Florida Flood Insurance Rate Map

The Florida Flood Insurance Rate Map (FIRM): Navigating Flood Risks and Protection

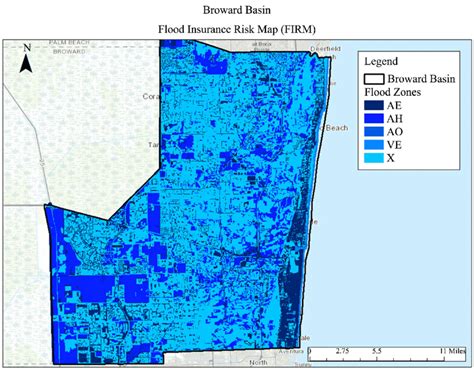

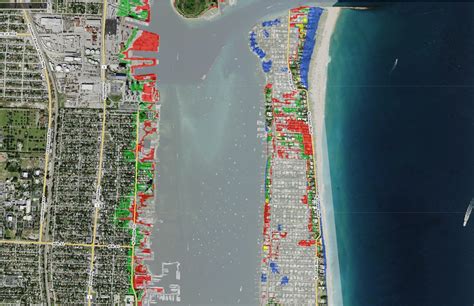

In the sunny state of Florida, where lush landscapes and vibrant coastal communities thrive, understanding and managing flood risks is of utmost importance. The Florida Flood Insurance Rate Map (FIRM) serves as a vital tool for residents, businesses, and policymakers, providing a comprehensive overview of flood zones and the potential hazards they pose. This article delves into the intricacies of the FIRM, exploring its purpose, how it's developed, and its significance in shaping flood preparedness and insurance coverage across the Sunshine State.

Unraveling the Purpose and Development of the FIRM

The Florida Flood Insurance Rate Map is a critical resource, developed and maintained by the Federal Emergency Management Agency (FEMA), in collaboration with state and local authorities. Its primary objective is to delineate areas prone to flooding, categorizing them into various zones based on the level of risk. By doing so, the FIRM serves as a foundation for floodplain management, community planning, and the accurate assessment of flood insurance requirements.

The development of the FIRM is a meticulous process, involving the collection and analysis of extensive data. FEMA utilizes a range of scientific methodologies, including historical flood records, topographic surveys, and advanced hydraulic modeling techniques. This data-driven approach ensures that the FIRM accurately reflects the complex flood dynamics unique to Florida's diverse landscapes, from its expansive wetlands to its vulnerable coastal regions.

Furthermore, the FIRM plays a pivotal role in shaping community resilience. Local governments and planning authorities rely on its insights to establish floodplain management regulations, zoning ordinances, and building codes. By integrating the FIRM into their decision-making processes, communities can proactively mitigate flood risks, protect critical infrastructure, and ensure the safety and well-being of their residents.

Navigating the FIRM: Understanding Flood Zones and Risk Levels

The Florida Flood Insurance Rate Map employs a standardized system to categorize flood zones, each representing a distinct level of flood risk. Here's a breakdown of the primary flood zones and their implications:

- Special Flood Hazard Areas (SFHAs): These zones, often denoted as "A" or "V" on the FIRM, indicate areas with a high risk of flooding. Properties within SFHAs are typically required to carry flood insurance, regardless of whether they have a mortgage from a federally regulated or insured lender.

- Moderate-to-Low Risk Areas: Zones labeled as "B," "C," or "X" represent areas with a reduced risk of flooding. While flood insurance is not federally mandated in these zones, it is still highly recommended, especially for properties located in close proximity to SFHAs.

- Undetermined Risk Areas: Some areas on the FIRM are designated as "D" zones, indicating that the flood risk has not been fully assessed. In such cases, additional data collection and analysis may be required to determine the specific flood zone and associated risks.

It's important to note that the FIRM provides a general overview of flood risks, and specific properties may have unique characteristics that influence their susceptibility to flooding. Therefore, it is crucial for property owners and prospective buyers to conduct thorough due diligence, including reviewing detailed flood maps and seeking expert advice from floodplain managers or insurance professionals.

