Cheapest Rental Insurance

Securing Affordable Rental Insurance: A Comprehensive Guide

Rental insurance is a vital consideration for anyone living in a rented property, as it provides essential protection for your belongings and can offer peace of mind. However, finding the cheapest rental insurance option that also meets your specific needs can be a daunting task. This guide aims to simplify the process, offering expert advice and insights to help you navigate the world of rental insurance with ease.

Understanding Rental Insurance Basics

Rental insurance, also known as renters' insurance, is a policy that covers your personal property and liabilities while you rent a home, apartment, or condominium. It is designed to protect you from financial losses in the event of theft, damage, or liability claims.

Unlike homeowners' insurance, which is often mandatory for property owners, rental insurance is typically optional for tenants. However, it is a wise investment, as it can cover the cost of replacing your belongings and provide liability protection if someone is injured in your rental unit.

Coverage Types

Rental insurance typically offers two main types of coverage:

- Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing, in the event of damage or theft. It can also cover additional living expenses if your rental becomes uninhabitable due to a covered incident.

- Liability Coverage: This provides protection if someone is injured on your rental property or if you accidentally cause damage to the landlord's property. It can cover medical expenses and legal fees associated with such incidents.

Additional Coverages

Depending on your provider and policy, you may have access to additional coverages, including:

- Personal Liability: Extends your liability coverage beyond your rental property, providing protection for accidents that occur away from your home.

- Identity Theft Protection: Assists you in the event of identity theft, offering resources and support to help resolve the issue.

- Loss of Use: Covers additional expenses if you need to temporarily relocate due to a covered loss.

- Personal Injury Protection: Provides coverage for legal fees and settlements if you are sued for libel, slander, or other personal injury claims.

Factors Affecting Rental Insurance Costs

The cost of rental insurance can vary significantly based on several factors. Understanding these factors can help you estimate your premium and make informed decisions about your coverage.

Location

The location of your rental property is a key determinant of your insurance rates. Areas with higher crime rates or a history of natural disasters may have higher premiums, as they pose a greater risk to insurers.

| Location | Average Premium |

|---|---|

| Urban Areas | $200 - $300 annually |

| Suburban Areas | $150 - $250 annually |

| Rural Areas | $100 - $200 annually |

Value of Belongings

The value of your personal property is another significant factor. Insurers will consider the replacement cost of your belongings when calculating your premium. If you have high-value items like jewelry, artwork, or expensive electronics, your insurance cost will likely be higher.

Deductibles

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your monthly premiums, but it means you'll pay more out of pocket if you need to make a claim.

Coverage Limits

The coverage limits you choose will also impact your premium. Higher limits provide more protection but will increase your costs. It's essential to find a balance between adequate coverage and affordability.

Provider and Policy Type

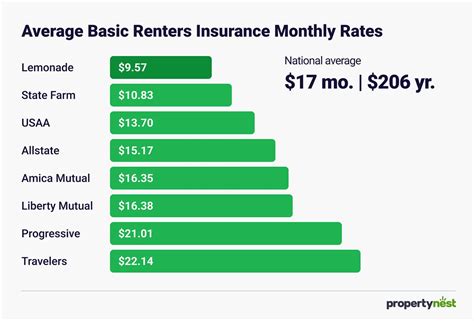

Different insurance providers offer various policy types and rates. Some providers specialize in rental insurance, while others offer it as an add-on to homeowners' or auto insurance policies. Comparing quotes from multiple providers can help you find the best deal.

Tips for Finding the Cheapest Rental Insurance

Securing affordable rental insurance requires a combination of research, understanding your needs, and exploring various options. Here are some tips to help you find the cheapest rental insurance that suits your requirements.

Shop Around

Don't settle for the first insurance quote you receive. Compare rates from multiple providers to find the best deal. Online comparison tools can be a convenient way to gather quotes from various insurers.

