Cheap Life Insurance Policies

Life insurance is an essential financial tool that provides peace of mind and security for individuals and their loved ones. While it is crucial to have adequate coverage, the cost of life insurance policies can vary significantly. Fortunately, there are affordable options available that offer comprehensive protection without breaking the bank. In this article, we will explore the world of cheap life insurance policies, uncovering the key factors, strategies, and insights to help you secure a policy that fits your budget and meets your needs.

Understanding Cheap Life Insurance Policies

Cheap life insurance policies are designed to offer affordable coverage to a wide range of individuals, including those with limited financial resources. These policies aim to provide a safety net for beneficiaries by ensuring they receive a financial payout in the event of the policyholder’s untimely demise. While the term “cheap” may suggest lower quality, it is important to note that these policies can still offer valuable protection with the right considerations.

Target Audience and Benefits

Cheap life insurance policies are particularly beneficial for individuals who are budget-conscious or have specific financial constraints. This includes young adults starting their careers, families on a tight budget, or those with limited disposable income. By opting for a cheap policy, these individuals can gain access to essential life insurance coverage, ensuring their loved ones are financially protected in the face of unexpected circumstances.

These policies often cater to a broad spectrum of people, including those with pre-existing medical conditions or high-risk occupations. By offering affordable rates, insurance providers aim to make coverage accessible to a diverse range of individuals who may otherwise face challenges in securing traditional policies.

Policy Types and Coverage

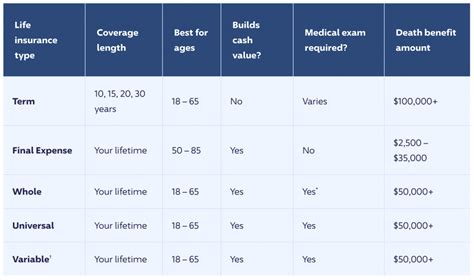

Cheap life insurance policies come in various forms, each with its own set of features and limitations. The two primary types are term life insurance and whole life insurance.

- Term Life Insurance: This is the most common and affordable option. It provides coverage for a specified period, typically ranging from 10 to 30 years. Term policies offer a fixed death benefit, ensuring that your beneficiaries receive a predetermined sum upon your passing. They are ideal for individuals seeking temporary coverage to protect their families during their working years or to cover specific financial obligations like mortgages or children's education.

- Whole Life Insurance: While whole life policies tend to be more expensive, they offer permanent coverage for the policyholder's entire life. These policies accumulate cash value over time, which can be borrowed against or withdrawn if needed. Whole life insurance is suitable for those seeking long-term protection and financial stability for their beneficiaries.

Factors Influencing Cheap Life Insurance Policies

The cost of cheap life insurance policies is influenced by several key factors. Understanding these factors can help you make informed decisions when shopping for affordable coverage.

Age and Health

One of the most significant determinants of life insurance rates is the policyholder’s age and health status. Generally, younger individuals are considered lower-risk and thus enjoy more affordable premiums. As you age, the cost of coverage tends to increase, as the likelihood of health complications and accidents rises.

Additionally, your health plays a crucial role. Insurance providers assess your medical history, lifestyle habits, and any pre-existing conditions to determine your risk level. Individuals with a healthy lifestyle and no major health issues are likely to receive more favorable rates. However, it's important to note that cheap life insurance policies are designed to accommodate a wide range of health profiles, making coverage accessible to those with certain health challenges.

Policy Duration and Coverage Amount

The duration of your policy and the coverage amount you choose directly impact the cost. Term life insurance policies with shorter durations, such as 10 or 15 years, are typically more affordable than longer-term options. Similarly, opting for a lower coverage amount can reduce your premiums, as the insurance provider assumes less financial risk.

It's essential to strike a balance between affordability and adequate coverage. While a cheap policy is desirable, it should still provide sufficient financial protection for your beneficiaries. Consider your financial obligations, such as outstanding debts, mortgage payments, and future expenses like college tuition, when determining the appropriate coverage amount.

