Get Quote On Auto Insurance

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers. Obtaining a quote for auto insurance is a fundamental step in ensuring you have adequate coverage for your specific needs. This comprehensive guide will walk you through the process of getting a quote on auto insurance, offering valuable insights and practical tips to make the experience efficient and informative.

Understanding Auto Insurance Quotes

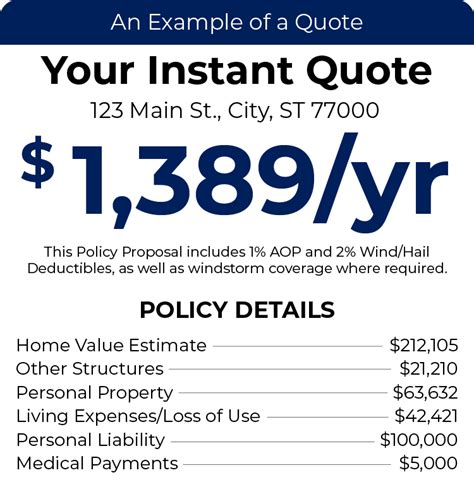

An auto insurance quote is an estimate of the cost of your insurance policy, tailored to your individual circumstances and requirements. It serves as a starting point for evaluating coverage options and prices from different insurance providers. Quotes are typically based on a range of factors, including your personal details, vehicle information, driving history, and the level of coverage you desire.

Factors Influencing Auto Insurance Quotes

Various elements impact the cost of your auto insurance quote. These include:

- Personal Information: Your age, gender, marital status, and location can affect your quote. Younger drivers, for instance, often pay higher premiums due to their perceived higher risk on the road.

- Vehicle Details: The make, model, and year of your vehicle, as well as its primary use (e.g., commuting, business, pleasure), influence your insurance costs. High-performance or luxury vehicles generally require more expensive coverage.

- Driving Record: Your driving history plays a significant role. A clean record with no accidents or traffic violations typically results in lower premiums. Conversely, multiple infractions or accidents can lead to higher insurance costs.

- Coverage Preferences: The type and extent of coverage you choose impact your quote. Comprehensive and collision coverage, for example, provide more extensive protection but come at a higher cost.

- Discounts: Many insurers offer discounts for various reasons, such as safe driving, loyalty, or bundling policies. Taking advantage of these discounts can significantly reduce your insurance premiums.

The Quote Process: Step-by-Step

Obtaining an auto insurance quote is a straightforward process that can be completed online, over the phone, or in person with an insurance agent. Here’s a detailed breakdown of the steps involved:

Step 1: Gather Necessary Information

Before initiating the quote process, ensure you have the following information readily available:

- Personal details: Name, date of birth, gender, marital status, and contact information.

- Vehicle information: Make, model, year, vehicle identification number (VIN), and estimated annual mileage.

- Driving history: Details of any accidents, traffic violations, or claims made in the past several years.

- Current insurance policy (if applicable): Policy number and expiration date.

Step 2: Choose Your Quote Method

Decide whether you prefer to get your quote online, over the phone, or by meeting with an insurance agent. Each method has its advantages:

- Online Quotes: Many insurance providers offer online quote tools. This method is convenient, allowing you to compare multiple quotes quickly. However, online quotes may not account for all potential discounts.

- Phone Quotes: Speaking with an insurance agent over the phone can provide more personalized service. They can guide you through the quote process and help identify potential discounts. However, phone quotes may take longer than online quotes.

- In-Person Quotes: Meeting with an insurance agent in person offers the most personalized experience. They can provide detailed explanations of coverage options and help tailor a policy to your needs. However, this method may be less convenient for those with busy schedules.

Step 3: Provide Required Information

Whether you choose an online, phone, or in-person quote, you’ll need to provide the necessary information to obtain an accurate estimate. This typically includes your personal details, vehicle information, and driving history.

Step 4: Review Coverage Options

Once you’ve provided the required information, the insurance provider will present you with various coverage options. Take the time to review these options carefully, ensuring you understand the scope and limitations of each. Consider your specific needs and budget when making your selection.

Step 5: Compare Quotes

If you’ve obtained multiple quotes, either from different providers or through different methods, it’s essential to compare them side by side. Evaluate the coverage, premiums, and any potential discounts offered. Consider the financial stability and reputation of the insurance companies as well.

Step 6: Select Your Insurance Provider

Based on your research and comparisons, choose the insurance provider that best meets your needs and offers the most competitive rates. Contact the chosen provider to finalize your policy and initiate coverage.

Tips for Obtaining the Best Auto Insurance Quote

To ensure you get the most accurate and affordable auto insurance quote, consider the following tips:

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple providers to find the best deal.

- Review Your Coverage Needs: Assess your specific needs and budget to determine the appropriate level of coverage. Don’t overpay for coverage you don’t need, but also ensure you have adequate protection.

- Explore Discounts: Ask about potential discounts, such as safe driver discounts, loyalty discounts, or discounts for bundling policies. These can significantly reduce your premiums.

- Consider Higher Deductibles: Opting for a higher deductible can lower your insurance premiums. However, ensure you have the financial means to cover the deductible in the event of a claim.

- Maintain a Clean Driving Record: A clean driving record can lead to lower insurance premiums. Avoid traffic violations and accidents to keep your record clear.

Conclusion

Obtaining an auto insurance quote is a critical step in securing adequate coverage for your vehicle. By understanding the factors that influence quotes and following the step-by-step process outlined above, you can navigate the quote process with confidence. Remember to shop around, review your coverage needs, and explore potential discounts to ensure you get the best value for your insurance dollar.

How often should I get an auto insurance quote?

+It’s recommended to get an auto insurance quote at least once a year to ensure you’re getting the best rates. Insurance companies may adjust their rates periodically, and your circumstances may change, affecting your coverage needs.

Can I get an auto insurance quote without providing my Social Security number?

+Yes, you can obtain an auto insurance quote without providing your Social Security number. While some insurers may request it for identity verification, it’s not always necessary. You can choose to provide it later during the application process if needed.

What happens if I have multiple vehicles under one policy?

+Having multiple vehicles under one policy can often result in discounted rates. Insurance providers may offer multi-vehicle discounts, which can significantly reduce your overall premiums. It’s worth considering bundling your policies for added convenience and savings.