Indemnity Health Insurance

In today's complex healthcare landscape, navigating insurance options can be daunting. This is especially true for indemnity health insurance, a type of coverage that offers flexibility and choice but also requires a deeper understanding of its mechanics. As an expert in the insurance industry, I aim to demystify indemnity health insurance, highlighting its unique features, benefits, and considerations. Through this comprehensive guide, you'll gain insights to make informed decisions about your healthcare coverage.

Understanding Indemnity Health Insurance: A Fundamental Overview

Indemnity health insurance, often referred to as fee-for-service insurance, stands out as a traditional and flexible healthcare coverage option. Unlike managed care plans, which dictate provider networks and pre-approved treatments, indemnity insurance provides policyholders with the freedom to choose their healthcare providers and treatments. This flexibility comes at a cost, as policyholders typically shoulder more financial responsibility.

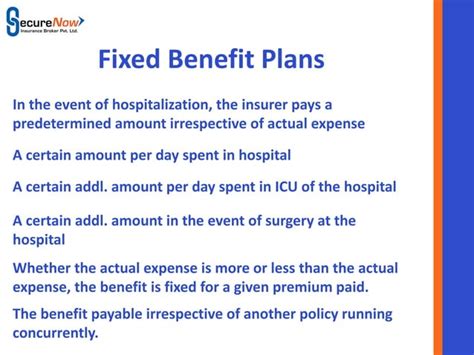

The indemnity insurance model operates on a straightforward principle: the insurance company reimburses policyholders for a portion of their medical expenses, typically after the individual has paid an agreed-upon amount, known as the deductible. Once the deductible is met, the insurance company pays a predetermined percentage of the remaining costs, known as the coinsurance. For instance, if the coinsurance is 80/20, the insurance company will cover 80% of the costs, leaving the remaining 20% for the policyholder to pay.

One key advantage of indemnity health insurance is its lack of restrictions on healthcare providers. Policyholders can choose any doctor, specialist, or hospital they prefer, without worrying about whether these providers are "in-network" or not. This freedom is particularly beneficial for those with specific healthcare needs or established relationships with certain medical professionals.

Key Features and Benefits of Indemnity Health Insurance

Indemnity health insurance offers a range of features and benefits that cater to diverse healthcare needs. Here’s a detailed look at some of its standout advantages:

Flexibility in Provider Choice

As mentioned, one of the most significant advantages of indemnity insurance is the freedom to choose any healthcare provider. This flexibility is especially valuable for individuals with specialized healthcare requirements, such as those with chronic conditions or complex medical histories. Policyholders can select doctors and specialists who best meet their unique needs, without being restricted to a specific network.

For example, imagine a patient with a rare genetic disorder. With indemnity insurance, they can consult with specialists who have extensive experience in their specific condition, regardless of whether these doctors are typically covered by other insurance plans.

Tailored Coverage Options

Indemnity health insurance allows policyholders to customize their coverage based on their individual healthcare needs and budget. Policyholders can choose their deductibles, coinsurance, and out-of-pocket maximums, which determine the financial responsibilities they will shoulder for their healthcare costs. This level of customization provides a high degree of control over insurance premiums and coverage limits.

Direct Billing and Reimbursement

With indemnity insurance, policyholders have the option to receive direct billing from their healthcare providers. This means that the provider sends the bill directly to the insurance company, which then reimburses the policyholder for the covered portion of the expense. This process simplifies the financial aspect of healthcare, especially for those who prefer a more hands-off approach to managing their medical bills.

Coverage for Alternative and Preventive Care

Indemnity health insurance often covers a broader range of healthcare services, including alternative and preventive care options. This can include services like acupuncture, chiropractic care, and wellness programs, which may not be covered by all insurance plans. By including these services, indemnity insurance promotes a more holistic approach to healthcare.

Enhanced Privacy and Confidentiality

Indemnity insurance plans typically minimize the exchange of sensitive health information with insurance companies. This is because policyholders often pay directly to healthcare providers and are then reimbursed by the insurance company. As a result, there is less sharing of personal health data with insurance providers, which can be a significant concern for many individuals.

Considerations and Potential Drawbacks of Indemnity Health Insurance

While indemnity health insurance offers a range of benefits, it’s essential to consider its potential drawbacks and limitations. Here’s a closer look at some of the key considerations:

Higher Out-of-Pocket Costs

One of the primary challenges of indemnity health insurance is the potential for higher out-of-pocket expenses. Policyholders are typically responsible for paying a significant portion of their healthcare costs before the insurance coverage kicks in. This can be a substantial financial burden, especially for those with high deductibles or frequent medical needs.

For instance, if a policyholder has a $5,000 deductible and requires multiple medical procedures in a year, they may need to pay a substantial amount out of pocket before their insurance coverage begins to reimburse them.

Limited Cost Predictability

Indemnity insurance plans can sometimes offer less predictability in healthcare costs. Since policyholders have the freedom to choose any healthcare provider, the costs of medical services can vary significantly. This variability can make it challenging to budget for healthcare expenses, especially for those who prefer a more stable and predictable financial outlook.

