Home Loan Calculator With Taxes And Insurance

Homeownership is an exciting journey, and understanding the financial aspects is crucial for a smooth and informed process. One of the essential tools for prospective homeowners is a comprehensive home loan calculator that accounts for various factors, including taxes and insurance. This calculator provides an accurate snapshot of the financial commitment involved, helping individuals make well-informed decisions about their mortgage.

Unveiling the Home Loan Calculator: A Comprehensive Tool

In the realm of mortgage planning, a sophisticated home loan calculator serves as a beacon, guiding prospective homeowners through the intricate financial landscape. This calculator, when equipped to consider taxes and insurance, offers an unparalleled level of precision in estimating the overall cost of homeownership.

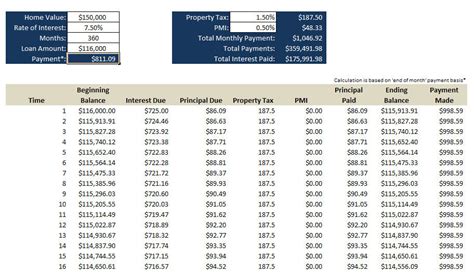

At its core, a home loan calculator is designed to provide a detailed breakdown of monthly mortgage payments. However, the true power of this tool lies in its ability to factor in the often-overlooked yet substantial expenses associated with taxes and insurance. By incorporating these elements, the calculator presents a holistic view of the financial responsibilities that come with owning a home.

For instance, consider the case of an individual seeking to purchase a home in a bustling city with high property taxes. A traditional mortgage calculator might provide a baseline estimate, but it fails to account for the significant tax burden. This is where a calculator with taxes and insurance shines. It ensures that prospective homeowners are not caught off guard by unexpected expenses, offering a realistic and comprehensive assessment of their financial commitments.

Understanding the Key Parameters

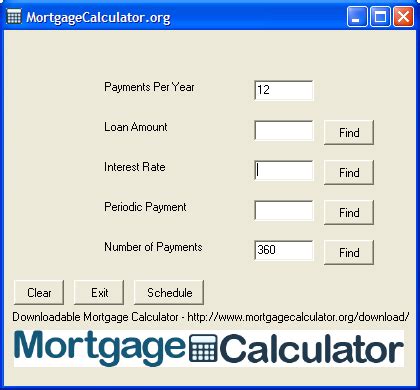

To harness the full potential of a home loan calculator with taxes and insurance, it’s essential to understand the key parameters it takes into account:

- Loan Amount: This is the primary driver of your mortgage payment. It represents the total sum borrowed to purchase the home.

- Interest Rate: The interest rate determines the cost of borrowing. It's typically expressed as an annual percentage and can significantly impact your monthly payments.

- Loan Term: The loan term, often measured in years, defines the duration over which you'll repay the mortgage. Common terms include 15, 20, and 30 years.

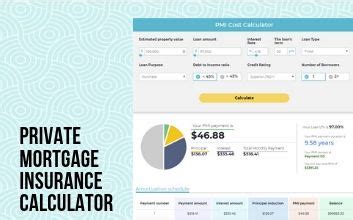

- Property Taxes: Property taxes are a critical component of homeownership costs. These taxes are typically assessed annually and can vary based on the location and value of the property.

- Homeowner's Insurance: Homeowner's insurance is another essential expense. It protects the homeowner against various risks, including damage to the property and liability claims. The cost of insurance can vary based on factors such as the location and type of home.

By inputting these parameters into the home loan calculator, individuals can obtain a detailed analysis of their monthly mortgage payments, including the portions allocated to principal, interest, taxes, and insurance. This transparency is invaluable for financial planning and helps prospective homeowners set realistic expectations.

The Power of Customization

One of the standout features of a sophisticated home loan calculator is its customization capabilities. Recognizing that every homeowner’s situation is unique, these calculators often allow users to input specific details about their loan and property. For example, users can specify the down payment amount, which directly impacts the loan-to-value ratio and can affect the interest rate and other loan terms.

Additionally, calculators with taxes and insurance often provide options to adjust the tax and insurance rates. This level of granularity is especially beneficial for individuals who anticipate changes in these expenses over time. By fine-tuning these parameters, users can simulate various scenarios and make informed decisions about their mortgage options.

Real-World Application: A Case Study

To illustrate the practical benefits of a home loan calculator with taxes and insurance, let’s consider a hypothetical scenario. Meet Sarah, a young professional looking to buy her first home in a desirable suburban area. Sarah has saved a substantial down payment and is pre-approved for a mortgage. However, she wants to ensure she fully understands the financial implications before making an offer.

