About Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. It is a contract between an insurance policyholder and an insurance company, where the insurer agrees to pay a sum of money, known as the death benefit, to the designated beneficiaries upon the policyholder's death. This financial safety net ensures that families can maintain their standard of living and cover expenses during a challenging time.

In today's complex financial landscape, understanding the intricacies of life insurance is crucial. This comprehensive guide aims to delve into the world of life insurance, exploring its various aspects, benefits, and considerations. By the end of this article, readers will have a deeper understanding of how life insurance works, the different types available, and the factors to keep in mind when choosing a policy that aligns with their unique needs and circumstances.

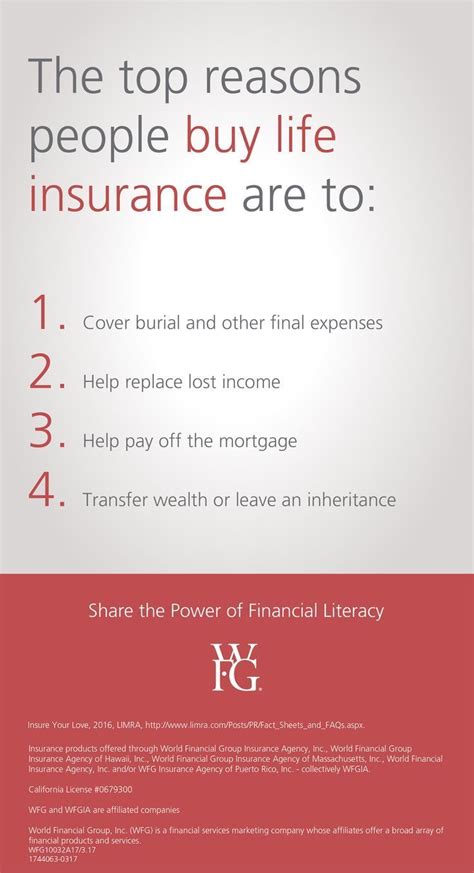

The Purpose and Importance of Life Insurance

Life insurance serves as a vital financial safeguard, offering protection and financial stability to individuals and their families. It is designed to provide a safety net, ensuring that loved ones are taken care of financially in the event of an untimely demise. The primary purpose of life insurance is to offer a financial cushion that can help cover a range of expenses, from immediate funeral costs to long-term needs such as mortgage payments, education expenses for children, and maintenance of the family’s standard of living.

The importance of life insurance cannot be overstated, especially for those with financial dependents or significant financial responsibilities. It acts as a crucial risk management tool, helping to mitigate the financial impact of losing a primary income earner. By providing a substantial death benefit, life insurance ensures that families can maintain their financial stability and continue to pursue their long-term goals even in the face of tragedy.

Moreover, life insurance policies often offer additional benefits beyond the death benefit. Many policies include features such as cash value accumulation, which allows policyholders to build savings within the policy. This cash value can be borrowed against or withdrawn to cover various financial needs during the policyholder's lifetime. Additionally, some policies offer accelerated death benefits, which provide access to a portion of the death benefit while the insured is still alive, often for specific medical or long-term care needs.

Types of Life Insurance Policies

The life insurance market offers a diverse range of policy types, each designed to meet different financial needs and preferences. Understanding the key differences between these policies is essential for making an informed decision.

Term Life Insurance

Term life insurance is a straightforward and affordable option, providing coverage for a specific period, known as the term. The policyholder selects a coverage amount and the term length, typically ranging from 10 to 30 years. During the term, the policyholder pays a fixed premium, and if they pass away within that period, their beneficiaries receive the death benefit. Term life insurance is ideal for those seeking temporary coverage, such as covering mortgage payments or providing financial support for children until they become independent.

One of the key advantages of term life insurance is its flexibility. Policyholders can choose the term length based on their specific needs, whether it's short-term coverage during their working years or longer-term protection until their children reach financial independence. Additionally, term life insurance often offers the option to convert the policy to a permanent life insurance plan, allowing policyholders to transition their coverage as their financial needs evolve.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifelong coverage. This type of policy provides a death benefit and accumulates cash value over time. The policyholder pays a level premium throughout their lifetime, and the cash value grows on a tax-deferred basis. The cash value can be used for various purposes, such as supplementing retirement income, covering long-term care expenses, or providing a financial cushion during challenging times.

Whole life insurance is often seen as a more comprehensive financial tool, offering both death benefit protection and a savings component. The cash value growth can be particularly beneficial for policyholders who seek long-term financial planning and stability. However, it's important to note that whole life insurance typically has higher premiums compared to term life insurance, making it a more significant financial commitment.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance option that allows policyholders to adjust their premiums and death benefit amounts over time. This type of policy offers a combination of death benefit protection and cash value accumulation, similar to whole life insurance. However, universal life insurance provides greater flexibility in terms of premium payments and coverage amounts, making it a popular choice for those seeking customizable coverage.

