Online Homeowner Insurance Quote

In today's digital age, obtaining an online homeowner insurance quote has become an efficient and convenient process. With just a few clicks, homeowners can gain valuable insights into their insurance options, making it an essential step in safeguarding their properties and assets. This article aims to delve into the intricacies of the online homeowner insurance quote process, exploring its benefits, key considerations, and the factors that influence the final quote.

Understanding the Online Homeowner Insurance Quote Process

The online homeowner insurance quote process is a straightforward yet comprehensive journey. It involves providing detailed information about your home and its unique characteristics, which are then used by insurance providers to assess risk and generate a personalized quote. This digital approach offers several advantages, including convenience, speed, and transparency.

Step-by-Step Guide to Obtaining an Online Quote

- Choose a Reputable Insurance Provider: Begin by selecting a trusted insurance company that offers online quoting services. Research their reputation, customer reviews, and the range of coverage options they provide.

- Gather Essential Information: Before starting the quote process, collect the necessary details about your home. This includes the property’s age, square footage, number of rooms, any recent renovations, and the value of your belongings.

- Access the Online Quoting Tool: Visit the insurance provider’s website and locate the online quoting tool. It is often easily accessible and designed for user-friendliness.

- Provide Accurate Information: Fill out the online form with precise details about your home and its features. Be honest and thorough, as any discrepancies can lead to inaccurate quotes or potential issues with coverage later on.

- Select Coverage Options: The quoting tool will guide you through various coverage options. Choose the levels of protection that align with your needs, considering factors like liability, property damage, and personal belongings coverage.

- Review and Compare Quotes: Once you’ve submitted your information, the tool will generate a quote based on the details provided. Take the time to review the quote, understanding the coverage limits, deductibles, and any additional features or endorsements offered.

- Consider Additional Factors: Besides the base quote, there are other factors to consider. These may include discounts for safety features, loyalty programs, or bundle options if you already have other insurance policies with the provider.

- Seek Professional Advice: If you have specific concerns or unique circumstances, it’s advisable to consult with an insurance professional. They can provide personalized guidance and ensure you’re getting the right coverage for your needs.

| Key Factors | Influence on Quote |

|---|---|

| Home Value | Higher home values often result in higher premiums. |

| Location | Areas prone to natural disasters or high crime rates may have higher quotes. |

| Age of the Home | Older homes might require more specialized coverage, impacting the quote. |

| Safety Features | Fire alarms, security systems, and other safety measures can lead to discounts. |

| Claim History | Previous claims can affect future quotes, especially if they were frequent or costly. |

The Benefits of Online Homeowner Insurance Quotes

Online homeowner insurance quotes offer a range of advantages that enhance the overall insurance shopping experience. These benefits include:

Convenience and Accessibility

One of the primary advantages is the convenience it provides. Homeowners can obtain quotes from the comfort of their homes, at any time that suits them. This flexibility eliminates the need for in-person meetings or lengthy phone calls, making the process more accessible and efficient.

Speed and Efficiency

Online quoting tools are designed to provide quick and efficient results. Within minutes, homeowners can receive personalized quotes, allowing for swift comparisons and decisions. This speed is particularly beneficial when time is of the essence, such as during a home purchase or when an existing policy is about to expire.

Transparency and Customization

The online process offers a high degree of transparency. Homeowners can see the breakdown of their quote, understanding the factors that influence the premium. Additionally, the ability to customize coverage options ensures that the quote aligns precisely with their unique needs and preferences.

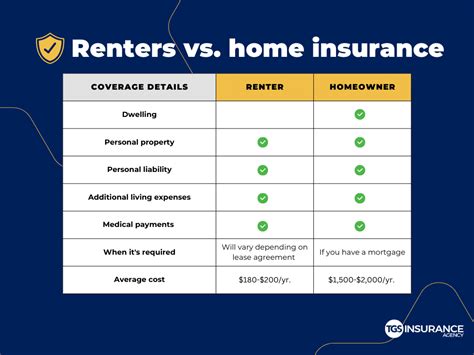

Comparison Shopping

With online quotes, comparison shopping becomes a breeze. Homeowners can easily collect and compare quotes from multiple insurance providers, ensuring they find the best value and coverage for their money. This competitive environment often leads to better deals and more favorable terms.

Factors Influencing Your Online Homeowner Insurance Quote

Several key factors play a role in determining the quote you receive for your homeowner insurance. Understanding these factors can help you anticipate potential costs and make informed decisions.

Home Value and Location

The value of your home is a significant factor in calculating your insurance quote. Higher-valued homes generally attract higher premiums, as they are considered more expensive to rebuild or repair. Additionally, the location of your home is crucial. Areas prone to natural disasters, high crime rates, or other risks may result in higher quotes to account for potential losses.

Age and Condition of the Home

The age and overall condition of your home can impact your insurance quote. Older homes may require more specialized coverage, as they might be at a higher risk of issues like electrical failures or plumbing problems. Regular maintenance and updates can help mitigate these risks and potentially lower your insurance costs.

Safety Features and Discounts

Implementing safety features in your home can lead to substantial discounts on your insurance premium. These features may include fire alarms, smoke detectors, sprinkler systems, security cameras, or even simple measures like deadbolt locks. Insurance providers often offer incentives for homeowners who take proactive steps to protect their properties.

Claim History and Credit Score

Your claim history and credit score are two critical factors that insurance providers consider. A history of frequent or costly claims can negatively impact your future quotes, as it may signal a higher risk of future losses. Similarly, a good credit score can lead to lower premiums, as it is often seen as an indicator of financial responsibility.

Tips for Optimizing Your Online Homeowner Insurance Quote

To ensure you receive the most accurate and competitive online homeowner insurance quote, consider the following tips:

- Provide Accurate Information: Be honest and precise when filling out the online quote form. Any discrepancies can lead to inaccurate quotes and potential issues with coverage.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Compare quotes from several insurance providers to find the best coverage at the most affordable price.

- Bundle Your Policies: If you have other insurance needs, such as auto or life insurance, consider bundling them with your homeowner insurance. Many providers offer discounts for multiple policy holders.

- Review Coverage Options: Understand the different coverage options available and choose the ones that best fit your needs. Consider factors like liability, property damage, and personal belongings coverage.

- Seek Professional Guidance: If you have complex insurance needs or unique circumstances, consult with an insurance professional. They can provide personalized advice and help you navigate the quote process effectively.

Conclusion

The online homeowner insurance quote process offers a convenient, efficient, and transparent way to assess your insurance needs. By understanding the key factors that influence your quote and following the provided tips, you can navigate this process with confidence. Remember, homeowner insurance is an essential investment in protecting your home and your peace of mind, so take the time to find the right coverage at the right price.

Can I customize my homeowner insurance coverage to fit my specific needs?

+Absolutely! Online quoting tools often provide a range of coverage options, allowing you to tailor your policy to your unique requirements. Whether you need increased liability protection, coverage for valuable possessions, or specific endorsements, you can customize your policy to ensure it meets your needs.

Are there any discounts available for homeowner insurance policies?

+Yes, insurance providers often offer a variety of discounts to encourage responsible behavior and reduce risks. These may include discounts for safety features like burglar alarms or smoke detectors, loyalty discounts for long-term customers, and even discounts for bundle policies if you have multiple insurance needs.

How often should I review and update my homeowner insurance policy?

+It’s recommended to review your homeowner insurance policy annually or whenever significant changes occur in your life or your home. This ensures that your coverage remains adequate and up-to-date. Changes like home renovations, additions to your family, or the acquisition of valuable items may warrant an update to your policy.