Progressive Car Insurance

Progressive Car Insurance has established itself as a leading provider of auto insurance solutions in the United States, offering a comprehensive range of coverage options and innovative services to cater to diverse customer needs. With a focus on customer satisfaction and a commitment to staying ahead of the curve, Progressive has become a trusted name in the insurance industry. This article delves into the world of Progressive Car Insurance, exploring its history, key features, and the benefits it brings to policyholders.

A History of Innovation and Customer-Centric Approach

Progressive Car Insurance traces its roots back to 1937, when it was founded by Jack Green and Joseph Lewis. From its early days, Progressive has been driven by a vision to revolutionize the insurance industry and provide customers with a better experience. The company’s founders believed in the power of innovation and technology to streamline processes and offer more personalized coverage options.

Over the decades, Progressive has consistently lived up to its name, introducing groundbreaking initiatives that have shaped the auto insurance landscape. One of its earliest innovations was the introduction of the Snapshot program, which utilizes telematics technology to analyze driving behavior and offer customized insurance rates. This program has not only incentivized safer driving but has also demonstrated Progressive's commitment to using data-driven insights for the benefit of its customers.

Progressive's customer-centric approach extends beyond its innovative products. The company prides itself on its exceptional customer service, with a dedicated team of knowledgeable representatives who are readily available to assist policyholders. Whether it's answering queries, guiding customers through the claims process, or offering advice on coverage options, Progressive ensures that its customers receive the support they need at every stage of their insurance journey.

Comprehensive Coverage Options

Progressive Car Insurance understands that every driver has unique needs and preferences when it comes to auto insurance. To cater to this diversity, the company offers a wide array of coverage options, ensuring that policyholders can tailor their insurance plans to align with their specific requirements.

Liability Coverage

Liability coverage is a fundamental aspect of any auto insurance policy, and Progressive provides flexible options to meet the varying needs of its customers. This coverage protects policyholders against claims arising from bodily injury or property damage caused to others in an accident for which the insured driver is at fault. Progressive offers different liability limits, allowing drivers to choose the level of coverage that best suits their budget and potential risks.

Collision and Comprehensive Coverage

In addition to liability coverage, Progressive offers collision and comprehensive coverage to provide more extensive protection. Collision coverage helps cover the cost of repairs or replacement if the insured vehicle is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, natural disasters, or damage caused by animals. These coverages ensure that policyholders can receive the financial support they need to get back on the road quickly and efficiently.

Additional Coverage Options

Progressive goes beyond the standard coverage options, offering a range of additional protections to address specific needs. These include:

- Medical Payments Coverage: This coverage helps cover the medical expenses incurred by the policyholder and their passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection in the event of an accident with a driver who does not have sufficient insurance coverage.

- Rental Car Coverage: Offers reimbursement for rental car expenses when the insured vehicle is undergoing repairs after an insured incident.

- Gap Coverage: Protects policyholders from financial loss if their vehicle is totaled or stolen, ensuring they can replace it without incurring additional costs.

The Power of Technology: Progressive’s Digital Innovations

Progressive Car Insurance has embraced technology to enhance its services and provide a seamless experience for its customers. The company’s digital platforms and mobile apps have revolutionized the way policyholders interact with their insurance provider, offering convenience and accessibility.

Online Services and Mobile Apps

Progressive’s online platform and mobile apps empower policyholders to manage their insurance needs efficiently. From obtaining quotes to making policy changes, customers can access a wide range of services with just a few clicks. The apps also provide real-time updates on claims, allowing policyholders to track the progress of their cases and stay informed throughout the process.

Telematics and Usage-Based Insurance

Progressive’s Snapshot program, as mentioned earlier, is a prime example of the company’s utilization of telematics technology. By installing a small device in the insured vehicle, Progressive can gather data on driving behavior, including miles driven, time of day, and braking patterns. This data-driven approach allows Progressive to offer usage-based insurance, providing policyholders with discounts based on their safe driving habits.

Digital Claims Process

Progressive has streamlined its claims process through digital innovations. Policyholders can initiate claims online or through the mobile app, providing details and evidence of the incident. Progressive’s advanced claim management system allows for efficient processing, with many claims being resolved within a matter of days. The company’s use of artificial intelligence and machine learning further enhances the accuracy and speed of claims handling, ensuring a smoother experience for customers.

Discounts and Savings

Progressive Car Insurance understands the importance of offering competitive rates and providing opportunities for policyholders to save on their premiums. The company offers a variety of discounts to help customers get the most value from their insurance plans.

Multi-Policy Discounts

One of the most significant ways to save with Progressive is by bundling policies. By insuring multiple vehicles or combining auto insurance with other types of coverage, such as homeowners or renters insurance, policyholders can enjoy substantial discounts. This multi-policy approach not only simplifies insurance management but also provides significant cost savings.

