Acess Insurance

In the complex world of insurance, understanding the intricacies of coverage is essential. Acess Insurance is a renowned provider that offers a comprehensive range of insurance solutions tailored to meet the diverse needs of individuals and businesses. With a focus on accessibility and customer satisfaction, Acess Insurance has become a trusted name in the industry. In this article, we delve into the key aspects of Acess Insurance, exploring its services, policies, and the unique value it brings to policyholders.

Acess Insurance: A Comprehensive Overview

Headquartered in [city, country], Acess Insurance has established itself as a leading provider of insurance services with a global reach. Founded in [founding year], the company has grown exponentially, now serving millions of satisfied customers worldwide. Acess Insurance’s mission is to make insurance simple, affordable, and accessible to all, ensuring peace of mind and financial security for its policyholders.

Insurance Products and Services

Acess Insurance offers an extensive portfolio of insurance products designed to cater to various life stages and business requirements. Here’s an overview of their key offerings:

- Health Insurance: Acess provides a range of health insurance plans, including individual and family coverage, with options for different budgets and healthcare needs. Their plans often include comprehensive benefits, such as coverage for hospital stays, prescription medications, and preventative care.

- Life Insurance: The company offers term life, whole life, and universal life insurance policies. These plans ensure financial protection for your loved ones in the event of unforeseen circumstances. Acess Insurance's life insurance policies are known for their competitive rates and flexible payment options.

- Auto Insurance: With a focus on safety and affordability, Acess Insurance provides auto insurance policies that cover a wide range of vehicles. Their policies include liability coverage, collision and comprehensive coverage, as well as optional add-ons like rental car reimbursement and roadside assistance.

- Home Insurance: Acess's home insurance policies protect your property and belongings against various risks, including fire, theft, and natural disasters. Their plans are customizable, allowing policyholders to choose coverage levels based on their specific needs.

- Business Insurance: Tailored to the unique needs of small businesses, Acess Insurance offers a variety of commercial insurance products. This includes general liability insurance, professional liability insurance (E&O), property insurance, and workers' compensation. They also provide specialized coverage for specific industries, ensuring businesses are adequately protected.

- Travel Insurance: For those who frequently travel, Acess Insurance offers travel insurance plans that cover trip cancellations, medical emergencies, lost luggage, and other travel-related risks. Their policies are flexible, allowing travelers to choose the level of coverage they require.

Key Features and Benefits of Acess Insurance

Acess Insurance stands out in the market with its commitment to customer satisfaction and innovative approaches to insurance. Here are some key features and benefits that set them apart:

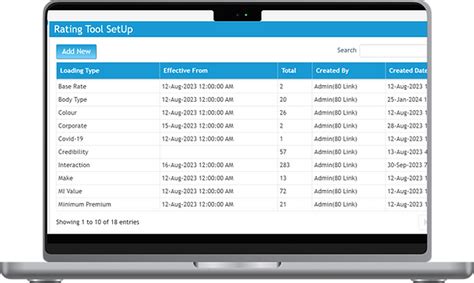

- Digital Convenience: Acess Insurance embraces digital technology, offering a seamless online experience for policyholders. From purchasing insurance to filing claims, their user-friendly platform makes the process efficient and convenient.

- Personalized Service: Despite their digital focus, Acess Insurance values personalized interactions. They assign dedicated insurance advisors to each client, ensuring tailored advice and support throughout the insurance journey.

- Competitive Pricing: Acess Insurance is known for its competitive premiums, offering affordable coverage options without compromising on quality. They regularly review their pricing to ensure policyholders receive the best value for their insurance needs.

- Claim Efficiency: The company has streamlined its claim process, ensuring prompt and fair settlements. Their efficient claims handling team works closely with policyholders to resolve claims quickly and with minimal hassle.

- Educational Resources: Acess Insurance believes in empowering their customers with knowledge. They provide a wealth of educational resources on their website, including articles, videos, and guides, to help policyholders better understand their insurance options and make informed decisions.

Performance and Recognition

Acess Insurance’s commitment to excellence has not gone unnoticed. The company has received numerous accolades and industry recognitions for its innovative approaches and customer-centric services. Some notable achievements include:

- Recipient of the "Best Insurance Provider" award for [award year] by [industry publication/association]

- Recognized as one of the "Top 10 Most Innovative Insurance Companies" in [award year] by [industry publication]

- Featured in [industry magazine] as a "Leading Insurer for Customer Satisfaction" in multiple consecutive years

- Certified as a "Green Insurance Company" for their commitment to sustainable practices and eco-friendly initiatives

Future Prospects and Industry Impact

Acess Insurance continues to evolve and innovate, staying ahead of industry trends. With a focus on digital transformation and data analytics, the company is well-positioned to enhance its services and offer even more personalized insurance solutions. Their commitment to sustainability and social responsibility further solidifies their positive impact on the industry and society as a whole.

As Acess Insurance expands its reach and influence, they are expected to play a pivotal role in shaping the future of insurance, making it more accessible, efficient, and tailored to the needs of a diverse range of customers.

| Insurance Type | Key Features |

|---|---|

| Health Insurance | Comprehensive coverage, flexible plans, and affordable premiums |

| Life Insurance | Competitive rates, flexible payment options, and customizable coverage |

| Auto Insurance | Safety-focused, affordable policies with optional add-ons |

| Home Insurance | Customizable coverage for property and belongings |

| Business Insurance | Tailored solutions for small businesses, including industry-specific coverage |

| Travel Insurance | Flexible plans covering a range of travel-related risks |

How can I get a quote from Acess Insurance for my specific insurance needs?

+You can easily get a personalized quote from Acess Insurance by visiting their official website and filling out a simple online form. Provide details about your insurance requirements, and their system will generate a tailored quote based on your needs. Alternatively, you can reach out to their customer support team via phone or email for assistance.

What sets Acess Insurance apart from other insurance providers in terms of customer service?

+Acess Insurance prioritizes personalized service and assigns dedicated advisors to each client. This ensures that policyholders receive tailored advice and support throughout their insurance journey. Their digital platform enhances convenience, but they also offer traditional methods of communication for those who prefer it.

How does Acess Insurance ensure competitive pricing for its insurance policies?

+Acess Insurance regularly reviews and adjusts their pricing to ensure they offer competitive premiums without compromising on the quality of coverage. They also provide a range of customizable options, allowing policyholders to choose the level of coverage they need, ensuring value for money.