Small Business Commercial Auto Insurance

Small business commercial auto insurance is an essential aspect of protecting your business and its assets. As a small business owner, you understand the importance of safeguarding your operations and minimizing risks. In today's fast-paced and competitive business landscape, having the right insurance coverage is crucial to ensure the longevity and success of your enterprise.

This comprehensive guide will delve into the world of commercial auto insurance, providing you with valuable insights and expert advice to make informed decisions for your small business. From understanding the basics to exploring the various coverage options, we will cover everything you need to know to secure your business vehicles and navigate the insurance landscape with confidence.

Understanding Commercial Auto Insurance for Small Businesses

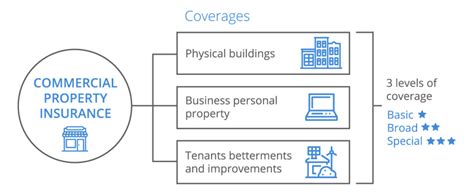

Commercial auto insurance is specifically designed to cater to the unique needs of businesses that utilize vehicles as part of their operations. Unlike personal auto insurance, this type of coverage offers broader protection, taking into account the specific risks associated with business use.

Small businesses, in particular, benefit from commercial auto insurance as it provides tailored coverage for a variety of vehicles, including:

- Company cars and trucks

- Vans and SUVs

- Trailers and tow vehicles

- Specialized equipment like food trucks or delivery vans

By understanding the scope and benefits of commercial auto insurance, small business owners can make informed decisions to protect their assets and mitigate potential financial losses arising from vehicle-related incidents.

Key Components of Commercial Auto Insurance

Commercial auto insurance policies are comprised of several key components, each offering distinct coverage and benefits. Understanding these components is crucial for small business owners to ensure they have the appropriate coverage to meet their specific needs.

Liability Coverage

Liability coverage is a fundamental aspect of commercial auto insurance. It provides protection in the event that your business vehicle is involved in an accident and causes damage to another person’s property or injuries to others. This coverage is designed to cover the costs associated with legal settlements, medical expenses, and property damage claims resulting from the accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for individuals injured in an accident caused by your business vehicle. |

| Property Damage Liability | Pays for repairs or replacements of property damaged in an accident caused by your business vehicle. |

Physical Damage Coverage

Physical damage coverage protects your business vehicles from damages resulting from accidents, vandalism, or natural disasters. This coverage is essential for ensuring the repair or replacement of your vehicles, thus minimizing downtime and maintaining operational efficiency.

- Collision Coverage: Covers damages to your vehicle when it collides with another vehicle or object.

- Comprehensive Coverage: Provides protection for damages caused by non-collision incidents, such as theft, vandalism, weather events, or animal collisions.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, provides coverage for medical expenses incurred by you or your employees as a result of an accident, regardless of who is at fault. This coverage is particularly beneficial for ensuring prompt medical attention and minimizing out-of-pocket expenses for your business.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects your business and its employees in the event of an accident with a driver who lacks sufficient insurance coverage. This coverage ensures that your business and its employees are compensated for injuries and damages, even if the at-fault driver cannot cover the costs.

Customizing Your Commercial Auto Insurance Policy

While the core components of commercial auto insurance provide essential coverage, small business owners have the flexibility to customize their policies to meet their unique needs. By adding optional coverages and endorsements, you can enhance your protection and address specific risks associated with your business operations.

Optional Coverages

Consider the following optional coverages to further protect your business and its assets:

- Hired and Non-Owned Auto Liability: Provides liability coverage for vehicles your business hires or borrows, such as rental cars or employee-owned vehicles used for business purposes.

- Roadside Assistance: Offers coverage for emergency services like towing, flat tire repair, or battery jump-starts, ensuring your vehicles can be quickly back on the road.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your business vehicle is being repaired due to a covered incident.

- Glass Coverage: Provides specific coverage for windshield and glass repairs or replacements, often with no deductible.

Endorsements

Endorsements are additions or modifications to your policy that allow you to customize your coverage even further. Here are some common endorsements to consider:

- Waiver of Depreciation: Ensures that, in the event of a total loss, your vehicle is valued at its pre-accident condition, rather than its depreciated value.

- Personal Effects Coverage: Provides coverage for personal belongings left in your business vehicle, such as laptops, tools, or equipment, in the event of theft or damage.