One of the key advantages of universal life insurance is its ability to adapt to changing financial circumstances. Policyholders can increase or decrease their premiums and death benefit amounts based on their current needs and financial situation. This flexibility makes universal life insurance an attractive option for individuals who expect their financial needs to fluctuate over time. Additionally, the cash value component of universal life insurance can be used for various purposes, providing a valuable financial resource during retirement or unexpected financial challenges.

| Life Insurance Type | Coverage | Premium | Flexibility |

|---|---|---|---|

| Term Life Insurance | Temporary (10-30 years) | Affordable, fixed premiums | Option to convert to permanent coverage |

| Whole Life Insurance | Lifetime | Higher, level premiums | Fixed coverage and cash value growth |

| Universal Life Insurance | Lifetime | Flexible, adjustable premiums | Customizable coverage and cash value accumulation |

Factors to Consider When Choosing Life Insurance

Selecting the right life insurance policy involves careful consideration of various factors. Here are some key aspects to keep in mind when making your decision:

Your Financial Needs and Goals

Assessing your financial needs and goals is crucial when choosing a life insurance policy. Consider your current financial responsibilities, such as mortgage payments, outstanding debts, and the financial well-being of your dependents. Determine the amount of coverage needed to provide sufficient financial support for your loved ones in the event of your untimely demise. Additionally, think about your long-term financial goals, such as retirement planning or funding your children’s education, and how life insurance can contribute to these objectives.

Coverage Amount and Term

The coverage amount and term of your life insurance policy should align with your financial needs and goals. For term life insurance, select a term length that corresponds to your specific needs, such as covering your children’s education or paying off your mortgage. Ensure that the coverage amount is sufficient to meet these obligations. For permanent life insurance, consider your long-term financial planning and the benefits of having lifelong coverage and cash value accumulation.

Premium Affordability and Budget

Life insurance premiums can vary significantly depending on the type of policy, coverage amount, and your personal factors such as age and health. It’s essential to choose a policy that fits within your budget and financial capabilities. Assess your current financial situation and determine how much you can comfortably allocate towards life insurance premiums. Remember that the cost of life insurance tends to increase with age, so securing coverage earlier can be more affordable in the long run.

Policy Features and Benefits

Different life insurance policies offer a range of features and benefits. Consider the additional advantages that align with your specific needs. For example, if you’re concerned about long-term care expenses, a policy with an accelerated death benefit rider can provide access to a portion of the death benefit while you’re still alive to cover these costs. Similarly, if you’re interested in building savings, policies with cash value accumulation can offer a valuable financial resource.

The Application and Underwriting Process

Applying for life insurance involves a comprehensive process known as underwriting. Underwriting is the method used by insurance companies to assess the risk associated with insuring an individual. Here’s an overview of the application and underwriting process:

Application Submission

The first step in applying for life insurance is to submit an application. This application typically includes detailed information about your personal and financial situation, as well as questions about your health and lifestyle. It’s important to provide accurate and truthful information during this stage, as any misrepresentation can lead to policy denial or reduced benefits.

Medical Examination

Many life insurance policies require a medical examination as part of the underwriting process. This examination is conducted by a licensed paramedical professional who assesses your overall health and collects samples for testing. The results of these tests, along with your medical history, are used to evaluate your risk profile and determine your premium and coverage eligibility.

Risk Assessment and Premium Determination

Once your application and medical examination results are received, the insurance company’s underwriting team assesses your risk profile. They consider factors such as your age, health status, family medical history, and lifestyle habits. Based on this assessment, the underwriters determine your premium and any potential exclusions or limitations on your coverage. It’s important to note that the underwriting process can vary depending on the insurance company and the type of policy you’re applying for.

Policy Offer and Acceptance

After the underwriting process is complete, the insurance company will extend a policy offer to you. This offer outlines the terms and conditions of your coverage, including the premium amount, coverage limits, and any applicable riders or exclusions. Carefully review the policy offer to ensure it aligns with your expectations and needs. If you’re satisfied with the terms, you can accept the offer and proceed with the policy.

Common Misconceptions About Life Insurance

Despite its importance, life insurance is often surrounded by misconceptions and myths. Here are some common misconceptions and the reality behind them:

Life Insurance is Too Expensive

One of the most prevalent misconceptions about life insurance is that it’s prohibitively expensive. While it’s true that life insurance premiums can vary based on individual factors, there are affordable options available. Term life insurance, in particular, offers cost-effective coverage for a specific period. Additionally, securing life insurance coverage earlier in life can lead to lower premiums due to lower risk and longer term options. It’s essential to shop around and compare policies to find the most suitable and affordable option for your needs.

