Professional And Liability Insurance

Professional and liability insurance, often referred to as PLI, is a critical aspect of risk management for businesses and professionals across various industries. This type of insurance provides protection against a wide range of potential liabilities and legal claims that could arise from the services or advice provided by an individual or a company. In today's complex and litigious business landscape, having robust professional and liability insurance coverage is not just a wise decision but often a necessary one to safeguard against financial and reputational risks.

Understanding Professional and Liability Insurance

Professional and liability insurance is a broad term that encompasses several specific types of insurance policies, each designed to address different types of risks. At its core, this insurance aims to protect the policyholder from claims made by clients or customers who allege that the services provided were inadequate, negligent, or harmful. It offers financial protection and can also cover the legal costs associated with defending such claims.

Key Components of Professional and Liability Insurance

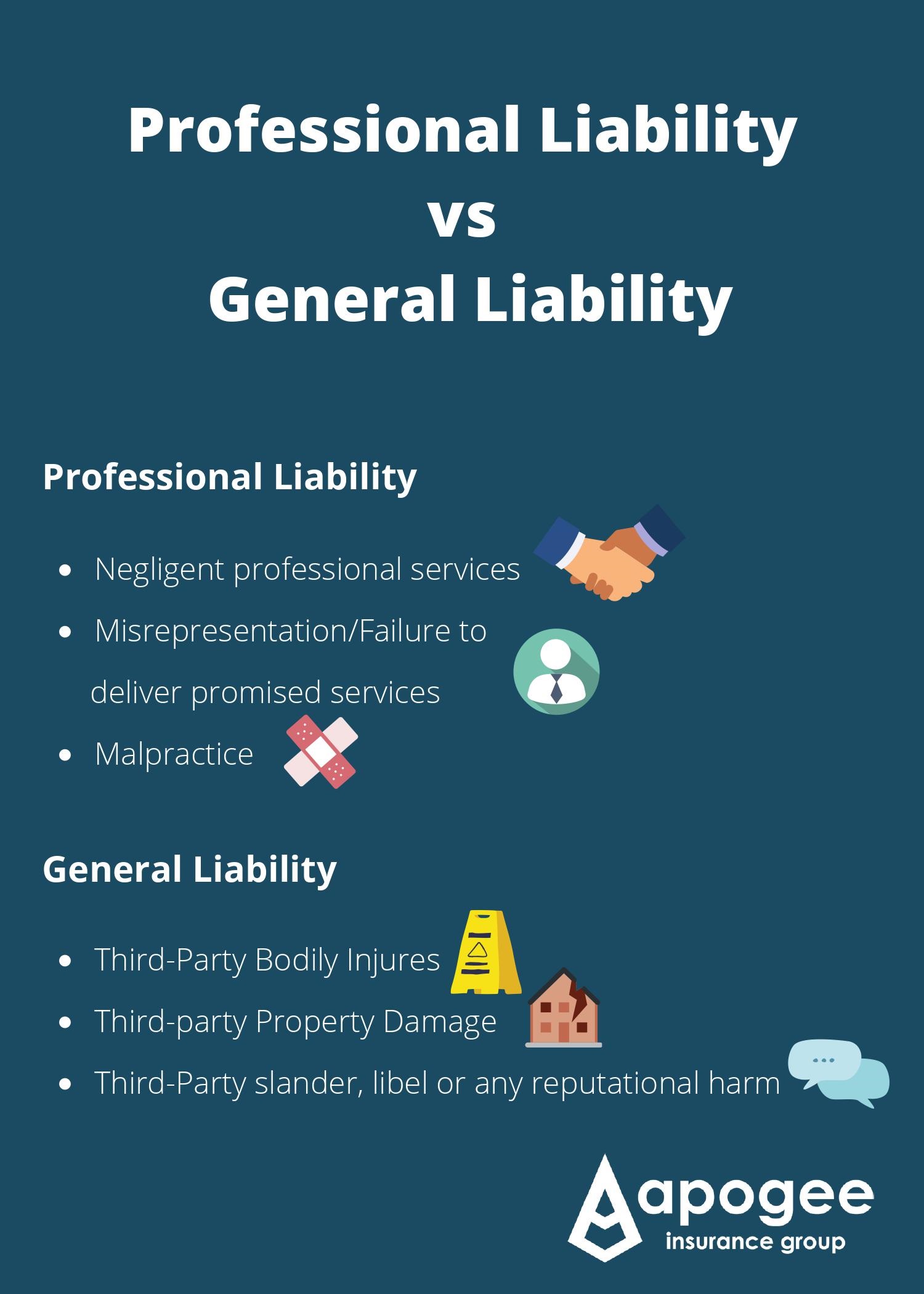

Professional liability insurance, also known as errors and omissions (E&O) insurance, is particularly relevant for professionals in industries such as consulting, healthcare, finance, and technology. It covers claims arising from mistakes, omissions, or failure to perform professional services as expected. For instance, a financial advisor might face a claim if their investment advice leads to significant losses for a client.

