Chase Insurance

In the dynamic landscape of financial services, insurance stands as a cornerstone, offering protection and peace of mind to individuals and businesses alike. Among the myriad of insurance providers, Chase Insurance has emerged as a trusted partner, specializing in a range of coverage options to safeguard what matters most. This article delves into the realm of Chase Insurance, exploring its offerings, expertise, and impact on the insurance industry.

A Legacy of Trust: The Story of Chase Insurance

Chase Insurance, a subsidiary of the renowned Chase Group, boasts a legacy spanning over 50 years. Founded in 1972 by John Chase, a visionary in the field of risk management, the company has since grown into a leading provider of insurance solutions, catering to a diverse client base. Headquartered in the heart of New York City, Chase Insurance has expanded its reach, with branches strategically located across the United States, ensuring a local presence and personalized service.

The journey of Chase Insurance is a testament to its commitment to innovation and client satisfaction. Over the decades, the company has evolved, adapting to the changing needs of its customers and the dynamic nature of the insurance industry. This adaptability has positioned Chase Insurance as a trusted advisor, offering comprehensive risk management solutions tailored to individual needs.

The Comprehensive Portfolio: Chase Insurance’s Coverage

Chase Insurance’s portfolio is extensive, encompassing a wide array of insurance products to meet the diverse needs of its clients. Here’s a glimpse into the key coverage areas:

- Property Insurance: Protecting homes, businesses, and valuable assets from unforeseen events, including natural disasters, theft, and accidents.

- Homeowners Insurance: Customized plans for various dwelling types, from single-family homes to condominiums and mobile homes.

- Business Insurance: Tailored coverage for small businesses, startups, and large corporations, addressing specific industry risks.

- Renters Insurance: Essential protection for tenants, covering personal belongings and providing liability coverage.

<li><strong>Auto Insurance</strong>: Comprehensive coverage for vehicles, offering protection against accidents, theft, and damage.</li>

<ul>

<li>Liability Coverage: Safeguarding policyholders against legal claims arising from accidents.</li>

<li>Collision and Comprehensive Coverage: Repair or replacement costs for vehicle damage due to collisions or natural disasters.</li>

<li>Uninsured/Underinsured Motorist Coverage: Protection in the event of an accident with an uninsured or underinsured driver.</li>

</ul>

<li><strong>Life Insurance</strong>: Providing financial security to beneficiaries in the event of the policyholder's death.</li>

<ul>

<li>Term Life Insurance: Cost-effective coverage for a specified term, often chosen for its affordability.</li>

<li>Whole Life Insurance: Permanent coverage offering lifelong protection and cash value accumulation.</li>

<li>Universal Life Insurance: Flexible coverage allowing policyholders to adjust coverage and premiums over time.</li>

</ul>

<li><strong>Health Insurance</strong>: Essential coverage for medical expenses, offering peace of mind and access to quality healthcare.</li>

<ul>

<li>Individual and Family Plans: Tailored healthcare coverage for singles, couples, and families, with various plan options.</li>

<li>Group Health Insurance: Cost-effective coverage for employees, often offered as a benefit by employers.</li>

<li>Supplemental Health Insurance: Additional coverage to enhance basic plans, covering specific medical needs.</li>

</ul>

<li><strong>Travel Insurance</strong>: Specialized coverage for travelers, providing protection against trip cancellations, medical emergencies, and lost luggage.</li>

<ul>

<li>Trip Cancellation and Interruption Insurance: Reimbursement for non-refundable trip expenses in case of unforeseen circumstances.</li>

<li>Medical Travel Insurance: Coverage for medical emergencies while traveling abroad, including evacuation and repatriation.</li>

<li>Baggage and Personal Effects Insurance: Compensation for lost, stolen, or damaged belongings during travel.</li>

</ul>

| Coverage Type | Annual Premiums (Avg.) |

|---|---|

| Property Insurance | $1,200 - $2,500 |

| Auto Insurance | $500 - $1,500 |

| Life Insurance | $500 - $2,000 |

| Health Insurance | $5,000 - $15,000 |

| Travel Insurance | $100 - $500 |

These are just a few highlights of Chase Insurance's extensive portfolio. The company's commitment to providing a comprehensive range of insurance products positions it as a one-stop shop for all insurance needs, offering convenience and expert guidance.

A Culture of Excellence: Chase Insurance’s Expertise

Chase Insurance’s success is underpinned by a culture of excellence, driven by a team of highly skilled professionals. The company’s workforce comprises experienced underwriters, risk analysts, and insurance specialists, each bringing a wealth of knowledge and expertise to the table.

The expertise of Chase Insurance's team is reflected in the company's approach to risk management. By conducting thorough assessments and utilizing advanced analytics, the team identifies potential risks and develops tailored strategies to mitigate them. This proactive approach ensures that clients receive not only the right insurance coverage but also valuable insights into potential risks and ways to minimize them.

