Are Insurance Premiums Deductible On Taxes

When it comes to managing personal finances, many individuals seek ways to optimize their tax obligations while ensuring adequate protection through insurance policies. One frequently asked question revolves around the deductibility of insurance premiums on taxes. In this comprehensive article, we will delve into the intricacies of this topic, providing a detailed analysis of the tax implications of insurance premiums and exploring the scenarios where deductions may be applicable.

Understanding the Basics: Insurance Premiums and Taxes

Insurance premiums are the regular payments made by policyholders to maintain their coverage under an insurance policy. These premiums can vary depending on the type of insurance, the level of coverage, and individual risk factors. While insurance is a vital tool for managing financial risks, the question of whether these premiums can be deducted from taxes often arises.

Taxes, on the other hand, are mandatory financial obligations levied by governments on individuals and businesses to fund public services and infrastructure. The tax system is complex, and understanding the deductibility of expenses like insurance premiums is crucial for optimizing one's financial position.

The Deductibility of Insurance Premiums: An In-Depth Analysis

The deductibility of insurance premiums on taxes is not a straightforward matter and varies depending on the type of insurance, the jurisdiction, and the individual’s tax status. In general, insurance premiums are considered a personal expense and are typically not deductible for most taxpayers. However, there are certain exceptions and scenarios where insurance premiums can be claimed as a tax deduction.

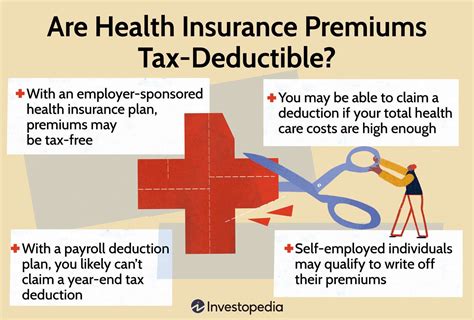

Health Insurance Premiums

One of the most common types of insurance where premiums may be deductible is health insurance. In many countries, including the United States, individuals who pay for their own health insurance premiums may be eligible for a tax deduction. This deduction is often available to those who are self-employed or those who do not have access to employer-provided health insurance.

For instance, in the US, taxpayers can claim a deduction for health insurance premiums on their federal income tax returns if they meet specific criteria. This includes having a qualifying health insurance plan and not being eligible for coverage under an employer-sponsored plan. The deduction amount can vary and is subject to certain limitations and adjustments.

| Country | Health Insurance Premium Deductibility |

|---|---|

| United States | Deduction available for self-employed and those without employer coverage |

| Canada | Premiums for private health insurance are generally not deductible |

| United Kingdom | Private medical insurance premiums are deductible for certain individuals |

Life Insurance Premiums

In contrast to health insurance, life insurance premiums are generally not deductible for personal policies. Life insurance is considered a personal expense and is not typically treated as a tax-deductible item. However, there are certain circumstances where life insurance premiums may be deductible, particularly when they are related to business or investment activities.

For example, if an individual owns a business and takes out a life insurance policy as part of a business succession plan or to secure a loan, the premiums paid for that policy may be deductible as a business expense. Similarly, if life insurance is purchased as part of an investment strategy, such as a variable life insurance policy, the premiums may be tax-deductible under specific conditions.

Other Types of Insurance

Beyond health and life insurance, there are various other types of insurance policies, including auto insurance, home insurance, and liability insurance. The deductibility of premiums for these policies also depends on the circumstances.

For instance, if an individual owns a business and insures their commercial property, the premiums paid for commercial insurance may be deductible as a business expense. Similarly, if an individual has rental properties, the insurance premiums for those properties can often be claimed as a tax deduction on rental income.

Maximizing Tax Benefits: Strategies and Considerations

Understanding the deductibility of insurance premiums is just the first step. To maximize tax benefits, individuals should consider the following strategies and factors:

- Review Tax Laws and Regulations: Stay updated on the tax laws and regulations in your jurisdiction. Tax codes and deductions can change over time, so it's essential to consult with tax professionals or refer to official government resources for the most accurate information.

- Consult a Tax Advisor: Given the complexity of tax laws, consulting a qualified tax advisor or accountant can provide valuable guidance tailored to your specific circumstances. They can help you navigate the deductibility rules and ensure you are taking advantage of all applicable deductions.

- Keep Detailed Records: Maintain organized records of your insurance premiums and any related expenses. This will make it easier to substantiate your deductions during tax season and provide evidence if your return is ever audited.

- Explore Tax-Advantaged Options: Consider insurance products that offer tax advantages. For example, certain types of life insurance policies, such as whole life or universal life insurance, may have tax-deferred growth or tax-free death benefits, providing long-term tax benefits.

The Impact of Insurance Premiums on Tax Planning

The deductibility of insurance premiums can have a significant impact on an individual’s tax planning strategy. By understanding the rules and regulations surrounding insurance premiums and taxes, individuals can make informed decisions about their insurance coverage and tax obligations.

For instance, if an individual is self-employed and eligible for a health insurance premium deduction, they may choose to purchase a higher level of coverage to maximize their tax benefits. On the other hand, for those with employer-provided health insurance, the premiums are typically not deductible, so their tax planning may focus on other aspects of their financial portfolio.

Conclusion: Navigating the Complex World of Insurance and Taxes

The deductibility of insurance premiums on taxes is a complex topic that requires a nuanced understanding of tax laws and regulations. While insurance premiums are generally not deductible for most taxpayers, certain types of insurance, such as health insurance, offer opportunities for tax deductions under specific circumstances.

By staying informed about tax laws, consulting professionals, and maintaining meticulous records, individuals can navigate the world of insurance and taxes with confidence. This comprehensive guide aims to provide a solid foundation for understanding the deductibility of insurance premiums, allowing individuals to make informed financial decisions and optimize their tax strategies.

Can I deduct health insurance premiums if I have employer-provided coverage?

+No, if you have access to employer-provided health insurance, the premiums are typically not deductible. This is because the cost of employer-provided health insurance is considered a benefit provided by the employer and is not treated as a personal expense.

Are there any limits to the health insurance premium deduction?

+Yes, the deduction for health insurance premiums is subject to limitations and adjustments. The specific limits depend on various factors, including your adjusted gross income and the type of health insurance plan you have. It’s advisable to consult a tax professional to understand the limits applicable to your situation.

Can I deduct the premiums for my spouse’s and children’s health insurance?

+Yes, if you are eligible for the health insurance premium deduction and you pay the premiums for your spouse’s and children’s health insurance, those premiums can also be claimed as a deduction. This applies to qualified family members covered under your policy.