Safe Driver Discounts

Progressive rewards safe driving habits through various discounts. Policyholders who maintain a clean driving record and avoid accidents or violations may be eligible for discounts on their premiums. Additionally, the Snapshot program offers an incentive-based approach, providing discounts to drivers who exhibit safe driving behavior as measured by the telematics device.

Other Discounts

Progressive offers a range of other discounts to cater to different customer segments. These include discounts for:

- Vehicle safety features (such as airbags, anti-lock brakes, and anti-theft devices)

- Good student grades (for young drivers who maintain a certain GPA)

- Military service (for active or retired military personnel)

- Pay-in-full options (for policyholders who choose to pay their premiums in full rather than in installments)

Progressive’s Commitment to Customer Satisfaction

At the heart of Progressive’s success is its unwavering commitment to customer satisfaction. The company understands that providing exceptional service is not just about offering competitive rates and coverage options, but also about ensuring a positive and seamless experience throughout the entire insurance journey.

Excellent Customer Service

Progressive prides itself on its customer-centric culture, with a dedicated team of knowledgeable and friendly representatives. Whether policyholders have questions about their coverage, need assistance with claims, or simply want to explore their options, Progressive’s customer service team is readily available to provide personalized support. The company’s commitment to timely and efficient service ensures that customers feel valued and well-cared for.

Claim Satisfaction

Progressive understands that claims can be a stressful and challenging time for policyholders. The company’s focus on customer satisfaction extends to its claims process, ensuring that policyholders receive the support and compensation they deserve. With a dedicated claims team and a streamlined digital process, Progressive aims to make the claims experience as smooth and efficient as possible.

Policyholder Feedback and Improvements

Progressive actively seeks feedback from its policyholders to continuously improve its services. By listening to customer feedback and suggestions, the company can identify areas for enhancement and implement changes that align with the needs and preferences of its customers. This commitment to ongoing improvement demonstrates Progressive’s dedication to delivering the best possible insurance experience.

The Future of Progressive Car Insurance

As the insurance industry continues to evolve, Progressive Car Insurance remains at the forefront, constantly innovating and adapting to meet the changing needs of its customers. With a strong focus on technology, data analytics, and customer satisfaction, Progressive is well-positioned to continue its legacy of providing top-notch insurance solutions.

Looking ahead, Progressive is likely to further leverage technology to enhance its services. This may include advancements in telematics, artificial intelligence, and machine learning, enabling more precise risk assessment and personalized coverage options. Additionally, Progressive is expected to continue its commitment to customer-centric initiatives, ensuring that policyholders receive the support and guidance they need to navigate the complexities of auto insurance.

In conclusion, Progressive Car Insurance has established itself as a leader in the industry through its innovative approach, comprehensive coverage options, and unwavering commitment to customer satisfaction. By embracing technology, offering competitive rates, and providing exceptional service, Progressive continues to be a trusted choice for millions of drivers across the United States.

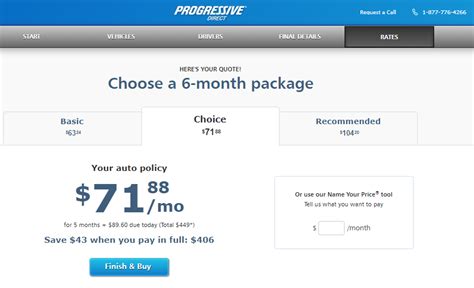

How can I get a quote from Progressive Car Insurance?

+Obtaining a quote from Progressive Car Insurance is a straightforward process. You can start by visiting their official website or downloading their mobile app. From there, you’ll be guided through a series of questions about your vehicle, driving history, and desired coverage options. Progressive’s online platform and app provide a user-friendly experience, allowing you to obtain a personalized quote quickly and easily.

What is Progressive’s Snapshot program, and how does it work?

+The Snapshot program is Progressive’s innovative usage-based insurance offering. It utilizes a small device, typically plugged into your vehicle’s diagnostic port, to collect data on your driving behavior. This data includes factors such as miles driven, time of day, and braking patterns. Based on this information, Progressive can offer personalized insurance rates, providing discounts to drivers who exhibit safe driving habits.

What types of discounts does Progressive Car Insurance offer?

+Progressive Car Insurance offers a range of discounts to help policyholders save on their premiums. These include multi-policy discounts for bundling multiple insurance policies, safe driver discounts for maintaining a clean driving record, and discounts for vehicle safety features, good student grades, military service, and pay-in-full options. Progressive’s discounts vary based on factors such as location and coverage options, so it’s recommended to explore their website or consult with a representative to understand the specific discounts available in your area.