Personal Car Insurance

Personal car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers worldwide. In a world where road accidents are an unfortunate reality, having the right insurance coverage can make a significant difference in managing the financial aftermath. This comprehensive guide aims to delve into the intricacies of personal car insurance, offering expert insights, real-world examples, and valuable advice to empower drivers in making informed decisions.

Understanding Personal Car Insurance

Personal car insurance, often simply referred to as auto insurance or motor insurance, is a contractual agreement between an individual (the policyholder) and an insurance provider. This contract ensures that in the event of an accident, theft, or other specified mishaps, the insurance company will compensate the policyholder for the resulting damages or losses. It is a crucial financial safety net that can safeguard individuals from potentially devastating expenses.

Key Components of Personal Car Insurance

Personal car insurance policies are tailored to meet the specific needs of individual drivers and their vehicles. Here's a breakdown of the essential components:

- Liability Coverage: This is a fundamental part of any car insurance policy. It covers the policyholder's legal responsibility for bodily injury or property damage caused to others in an accident for which the policyholder is at fault. Liability coverage typically includes both bodily injury liability and property damage liability.

- Collision Coverage: This type of coverage pays for the repair or replacement of the insured vehicle after an accident, regardless of fault. It is particularly valuable in cases where the other driver is uninsured or underinsured.

- Comprehensive Coverage: This coverage protects against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or collisions with animals. It provides a more comprehensive level of protection, ensuring that the policyholder's vehicle is covered in a wide range of scenarios.

- Medical Payments or Personal Injury Protection (PIP): This coverage pays for medical expenses for the policyholder and their passengers, regardless of who is at fault in an accident. It can include coverage for funeral expenses, lost wages, and other related costs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who either has no insurance or insufficient insurance to cover the damages. It ensures that the policyholder is not left financially burdened in such situations.

The Importance of Personal Car Insurance

The significance of personal car insurance cannot be overstated. Here are some key reasons why it is an essential aspect of responsible vehicle ownership:

Financial Protection

Car accidents can result in substantial financial losses, including vehicle repairs, medical bills, legal fees, and property damage. Personal car insurance provides a financial safety net, ensuring that policyholders are not left with overwhelming expenses. By covering these costs, insurance helps individuals manage the financial aftermath of accidents effectively.

Legal Compliance

In most jurisdictions, it is mandatory for vehicle owners to have at least a basic level of car insurance. Failure to comply with these legal requirements can result in penalties, including fines, license suspension, or even imprisonment. Personal car insurance ensures that drivers remain compliant with the law and avoid potential legal issues.

Peace of Mind

Knowing that you are protected in the event of an accident or vehicle-related incident can provide immense peace of mind. Personal car insurance offers a sense of security, allowing drivers to focus on the road and their journey without constant worry about the financial implications of potential mishaps.

Choosing the Right Personal Car Insurance Policy

Selecting the appropriate personal car insurance policy involves careful consideration of various factors. Here's a step-by-step guide to help drivers make informed choices:

Assess Your Needs

Start by evaluating your specific needs and circumstances. Consider factors such as the value of your vehicle, your driving record, the number of miles you drive annually, and any unique circumstances like regular commuting or frequent road trips. Understanding your needs is crucial in determining the type and level of coverage you require.

Research Insurance Providers

Take the time to research and compare different insurance providers. Look into their reputation, financial stability, customer service, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights into the experiences of other policyholders.

Understand Coverage Options

Familiarize yourself with the different types of coverage available, as outlined earlier. Understand the differences between liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Determine which of these coverages are mandatory in your jurisdiction and which ones are optional but highly recommended based on your specific needs.

Compare Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Remember that the cheapest quote may not always be the best option. Consider factors such as the reputation of the insurer, the level of coverage provided, and any additional perks or discounts offered.

Consider Additional Coverages

Some insurance providers offer optional additional coverages that can enhance your protection. These may include rental car coverage, gap insurance, or roadside assistance. Evaluate whether these additional coverages are worth the extra cost based on your personal circumstances and driving habits.

Read the Policy Documents

Before finalizing your insurance policy, carefully review the policy documents. Understand the terms and conditions, including any exclusions or limitations. Ensure that you are aware of any deductibles, coverage limits, and the process for filing claims. If you have any questions or concerns, don't hesitate to reach out to the insurance provider for clarification.

Personal Car Insurance: Real-World Scenarios

To illustrate the importance and impact of personal car insurance, let's explore a few real-world scenarios:

Scenario 1: Collision with an Uninsured Driver

Imagine you're involved in an accident where the other driver is at fault but lacks insurance coverage. Without uninsured motorist coverage, you would be left to bear the costs of repairing your vehicle and any medical expenses resulting from the accident. However, with this coverage, your insurance provider steps in to compensate you, ensuring that you're not financially burdened.

Scenario 2: Comprehensive Coverage for Natural Disasters

Consider a situation where your vehicle is damaged due to a natural disaster, such as a hurricane or flood. If you have comprehensive coverage, your insurance policy will cover the repairs or even provide a replacement vehicle, helping you get back on the road quickly and without significant financial strain.