Consider Bundling

If you have other insurance policies, such as auto or homeowners' insurance, consider bundling your rental insurance with these policies. Many insurers offer discounts when you combine multiple policies, which can significantly reduce your overall premium.

Review Coverage Options

Carefully review the coverage options offered by each insurer. Ensure you understand the specific risks covered and any exclusions or limitations. Tailor your coverage to your needs to avoid overpaying for unnecessary add-ons.

Increase Your Deductible

Opting for a higher deductible can lower your monthly premiums. However, ensure you can afford the deductible amount if you need to make a claim. It's a trade-off between lower monthly costs and higher out-of-pocket expenses.

Negotiate with Your Landlord

Some landlords offer discounts or referrals for rental insurance. Discuss this with your landlord and see if they have any partnerships with insurance providers that could benefit you.

Take Advantage of Discounts

Insurance providers often offer discounts for various reasons. These may include discounts for:

- Being a non-smoker

- Having security features like a home alarm system

- Bundling multiple policies with the same provider

- Maintaining a good credit score

- Being a long-term customer

Explore Group Discounts

Some insurers offer group discounts for rental insurance. Check with your employer, alumni association, or professional organization to see if they have any insurance partnerships that could save you money.

Consider State-Specific Programs

Some states have programs that provide affordable rental insurance to eligible tenants. Research whether your state offers such programs and if you qualify.

Real-World Rental Insurance Scenarios

To better understand the impact of rental insurance, let's explore some real-world scenarios and how insurance can provide protection.

Scenario 1: Burglary

Imagine a burglar breaks into your rental home and steals your laptop, TV, and some jewelry. Without rental insurance, you would have to cover the cost of replacing these items out of pocket. However, with rental insurance, your personal property coverage would kick in, providing compensation for your losses.

Scenario 2: Water Damage

A burst pipe in your rental unit causes extensive water damage, affecting your furniture, flooring, and personal belongings. Without insurance, you would be responsible for the costly repairs and replacements. With rental insurance, your policy could cover the cost of repairing or replacing damaged items, as well as any additional living expenses if you need to relocate temporarily.

Scenario 3: Liability Claim

A guest at your rental property slips and falls, injuring themselves. They decide to pursue a liability claim against you. Rental insurance with liability coverage would protect you by covering the medical expenses and legal fees associated with the claim, providing a vital safety net.

Expert Insights and Recommendations

As an industry expert, here are some additional insights and recommendations to help you make informed decisions about your rental insurance:

For example, if your annual income is $50,000, you should aim for at least $25,000 in personal property coverage. This ensures that if you need to replace all your belongings, you have sufficient insurance to do so.

For instance, if you purchase an expensive piece of artwork, you should consider increasing your personal property coverage to accommodate the new item's value.

Conclusion: Empowering Your Rental Insurance Journey

Securing the cheapest rental insurance is not just about finding the lowest premium. It's about understanding your needs, exploring your options, and making informed decisions. By following the tips and insights provided in this guide, you can navigate the rental insurance landscape with confidence and find a policy that provides the protection you need at a price you can afford.

Remember, rental insurance is an investment in your peace of mind and financial security. With the right coverage, you can enjoy your rental home knowing that you're protected from unforeseen circumstances.

Can I Get Rental Insurance if I Have a Low Credit Score?

+Yes, rental insurance is typically available regardless of your credit score. However, a lower credit score may result in a higher premium. It’s worth shopping around and comparing quotes to find the best deal.

What Happens if I Need to File a Claim?

+If you need to file a claim, you’ll typically need to provide documentation of the loss or damage. This may include police reports, photos, or receipts. Your insurer will assess the claim and, if approved, provide compensation as outlined in your policy.

Is Rental Insurance Worth the Cost?

+Rental insurance provides valuable protection for your belongings and liabilities. While the cost may seem like an added expense, it’s a small price to pay for peace of mind and financial security. The potential savings in the event of a covered loss can far outweigh the cost of the premium.