Dental Insurance Plans California

Dental insurance is an essential aspect of healthcare, offering individuals and families access to affordable dental care and preventive services. In California, dental insurance plans play a crucial role in maintaining the oral health of its diverse population. This comprehensive guide aims to explore the landscape of dental insurance in the Golden State, providing an in-depth analysis of coverage options, benefits, and considerations for Californians seeking optimal dental care.

Understanding Dental Insurance in California

Dental insurance in California is a vital component of the state’s healthcare system, ensuring that residents have access to quality dental care without incurring substantial financial burdens. With a diverse range of providers and plans available, understanding the nuances of dental insurance is key to making informed choices.

The Importance of Dental Coverage

Oral health is an integral part of overall well-being, and dental insurance plays a pivotal role in promoting preventive care and addressing dental issues before they escalate. Regular dental check-ups and cleanings, covered by insurance, help detect and treat problems early, leading to better oral health outcomes.

Additionally, dental insurance provides financial protection against the costs of dental treatments, which can be significant, especially for more complex procedures. By offering coverage for a wide range of services, from routine cleanings to major restorative work, dental insurance plans in California aim to make quality dental care accessible to all.

Dental Insurance Providers in California

California boasts a competitive market for dental insurance, with numerous providers offering a diverse array of plans. Some of the prominent dental insurance carriers in the state include:

- Delta Dental of California: One of the largest dental insurers in the state, Delta Dental offers a comprehensive network of providers and a wide range of plan options, catering to individuals, families, and businesses.

- Blue Cross Blue Shield of California: Well-known for their comprehensive health insurance plans, Blue Cross Blue Shield also offers dental coverage, providing an extensive network and flexible plan designs.

- United Concordia Dental: A leading national dental insurer, United Concordia offers a variety of plans tailored to meet the needs of California residents, including PPO and DHMO options.

- MetLife Dental: MetLife's dental plans provide access to a large network of dentists across the state, offering affordable coverage for a wide range of dental services.

- Aetna Dental: With a strong presence in California, Aetna offers dental plans that combine flexibility and affordability, making quality dental care accessible to a broad range of residents.

Types of Dental Insurance Plans

Dental insurance plans in California come in various forms, each designed to cater to different needs and preferences. Understanding the different types of plans is essential when choosing the right coverage.

Preferred Provider Organization (PPO) Plans

PPO plans offer the flexibility to choose any licensed dentist, whether in-network or out-of-network. With a PPO plan, you can expect:

- In-Network Benefits: When visiting an in-network dentist, you'll typically pay lower out-of-pocket costs, as the plan has negotiated discounted rates with these providers.

- Out-of-Network Flexibility: If you choose an out-of-network dentist, you'll still receive coverage, although you may pay more out of pocket.

- Wide Network: PPO plans often have extensive networks, ensuring you have a broad range of dental care options.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans are known for their cost-effectiveness and focus on preventive care. Key features include:

- In-Network Coverage: You must select a primary care dentist from the plan's network, and all services are typically covered at 100% when obtained from in-network providers.

- Limited Out-of-Network Options: DHMO plans typically do not cover out-of-network care, so it's essential to choose a plan with a network that meets your needs.

- Emphasis on Preventive Care: These plans encourage regular check-ups and cleanings, often covering these services at no cost to you.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, provide the most flexibility in choosing dental providers. Here’s what you can expect:

- Provider Choice: You can visit any dentist, regardless of their network status.

- Reimbursement: After receiving treatment, you pay the dentist directly, and the plan reimburses you for a portion of the cost based on the plan's fee schedule.

- No Network Restrictions: Indemnity plans don't limit your choice of providers, making them suitable for those with specific dental needs or preferences.

Dental Insurance Coverage and Benefits

Dental insurance plans in California offer a range of coverage and benefits, designed to meet the varying needs of individuals and families. Understanding the specific coverage and benefits is crucial when selecting a plan.

Routine Dental Care

Most dental insurance plans in California cover routine dental care, which includes:

- Dental Cleanings: Typically covered at 100% every 6 months, these cleanings help maintain oral hygiene and detect early signs of dental issues.

- Dental Exams: Regular exams, often covered at 100%, allow dentists to assess oral health and recommend necessary treatments.

- X-rays: Essential for diagnosing dental problems, X-rays are usually covered at a specified frequency, ensuring timely detection of issues.

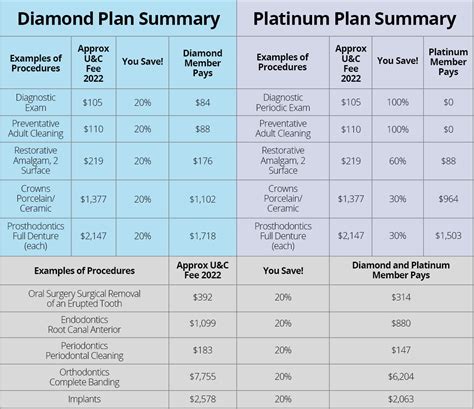

Basic Dental Procedures

Basic dental procedures, such as fillings and simple extractions, are often covered at a higher percentage than more complex treatments. For instance, a typical PPO plan might cover basic procedures at 80% after the deductible.

Major Dental Procedures

Major dental procedures, including crowns, root canals, and oral surgery, are generally covered at a lower percentage than basic procedures. For example, a DHMO plan might cover major procedures at 50%.

Orthodontic Treatment

Orthodontic treatment, such as braces and Invisalign, is often covered separately from regular dental coverage. Plans may have specific age limits and coverage limits for orthodontic care, so it’s essential to review these details carefully.

