Progressive Home Insurance Company

Progressive Home Insurance Company: Protecting Your Home and Family

Home insurance is a vital aspect of safeguarding your most valuable asset—your home. Among the many insurance providers in the market, Progressive Home Insurance Company stands out as a reliable and comprehensive option for homeowners seeking peace of mind. With a rich history and a focus on innovation, Progressive has established itself as a trusted partner for individuals and families looking to secure their homes and futures.

In this in-depth article, we will delve into the world of Progressive Home Insurance, exploring its services, unique features, and the benefits it offers to homeowners. From understanding the basics of home insurance to uncovering the advantages of choosing Progressive, we aim to provide a comprehensive guide to help you make informed decisions about protecting your home.

A Legacy of Trust: Progressive’s Journey

Progressive Home Insurance Company, a subsidiary of the renowned Progressive Corporation, has been a prominent player in the insurance industry for decades. Founded with a vision to revolutionize insurance and make it more accessible, Progressive has consistently delivered on its promise of providing quality coverage and exceptional customer experiences.

The company’s journey began in 1937 when Joseph Lewis and Jack Green founded Progressive Mutual Insurance Company in Ohio. Their innovative approach focused on offering affordable rates and personalized service, a departure from the traditional insurance models of the time. Over the years, Progressive expanded its reach, introducing innovative products and services that revolutionized the industry.

Today, Progressive Home Insurance continues to build on its legacy, offering a wide range of insurance products tailored to meet the diverse needs of homeowners. With a commitment to customer satisfaction and a dedicated team of professionals, Progressive has earned a reputation for excellence in the home insurance sector.

Understanding Home Insurance: The Basics

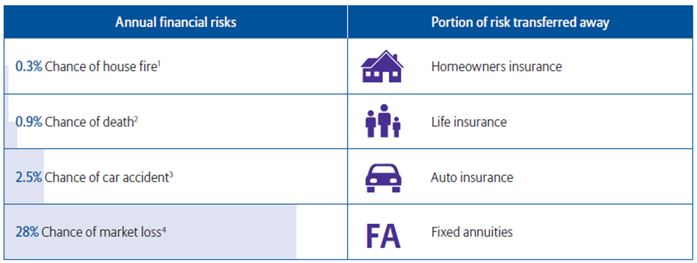

Before we delve into the specifics of Progressive Home Insurance, let’s establish a solid foundation by understanding the basics of home insurance. Home insurance, also known as homeowners insurance, is a form of property insurance designed to protect homeowners from financial losses resulting from various perils, such as fire, theft, natural disasters, and liability claims.

Home insurance policies typically cover two main components: the structure of the home and the personal belongings within it. Here’s a breakdown of the key coverage aspects:

Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and permanent fixtures. It provides protection against damage caused by covered perils, ensuring your home can be repaired or rebuilt.

Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, clothing, and other personal belongings. It offers financial protection in case of theft, damage, or loss.

Liability Coverage: This provides protection if someone is injured on your property or if you are held legally responsible for causing damage or injury to others. It covers legal fees and any resulting settlements or judgments.

Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, this coverage helps cover temporary living expenses, such as hotel stays or additional costs associated with relocating.

Other Coverages: Depending on your policy and specific needs, additional coverages may be available, including coverage for specific high-value items, identity theft protection, and more.

It’s important to note that home insurance policies can vary in terms of coverage limits, deductibles, and exclusions. Understanding these nuances is crucial when choosing a home insurance provider and policy.

Progressive Home Insurance: A Comprehensive Approach

Progressive Home Insurance offers a comprehensive suite of coverage options tailored to meet the unique needs of homeowners. Their policies are designed to provide extensive protection while offering flexibility and customization. Let’s explore some of the key features and benefits of Progressive Home Insurance:

Customizable Coverage Options

Progressive understands that every homeowner has different requirements, which is why they offer customizable coverage options. Whether you need basic coverage or want to enhance your policy with additional protections, Progressive provides the flexibility to create a plan that aligns with your specific needs.

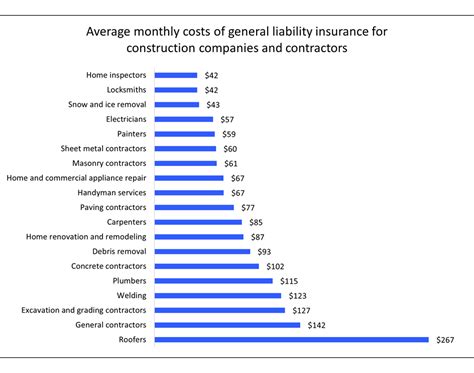

Competitive Rates and Discounts

One of the standout features of Progressive Home Insurance is its commitment to offering competitive rates. The company strives to provide affordable coverage options without compromising on quality. Additionally, Progressive offers various discounts to help homeowners save on their insurance premiums. These discounts may include:

Multi-Policy Discount: Combining your home and auto insurance policies with Progressive can lead to significant savings.