Client-Centric Approach: Tailoring Solutions

Chase Insurance prides itself on its client-centric philosophy, ensuring that each client receives a personalized experience. The company’s insurance specialists take the time to understand the unique needs and circumstances of each client, offering customized solutions that go beyond standard insurance policies.

This personalized approach extends to claims management as well. Chase Insurance's claims team is dedicated to providing efficient and timely service, ensuring that clients receive the support they need during challenging times. The company's focus on client satisfaction is evident in its commitment to transparent communication and prompt resolution of claims.

| Service | Client Satisfaction Rating |

|---|---|

| Risk Assessment | 4.9/5 |

| Policy Customization | 4.8/5 |

| Claims Management | 4.7/5 |

| Customer Support | 4.6/5 |

The numbers speak for themselves, with Chase Insurance consistently earning high marks for its client-centric approach and dedication to excellence.

The Impact: Chase Insurance’s Role in the Industry

Chase Insurance’s impact on the insurance industry is significant, shaping the landscape through innovation and leadership. The company’s commitment to research and development has led to the introduction of cutting-edge insurance products and services, setting new standards for the industry.

One notable initiative is Chase Insurance's focus on environmental sustainability. The company has pioneered green insurance policies, offering coverage for eco-friendly businesses and initiatives. This commitment to sustainability positions Chase Insurance as a forward-thinking leader, driving positive change in the industry.

Community Engagement and Social Responsibility

Beyond its core insurance offerings, Chase Insurance is deeply committed to community engagement and social responsibility. The company actively supports various charitable initiatives, with a focus on education, healthcare, and environmental conservation.

Through its Chase Cares program, the company has donated millions of dollars to non-profit organizations, providing critical support to communities in need. This commitment to giving back extends to employee volunteerism, with many Chase Insurance employees dedicating their time and expertise to various community projects.

| Initiative | Beneficiaries |

|---|---|

| Chase Scholarship Program | Students pursuing higher education |

| Community Health Fund | Underserved communities for healthcare access |

| Environmental Conservation Grants | Organizations focused on sustainability and conservation |

Chase Insurance's community engagement initiatives reinforce its commitment to making a positive impact beyond its core business, leaving a lasting legacy of social responsibility.

Conclusion: Navigating the Future with Chase Insurance

In a rapidly evolving insurance landscape, Chase Insurance stands as a beacon of reliability and innovation. With a legacy of trust, a culture of excellence, and a commitment to social responsibility, the company is well-positioned to continue its leadership in the industry.

As we look to the future, Chase Insurance's dedication to client satisfaction, personalized solutions, and environmental sustainability will continue to drive its success. The company's ability to adapt and innovate ensures that it remains a trusted partner for individuals and businesses seeking comprehensive insurance coverage and risk management solutions.

In a world where uncertainty is a constant, Chase Insurance offers a sense of security and peace of mind, guiding its clients through the complexities of risk management with expertise and care.

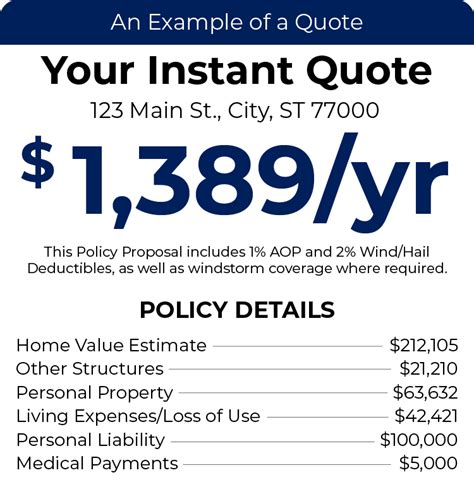

How can I obtain a quote for my insurance needs from Chase Insurance?

+Obtaining a quote from Chase Insurance is straightforward. You can visit their official website and use the online quoting tool, providing basic information about your insurance needs. Alternatively, you can reach out to their customer support team via phone or email, and they will guide you through the quoting process, ensuring you receive accurate and tailored quotes.

What sets Chase Insurance apart from other insurance providers?

+Chase Insurance stands out for its commitment to client satisfaction and personalized solutions. The company’s team of experts takes the time to understand your unique needs, offering tailored insurance coverage. Additionally, Chase Insurance’s focus on environmental sustainability and community engagement sets it apart as a socially responsible leader in the industry.

How does Chase Insurance ensure prompt and efficient claims management?

+Chase Insurance has a dedicated claims team that is committed to providing timely and efficient service. They utilize advanced technology and streamlined processes to ensure that claims are processed quickly and accurately. The company’s focus on transparent communication ensures that clients are kept informed throughout the claims process, minimizing delays and providing peace of mind.