monthly. Ask about available discounts and see if you qualify for any.

6. Consider Short-Term or Catastrophic Plans

If you’re generally healthy and only need insurance for unexpected emergencies, short-term or catastrophic health insurance plans can be a cost-effective option. These plans provide coverage for major medical events but may have limited benefits for routine care.

Maximizing the Value of Your Health Insurance

Once you’ve secured affordable health insurance, it’s essential to make the most of your coverage. Here are some tips to optimize your insurance plan:

1. Understand Your Plan’s Coverage

Take the time to thoroughly read and understand your insurance policy. Know what services are covered, any limitations or exclusions, and the process for claiming reimbursements. This knowledge will help you make informed decisions about your healthcare.

2. Choose In-Network Providers

When selecting healthcare providers, opt for those who are in your insurance plan’s network. In-network providers have negotiated rates with the insurance company, often resulting in lower out-of-pocket costs for you.

3. Take Advantage of Preventive Care

Many health insurance plans cover preventive care services, such as annual check-ups, vaccinations, and screenings, at no additional cost. Make use of these services to stay on top of your health and catch potential issues early, which can save you money in the long run.

4. Manage Chronic Conditions Effectively

If you have a chronic condition, work closely with your healthcare providers to manage it effectively. Proper management can help prevent complications and reduce the need for costly emergency treatments.

5. Stay Informed about Plan Changes

Insurance providers may make changes to their plans annually, so stay updated. Review any changes to your plan’s coverage, premiums, or deductibles to ensure you’re still getting the best value for your money.

The Future of Affordable Health Insurance

The landscape of health insurance is constantly evolving, driven by advancements in technology, changing healthcare regulations, and shifts in consumer preferences. Here’s a glimpse into the potential future of affordable health insurance:

1. Digital Health Solutions

The integration of digital health technologies, such as telemedicine and remote monitoring, has the potential to reduce healthcare costs. These solutions offer convenient and cost-effective alternatives to traditional in-person visits, making healthcare more accessible and affordable.

2. Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models reward healthcare providers for achieving positive health outcomes rather than simply billing for services rendered. This shift could lead to more affordable and efficient healthcare systems.

3. Health Insurance Innovation

Insurance companies are continually innovating to provide more affordable and tailored coverage. This includes the development of new plan types, the integration of wellness programs, and the use of predictive analytics to identify and manage health risks proactively.

4. Government Initiatives

Governments around the world are recognizing the importance of affordable healthcare and are implementing initiatives to make it more accessible. These efforts may include expanding public healthcare systems, implementing universal healthcare programs, or subsidizing private insurance plans.

5. Consumer Education and Empowerment

As consumers become more educated about healthcare and insurance, they are better equipped to make informed choices. This empowerment can drive the demand for more transparent and affordable healthcare options, influencing the market to meet these needs.

Frequently Asked Questions

Can I get health insurance if I have a pre-existing condition?

+Yes, many countries have laws in place to ensure individuals with pre-existing conditions can access health insurance. However, the specific rules and premiums may vary. It’s advisable to explore options like guaranteed-issue plans or government-subsidized programs.

What if I’m between jobs and need health insurance temporarily?

+Consider short-term health insurance plans, which offer temporary coverage. These plans are generally more affordable but may have limited benefits. Alternatively, explore government-funded options or COBRA coverage if you’re eligible.

How can I reduce my health insurance premiums?

+You can explore options like high-deductible plans with an HSA, opt for generic medications, or negotiate with your insurer for discounts. Additionally, maintaining a healthy lifestyle and avoiding tobacco use can lead to lower premiums.

Are there any tax benefits associated with health insurance?

+Yes, in many countries, you can claim tax deductions or credits for health insurance premiums. These incentives vary based on your country’s tax laws, so it’s advisable to consult a tax professional for specific guidance.

Finding the cheapest health insurance is a balancing act between cost and coverage. By understanding the factors that influence insurance costs and employing strategic approaches, you can secure an affordable plan that meets your healthcare needs. Remember, staying informed and proactive is key to making the most of your health insurance coverage.