Price Of Insurance For A Car

When it comes to car insurance, one of the most common questions that prospective policyholders have is, "How much will it cost me?" The price of insurance for a car can vary significantly based on numerous factors, and understanding these variables is crucial for making informed decisions about your coverage. This comprehensive guide will delve into the key aspects that influence car insurance premiums, providing you with the knowledge to navigate the insurance landscape effectively.

The Intricate Web of Factors Influencing Car Insurance Premiums

The cost of insuring your vehicle is not a one-size-fits-all proposition. It is a complex calculation that takes into account a multitude of factors, each contributing to the final premium. These factors can be broadly categorized into personal, vehicle-related, and regional considerations.

Personal Factors: A Unique Reflection of Your Circumstances

Your individual circumstances play a significant role in determining your car insurance premium. Insurance providers assess a range of personal factors to gauge the level of risk you pose as a policyholder. These factors include:

- Age and Gender: Younger drivers, particularly males, are often considered higher-risk due to their propensity for more aggressive driving behaviors. As a result, they typically pay higher premiums. Conversely, mature drivers, especially females, may enjoy more favorable rates.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance costs. On the other hand, a history of accidents or traffic citations can significantly increase your premiums.

- Credit Score: Believe it or not, your credit score can influence your insurance premium. Many insurers use credit-based insurance scores to assess risk, and a higher credit score may result in a lower premium.

- Marital Status: Married individuals are often seen as lower-risk policyholders and may be offered more favorable rates.

- Education Level: Some insurers offer discounts to individuals with higher education levels, as they are perceived to be more responsible and less likely to engage in risky behaviors.

Vehicle-Related Factors: The Impact of Your Choice of Wheels

The type of vehicle you drive is another critical factor in determining your insurance premium. Here’s how your choice of vehicle can influence your costs:

- Make and Model: Certain makes and models of vehicles are more expensive to insure due to their higher repair costs, susceptibility to theft, or higher accident rates. For instance, sports cars and luxury vehicles often command higher premiums.

- Vehicle Age and Value: Older vehicles, especially those with lower market values, may be cheaper to insure. This is because the replacement cost of the vehicle is lower, and there may be fewer safety features to consider.

- Vehicle Usage: The purpose for which you use your vehicle can affect your premium. If you use your car for business purposes or commute long distances daily, your insurance costs may be higher.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, and collision avoidance systems, may qualify for insurance discounts.

Regional Factors: A Geographical Perspective on Insurance Costs

The region where you live and drive your vehicle also plays a role in determining your insurance premium. Regional factors that can influence your costs include:

- Location: Urban areas often have higher insurance premiums due to increased traffic density, higher accident rates, and higher rates of vehicle theft.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes or hail storms, may see higher insurance rates due to the increased risk of weather-related damage.

- Traffic and Crime Rates: Areas with higher traffic congestion and crime rates are typically associated with higher insurance costs.

- Local Laws and Regulations: Some states or regions may have specific laws that impact insurance rates, such as no-fault insurance laws or mandatory coverage requirements.

Additional Considerations: A Comprehensive Approach to Insurance Pricing

Beyond the personal, vehicle-related, and regional factors, there are other considerations that can impact your insurance premium. These include:

- Coverage Limits and Deductibles: The level of coverage you choose and the deductible you’re willing to pay can significantly affect your premium. Higher coverage limits and lower deductibles generally result in higher premiums.

- Discounts and Bundling: Many insurers offer discounts for various reasons, such as safe driving, loyalty, or bundling multiple policies (e.g., auto and home insurance) with the same provider.

- Claims History: Your past claims history with the insurer can impact your future premiums. Frequent claims may lead to higher rates or even non-renewal of your policy.

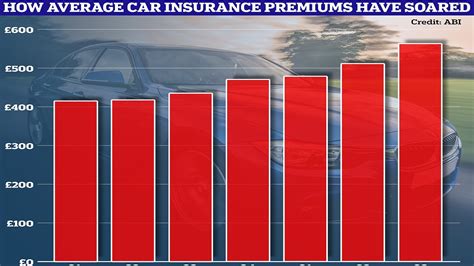

- Competition and Market Dynamics: The insurance market is competitive, and insurers may adjust their premiums to remain competitive or to reflect changes in the market.

The Fine Print: Understanding Insurance Policies and Costs

When reviewing car insurance policies, it’s essential to go beyond the premium and delve into the fine print. Here’s a breakdown of what you should consider:

Types of Coverage

Car insurance policies typically offer a range of coverage options, including:

- Liability Coverage: This is the most basic form of insurance, covering the cost of damages and injuries you cause to others in an accident.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This covers damages caused by non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance.

Policy Terms and Conditions

Each insurance policy will have specific terms and conditions that outline what is and isn’t covered. These may include:

- Exclusions: Certain events or circumstances may not be covered by your policy, such as damage caused by floods or earthquakes if you don’t have specific endorsements for these perils.

- Limits and Deductibles: The policy will specify the maximum amount the insurer will pay for a covered claim (the limit) and the amount you must pay out of pocket before the insurer covers the rest (the deductible).

- Claims Process: The policy should detail the steps you need to take in the event of a claim, including how to report the claim, what information to provide, and what to expect during the claims process.