Safety Discounts: Progressive rewards homeowners who take proactive measures to protect their homes. This includes discounts for installing security systems, smoke detectors, and fire alarms.

Loyalty Discounts: Progressive values long-term customers and offers loyalty discounts to reward those who maintain their policies over time.

Bundling Discounts: Bundling your home insurance with other Progressive products, such as renters or condo insurance, can result in additional savings.

Comprehensive Perils Coverage

Progressive Home Insurance policies provide coverage for a wide range of perils, ensuring your home is protected against a variety of potential risks. Here are some of the perils typically covered by Progressive:

Fire and Smoke Damage: Progressive covers losses resulting from fire, including damage caused by smoke, ash, or fire-fighting efforts.

Theft and Burglary: If your home is broken into and personal belongings are stolen, Progressive provides coverage for the loss or damage.

Vandalism: Progressive covers vandalism-related damages, including graffiti, intentional destruction of property, and more.

Natural Disasters: Depending on your policy and the specific perils covered, Progressive offers protection against natural disasters such as hurricanes, tornadoes, hail, and earthquakes.

Liability Claims: Progressive’s liability coverage provides protection if someone is injured on your property or if you are sued for causing bodily injury or property damage to others.

Enhanced Coverage Options

In addition to the standard coverage, Progressive Home Insurance offers enhanced coverage options to provide even greater peace of mind. These optional coverages include:

Replacement Cost Coverage: This coverage ensures that in the event of a covered loss, your home and personal belongings are replaced with new items of similar quality, regardless of their current market value.

Personal Property Replacement Cost: With this coverage, Progressive will replace your personal belongings with new items of the same or similar kind, without deducting for depreciation.

Identity Theft Protection: Progressive offers identity theft coverage to assist you in the event of identity theft. This coverage provides resources and assistance to help you recover and restore your identity.

Home Systems Protection: This coverage provides protection for home systems, such as plumbing, electrical wiring, and heating/cooling systems, in the event of a covered loss.

Superior Customer Service and Claims Experience

Progressive Home Insurance is renowned for its exceptional customer service and seamless claims process. The company’s dedicated team of professionals is committed to providing timely and efficient assistance throughout the entire insurance journey. Here’s what sets Progressive apart:

24⁄7 Customer Support: Progressive offers round-the-clock customer support, ensuring you can reach out anytime, day or night, for assistance with policy inquiries, claims, or other insurance-related matters.

Online and Mobile Accessibility: Progressive’s online platform and mobile app provide convenient access to your policy information, allowing you to manage your account, make payments, and file claims from the comfort of your home.

Fast and Efficient Claims Process: Progressive understands the importance of swift resolution during a claim. Their streamlined claims process ensures that your claim is handled promptly and efficiently, minimizing the stress and inconvenience associated with a loss.

Claims Specialists: Progressive assigns dedicated claims specialists to guide you through the claims process, providing personalized support and ensuring a smooth experience.

Real-Life Examples: Progressive Home Insurance in Action

To illustrate the benefits of Progressive Home Insurance, let’s explore a few real-life scenarios where Progressive’s coverage made a significant difference for homeowners:

Case Study 1: Natural Disaster Protection

John and his family live in a hurricane-prone area. Despite taking precautions, a severe hurricane caused significant damage to their home, including roof damage, broken windows, and water damage throughout the property. Thanks to their Progressive Home Insurance policy, which included coverage for hurricanes, John was able to file a claim and receive financial assistance to repair the damage. Progressive’s prompt response and efficient claims process ensured that John’s family could quickly return to their home and get their lives back on track.

Case Study 2: Burglary and Personal Belongings Protection

Emily, a single mother, experienced a break-in at her home while she was at work. The burglars stole her laptop, jewelry, and other valuable items. Thankfully, Emily had a Progressive Home Insurance policy that covered theft and personal belongings. With Progressive’s help, Emily was able to file a claim and receive compensation for the stolen items, allowing her to replace her belongings and feel secure in her home once again.

Case Study 3: Liability Protection

Michael, a homeowner with a Progressive policy, accidentally left a garden hose unattended, causing a slip and fall accident on his property. The visitor sustained injuries and sued Michael for negligence. Progressive’s liability coverage stepped in, providing legal defense and covering the settlement costs, ensuring that Michael’s financial well-being was protected.

Performance Analysis: Progressive’s Track Record

Progressive Home Insurance has consistently demonstrated its commitment to delivering exceptional performance and customer satisfaction. Here are some key performance indicators and accolades that highlight Progressive’s success:

Financial Strength: Progressive has maintained a strong financial position, earning high ratings from reputable rating agencies such as A.M. Best and Standard & Poor’s. This financial stability ensures that Progressive can fulfill its policy obligations and provide long-term security to its customers.