- Additional Insured: Allows you to add specific individuals or entities as additional insured parties under your policy, providing them with liability protection.

Evaluating Your Small Business’s Insurance Needs

When it comes to commercial auto insurance, it’s crucial to evaluate your small business’s specific needs and risks. By conducting a thorough assessment, you can ensure that your insurance coverage aligns with your business operations and potential liabilities.

Business Operations and Vehicle Usage

Consider the following factors related to your business operations and vehicle usage:

- Number of vehicles: Assess the total number of vehicles your business operates, including cars, trucks, vans, and any specialized equipment.

- Vehicle type and usage: Determine the primary purpose and usage of each vehicle, whether for sales and service, transportation of goods, or employee commuting.

- Driver demographics: Evaluate the age, experience, and driving records of your employees who operate business vehicles. Consider any specific risks or potential liabilities associated with your driver profile.

- Operational hours and locations: Assess the typical operational hours and locations where your vehicles are used. Consider any unique risks associated with your operating areas, such as heavy traffic, harsh weather conditions, or high-crime neighborhoods.

Risk Assessment and Coverage Gaps

Conducting a risk assessment is vital to identifying potential coverage gaps and ensuring your commercial auto insurance provides adequate protection. Here are some key factors to consider:

- Accident history: Review your business's accident history to identify any patterns or recurring issues that may require additional coverage or risk management strategies.

- Liability limits: Evaluate your current liability limits and consider whether they are sufficient to cover potential damages arising from accidents or incidents involving your business vehicles.

- Coverage exclusions: Review your policy's exclusions carefully to ensure there are no gaps in coverage that could leave your business vulnerable. Address any identified exclusions through additional endorsements or separate policies.

The Impact of Commercial Auto Insurance on Your Business

Beyond providing financial protection, commercial auto insurance has a significant impact on various aspects of your small business’s operations and overall success. By securing adequate coverage, you can mitigate risks, ensure business continuity, and foster a positive reputation and client confidence.

Risk Mitigation and Business Continuity

Commercial auto insurance plays a crucial role in mitigating risks associated with vehicle-related incidents. By having the right coverage in place, you can protect your business from potential financial losses, legal liabilities, and operational disruptions. In the event of an accident or incident, your insurance policy can cover the costs of repairs, medical expenses, and legal settlements, allowing your business to continue operating without significant interruptions.

Building Client Confidence and Trust

For small businesses that utilize vehicles for client-facing operations, such as delivery services or field service providers, commercial auto insurance is essential for building client confidence and trust. Clients expect their interactions with your business to be safe and secure. By demonstrating that you have taken the necessary steps to insure your vehicles and protect their interests, you can enhance your reputation and foster long-term client relationships.

Compliance with Industry Standards and Regulations

Certain industries and business sectors may have specific regulations and requirements regarding commercial auto insurance. By ensuring your business complies with these standards, you can avoid legal penalties, fines, and potential license suspensions. Commercial auto insurance not only protects your business but also demonstrates your commitment to safety and compliance, which is essential for maintaining a positive public image and attracting new clients.

FAQs

How much does commercial auto insurance cost for small businesses?

+The cost of commercial auto insurance can vary based on several factors, including the type and number of vehicles, driver profiles, coverage limits, and the business’s accident history. On average, small businesses can expect to pay between 600 and 1,500 per vehicle annually. However, it’s essential to obtain multiple quotes and compare coverage options to find the best value for your specific needs.

Can I bundle my commercial auto insurance with other business insurance policies to save money?

+Yes, bundling your commercial auto insurance with other business insurance policies, such as general liability or property insurance, can often result in significant cost savings. Many insurance providers offer bundled packages or multi-policy discounts, allowing you to streamline your coverage and reduce overall expenses.

What happens if I’m involved in an accident while using a rented or borrowed vehicle for business purposes?

+If you’re involved in an accident while using a rented or borrowed vehicle for business purposes, your commercial auto insurance policy’s hired and non-owned auto liability coverage will typically provide protection. This coverage extends to vehicles your business hires or borrows, ensuring you’re covered even when using temporary or alternative transportation.

Are there any tax benefits associated with commercial auto insurance for small businesses?

+Yes, small businesses can often take advantage of tax benefits associated with commercial auto insurance. Premiums paid for business auto insurance are typically tax-deductible as a necessary business expense. Consult with a tax professional to understand how these deductions can impact your business’s tax liability.