Add-Ons and Endorsements

In addition to the standard coverage options, many insurers offer add-ons or endorsements that can customize your policy to your specific needs. These may include:

- Roadside Assistance: Provides help in case of a breakdown, flat tire, or running out of fuel.

- Rental Car Coverage: Covers the cost of renting a vehicle while your car is being repaired after an accident.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease if your car is totaled.

- Custom Parts and Equipment Coverage: Protects the cost of custom modifications or upgrades you’ve made to your vehicle.

Comparing Quotes and Choosing the Right Policy

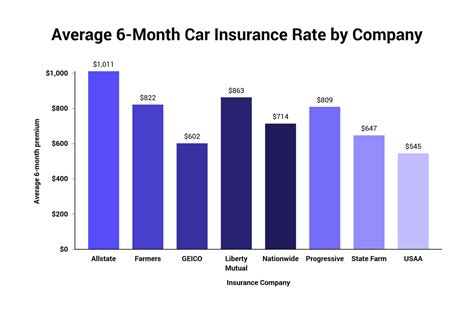

To ensure you’re getting the best value for your insurance dollar, it’s crucial to compare quotes from multiple insurers. When comparing quotes, consider the following:

- Coverage Levels: Make sure you’re comparing policies with similar coverage levels. For example, if one quote includes collision coverage and another doesn’t, the premiums won’t be directly comparable.

- Deductibles: Higher deductibles can lead to lower premiums, but consider whether you can afford the deductible if you need to make a claim.

- Discounts: Inquire about any available discounts, such as safe driver discounts, loyalty discounts, or discounts for bundling multiple policies.

- Reputation and Financial Stability: Research the insurer’s reputation and financial stability. You want to ensure the company is financially sound and has a track record of paying claims promptly and fairly.

- Customer Service and Claims Handling: Read reviews and ask around to get a sense of the insurer’s customer service and claims handling reputation. You want to choose a company that makes the claims process as smooth and stress-free as possible.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is evolving, and several trends and innovations are shaping the future of automotive coverage. Here’s a glimpse into what lies ahead:

Usage-Based Insurance (UBI)

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining traction. This type of insurance policy bases your premium on your actual driving behavior, as monitored by telematics devices or smartphone apps. UBI can offer significant savings for safe drivers, as it rewards good driving habits and discourages risky behaviors.

Connected Car Technology

The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to have a significant impact on car insurance. These technologies can enhance safety, reduce the risk of accidents, and provide valuable data for insurers to better assess risk and set premiums.

Data-Driven Underwriting

Insurers are increasingly leveraging data analytics and machine learning to improve underwriting accuracy. By analyzing vast amounts of data, insurers can more precisely assess risk and tailor policies to individual drivers, leading to more personalized and accurate premiums.

Digital Transformation

The car insurance industry is undergoing a digital transformation, with insurers investing in technology to enhance the customer experience. This includes online quote comparisons, digital policy management, and streamlined claims processes. Digital tools can make it easier for customers to research, purchase, and manage their insurance policies.

Insurtech Partnerships

Insurtech startups are disrupting the traditional insurance model with innovative solutions and technologies. Traditional insurers are partnering with these startups to enhance their offerings, improve customer experience, and stay competitive in the evolving insurance landscape.

Sustainable Insurance Practices

As sustainability and environmental concerns gain prominence, the insurance industry is exploring ways to support sustainable practices. This includes offering incentives for electric vehicles, encouraging eco-friendly driving behaviors, and supporting initiatives to reduce carbon emissions.

How can I lower my car insurance premium?

+There are several strategies to lower your car insurance premium. First, shop around and compare quotes from multiple insurers to find the best rate. Also, consider increasing your deductible, as a higher deductible can lead to lower premiums. Maintain a clean driving record, as insurers reward safe drivers with lower rates. Explore discounts, such as safe driver discounts, loyalty discounts, or discounts for bundling multiple policies. Finally, consider the type of vehicle you drive, as certain makes and models are more expensive to insure.

What factors determine the cost of my car insurance policy?

+The cost of your car insurance policy is determined by a variety of factors, including your personal characteristics (age, gender, driving history, credit score), the type of vehicle you drive (make, model, age, safety features), where you live and drive (urban vs. rural, weather conditions, traffic and crime rates), the level of coverage you choose (liability, collision, comprehensive, PIP, uninsured/underinsured motorist), and your claims history with the insurer.

What is the difference between liability, collision, and comprehensive coverage?

+Liability coverage is the most basic form of insurance, covering the cost of damages and injuries you cause to others in an accident. Collision coverage covers damage to your vehicle in an accident, regardless of fault. Comprehensive coverage covers damages caused by non-collision incidents, such as theft, vandalism, fire, or natural disasters.

How can I get a more accurate quote for my car insurance?

+To get a more accurate quote, provide as much detailed information as possible to the insurer. This includes your personal details (age, gender, driving history, credit score), vehicle details (make, model, age, safety features), and location details (urban vs. rural, weather conditions, traffic and crime rates). Also, consider the level of coverage you want and any add-ons or endorsements you may need.

What are some common discounts available for car insurance?

+Common discounts for car insurance include safe driver discounts, loyalty discounts, multi-policy discounts (bundling auto and home insurance), good student discounts, and discounts for vehicles with advanced safety features. Some insurers also offer discounts for paying your premium in full or for using telematics devices to monitor your driving behavior.