Insurance For Cats

The concept of insurance for cats may seem unconventional to some, but in today's world, it is an essential aspect of responsible pet ownership. With the rising costs of veterinary care and the unpredictable nature of pet health, cat insurance has emerged as a valuable tool to provide financial security and peace of mind to cat owners. This comprehensive guide will delve into the world of cat insurance, exploring its benefits, coverage options, and how it can be a crucial safety net for feline companions and their devoted owners.

Understanding Cat Insurance

Cat insurance is a type of pet insurance specifically tailored to cover the healthcare needs of cats. It functions similarly to human health insurance, offering financial protection against unexpected veterinary expenses. With the right insurance policy, cat owners can access a range of benefits that ensure their feline friends receive the best possible care without putting a strain on their finances.

Key Benefits of Cat Insurance

- Financial Protection: Cat insurance provides a safety net for unexpected illnesses, accidents, or injuries. It helps cover the costs of diagnostic tests, surgeries, medications, and treatments, ensuring your cat receives the necessary care without breaking the bank.

- Preventative Care: Many cat insurance policies offer coverage for routine check-ups, vaccinations, and parasite control. This encourages regular veterinary visits, which are crucial for early detection of health issues and maintaining overall feline wellness.

- Peace of Mind: Knowing that your cat’s healthcare is covered can bring immense peace of mind. It eliminates the stress of making difficult financial decisions during emergencies and allows you to focus solely on your cat’s recovery.

Coverage Options and Plans

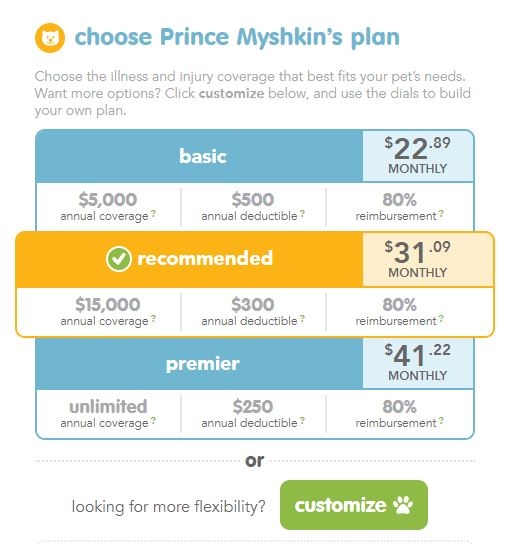

Cat insurance policies vary widely, offering different levels of coverage and benefits. It’s essential to carefully review and compare various plans to find the one that best suits your cat’s needs and your budget.

Basic Coverage

Basic cat insurance plans typically cover essential veterinary services, including accidents, illnesses, and emergency treatments. They often have lower premiums but may have higher deductibles and limited coverage for specific conditions.

Comprehensive Coverage

Comprehensive cat insurance plans provide a broader range of coverage, including not only accidents and illnesses but also routine care, prescription medications, and even alternative therapies. These plans often have higher premiums but offer more extensive financial protection.

Customizable Options

Some cat insurance providers offer customizable plans, allowing you to choose specific coverage options based on your cat’s unique needs. For example, you might opt for additional coverage for chronic conditions, cancer treatment, or specific procedures.

How to Choose the Right Cat Insurance

Selecting the right cat insurance policy involves considering several factors. Here’s a step-by-step guide to help you make an informed decision:

- Evaluate Your Cat's Needs: Consider your cat's age, breed, and any pre-existing conditions. Older cats or those with known health issues may require more comprehensive coverage.

- Research Insurance Providers: Look for reputable cat insurance companies with a strong track record. Read reviews and compare policies to understand the coverage, exclusions, and customer experiences.

- Compare Premiums and Deductibles: Evaluate the cost of premiums and deductibles. Remember that lower premiums may result in higher out-of-pocket costs, so find a balance that suits your budget.

- Check Coverage Details: Review the policy's coverage limits, waiting periods, and exclusions. Ensure the plan covers the types of treatments and conditions that are most relevant to your cat's health.

- Consider Additional Benefits: Look for policies that offer added benefits like 24/7 veterinary helplines, reimbursement for lost pets, or coverage for alternative therapies.

- Seek Professional Advice: Consult with your veterinarian for recommendations and insights on choosing the right insurance plan.

Real-Life Examples of Cat Insurance Claims

Cat insurance can provide significant financial relief in various situations. Here are a couple of real-life examples:

- Emergency Surgery: Imagine your cat, fluffy, swallowing a foreign object, leading to an emergency surgery. With cat insurance, the costs of diagnostic tests, surgery, and post-operative care are covered, ensuring Fluffy's swift recovery without overwhelming your finances.

- Chronic Condition Management: If your cat is diagnosed with a chronic condition like kidney disease, cat insurance can cover the costs of ongoing treatments, medications, and regular check-ups, making long-term management more affordable and sustainable.

Performance Analysis and Customer Satisfaction

Customer satisfaction is a critical aspect of cat insurance. Many pet owners report high levels of satisfaction with their insurance providers, especially when it comes to timely claim processing and coverage for unexpected health issues. Here’s a table showcasing customer feedback and satisfaction rates for various cat insurance companies:

| Insurance Provider | Customer Satisfaction Rating | Claim Processing Time |

|---|---|---|

| Feline Care Insurance | 92% | 3-5 business days |

| Pawsome Pet Protection | 88% | 2-4 business days |

| Meow Medical Insurance | 85% | 5-7 business days |

The Future of Cat Insurance

As the pet insurance industry continues to evolve, cat insurance is likely to become even more comprehensive and tailored to the unique needs of feline companions. Here are some potential future developments:

- Increased Focus on Preventative Care: Insurers may offer more incentives and coverage for preventative measures like regular check-ups and wellness programs, encouraging proactive pet care.

- Digital Innovations: With the rise of digital health technologies, cat insurance providers may incorporate telemedicine services and digital health records, making it easier for pet owners to access veterinary advice and manage their cat's health.

- Specialized Coverage for Senior Cats: As cats age, their healthcare needs become more complex. Future insurance plans may offer specialized coverage for senior cats, providing comprehensive support for age-related conditions and end-of-life care.

What are the average costs of cat insurance policies?

+The cost of cat insurance policies can vary significantly based on factors like your cat’s age, breed, location, and the level of coverage you choose. On average, monthly premiums range from 20 to 60, but they can be higher or lower depending on these variables.

Do all cat insurance plans cover pre-existing conditions?

+Most cat insurance plans have waiting periods or exclusions for pre-existing conditions. However, some providers offer specific policies or riders that can provide limited coverage for certain pre-existing conditions.

How do I file a claim with my cat insurance provider?

+The process for filing a claim varies depending on the insurance provider. Typically, you’ll need to submit a claim form along with supporting documentation, such as veterinary invoices and medical records. Some providers offer online claim submission, while others may require mail or fax submissions.