Life Insurance is Only for the Wealthy

Another misconception is that life insurance is exclusively for the wealthy or those with significant assets. In reality, life insurance is a crucial financial tool for individuals of all income levels. It provides a safety net for families, ensuring they can maintain their financial stability and pursue their goals even in the absence of a primary income earner. Life insurance is particularly important for those with financial dependents or substantial financial obligations, such as mortgages or outstanding debts.

Life Insurance is Unnecessary for Young, Healthy Individuals

Some people believe that life insurance is unnecessary for young, healthy individuals who have no immediate financial concerns. However, this misconception overlooks the long-term financial planning benefits of life insurance. Even young, healthy individuals can benefit from life insurance by securing coverage at a lower cost and protecting their future financial goals. Life insurance provides peace of mind and ensures that unexpected events won’t derail their financial plans. Additionally, certain types of life insurance, such as whole life or universal life, offer cash value accumulation, which can be a valuable savings tool over time.

The Future of Life Insurance: Technological Advancements and Innovations

The life insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of life insurance and the innovations shaping the industry:

Digital Transformation

The digital revolution has transformed the way consumers interact with financial services, including life insurance. Insurance companies are embracing digital technologies to streamline the application process, provide personalized policy options, and offer efficient customer service. From online applications to digital policy management platforms, the life insurance industry is becoming more accessible and user-friendly.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the underwriting process. Insurance companies are leveraging advanced algorithms and machine learning to analyze vast amounts of data, improving risk assessment and premium determination. AI-powered systems can process medical records, financial information, and lifestyle data to provide more accurate and efficient underwriting decisions. This technology not only enhances the accuracy of risk assessment but also reduces the time and resources required for the underwriting process.

Parametric Insurance and Micro-Insurance

Parametric insurance and micro-insurance are emerging concepts in the life insurance space. Parametric insurance policies provide coverage based on predefined parameters, such as natural disasters or specific events. These policies offer quick payouts based on the occurrence of the defined event, rather than individual claims assessments. Micro-insurance, on the other hand, focuses on providing affordable coverage to underserved populations, often through innovative distribution channels and simplified policy structures.

Blockchain Technology and Smart Contracts

Blockchain technology and smart contracts are poised to revolutionize the life insurance industry by enhancing transparency, security, and efficiency. Blockchain can provide a secure and tamper-proof ledger for policy information, claims processing, and premium payments. Smart contracts, self-executing contracts with predefined rules, can automate various aspects of the insurance process, including policy issuance, premium payments, and claim settlements. This technology has the potential to reduce administrative burdens, improve data integrity, and enhance overall customer experience.

Conclusion: Empowering Your Financial Future with Life Insurance

Life insurance is a powerful financial tool that provides security, peace of mind, and financial stability to individuals and their families. By understanding the different types of life insurance policies, assessing your financial needs, and navigating the application process, you can make informed decisions to protect your loved ones and empower your financial future.

In today's dynamic financial landscape, life insurance remains a cornerstone of financial planning. It offers a safety net that can help families navigate unexpected challenges and pursue their long-term goals. As the life insurance industry continues to innovate and adapt, policyholders can benefit from enhanced accessibility, efficiency, and personalized coverage options.

Whether you're seeking temporary coverage with term life insurance or lifelong protection with permanent life insurance, the key is to choose a policy that aligns with your unique circumstances and financial objectives. By staying informed and proactive, you can make life insurance work for you, ensuring a brighter and more secure financial future for yourself and your loved ones.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your specific financial situation and goals. Generally, experts recommend calculating your coverage based on your income, outstanding debts, and the financial needs of your dependents. Consider factors such as mortgage payments, education expenses, and long-term financial obligations. It’s beneficial to consult with a financial advisor or use online calculators to determine an appropriate coverage amount.

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers affordable premiums and is ideal for temporary coverage needs. Whole life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time. Whole life insurance typically has higher premiums but offers both death benefit protection and a savings component.

Can I convert my term life insurance policy to a permanent policy?

+Yes, many term life insurance policies offer the option to convert to a permanent life insurance plan, such as whole life or universal life insurance. This conversion typically occurs without the need for a new medical examination and allows you to transition your coverage as your financial needs evolve.

What are some common riders or additional benefits offered by life insurance policies?

+Life insurance policies often offer additional riders or benefits to enhance coverage. Common riders include accelerated death benefits, which provide access to a portion of the death benefit while the insured is still alive for specific needs like long-term care. Other riders may include waiver of premium, which waives premium payments if the insured becomes disabled, or child riders, which provide coverage for the policyholder’s children.