Comprehensive Insurance Auto

In the complex world of car insurance, having a comprehensive understanding of the different coverage options is essential for every vehicle owner. Among the various types of auto insurance, comprehensive insurance stands out as a crucial component that offers protection against a wide range of risks beyond the basic liability coverage.

This comprehensive guide aims to shed light on the ins and outs of comprehensive insurance for automobiles, exploring its benefits, what it covers, how it works, and most importantly, how it can provide peace of mind for drivers. Whether you're a seasoned car owner or a new driver, gaining insight into this type of insurance is invaluable for making informed decisions about your vehicle's protection.

Understanding Comprehensive Insurance

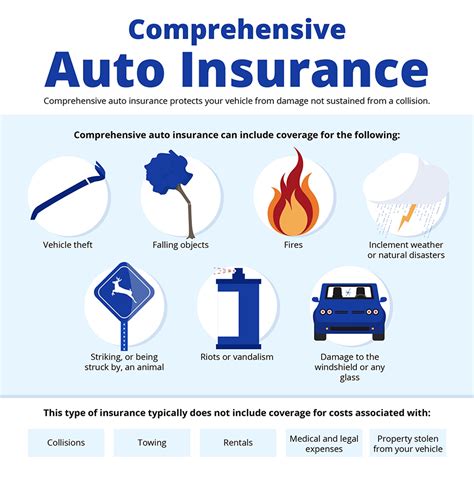

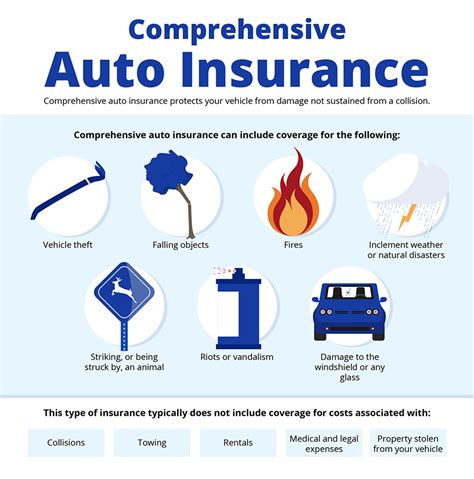

Comprehensive insurance, also known as full coverage in some regions, is an auto insurance policy that provides broad protection for your vehicle. Unlike liability insurance, which primarily covers damage to other people’s property or injuries caused by you, comprehensive insurance steps in to protect your own vehicle from a variety of unexpected events.

This type of insurance is designed to offer financial protection for damages or losses that occur outside of a typical collision with another vehicle. It covers events like natural disasters, theft, vandalism, and even damage caused by animals. By opting for comprehensive coverage, you gain a safety net that can help you recover from these unexpected situations without incurring significant out-of-pocket expenses.

Key Benefits of Comprehensive Insurance

One of the primary advantages of comprehensive insurance is the peace of mind it provides. With this coverage, you can drive knowing that you’re protected from a wide range of potential hazards. It’s an essential aspect of car ownership, especially for those who live in areas prone to natural disasters or those who frequently park their vehicles in high-risk locations.

Additionally, comprehensive insurance often includes rental car reimbursement, which can be a lifesaver if your vehicle is in the shop for repairs following an insured event. This benefit ensures you have a temporary replacement vehicle, allowing you to maintain your daily routine and work commitments.

Another key benefit is personal item coverage. If your vehicle is broken into and personal items are stolen or damaged, comprehensive insurance may provide coverage for these losses, helping you replace valuable belongings.

What Does Comprehensive Insurance Cover?

Comprehensive insurance is designed to protect against a variety of non-collision events. Here’s a breakdown of some of the key coverages included in a typical comprehensive policy:

Natural Disasters

Whether it’s a hurricane, tornado, hailstorm, or flooding, comprehensive insurance has you covered. These events can cause significant damage to your vehicle, and having this coverage ensures you won’t be left footing the entire bill.

Theft and Vandalism

If your vehicle is stolen or vandalized, comprehensive insurance steps in to help. This coverage can assist with repairs or even replacement if the vehicle is not recoverable.

Animal Collisions

Hitting an animal on the road can cause extensive damage to your vehicle. Comprehensive insurance covers repairs needed in such incidents, ensuring your car is back on the road quickly.

Fallen Trees and Other Debris

In the aftermath of a storm, fallen trees or other debris can damage your vehicle. Comprehensive insurance covers these types of incidents, providing financial protection for necessary repairs.

Fire and Explosion

If your vehicle is damaged due to fire or explosion, comprehensive coverage will help cover the costs of repairs or replacement.