Insurance Company and Policy Features

Different insurance companies offer varying rates and policy features. It’s crucial to shop around and compare quotes from multiple providers to find the best deal. Some companies specialize in providing affordable coverage to specific demographics or cater to individuals with unique circumstances.

Additionally, the features and riders included in your policy can affect the cost. Certain policy enhancements, such as accelerated death benefits or waiver of premium riders, may increase your premiums. It's important to carefully review the policy's terms and conditions to ensure you understand the coverage and any additional costs associated with it.

Strategies for Securing Cheap Life Insurance Policies

Securing a cheap life insurance policy requires a strategic approach. Here are some effective strategies to help you find the most affordable coverage that suits your needs:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Take the time to compare rates from multiple insurance providers. Online quote comparison tools can be invaluable in this process, allowing you to quickly assess the market and identify the most competitive rates.

Consider reaching out to independent insurance agents who work with multiple carriers. They can provide valuable insights and help you navigate the complex world of life insurance, ensuring you make an informed decision.

Assess Your Coverage Needs

Before purchasing a policy, carefully evaluate your coverage needs. Consider your financial obligations, such as outstanding debts, mortgage payments, and future expenses. Calculate the amount of coverage required to ensure your loved ones are financially secure in the event of your untimely demise.

Avoid overinsuring yourself, as it can lead to unnecessary expenses. Instead, aim for a coverage amount that provides sufficient protection without straining your budget.

Improve Your Health and Lifestyle

Insurance providers assess your health and lifestyle when determining your rates. By adopting a healthier lifestyle and addressing any health concerns, you may be eligible for more favorable premiums. Here are some steps you can take to improve your health and potentially reduce your life insurance costs:

- Maintain a healthy weight and BMI.

- Quit smoking and avoid excessive alcohol consumption.

- Manage pre-existing conditions through regular medical check-ups and prescribed treatments.

- Engage in regular physical activity and exercise.

- Manage stress levels and practice healthy coping mechanisms.

Consider Term Life Insurance

Term life insurance is often the most cost-effective option, especially for younger individuals or those with short-term financial obligations. By opting for a term policy, you can enjoy affordable coverage for a specified period, ensuring your loved ones are protected during critical stages of life.

Consider your financial goals and obligations when choosing the term length. For example, if you have young children, a 20-year term policy may provide adequate coverage until they become financially independent.

Group or Employer-Sponsored Plans

If you’re employed, consider taking advantage of group life insurance plans offered by your employer. These plans often provide affordable coverage with simplified underwriting processes. While the coverage amounts may be limited, they can be a valuable supplement to your personal life insurance policy.

Review and Adjust Coverage Regularly

Life insurance needs evolve over time. As your financial situation changes, it’s important to review your coverage and make adjustments accordingly. Regularly assess your policy to ensure it aligns with your current needs and budget. Consider increasing your coverage amount or adjusting the term length as necessary.

Additionally, keep an eye on market trends and new insurance products. As you gain more experience and knowledge, you may identify opportunities to switch policies or providers to secure better rates and coverage.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of cheap life insurance policies, let’s examine some real-world examples and performance data.

Case Study: Young Professional

John, a 25-year-old professional, is in excellent health and has a stable income. He wants to secure affordable life insurance to protect his future family. After researching and comparing quotes, he opts for a 15-year term life insurance policy with a coverage amount of 500,000. The policy costs him approximately 150 per month, providing him with peace of mind and financial security.

Case Study: Family with Pre-Existing Conditions

The Smith family consists of a couple in their early 40s with two young children. Both parents have pre-existing health conditions, making traditional life insurance policies expensive. After exploring their options, they find a specialized provider offering affordable coverage for individuals with health challenges. They secure a whole life insurance policy with a coverage amount of 250,000, paying around 300 per month. This policy ensures their children’s financial security, even if the unexpected were to occur.