General liability insurance, on the other hand, protects against a broader range of risks, including bodily injury, property damage, and advertising injuries. This type of insurance is beneficial for businesses that interact directly with the public or have physical premises. It can cover claims from customers who slip and fall on your premises or from competitors who allege trademark infringement.

| Professional Liability Insurance (E&O) | General Liability Insurance |

|---|---|

| Covers claims related to professional services | Protects against bodily injury, property damage, and advertising injuries |

| Relevant for professionals in various fields | Beneficial for businesses with public interaction or physical premises |

| Includes legal costs for defending claims | Covers a wide range of potential liabilities |

Benefits and Importance

The benefits of professional and liability insurance are twofold: financial protection and peace of mind. Financially, these policies can cover the costs of legal defense, settlements, or judgments resulting from covered claims. This protection is especially crucial for small businesses and startups, as legal battles can quickly deplete their resources. Moreover, having adequate insurance can enhance a company’s credibility and attract clients who value reliability and stability.

Choosing the Right Professional and Liability Insurance

When selecting professional and liability insurance, several factors come into play. It’s crucial to consider the nature of your business or profession, the potential risks you face, and the level of coverage you require. Additionally, the cost of insurance should be balanced against the potential financial risks you might encounter.

Evaluating Coverage Options

Professional and liability insurance policies can vary significantly in terms of coverage limits, deductibles, and exclusions. It’s important to understand what is and isn’t covered by your policy. For instance, some policies might have limits on the number of claims or the total amount of coverage over a specific period.

Consider your specific risks and choose a policy that offers sufficient coverage. For professionals in high-risk fields, such as healthcare or financial services, higher limits might be necessary to provide adequate protection. Similarly, if your business involves complex or innovative technologies, you might need broader coverage to account for potential emerging risks.

Cost Considerations

The cost of professional and liability insurance can vary widely based on factors like the type of business, the size of the organization, and the level of coverage required. Premiums can also be influenced by the insurance company’s assessment of your business’s risk profile. It’s essential to shop around and compare quotes from different insurers to find the best value for your specific needs.

While cost is an important factor, it should not be the sole determinant. Opting for the cheapest policy might leave you vulnerable to significant financial risks if a claim exceeds the policy limits. Balancing cost with adequate coverage is key to ensuring you have the protection you need without overspending.

Working with Insurance Brokers

For many businesses and professionals, working with an insurance broker can be a valuable step in securing the right professional and liability insurance. Brokers have extensive knowledge of the insurance market and can provide guidance on the most suitable policies for your needs. They can also negotiate with insurers on your behalf to secure the best terms and conditions.

An insurance broker can help you understand the intricacies of different policies, including any potential exclusions or limitations. They can also assist in managing the claims process should you need to make a claim. Their expertise can be particularly beneficial for complex or high-risk businesses that require specialized insurance coverage.

The Claims Process and Best Practices

Understanding the claims process and following best practices can be critical in effectively managing professional and liability insurance claims. The steps you take when a claim is made can significantly impact the outcome and the financial implications for your business.

Reporting Claims Promptly

One of the most important aspects of managing insurance claims is reporting them promptly. Most insurance policies have specific timeframes within which claims must be reported. Failing to report a claim within the stipulated time can lead to the claim being denied or the policy being invalidated.

When a potential claim arises, it's crucial to notify your insurance provider as soon as possible. Many policies have dedicated claims hotlines or online portals to facilitate the reporting process. The sooner you report a claim, the sooner your insurer can begin investigating and managing the claim, which can help to mitigate any potential damages.

Cooperating with the Insurance Company

Once you’ve reported a claim, it’s essential to cooperate fully with your insurance company during the claims process. This includes providing all the necessary information and documentation requested by the insurer. Being transparent and providing accurate information can help expedite the claims process and increase the likelihood of a favorable outcome.