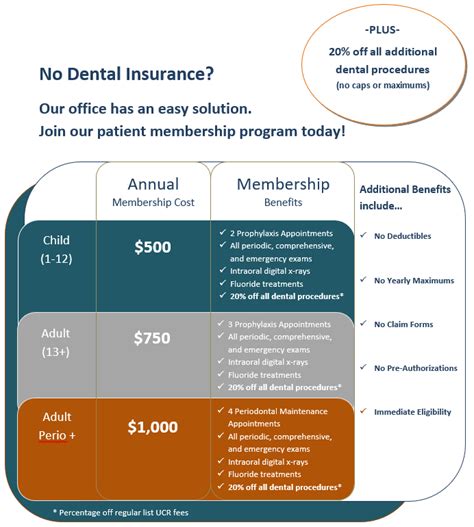

Additional Benefits

Some dental insurance plans in California offer additional benefits to enhance coverage. These may include:

- Emergency Dental Care: Coverage for unexpected dental emergencies, such as severe toothaches or injuries.

- Cosmetic Dentistry: Plans may cover a portion of the cost for cosmetic procedures like teeth whitening or veneers.

- Discounts: Certain plans offer additional discounts on dental services or products, providing extra savings.

Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan in California involves careful consideration of your specific needs and preferences. Here are some factors to keep in mind:

Network Providers

Review the plan’s network to ensure it includes dentists you’re comfortable with and has a good mix of general dentists and specialists. If you have a preferred dentist, check if they’re in-network.

Coverage and Benefits

Evaluate the plan’s coverage for the services you’re likely to need. Consider the percentage of coverage for basic, major, and orthodontic procedures, as well as any additional benefits that align with your dental goals.

Cost

Dental insurance plans come with different premium costs, deductibles, and out-of-pocket expenses. Balance the cost of the plan with the coverage it provides to find the best value for your needs.

Flexibility

Consider the level of flexibility you desire in choosing your dental providers. PPO plans offer the most flexibility, while DHMO plans have more restrictions, but may be more cost-effective.

Reviews and Reputation

Research the reputation and customer satisfaction ratings of the insurance provider. Look for reviews and testimonials to get a sense of the overall experience with the plan and its administration.

Tips for Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance coverage in California, consider the following tips:

Regular Dental Visits

Schedule regular dental check-ups and cleanings to maintain optimal oral health and take advantage of preventive care benefits.

Understand Your Coverage

Review your plan’s coverage details, including what’s covered, at what percentage, and any limitations or exclusions. This knowledge will help you plan for dental treatments effectively.

Choose In-Network Providers

If your plan offers a network of providers, choose in-network dentists to maximize your coverage and minimize out-of-pocket costs.

Stay Informed

Keep up-to-date with any changes to your plan’s coverage or network providers. This ensures you’re aware of any modifications that may impact your dental care choices.

Use Pre-Authorization

For more complex or costly procedures, consider obtaining pre-authorization from your insurance provider to ensure coverage and avoid unexpected costs.

Future Trends in Dental Insurance

The landscape of dental insurance in California is evolving, driven by technological advancements and changing consumer needs. Here are some trends to watch for:

Telehealth and Virtual Dental Consultations

The rise of telehealth services is expected to continue, offering remote dental consultations and triaging for non-emergency dental issues.

Integration with Digital Dental Records

Dental insurance providers may increasingly integrate with digital dental record systems, allowing for more efficient claim processing and better patient care coordination.

Focus on Preventive Care

With the understanding that preventive care leads to better oral health outcomes, dental insurance plans may further emphasize and incentivize regular check-ups and cleanings.

Enhanced Orthodontic Coverage

As the demand for orthodontic treatment grows, dental insurance plans may offer more comprehensive coverage for braces and clear aligners, making these treatments more accessible.

Conclusion

Dental insurance plans in California offer a diverse range of options, ensuring that residents can access quality dental care tailored to their needs. By understanding the different types of plans, coverage, and benefits, Californians can make informed choices to maintain optimal oral health. As the dental insurance landscape continues to evolve, staying informed and engaged will be key to navigating the system effectively and making the most of available coverage.

How do I find the best dental insurance plan for my needs in California?

+To find the best plan, consider your specific dental needs, preferred providers, and budget. Evaluate plans based on coverage, network, cost, and flexibility. Research and compare multiple options to make an informed decision.

What is the average cost of dental insurance in California?

+The cost of dental insurance in California varies based on factors like age, location, and plan type. On average, individual plans can range from 30 to 50 per month, while family plans may cost around 100 to 200 per month. However, costs can vary significantly, so it’s best to obtain specific quotes for your situation.

Are there any discounts or special programs for dental insurance in California?

+Yes, some dental insurance providers in California offer discounts for families, students, and seniors. Additionally, programs like Denti-Cal provide dental coverage for eligible low-income individuals and families. It’s worth exploring these options to find the most affordable coverage.

How do I know if my dentist is in-network with my insurance plan?

+You can verify if your dentist is in-network by contacting your insurance provider or checking their website. Most providers offer tools to search for in-network dentists based on your location and plan. It’s essential to confirm this information to ensure you receive the maximum coverage benefits.

What happens if I need emergency dental care while traveling outside of California?

+If you have an emergency while traveling, some insurance plans offer coverage for out-of-network care. Contact your insurance provider’s emergency hotline for guidance and to locate a nearby dentist who can provide the necessary treatment. Keep in mind that out-of-network care may incur higher out-of-pocket costs.