Using a comprehensive home loan calculator, Sarah inputs her loan amount, interest rate, and loan term. She then specifies the estimated property taxes for the area, which are known to be relatively high due to the region's thriving economy. Additionally, she inputs the cost of homeowner's insurance, which is slightly above average due to the area's occasional weather-related risks.

The calculator provides Sarah with a detailed breakdown of her monthly payments. It shows that a significant portion of her payment goes towards taxes and insurance, which are lumped together as "Escrow" or "HOA" payments. This transparency allows Sarah to assess her financial capacity and make adjustments if needed. For instance, she might decide to increase her down payment to reduce the overall loan amount and, consequently, her monthly payments.

Furthermore, the calculator's customization features allow Sarah to experiment with different scenarios. She can input various interest rates to see how they impact her payments, or she can adjust the loan term to explore the trade-off between shorter-term payments and long-term financial obligations.

The Importance of Accuracy and Transparency

In the complex world of mortgage lending, accuracy and transparency are non-negotiable. A home loan calculator with taxes and insurance serves as a reliable compass, guiding individuals through the financial intricacies of homeownership. By providing an accurate and detailed analysis, these calculators empower prospective homeowners to make informed decisions, avoid financial pitfalls, and ultimately achieve their dream of homeownership.

Moreover, the transparency offered by these calculators fosters trust between lenders and borrowers. It demonstrates a commitment to ethical lending practices and ensures that homeowners are fully aware of their financial commitments from the outset. This level of transparency is essential for building long-lasting relationships between lenders and borrowers, as it fosters a culture of financial responsibility and mutual understanding.

Advanced Features and Future Implications

As technology continues to advance, home loan calculators are evolving to incorporate even more sophisticated features. These advancements are designed to enhance the user experience and provide an even more accurate representation of the financial landscape.

Dynamic Tax and Insurance Rates

One notable advancement is the ability to input dynamic tax and insurance rates. This feature allows calculators to account for fluctuations in these expenses over time. For instance, property taxes might increase due to rising property values or changes in local tax policies. By incorporating these dynamic rates, calculators provide a more realistic long-term financial projection.

Scenario Analysis and What-If Scenarios

Another powerful feature is the ability to conduct scenario analysis. This allows users to input multiple variables and simulate various financial scenarios. For example, a user might want to see how a sudden increase in interest rates would impact their monthly payments or how a larger down payment would affect their overall financial obligations.

Integration with Property Data

In the future, we can expect home loan calculators to integrate with comprehensive property data sources. This integration would provide users with accurate information about the property they’re considering, including historical tax assessments, insurance rates, and even neighborhood trends. Such integration would enhance the calculator’s precision and provide users with a more holistic understanding of their prospective home’s financial implications.

AI-Powered Recommendations

Artificial Intelligence (AI) is set to play a significant role in enhancing home loan calculators. AI algorithms can analyze user data and provide personalized recommendations based on their financial situation and goals. For instance, AI might suggest the most suitable loan term or recommend strategies to optimize the mortgage process, such as refinancing options or strategies to reduce closing costs.

The Future of Mortgage Planning

As we look ahead, the future of mortgage planning appears increasingly digital and personalized. Home loan calculators, equipped with advanced features and powered by AI, will become essential tools for prospective homeowners. These calculators will not only provide accurate financial projections but also serve as trusted advisors, guiding individuals through the complex world of homeownership with confidence and clarity.

Conclusion: Empowering Homeownership

A home loan calculator with taxes and insurance is a powerful tool that empowers prospective homeowners to make informed decisions. By providing a detailed financial analysis, it ensures that individuals fully understand the commitments associated with homeownership. As technology continues to advance, these calculators will become even more sophisticated, offering an unparalleled level of precision and personalization.

As we embrace the future of mortgage planning, let us recognize the critical role these calculators play in fostering financial responsibility and transparency. With their guidance, prospective homeowners can navigate the complex journey of homeownership with confidence, ensuring a stable and rewarding financial future.

How accurate are home loan calculators in estimating monthly payments?

+Home loan calculators provide a good estimate of monthly payments, but they are not foolproof. Accuracy depends on the quality of the data inputted. It’s crucial to input accurate figures for loan amount, interest rate, loan term, taxes, and insurance to get a precise estimate.

Can I adjust the loan term to see the impact on monthly payments?

+Yes, most advanced home loan calculators allow users to adjust the loan term. A longer loan term typically results in lower monthly payments but a higher overall cost due to accumulated interest. Conversely, a shorter loan term means higher monthly payments but a lower overall cost.

What happens if property taxes or insurance rates change after I’ve taken out the loan?

+Changes in property taxes or insurance rates can affect your monthly payments. Many lenders include an escrow account in your mortgage, which accumulates funds to cover these expenses. If the taxes or insurance rates increase, the lender will adjust the escrow payment accordingly.