Insure Number

Welcome to an in-depth exploration of the fascinating world of insure numbers, a critical component in the realm of insurance and risk management. In this comprehensive guide, we will delve into the intricacies of insure numbers, uncovering their purpose, functionality, and the profound impact they have on the insurance industry and policyholders alike. Get ready to discover the secrets behind these seemingly simple digits and unlock a deeper understanding of their role in safeguarding our financial well-being.

The Fundamentals of Insure Numbers

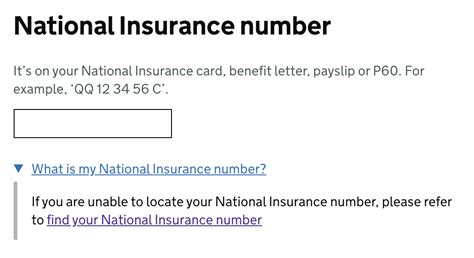

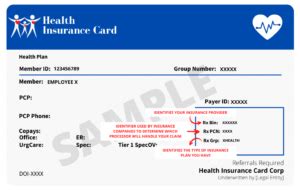

At its core, an insure number is a unique identifier assigned to an insurance policy or account. This number acts as a digital fingerprint, allowing insurance providers to track and manage policies efficiently. Much like a social security number identifies an individual, an insure number provides a distinct identity to an insurance policy, ensuring accurate record-keeping and streamlined administration.

The structure of an insure number typically consists of a combination of letters and digits, carefully crafted to avoid duplication and ensure uniqueness. This alphanumeric format not only adds an extra layer of security but also facilitates easy reference and retrieval of policy information. Whether it's a homeowner's insurance policy, auto insurance, or even life insurance, each policy is assigned a unique insure number, serving as a key identifier throughout the policy lifecycle.

For insurance providers, the insure number is a powerful tool for managing vast portfolios of policies. It enables efficient data retrieval, allowing insurers to access policy details, track claims, and manage renewals with precision. Moreover, insure numbers play a crucial role in mitigating fraud and ensuring the integrity of insurance transactions. By cross-referencing insure numbers, insurers can verify policy authenticity, detect potential scams, and maintain the trust and security of their policyholders.

The Journey of an Insure Number

The life cycle of an insure number begins with policy initiation. When a policyholder purchases an insurance policy, the insurer generates a unique insure number, often through a sophisticated algorithm that ensures no two policies share the same identifier. This number is then linked to the policyholder’s personal information, policy details, and any relevant endorsements or riders.

As the policy progresses, the insure number accompanies the policyholder through various stages. It is referenced during premium payments, policy amendments, and claims processing. Each interaction with the insurer is logged against the insure number, creating a comprehensive audit trail that facilitates efficient policy management and provides a clear record of policy activity.

When it comes to claims, the insure number takes center stage. Policyholders often provide their insure number when initiating a claim, allowing insurers to swiftly access the relevant policy details and assess the claim accurately. This streamlined process not only benefits policyholders by expediting claim settlements but also helps insurers manage their claims workload effectively.

The Role of Insure Numbers in Policy Management

Insure numbers are instrumental in the day-to-day operations of insurance providers. They serve as a cornerstone for policy administration, enabling insurers to maintain accurate and up-to-date records. With insure numbers, insurers can easily locate policies, view coverage details, and manage policy changes, ensuring that policyholders receive the coverage they need when they need it.

Moreover, insure numbers play a vital role in policy renewal. As renewal dates approach, insurers can quickly identify policies due for renewal by referencing their insure numbers. This proactive approach ensures that policyholders receive timely reminders and can renew their coverage without disruption. By streamlining the renewal process, insure numbers contribute to a seamless and hassle-free experience for policyholders.

Additionally, insure numbers facilitate effective communication between insurers and policyholders. Whether it's providing policy updates, offering additional coverage options, or sending important notices, insurers can target their communications specifically to policyholders by referencing their insure numbers. This personalized approach strengthens the insurer-policyholder relationship and enhances customer satisfaction.

The Impact of Insure Numbers on Policyholders

For policyholders, insure numbers are more than just a string of characters. They represent a direct line of communication with their insurance provider, offering peace of mind and a sense of security. Policyholders can easily access their policy information by providing their insure number, allowing them to stay informed about their coverage and any associated benefits.

Insure numbers empower policyholders to take control of their insurance journey. They can proactively manage their policies, track premiums, and make informed decisions about their coverage. Moreover, insure numbers simplify the claims process, enabling policyholders to efficiently initiate and track their claims, ensuring a swift and seamless resolution.