Customer Satisfaction: Progressive has earned a reputation for its exceptional customer service. Numerous customer reviews and ratings highlight the company’s dedication to providing prompt, friendly, and knowledgeable assistance. Progressive’s commitment to customer satisfaction has led to high retention rates and positive feedback.

Claims Handling: Progressive’s efficient and fair claims handling process has been widely recognized. The company’s claims specialists are known for their expertise and empathy, ensuring that policyholders receive the support they need during difficult times. Progressive’s commitment to timely claim resolution has resulted in a high level of customer satisfaction.

Innovation and Technology: Progressive continues to invest in innovative technologies to enhance the customer experience. Their online and mobile platforms offer convenient access to policy information, claims filing, and other services, making insurance management more accessible and efficient.

Future Implications and Industry Insights

As the insurance industry continues to evolve, Progressive Home Insurance remains at the forefront, embracing technological advancements and adapting to changing consumer needs. Here are some future implications and industry insights to consider:

Digital Transformation: Progressive recognizes the importance of digital transformation and is continuously enhancing its online and mobile platforms. The company aims to provide even more streamlined services, allowing customers to manage their policies and file claims with ease.

Personalized Coverage: Progressive understands that homeowners have unique needs and preferences. In the future, the company plans to further customize its coverage options, offering personalized policies that cater to individual circumstances and risk profiles.

Risk Assessment and Prevention: Progressive is committed to helping homeowners mitigate risks and prevent losses. The company’s focus on education and awareness will continue, providing resources and tools to help homeowners identify potential hazards and take proactive measures to protect their homes.

Industry Collaboration: Progressive actively collaborates with industry partners and experts to stay at the forefront of insurance innovation. By leveraging industry insights and best practices, Progressive aims to deliver cutting-edge solutions and maintain its competitive edge.

FAQ: Progressive Home Insurance

What types of homes does Progressive Home Insurance cover?

+Progressive Home Insurance offers coverage for a wide range of homes, including single-family homes, condominiums, townhomes, mobile homes, and even rental properties. Whether you own a primary residence or a vacation home, Progressive can provide the protection you need.

Does Progressive Home Insurance cover flood damage?

+No, standard home insurance policies, including Progressive's, typically do not cover flood damage. Flood insurance is a separate policy that can be purchased through the National Flood Insurance Program (NFIP) or private insurers. It's important to assess your flood risk and consider purchasing flood insurance if necessary.

Can I customize my Progressive Home Insurance policy to include specific coverages?

+Absolutely! Progressive offers customizable coverage options to meet your unique needs. You can add endorsements or riders to your policy to enhance your protection, such as coverage for high-value items, identity theft protection, or home systems protection. Discuss your requirements with a Progressive agent to tailor your policy accordingly.

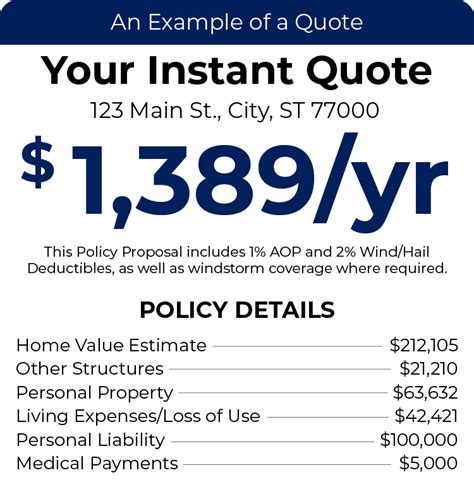

How can I get a Progressive Home Insurance quote?

+Obtaining a Progressive Home Insurance quote is straightforward. You can start by visiting their website and using the online quote tool, which provides an estimate based on your home's location and basic information. Alternatively, you can reach out to a Progressive agent, who will guide you through the quoting process and help you find the best coverage options for your needs.

What should I do in the event of a claim with Progressive Home Insurance?

+If you experience a covered loss, it's important to take immediate action. First, ensure the safety of your family and take steps to prevent further damage. Then, contact Progressive's claims department as soon as possible to report the claim. They will guide you through the process, provide resources, and assign a dedicated claims specialist to assist you.

In conclusion, Progressive Home Insurance Company stands as a trusted partner for homeowners seeking comprehensive and reliable insurance coverage. With its rich history, innovative approach, and commitment to customer satisfaction, Progressive offers a range of benefits, including customizable coverage options, competitive rates, and exceptional customer service. By understanding the basics of home insurance and exploring the advantages of Progressive, homeowners can make informed decisions to protect their homes and families. Remember, home insurance is an investment in your peace of mind, and Progressive Home Insurance is here to ensure that investment pays off.