The Role of Flood Insurance: Protecting Florida's Residents and Businesses

Flood insurance is a critical component of financial protection for Floridians, given the state's vulnerability to flooding events. The National Flood Insurance Program (NFIP), administered by FEMA, plays a central role in providing flood insurance coverage to property owners, renters, and businesses. By understanding the FIRM and its implications, individuals and businesses can make informed decisions about their insurance needs and coverage options.

The NFIP offers two primary types of flood insurance policies: the Standard Flood Insurance Policy (SFIP) and the Preferred Risk Policy (PRP). The SFIP is designed for properties located in Special Flood Hazard Areas (SFHAs) and provides comprehensive coverage for both building and contents. On the other hand, the PRP is tailored for properties in lower-risk areas and offers more affordable premiums, making flood insurance more accessible for those outside the SFHA zones.

In addition to providing financial protection, flood insurance plays a vital role in fostering community resilience and economic stability. By encouraging widespread adoption of flood insurance, communities can minimize the financial impact of flooding events, expedite recovery efforts, and maintain a robust local economy. Moreover, the presence of flood insurance can enhance property values and attract investment, as it demonstrates a commitment to proactive flood risk management.

Community Engagement and Flood Risk Mitigation

The effectiveness of the Florida Flood Insurance Rate Map extends beyond its role in insurance assessments. It serves as a powerful tool for community engagement and flood risk mitigation efforts. Local governments, community organizations, and residents can utilize the FIRM to identify areas at risk and develop targeted strategies to enhance resilience.

Through community workshops, educational initiatives, and collaborative planning, stakeholders can come together to discuss flood risks, share experiences, and develop innovative solutions. This community-centric approach fosters a culture of preparedness, empowering residents to take an active role in protecting their homes, businesses, and neighborhoods. By leveraging the insights provided by the FIRM, communities can implement measures such as elevating structures, implementing flood-resistant design practices, and enhancing natural buffers to mitigate flood impacts.

Future Innovations and Advancements in Flood Mapping

As technology and scientific understanding continue to advance, the field of flood mapping is evolving to provide even more accurate and detailed assessments of flood risks. FEMA, in partnership with research institutions and industry experts, is exploring innovative technologies and methodologies to enhance the precision and timeliness of flood mapping.

One such advancement is the integration of LiDAR (Light Detection and Ranging) technology, which utilizes laser pulses to create highly accurate topographic maps. LiDAR data can capture intricate details of the landscape, including elevation changes, drainage patterns, and vegetation cover, enabling more precise flood modeling and zone delineation. Additionally, advancements in remote sensing and satellite imagery analysis are enhancing our ability to monitor and predict flood events, providing valuable real-time data for emergency response and recovery efforts.

Furthermore, the development of advanced hydrological and hydraulic models is enabling more sophisticated simulations of flood behavior. These models consider a range of factors, including rainfall patterns, river flows, and coastal storm surges, to provide a comprehensive understanding of flood dynamics. By incorporating these models into the FIRM, FEMA can further refine flood zone designations and provide more accurate assessments of flood risks, ultimately enhancing the effectiveness of floodplain management and insurance programs.

Conclusion: Empowering Floridians to Navigate Flood Risks

The Florida Flood Insurance Rate Map is a cornerstone of flood risk management and preparedness in the Sunshine State. By providing a comprehensive overview of flood zones and associated risks, the FIRM empowers residents, businesses, and policymakers to make informed decisions about flood protection and insurance coverage. As Florida continues to face the challenges posed by a changing climate and increasing flood risks, the FIRM will remain a vital tool, guiding communities towards resilience and ensuring the well-being of its residents.

What is the purpose of the Florida Flood Insurance Rate Map (FIRM)?

+The FIRM is designed to provide detailed information about flood zones and the associated risks in Florida. It helps residents, businesses, and policymakers understand flood hazards, assess their vulnerability, and make informed decisions regarding flood protection and insurance.

How often is the FIRM updated, and why is it important to have current information?

+The FIRM is periodically updated to incorporate new data, scientific advancements, and changes in the landscape. Staying up-to-date with the latest FIRM information is crucial as it ensures that flood risk assessments are accurate and reflects the dynamic nature of flood hazards.

Are there any resources available to help me understand my property’s flood zone designation and associated risks?

+Absolutely! FEMA provides various resources, including online tools and detailed flood maps, to help property owners and residents understand their flood zone designation. Local floodplain managers and insurance professionals can also provide valuable insights and guidance.