In today's digital age, insure numbers have become even more critical. With the rise of online insurance platforms and mobile apps, policyholders can easily access their policy information and manage their policies on-the-go. Insure numbers serve as a secure gateway to these digital services, providing policyholders with convenient and efficient access to their insurance portfolios.

The Future of Insure Numbers: Technological Innovations

As technology continues to advance, the role of insure numbers is evolving. Insurers are leveraging innovative technologies to enhance the functionality and security of insure numbers. One such development is the integration of blockchain technology, which offers a decentralized and secure platform for managing insure numbers and policy data.

Blockchain technology provides an immutable ledger, ensuring that insure numbers and policy information are secure and tamper-proof. This not only enhances data integrity but also streamlines the verification process, making it easier for insurers to authenticate policies and mitigate fraud risks. Additionally, blockchain-based insure numbers can facilitate seamless interoperability between different insurance providers, enabling policyholders to seamlessly transfer their coverage across insurers.

Another exciting development is the use of artificial intelligence (AI) and machine learning algorithms in insure number management. AI-powered systems can analyze vast amounts of policy data, identifying patterns and trends that can optimize policy administration and claims processing. By leveraging AI, insurers can enhance their operational efficiency, improve customer service, and provide more personalized insurance solutions.

Furthermore, insure numbers are expected to play a pivotal role in the growing trend of parametric insurance. Parametric insurance, which pays out based on predefined parameters rather than individual claims, relies on accurate and real-time data. Insure numbers, combined with advanced sensors and IoT devices, can provide insurers with critical data points, enabling them to trigger payouts swiftly and accurately in the event of a covered loss.

The Importance of Insure Number Security

With the increasing reliance on insure numbers, ensuring their security and confidentiality becomes paramount. Insurers must implement robust security measures to protect insure numbers and the sensitive policy data they represent. This includes employing encryption protocols, access controls, and regular security audits to safeguard against unauthorized access and data breaches.

Furthermore, insurers should educate policyholders on the importance of keeping their insure numbers secure. Policyholders should be encouraged to treat their insure numbers with the same level of confidentiality as their social security numbers or other personal identifiers. This includes safeguarding insure numbers from unauthorized disclosure, using secure channels for communication, and being vigilant against potential scams or phishing attempts.

Insure Numbers: A Catalyst for Industry Growth

Insure numbers are not just a means of identification; they are a catalyst for growth and innovation in the insurance industry. By providing a standardized and efficient way to manage policies, insure numbers enable insurers to scale their operations and reach a wider audience. This scalability, coupled with efficient policy management, allows insurers to offer competitive pricing and innovative coverage options, ultimately driving industry growth and attracting more policyholders.

Moreover, insure numbers facilitate data-driven decision-making, allowing insurers to analyze policy trends, identify areas for improvement, and develop more targeted insurance products. By leveraging the wealth of data associated with insure numbers, insurers can stay ahead of the curve, adapt to changing market dynamics, and provide policyholders with the coverage they need in an ever-evolving risk landscape.

Conclusion: The Power of Insure Numbers

In a world where risk is ever-present, insure numbers stand as a beacon of reliability and security. From policy initiation to claims settlement, insure numbers guide the insurance journey, ensuring accuracy, efficiency, and peace of mind. As the insurance industry continues to evolve, insure numbers will remain a cornerstone, driving innovation, enhancing customer experiences, and safeguarding the financial well-being of policyholders.

So, the next time you glance at your insurance policy or provide your insure number, remember the intricate web of processes and technologies that this simple identifier supports. Insure numbers are not just numbers; they are the key to unlocking a world of financial protection and security.

How do I find my insure number?

+Your insure number is typically located on your insurance policy document or certificate. It is often highlighted or displayed prominently, making it easy to identify. If you cannot locate it, you can contact your insurance provider, who will be able to provide you with your insure number.

Can insure numbers be changed or updated?

+In general, insure numbers are unique and permanent. They are assigned to your policy when it is first created and remain unchanged throughout the policy’s lifecycle. However, in certain situations, such as policy transfers or mergers, insurers may assign new insure numbers to maintain accuracy and clarity in their records.

Are insure numbers shared with third parties?

+Insure numbers are considered sensitive information and are typically not shared with third parties without your consent or under specific legal circumstances. Insurers prioritize the confidentiality of insure numbers to protect your privacy and prevent unauthorized access to your policy details.