Motorcycle Insurance Near Me

When it comes to protecting your beloved motorcycle, having the right insurance coverage is essential. Whether you're a seasoned rider or a novice, understanding the options available for motorcycle insurance near you is crucial to ensuring peace of mind and financial security on the road. This comprehensive guide will delve into the world of motorcycle insurance, exploring the factors that influence rates, the types of coverage available, and how to find the best policies in your area.

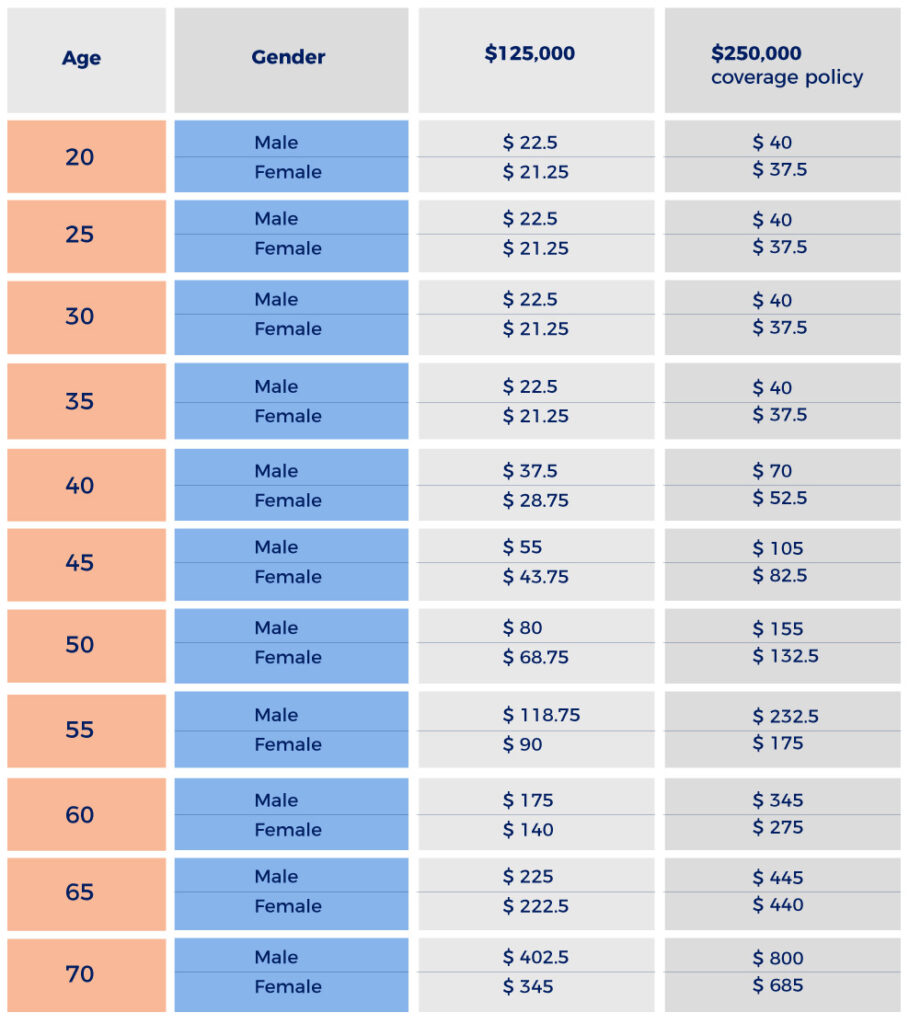

Understanding Motorcycle Insurance Rates

Motorcycle insurance rates can vary significantly depending on numerous factors. Insurance companies consider a range of variables when determining the cost of your policy, including your riding experience, the make and model of your bike, your age, and your geographic location. Additionally, your riding history, including any accidents or traffic violations, plays a pivotal role in shaping your insurance premium.

The Impact of Location

Your geographic location is a critical factor in determining motorcycle insurance rates. Insurance providers assess the risk associated with riding in your area, taking into account factors like the frequency of accidents, theft rates, and even weather conditions. Areas with higher accident rates or a greater propensity for theft may command higher insurance premiums. Conversely, regions with lower risks may offer more affordable coverage.

| Region | Average Insurance Rate |

|---|---|

| Urban Areas | $1,200 - $1,800 per year |

| Suburban Areas | $900 - $1,400 per year |

| Rural Areas | $700 - $1,100 per year |

These rates are merely estimates and can vary significantly based on individual circumstances and the specific insurance provider. It's crucial to obtain quotes from multiple insurers to find the most competitive rates for your unique situation.