How Does Comprehensive Insurance Work?

When you purchase comprehensive insurance, you’ll typically be required to choose a deductible, which is the amount you’ll pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and your vehicle sustains 3,000 worth of damage in a covered event, you’ll pay the first 500, and your insurance will cover the remaining 2,500.

It's important to note that comprehensive insurance typically comes with a higher premium than basic liability coverage. However, the added protection it provides can be well worth the cost, especially if you live in an area with high risks for natural disasters or theft.

When a covered event occurs, you'll need to file a claim with your insurance provider. They will then assess the damage and determine the value of the loss. If the cost of repairs exceeds the value of your vehicle, your insurance company may declare it a total loss and provide a payout based on the vehicle's actual cash value.

Actual Cash Value vs. Replacement Cost

Comprehensive insurance typically pays out the actual cash value of your vehicle at the time of the loss. This takes into account depreciation, so you may not receive the full replacement cost. However, some insurers offer replacement cost coverage, which provides the full cost of a new vehicle if yours is totaled within a certain period after purchase.

Comparing Comprehensive Insurance Options

When shopping for comprehensive insurance, it’s crucial to compare different policies to find the best fit for your needs and budget. Consider factors such as:

- Coverage Limits: Ensure the policy provides adequate coverage for your vehicle's value and your personal items.

- Deductibles: Choose a deductible that balances affordability with the level of protection you need.

- Additional Benefits: Look for policies that include rental car reimbursement and personal item coverage.

- Reputation and Financial Strength: Opt for insurers with a strong financial rating and a good reputation for prompt claims processing.

It's also a good idea to bundle your comprehensive insurance with other types of coverage, such as liability and collision insurance, to take advantage of potential discounts and ensure you have all the protection you need.

Real-World Examples of Comprehensive Insurance in Action

Let’s look at a few scenarios where comprehensive insurance has made a significant difference in people’s lives:

Scenario 1: Natural Disaster Strikes

In this scenario, a driver living in a hurricane-prone area experiences extensive wind damage to their vehicle during a storm. Their comprehensive insurance policy covers the repairs, providing a much-needed financial relief during a stressful time.

Scenario 2: Theft and Vandalism

A car owner wakes up to find their vehicle vandalized and some personal items stolen. Their comprehensive insurance policy covers the cost of repairs to the vehicle and also reimburses them for the value of the stolen items.

Scenario 3: Animal Collision

While driving on a rural road, a driver hits a deer. Their comprehensive insurance policy covers the repairs, allowing them to get back on the road quickly and safely.

The Future of Comprehensive Insurance

As the auto insurance industry continues to evolve, comprehensive insurance is likely to adapt to meet the changing needs of vehicle owners. With advancements in technology, we may see more innovative coverage options, such as:

- Enhanced Natural Disaster Coverage: Insurance providers may offer more specialized coverage for specific natural disasters, providing tailored protection for different regions.

- Improved Theft Protection: With the rise of keyless entry systems, insurers may develop new strategies to combat vehicle theft, offering additional security features and coverage.

- Advanced Driver Assistance Systems (ADAS) Coverage: As ADAS technologies become more prevalent, insurers may develop policies that specifically cover repairs or replacements for these advanced safety features.

Additionally, the use of telematics and data analytics may lead to more personalized and affordable comprehensive insurance options, offering incentives for safe driving behaviors.

Frequently Asked Questions

What is the difference between comprehensive and collision insurance?

+

Comprehensive insurance covers non-collision events like natural disasters, theft, and vandalism, while collision insurance covers damages resulting from a collision with another vehicle or object. Both are essential for comprehensive protection.

Do I need comprehensive insurance if I have an older car?

+

While comprehensive insurance is beneficial for all vehicles, it may be more cost-effective for newer or more valuable cars. For older vehicles, consider the vehicle’s value and the potential cost of repairs before deciding.

How can I reduce my comprehensive insurance premium?

+

You can reduce your premium by increasing your deductible, maintaining a clean driving record, and taking advantage of any available discounts, such as multi-policy or safe driver discounts.

What should I do if my vehicle is damaged in a covered event?

+

First, ensure your safety and the safety of others. Then, contact your insurance provider to report the incident and initiate the claims process. They will guide you through the necessary steps to have your vehicle repaired or replaced.

Can I get comprehensive insurance for my classic car?

+

Yes, comprehensive insurance is available for classic cars. However, due to their unique value and potential for increased risks, the coverage and pricing may be different from standard policies. Consult with a specialist insurer for classic car coverage.