Performance Analysis

The performance of cheap life insurance policies is largely dependent on the individual’s needs and circumstances. Here’s a table showcasing the average annual premiums for different policy types and coverage amounts, based on a 30-year-old individual with no pre-existing health conditions:

| Policy Type | Coverage Amount ($) | Average Annual Premium |

|---|---|---|

| Term Life Insurance (10 years) | 250,000 | 350 |

| Term Life Insurance (20 years) | 500,000 | 500 |

| Whole Life Insurance | 100,000 | 800 |

| Whole Life Insurance | 500,000 | 1,500 |

These numbers provide a general overview, and actual premiums may vary based on individual factors. It's important to note that cheap life insurance policies can offer significant value when tailored to your specific needs and budget.

Future Implications and Industry Trends

The life insurance industry is constantly evolving, and cheap life insurance policies are no exception. Here are some future implications and trends to watch out for:

Technological Advancements

The use of technology is transforming the life insurance landscape. Insurtech companies are leveraging data analytics and artificial intelligence to streamline the underwriting process, making it faster and more efficient. This can lead to reduced costs and increased accessibility for individuals seeking affordable coverage.

Increased Competition

The life insurance market is becoming increasingly competitive, with more providers entering the space. This competition benefits consumers, as it drives down prices and encourages innovation. As a result, individuals can expect more affordable options and improved customer experiences when shopping for cheap life insurance policies.

Focus on Health and Wellness

Insurance providers are recognizing the importance of health and wellness in determining life insurance rates. Some companies are offering incentives and discounts to policyholders who maintain healthy lifestyles or participate in wellness programs. This trend may lead to more affordable coverage for individuals who prioritize their health.

Customization and Personalization

The future of life insurance lies in customization and personalization. Insurance providers are developing tools and platforms that allow individuals to tailor their policies to their specific needs and circumstances. This level of customization can result in more affordable coverage, as policyholders can select the features and riders that align with their financial goals.

Conclusion

Cheap life insurance policies offer an accessible and affordable way to secure financial protection for your loved ones. By understanding the factors that influence rates, adopting strategic approaches, and staying informed about industry trends, you can navigate the world of life insurance with confidence. Remember, life insurance is an essential component of your financial plan, and with the right approach, you can find a policy that fits your budget and provides peace of mind.

Frequently Asked Questions

How much does cheap life insurance typically cost?

+

The cost of cheap life insurance varies depending on factors such as age, health, policy duration, and coverage amount. On average, term life insurance policies for a 30-year-old individual can range from 150 to 500 per year for coverage amounts between 250,000 and 500,000. Whole life insurance policies tend to be more expensive, with average annual premiums ranging from 800 to 1,500 for similar coverage amounts.

Are cheap life insurance policies reliable?

+

Yes, cheap life insurance policies can be reliable and provide valuable protection. While they may have lower premiums, reputable insurance companies ensure that these policies meet the necessary standards and provide the promised benefits. It’s essential to choose a well-established provider with a solid financial rating to ensure the policy’s reliability.

Can I increase my coverage amount later if my financial needs change?

+

Yes, most life insurance policies allow you to increase your coverage amount at certain points, such as during policy renewals or significant life events like marriage or the birth of a child. However, it’s important to review the policy’s terms and conditions to understand any potential limitations or additional costs associated with increasing coverage.

What happens if I miss a premium payment for my cheap life insurance policy?

+

Missing a premium payment can have serious consequences for your life insurance coverage. Most policies have a grace period, typically 30 days, during which you can make the missed payment without any impact on your coverage. However, if you fail to make the payment within the grace period, your policy may lapse, and you may lose all benefits. It’s crucial to stay up-to-date with your premium payments to maintain continuous coverage.

Can I switch to a different life insurance policy if I find a better deal?

+

Yes, you have the flexibility to switch to a different life insurance policy if you find a better deal that aligns with your needs and budget. However, it’s important to carefully review the terms and conditions of your existing policy to understand any potential surrender charges or penalties associated with canceling your current policy. Additionally, ensure that your new policy provides the coverage and benefits you require.