Types of Motorcycle Insurance Coverage

Motorcycle insurance offers a range of coverage options to protect you and your bike. Understanding the different types of coverage available is essential to tailoring a policy that suits your needs and provides the necessary protection.

Liability Coverage

Liability coverage is a fundamental component of motorcycle insurance. It protects you in the event that you are found legally responsible for an accident that causes injuries or property damage to others. This coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties.

- Property Damage Liability: Pays for repairs or replacements of damaged property.

- Legal Defense Costs: Provides coverage for legal fees if you are sued as a result of an accident.

Collision Coverage

Collision coverage is designed to protect your motorcycle in the event of an accident. It covers the cost of repairs or replacements if your bike is damaged in a collision, regardless of who is at fault. This coverage is particularly beneficial for riders with newer or more expensive motorcycles.

Comprehensive Coverage

Comprehensive coverage offers protection against a wide range of non-collision incidents, including:

- Theft

- Vandalism

- Fire

- Natural disasters

- Animal collisions

Comprehensive coverage provides financial security against unforeseen events that could damage your motorcycle.

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event that you are involved in an accident with a driver who has insufficient or no insurance coverage. It ensures that you are compensated for your injuries and property damage, even if the at-fault driver cannot provide adequate financial coverage.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides coverage for your medical expenses in the event of an accident, regardless of fault. This coverage can help cover the cost of medical treatment, hospital stays, and other related expenses.

Finding the Best Motorcycle Insurance Near You

Locating the best motorcycle insurance in your area requires a combination of research, comparison, and understanding your specific needs. Here are some steps to guide you through the process:

Research Local Insurance Providers

Start by identifying the insurance companies that operate in your region. Look for providers that specialize in motorcycle insurance or have a strong reputation for offering comprehensive coverage at competitive rates. Online reviews and recommendations from fellow riders can be valuable resources in this stage.

Obtain Quotes

Reach out to the identified insurance providers and request quotes. Be prepared to provide detailed information about yourself, your riding history, and your motorcycle. Compare the quotes carefully, taking into account the coverage limits, deductibles, and any additional perks or discounts offered.

Consider Customization Options

Different insurance providers offer a range of customization options to tailor your policy to your specific needs. Some providers may allow you to adjust your deductible, while others might offer add-ons like roadside assistance or accessory coverage. Assess your needs and preferences to determine which customization options are most beneficial for you.

Evaluate Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Look for companies with a strong track record of prompt and efficient claims processing. Read reviews and seek recommendations to gauge the level of service you can expect.

Bundle Policies for Potential Savings

If you already have auto or home insurance, consider bundling your motorcycle insurance with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you a significant amount on your overall insurance costs.

Frequently Asked Questions

How much does motorcycle insurance typically cost per year?

+The cost of motorcycle insurance can vary widely based on individual factors such as your riding experience, the make and model of your bike, and your location. On average, motorcycle insurance rates range from $700 to $1,800 per year. However, it's important to obtain quotes from multiple insurers to find the most competitive rates for your specific situation.

What factors influence motorcycle insurance rates the most?

+Several factors play a significant role in determining motorcycle insurance rates. These include your riding experience, the age and type of your motorcycle, your geographic location, and your riding history (including any accidents or traffic violations). Insurance providers assess these factors to gauge the level of risk associated with insuring you, which ultimately impacts the cost of your policy.

Can I customize my motorcycle insurance policy to suit my specific needs?

+Absolutely! Most insurance providers offer a range of customization options to tailor your policy to your specific requirements. You can typically adjust your deductible, add optional coverages like roadside assistance or accessory coverage, and even bundle your motorcycle insurance with other policies (such as auto or home insurance) to potentially save on overall costs.

What should I do if I'm involved in a motorcycle accident?

+In the unfortunate event of a motorcycle accident, it's important to remain calm and take the following steps: (1) Ensure your safety and the safety of others involved; (2) Contact the police to file a report; (3) Document the accident scene with photos and notes; (4) Exchange information with the other party(ies) involved; (5) Contact your insurance provider to report the accident and initiate the claims process.

Finding the right motorcycle insurance near you requires careful consideration of your needs, research into available options, and a comprehensive understanding of the coverage types and factors that influence rates. By following the steps outlined in this guide and leveraging the power of online comparison tools, you can secure a policy that provides the protection you need at a price that fits your budget.