Scenario 3: Medical Payments Coverage

In an accident where you sustain minor injuries, medical payments coverage can be a lifesaver. This coverage pays for your medical expenses, allowing you to focus on your recovery without worrying about the financial implications. It ensures that you receive the necessary medical care without delay.

Tips for Maximizing Personal Car Insurance Benefits

To make the most of your personal car insurance policy, consider the following tips:

- Maintain a Clean Driving Record: A clean driving record can lead to lower insurance premiums. Avoid traffic violations and accidents to keep your insurance costs down.

- Bundle Policies: Consider bundling your car insurance with other insurance policies, such as home or life insurance. Many insurers offer discounts for bundling multiple policies, making it a cost-effective option.

- Explore Discounts: Insurance providers often offer various discounts, such as safe driver discounts, good student discounts, or loyalty discounts. Ask your insurer about the discounts available and how you can qualify for them.

- Raise Your Deductible: Opting for a higher deductible can lower your insurance premiums. However, ensure that you have the financial means to cover the higher deductible in the event of a claim.

- Regularly Review Your Policy: Insurance needs can change over time. Review your policy annually to ensure that your coverage still meets your requirements. Update your policy as necessary to reflect changes in your vehicle, driving habits, or personal circumstances.

The Future of Personal Car Insurance

The personal car insurance landscape is evolving, driven by advancements in technology and changing consumer needs. Here's a glimpse into the future:

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and habits, are gaining popularity. These devices can provide real-time data on driving patterns, allowing insurance providers to offer usage-based insurance policies. Such policies reward safe driving behaviors with lower premiums, encouraging safer driving practices.

Connected Car Technology

The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to revolutionize personal car insurance. These technologies can enhance safety, reduce accidents, and provide valuable data for insurance providers. As connected car technology becomes more prevalent, insurance policies may adapt to offer incentives for adopting these safety features.

AI and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the insurance industry. Insurers are leveraging these technologies to analyze vast amounts of data, identify patterns, and make more accurate risk assessments. This can lead to more personalized insurance policies, tailored to individual driving behaviors and risks.

Increased Focus on Prevention

The future of personal car insurance is likely to see a greater emphasis on accident prevention. Insurance providers may offer incentives and rewards for drivers who adopt safe driving practices and technologies. Additionally, with the rise of autonomous vehicles, insurance policies may evolve to cover new risks and liabilities associated with this emerging technology.

Frequently Asked Questions

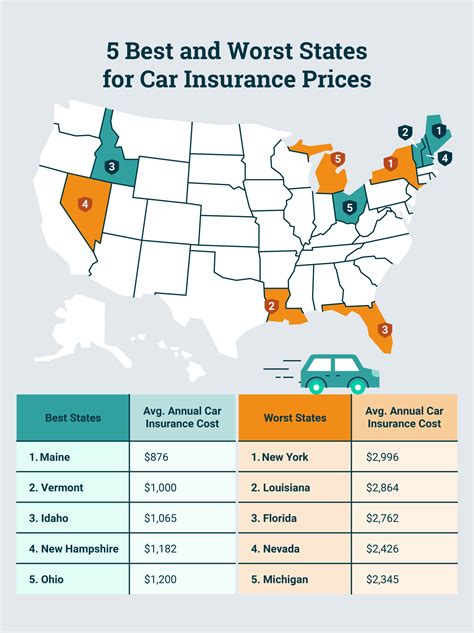

How much does personal car insurance typically cost?

+

The cost of personal car insurance varies widely based on factors such as location, driving record, vehicle type, and coverage limits. On average, policyholders can expect to pay between 500 and 1,500 annually for a standard policy. However, rates can be significantly higher or lower depending on individual circumstances.

What factors influence the cost of personal car insurance?

+

The cost of personal car insurance is influenced by various factors, including the policyholder’s age, gender, driving record, location, vehicle type, and coverage limits. Insurance providers also consider the risk associated with the policyholder’s driving habits and the likelihood of accidents or claims.

How can I reduce my personal car insurance premiums?

+

There are several strategies to reduce personal car insurance premiums. These include maintaining a clean driving record, shopping around for quotes from multiple insurers, bundling policies, opting for a higher deductible, and exploring discounts. Additionally, safe driving practices and adopting vehicle safety features can lead to lower premiums over time.

What happens if I don’t have personal car insurance and get into an accident?

+

If you are involved in an accident without personal car insurance, you may be held financially responsible for all damages and injuries resulting from the accident. This can lead to significant out-of-pocket expenses, including vehicle repairs, medical bills, and legal fees. In some jurisdictions, driving without insurance is a criminal offense and can result in penalties, fines, or even imprisonment.

How often should I review my personal car insurance policy?

+

It is recommended to review your personal car insurance policy annually or whenever there is a significant change in your circumstances. This ensures that your coverage remains adequate and up-to-date. Changes that may require a policy review include buying a new vehicle, moving to a different location, getting married, or adding a young driver to your policy.