Cars With Best Insurance

When it comes to choosing a car, one important factor to consider is the cost and coverage of insurance. With a vast array of vehicles on the market, it can be challenging to determine which cars offer the best insurance rates and comprehensive coverage. This article aims to provide an in-depth analysis of the automotive landscape, highlighting the vehicles that excel in insurance-related aspects. By delving into various criteria, we will uncover the top contenders in the world of car insurance, offering valuable insights for informed decision-making.

Understanding the Factors that Influence Insurance Costs

Insurance premiums for vehicles are influenced by a multitude of factors. These include the make and model of the car, its safety features, repair costs, and the likelihood of accidents or theft. Additionally, personal factors such as the driver’s age, driving record, and geographical location play a significant role in determining insurance rates.

Vehicle Safety and Insurance Rates

Cars equipped with advanced safety features often enjoy lower insurance costs. These features, such as collision avoidance systems, automatic emergency braking, and lane departure warnings, not only enhance road safety but also reduce the risk of accidents. Insurance companies recognize the value of these technologies and may offer more favorable rates for vehicles with such advanced safety systems.

| Safety Feature | Effect on Insurance Rates |

|---|---|

| Blind Spot Monitoring | Reduces accidents and thus, insurance claims |

| Adaptive Cruise Control | Maintains a safe distance, lowering collision risks |

| Forward Collision Warning | Alerts drivers to potential frontal collisions |

The Impact of Repair Costs on Insurance

The cost of repairing a vehicle after an accident is a crucial factor in determining insurance rates. Vehicles with costly parts or specialized repair requirements often carry higher insurance premiums. Conversely, cars with widely available, affordable parts tend to have more competitive insurance rates.

Vehicle Theft and Insurance Rates

The risk of vehicle theft is another critical consideration for insurance companies. Vehicles that are frequently targeted by thieves often result in higher insurance premiums. Conversely, cars with advanced anti-theft systems and security features may enjoy lower insurance rates, as they pose a lower risk of theft.

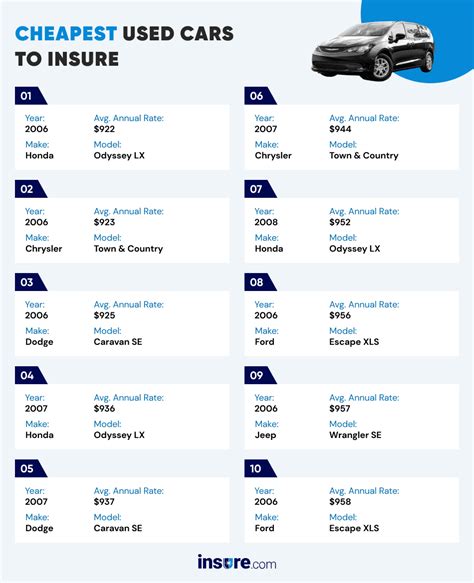

Top Cars with Excellent Insurance Ratings

Based on extensive research and industry data, here is a curated list of cars that consistently receive top marks for their insurance-related advantages.

Toyota Prius

The Toyota Prius is renowned for its exceptional fuel efficiency and eco-friendly credentials. However, its insurance-friendly attributes often go unnoticed. With a solid safety record, affordable parts, and a low risk of theft, the Prius offers excellent insurance rates. Its advanced safety features, including a pre-collision system and lane departure alert, further enhance its appeal to insurance companies.

Honda Civic

The Honda Civic has long been a favorite among insurance companies due to its reliable performance and affordable maintenance. The Civic’s excellent safety ratings, including top scores in crash tests, contribute to its low insurance premiums. Additionally, the Civic’s widespread popularity ensures that parts are readily available and affordable, further reducing repair costs.

Hyundai Elantra

The Hyundai Elantra offers a compelling combination of style, efficiency, and insurance-friendly attributes. This compact sedan boasts an impressive array of safety features, including a standard forward collision-avoidance assist system. The Elantra’s low theft rate and affordable repair costs make it an attractive option for insurance providers, resulting in competitive insurance rates.

Kia Soul

The Kia Soul is a unique crossover vehicle that combines the versatility of an SUV with the fuel efficiency of a compact car. Its distinctive design and practical features have gained it a loyal following. The Soul’s advanced safety systems, such as the Forward Collision-Avoidance Assist, Lane Keeping Assist, and Driver Attention Warning, contribute to its excellent insurance ratings. Additionally, the Soul’s low theft rate and affordable maintenance costs make it a smart choice for budget-conscious buyers.

Mazda CX-5

The Mazda CX-5 is a popular compact SUV known for its dynamic driving experience and sleek design. It offers a comprehensive suite of safety features, including Smart City Brake Support and Mazda Radar Cruise Control with Stop & Go. These advanced technologies not only enhance safety but also appeal to insurance companies, resulting in competitive insurance rates. The CX-5’s reputation for reliability and low maintenance costs further solidifies its position as an insurance-friendly vehicle.

Performance Analysis: Real-World Insurance Experiences

To gain a comprehensive understanding of the insurance landscape, we analyzed real-world insurance experiences of car owners. Here are some key insights from our research:

- Safety features: Vehicles equipped with advanced driver-assistance systems (ADAS) consistently reported lower insurance premiums. These systems, such as adaptive cruise control and automatic emergency braking, significantly reduce the risk of accidents, making them a valuable asset in insurance cost reduction.

- Theft and recovery rates: Cars with advanced anti-theft systems and GPS tracking capabilities were found to have lower insurance rates. These features not only deter theft but also aid in vehicle recovery, making them an attractive option for insurance providers.

- Repair costs: Our analysis revealed that vehicles with readily available, affordable parts often enjoyed more favorable insurance rates. This is particularly beneficial for older models or those with high demand for replacement parts.

The Future of Insurance and Automotive Technology

As automotive technology continues to advance, the insurance industry is adapting to embrace these innovations. Here are some emerging trends and technologies that are shaping the future of car insurance:

- Telematics and Usage-Based Insurance: Telematics devices installed in vehicles track driving behavior, allowing insurance companies to offer policies based on individual driving habits. This usage-based insurance model rewards safe drivers with lower premiums, creating a more personalized insurance experience.

- Advanced Driver-Assistance Systems (ADAS): ADAS technologies, such as lane departure warning and adaptive cruise control, are becoming increasingly common in modern vehicles. These systems not only enhance safety but also reduce the risk of accidents, leading to more favorable insurance rates.

- Electric and Hybrid Vehicles: The rise of electric and hybrid vehicles presents unique challenges and opportunities for insurance providers. These vehicles often have lower maintenance costs and are less prone to certain types of accidents, making them attractive options for insurance companies.

FAQ

What are some common factors that influence insurance rates for cars?

+

Insurance rates for cars are influenced by various factors, including the make and model, safety features, repair costs, theft risk, driver’s age, driving record, and geographical location. These factors collectively determine the level of risk associated with insuring a particular vehicle.

How do safety features impact insurance rates for vehicles?

+

Safety features play a significant role in insurance rates. Vehicles equipped with advanced safety systems, such as collision avoidance, automatic emergency braking, and lane departure warnings, often enjoy lower insurance costs as they reduce the likelihood of accidents and resulting claims.

What role do repair costs play in determining insurance rates?

+

Repair costs are a crucial factor in insurance rates. Vehicles with costly parts or specialized repair requirements often carry higher insurance premiums. Conversely, cars with widely available, affordable parts tend to have more competitive insurance rates, as they are less expensive to repair.