State Farm Quote Insurance

Finding the right insurance coverage is a crucial aspect of financial planning, and State Farm, a well-known insurance provider, offers a comprehensive range of services to cater to various needs. This article delves into the world of State Farm insurance, specifically focusing on the quote process, the types of insurance they offer, and the benefits of choosing State Farm as your insurance partner. We'll explore the ease of obtaining a quote, the coverage options available, and the reasons why State Farm is a trusted choice for millions of individuals and businesses.

The State Farm Quote Process: Quick, Simple, and Customized

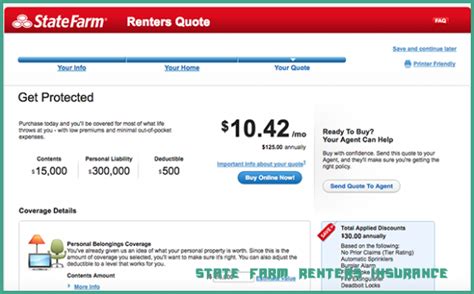

State Farm understands that getting an insurance quote should be a seamless and efficient process. Their online quote system is designed with user-friendliness in mind, allowing you to receive a personalized quote within minutes. Here’s a step-by-step breakdown of the State Farm quote process:

- Visit the State Farm Website: Begin by navigating to the official State Farm website. It's easily accessible and user-friendly, ensuring a smooth start to your quote journey.

- Choose Your Insurance Type: State Farm offers a wide array of insurance options, including auto, home, life, health, and more. Select the type of insurance you're interested in to tailor your quote accordingly.

- Provide Basic Information: You'll be prompted to enter some basic details, such as your name, contact information, and the specific coverage you're seeking. This step is quick and straightforward, ensuring you can move through the process efficiently.

- Answer Coverage Questions: To provide an accurate quote, State Farm will ask a series of questions related to your insurance needs. For example, if you're quoting auto insurance, you'll be asked about your vehicle, driving history, and desired coverage limits. These questions help State Farm tailor a quote that meets your unique circumstances.

- Review and Compare: Once you've provided the necessary information, State Farm's system will generate a customized quote. You can review the details, including coverage limits, deductibles, and premiums. If you have multiple insurance needs, State Farm allows you to compare quotes side by side, making it easy to choose the best option for your situation.

- Purchase or Save for Later: If you're satisfied with the quote, you can proceed with the purchase and secure your insurance coverage. However, if you prefer to review the quote later or compare it with other options, State Farm provides the flexibility to save it for future reference.

Comprehensive Insurance Coverage with State Farm

State Farm is dedicated to providing a comprehensive suite of insurance products to meet the diverse needs of its customers. Here’s an overview of the key insurance types offered by State Farm, along with their unique benefits:

Auto Insurance

State Farm’s auto insurance is tailored to protect you and your vehicle. They offer a range of coverage options, including:

- Liability Coverage: Protects you against claims for bodily injury or property damage caused by you or another driver.

- Collision Coverage: Covers damage to your vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Provides protection for your vehicle against non-collision incidents, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps cover medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

Home Insurance

State Farm’s home insurance policies are designed to protect your home and its contents. Their comprehensive coverage options include:

- Dwelling Coverage: Provides financial protection for the structure of your home, including repairs or rebuilding in the event of damage or destruction.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing, in case of loss or damage.

- Liability Coverage: Offers protection if someone is injured on your property or if you’re held legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: Assists with temporary living expenses if your home becomes uninhabitable due to a covered loss, such as a fire or natural disaster.

Life Insurance

State Farm’s life insurance policies provide financial security for your loved ones in the event of your passing. Their life insurance options include:

- Term Life Insurance: Offers coverage for a specified period, typically 10, 20, or 30 years. It’s a cost-effective option for those seeking temporary protection.

- Permanent Life Insurance: Provides lifelong coverage, offering a death benefit to your beneficiaries and the potential for cash value accumulation.

- Whole Life Insurance: Combines permanent life insurance coverage with cash value growth, offering a stable financial option for long-term protection.

- Universal Life Insurance: Provides flexibility in terms of premium payments and coverage amounts, allowing you to adjust your policy as your needs change.

Health Insurance

State Farm’s health insurance plans aim to provide affordable and comprehensive medical coverage. Their health insurance offerings include:

- Individual and Family Plans: Customizable health insurance plans designed to meet the unique needs of individuals and families, covering a range of medical expenses.

- Dental and Vision Plans: Supplemental insurance options that cover dental and vision care, ensuring you have access to quality dental and eye care services.

- Medicare Supplement Plans: Designed to fill the gaps in original Medicare coverage, providing additional financial protection for Medicare beneficiaries.

Why Choose State Farm for Your Insurance Needs

State Farm has earned its reputation as a trusted insurance provider for numerous reasons. Here are some key advantages of choosing State Farm for your insurance coverage:

Financial Strength and Stability

State Farm is one of the largest insurance providers in the United States, with a long-standing history of financial stability. Their strong financial position ensures that they can provide reliable coverage and honor claims promptly.

Personalized Service

State Farm is committed to delivering personalized service to its customers. Their network of local agents is dedicated to understanding your unique needs and providing tailored insurance solutions. You’ll have a dedicated agent who can guide you through the insurance process and offer ongoing support.

Innovative Digital Tools

State Farm embraces digital innovation to enhance the customer experience. Their online platform and mobile app offer convenient access to your insurance information, allowing you to manage your policies, file claims, and make payments with ease.

Claims Handling Expertise

State Farm has a proven track record of efficient and fair claims handling. Their dedicated claims teams are experienced in navigating complex insurance scenarios, ensuring a smooth and stress-free claims process for their customers.

Community Engagement

State Farm is actively involved in community initiatives and supports various causes. Their commitment to giving back to the communities they serve fosters a sense of trust and goodwill among their customers.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Medical Payments, Uninsured/Underinsured Motorist |

| Home Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses |

| Life Insurance | Term, Permanent, Whole, Universal |

| Health Insurance | Individual and Family Plans, Dental and Vision, Medicare Supplements |

How long does it take to get a State Farm insurance quote?

+

The quote process typically takes just a few minutes. State Farm’s online quote system is designed for efficiency, allowing you to receive a personalized quote within minutes by providing basic information and answering coverage questions.

Can I customize my insurance coverage with State Farm?

+

Absolutely! State Farm offers a wide range of coverage options, and their quotes are tailored to your specific needs. You can customize your insurance coverage by selecting the types and limits of coverage that best suit your circumstances.

What makes State Farm a trusted insurance provider?

+

State Farm’s reputation as a trusted provider is built on its financial strength, personalized service, innovative digital tools, and expertise in claims handling. Their commitment to customer satisfaction and community engagement also sets them apart.

Can I bundle multiple insurance policies with State Farm?

+

Yes, State Farm encourages policy bundling to save you money. By combining multiple insurance policies, such as auto and home insurance, you can often qualify for significant discounts, making your insurance coverage more affordable.

How can I reach State Farm’s customer support?

+

State Farm offers multiple channels for customer support. You can reach their customer service team via phone, email, or live chat on their website. Additionally, you can connect with your local State Farm agent for personalized assistance.