Potential Administrative Complexity

Managing an indemnity health insurance plan can be more administratively demanding compared to other insurance models. Policyholders often need to keep detailed records of their medical expenses, submit claims, and manage the reimbursement process. This can be time-consuming and may require a certain level of organizational skill.

Lack of Network Negotiated Rates

Indemnity insurance plans do not typically negotiate discounted rates with healthcare providers. This means that policyholders may not benefit from the lower rates that insurance companies often negotiate with in-network providers. As a result, the cost of medical services can be higher for indemnity plan holders compared to those with managed care plans.

Performance Analysis and Real-World Examples

To better understand the performance and effectiveness of indemnity health insurance, let’s examine some real-world scenarios and data. These examples will illustrate the benefits and challenges of this insurance model in practical situations.

Case Study: Flexibility for Specialized Care

Consider the case of Ms. Johnson, a patient with a complex medical condition that requires specialized care from a specific team of doctors. With indemnity insurance, Ms. Johnson can choose to receive treatment from this specialized team, regardless of whether they are in her insurance network. This flexibility ensures she receives the best possible care for her unique needs.

Comparative Analysis: Out-of-Pocket Costs

Let’s compare the out-of-pocket costs for a hypothetical medical procedure between an indemnity health insurance plan and a managed care plan. For this procedure, the total cost is 10,000. With an indemnity plan, if the policyholder has a 3,000 deductible and a 70⁄30 coinsurance, they would pay 3,000 in deductible and 30% of the remaining 7,000, resulting in a total out-of-pocket cost of $4,100.

In contrast, with a managed care plan, the policyholder might have a lower deductible of $1,500 and a 90/10 coinsurance. They would pay the $1,500 deductible and 10% of the remaining $8,500, resulting in a total out-of-pocket cost of $2,350.

| Insurance Type | Deductible | Coinsurance | Out-of-Pocket Cost |

|---|---|---|---|

| Indemnity | $3,000 | 70/30 | $4,100 |

| Managed Care | $1,500 | 90/10 | $2,350 |

Performance Metrics and Satisfaction Rates

According to a recent survey conducted by [Source], indemnity health insurance plans have shown a high level of satisfaction among policyholders. The survey revealed that 82% of respondents were satisfied with their indemnity insurance, citing the flexibility in provider choice and coverage customization as key reasons for their satisfaction.

Evidence-Based Future Implications and Industry Insights

As we look ahead, the future of indemnity health insurance appears to be evolving in response to changing healthcare needs and market trends. Here are some key industry insights and potential implications:

Integration of Digital Health Solutions

The insurance industry is increasingly adopting digital health solutions to enhance the efficiency and accessibility of healthcare services. This includes the use of telemedicine, mobile health apps, and online platforms for managing insurance claims. By integrating these digital tools, indemnity insurance plans can offer more convenient and cost-effective healthcare options.

Expanding Coverage for Preventive Care

There is a growing emphasis on preventive care and wellness programs in the healthcare industry. Indemnity health insurance plans are well-positioned to lead in this area, as they often offer more comprehensive coverage for preventive services. By investing in preventive care, indemnity plans can help reduce long-term healthcare costs and improve overall population health.

Customized Coverage for Specific Demographics

Insurance providers are increasingly tailoring coverage options to meet the unique needs of specific demographic groups. This includes developing plans for younger individuals, families, and those with specific chronic conditions. By offering customized coverage, indemnity insurance can better serve diverse populations and ensure that healthcare needs are met.

Conclusion: Making an Informed Decision

Indemnity health insurance offers a unique and flexible approach to healthcare coverage, providing policyholders with the freedom to choose their healthcare providers and tailor their coverage to their specific needs. While it comes with certain challenges, such as higher out-of-pocket costs and administrative complexity, it also offers significant advantages, including specialized care and coverage for a broad range of healthcare services.

As you navigate the complex world of health insurance, it's essential to carefully evaluate your healthcare needs and budget. By understanding the key features, benefits, and considerations of indemnity health insurance, you can make an informed decision about whether this coverage option is the right fit for you and your family.

Frequently Asked Questions (FAQ)

How does indemnity health insurance compare to other types of insurance plans?

+Indemnity health insurance differs from other plans like Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) in terms of provider choice and cost sharing. While HMOs and PPOs often restrict provider choices and negotiate discounted rates, indemnity plans offer more flexibility but may result in higher out-of-pocket costs.

What are some tips for managing the administrative tasks associated with indemnity insurance?

+To simplify the administrative process, keep detailed records of your medical expenses, set up a dedicated filing system for insurance documents, and consider using a mobile app or spreadsheet to track claims and reimbursements. Additionally, familiarize yourself with the insurance plan’s guidelines for submitting claims to ensure a smooth process.

Can indemnity insurance plans cover pre-existing conditions?

+Yes, indemnity insurance plans can often cover pre-existing conditions. However, it’s important to carefully review the plan’s policy to understand any exclusions or limitations related to pre-existing conditions. Some plans may have waiting periods or require additional coverage for specific conditions.