Your insurance company may require you to provide details such as the circumstances leading up to the claim, any witness statements, and evidence of losses or damages. It's important to respond promptly to these requests and to keep open lines of communication with your insurer. This cooperation can help to build a positive relationship with your insurer and potentially lead to more favorable claim outcomes.

Documenting and Mitigating Risks

Documenting potential risks and taking steps to mitigate them can be a valuable practice for any business. By identifying and addressing potential risks, you can reduce the likelihood of claims and, if claims do arise, you’ll have a more comprehensive understanding of the circumstances.

This documentation can be especially useful when making an insurance claim. It provides a clear record of the steps you've taken to manage risks and can demonstrate your commitment to preventing losses. For instance, if you operate a business that involves public interaction, having detailed safety protocols and training records can be beneficial in the event of a liability claim.

Future Implications and Trends

The landscape of professional and liability insurance is constantly evolving, influenced by factors such as technological advancements, changing regulatory environments, and shifts in societal expectations. Understanding these trends and their potential implications can help businesses and professionals stay ahead of the curve and ensure they have the right insurance coverage for the future.

Impact of Technology

The rise of technology and digital services has introduced new risks and complexities into the insurance landscape. From cybersecurity threats to data breaches, technology-related risks are becoming increasingly common and can have significant financial and reputational implications. As a result, insurance providers are offering more specialized coverage options to address these emerging risks.

For businesses operating in the digital realm, such as e-commerce stores or software development companies, having adequate insurance coverage for technology-related risks is crucial. This might include cyber liability insurance to protect against data breaches or insurance for intellectual property, which can be vulnerable to theft or infringement in the digital space.

Regulatory Changes and Compliance

Changes in regulations and compliance standards can also have a significant impact on professional and liability insurance. As industries evolve and new risks emerge, regulatory bodies often introduce new guidelines and requirements to protect consumers and stakeholders. These changes can influence the types of insurance coverage businesses need to have in place.

Staying abreast of regulatory changes is essential for businesses to ensure they maintain adequate insurance coverage. For instance, in the healthcare industry, changes to patient privacy regulations might require healthcare providers to have more robust insurance coverage for patient data protection. Similarly, in the financial services sector, changes to investment regulations could impact the type and level of professional liability insurance required.

The Growing Importance of Risk Management

As businesses and professionals face an increasingly complex and litigious environment, the importance of effective risk management is growing. This includes not only having the right insurance coverage but also implementing robust risk management strategies to identify, assess, and mitigate potential risks.

Risk management strategies can involve a range of practices, such as conducting regular risk assessments, implementing internal control measures, and providing employee training on risk identification and mitigation. By integrating risk management into their operations, businesses can not only reduce the likelihood of claims but also improve their overall operational efficiency and resilience.

What are the key differences between professional liability insurance and general liability insurance?

+Professional liability insurance, or E&O insurance, covers claims related to professional services, such as mistakes or omissions in the performance of those services. General liability insurance, on the other hand, provides broader protection against bodily injury, property damage, and advertising injuries. While professional liability insurance is essential for professionals in fields like consulting or healthcare, general liability insurance is more suitable for businesses with public interaction or physical premises.

How do I choose the right level of coverage for my business or profession?

+Choosing the right level of coverage involves assessing your specific risks and the potential financial impact of claims. For high-risk professions or businesses, higher coverage limits might be necessary. It’s also important to consider the cost of insurance and balance it against your risk appetite. Consulting with an insurance professional can help you navigate these decisions and ensure you have adequate protection.

What steps can I take to effectively manage insurance claims and improve the chances of a favorable outcome?

+Effective claims management involves reporting claims promptly, providing all necessary information and documentation to your insurer, and maintaining open communication throughout the process. It’s also beneficial to document potential risks and take steps to mitigate them, as this can strengthen your claim and demonstrate your commitment to risk management.

How can I stay updated on regulatory changes that might impact my insurance needs?

+Staying informed about regulatory changes is crucial for maintaining adequate insurance coverage. You can subscribe to industry newsletters or follow reputable sources that provide updates on regulatory changes. Additionally, working with an insurance broker or consulting with legal professionals can help you stay abreast of relevant changes and their potential implications for your business.

What role does risk management play in professional and liability insurance, and how can I implement effective risk management strategies in my business?

+Risk management is a critical aspect of professional and liability insurance, as it helps identify and mitigate potential risks. Implementing effective risk management strategies involves conducting regular risk assessments, implementing internal controls, and providing employee training on risk identification and mitigation. By integrating risk management into your business operations, you can not only reduce the likelihood of claims but also improve overall operational efficiency and resilience.