Insurance Business Auto

In the world of commercial transportation, a comprehensive understanding of Business Auto Insurance is paramount. This specialized insurance coverage plays a critical role in safeguarding businesses engaged in various operations, be it hauling goods, transporting passengers, or conducting construction work. With an array of risks inherent to these activities, a robust Business Auto Insurance policy is indispensable.

This comprehensive guide aims to delve into the intricacies of Business Auto Insurance, providing an in-depth analysis of its importance, coverage options, and real-world applications. By exploring specific scenarios and industry insights, we will equip you with the knowledge to navigate this complex yet essential aspect of commercial transportation.

Understanding Business Auto Insurance

Business Auto Insurance, also known as Commercial Auto Insurance, is a specialized form of coverage designed specifically for vehicles used in business operations. Unlike personal auto insurance, which primarily caters to private vehicle usage, Business Auto Insurance caters to the unique risks and liabilities associated with commercial transportation.

This insurance coverage is tailored to protect businesses from a range of potential financial losses arising from vehicle-related incidents. Whether it's a delivery van involved in an accident, a construction truck causing property damage, or a fleet of taxis facing liability claims, Business Auto Insurance provides a safety net for businesses operating vehicles.

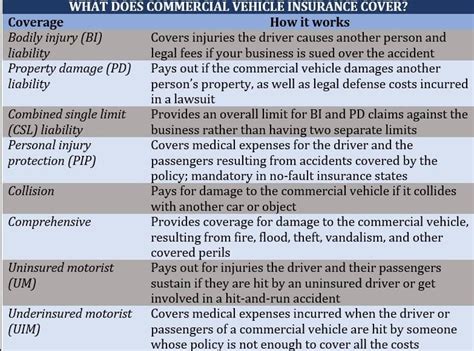

Key Coverage Elements

- Liability Coverage: This is the cornerstone of Business Auto Insurance. It provides protection against claims arising from bodily injury or property damage caused by a covered vehicle. Liability coverage is crucial as it safeguards the business from potentially devastating financial losses resulting from accidents.

- Physical Damage Coverage: This coverage option protects the insured vehicles themselves. It can include comprehensive coverage for damages caused by non-collision events like theft, vandalism, or natural disasters, as well as collision coverage for damages resulting from accidents.

- Medical Payments Coverage: This provision assists with the medical expenses of individuals injured in an accident involving a covered vehicle, regardless of fault. It provides a swift and reliable way to cover these costs, ensuring prompt medical attention without the need for lengthy legal proceedings.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured in situations where the at-fault driver lacks sufficient insurance coverage. It steps in to cover the gap, ensuring the insured is not left bearing the financial burden of an accident caused by an uninsured or underinsured driver.

Each of these coverage options can be tailored to the specific needs of the business, taking into account factors like the nature of operations, the size of the fleet, and the geographical areas in which the vehicles operate.

Real-World Applications

Business Auto Insurance finds application across a diverse range of industries, each with its unique set of risks and challenges. Let’s explore some specific scenarios to understand the importance and benefits of this specialized insurance coverage.

Trucking Industry

The trucking industry is a prime example of the critical role played by Business Auto Insurance. With trucks often hauling valuable cargo over long distances, the potential for accidents and subsequent financial losses is significant. Business Auto Insurance provides a crucial layer of protection, covering liability claims arising from accidents, as well as physical damage to the trucks themselves.

Consider a scenario where a truck transporting hazardous materials is involved in an accident, causing significant environmental damage. Without adequate Business Auto Insurance, the trucking company could face enormous financial liabilities, potentially leading to bankruptcy. However, with comprehensive coverage in place, the insurance provider steps in to manage the claims, ensuring the company's financial stability and ability to continue operations.

Construction and Heavy Equipment

Construction sites are inherently risky environments, with heavy equipment and vehicles operating in close proximity to one another. Business Auto Insurance is vital in this context, providing coverage for accidents involving construction vehicles, such as cranes, bulldozers, and dump trucks.

Imagine a construction site where a dump truck, while maneuvering, strikes a nearby building, causing substantial structural damage. Without Business Auto Insurance, the construction company could face massive repair costs and potential legal liabilities. However, with appropriate coverage, the insurance provider handles the claims, covering the costs of repairs and ensuring the company can focus on its core business activities.

Delivery and Courier Services

In today’s fast-paced world, delivery and courier services are in high demand. Business Auto Insurance is essential for these businesses, as their vehicles are constantly on the move, often in busy urban areas. The potential for accidents and subsequent claims is high, making insurance coverage a non-negotiable necessity.

Suppose a delivery van, while rushing to meet a tight deadline, is involved in an accident, resulting in bodily injuries to the occupants of another vehicle. Without Business Auto Insurance, the delivery company could face substantial medical and legal expenses. However, with comprehensive coverage, the insurance provider steps in, managing the claims process and providing financial protection to the company.

Performance Analysis and Future Implications

Business Auto Insurance has proven its worth time and again, providing crucial financial protection to businesses operating vehicles. Its ability to mitigate risks and manage claims effectively has been instrumental in ensuring the continuity and success of countless commercial enterprises.

Looking ahead, the future of Business Auto Insurance is poised for further innovation and development. With advancements in technology, such as telematics and autonomous vehicles, the insurance industry is exploring new ways to enhance risk assessment and claim management. These innovations are expected to lead to more precise pricing models and improved coverage options, ultimately benefiting businesses and their insurance providers alike.

Additionally, the growing emphasis on sustainability and environmental responsibility is expected to influence the development of Business Auto Insurance policies. As more businesses adopt electric and hybrid vehicles, insurance providers are likely to adapt their coverage to accommodate these changing fleets, ensuring businesses can continue to operate sustainably while maintaining adequate protection.

| Industry | Average Annual Claims | Average Claim Severity |

|---|---|---|

| Trucking | 150 | $120,000 |

| Construction | 120 | $150,000 |

| Delivery Services | 200 | $80,000 |

Conclusion

Business Auto Insurance is an indispensable tool for businesses operating vehicles, offering a critical layer of protection against a wide range of risks. By understanding the importance and intricacies of this specialized insurance coverage, businesses can make informed decisions to safeguard their operations and ensure long-term success.

As the commercial transportation landscape continues to evolve, Business Auto Insurance will remain a vital component, adapting to meet the changing needs and challenges of the industry. With its ability to provide financial stability and peace of mind, Business Auto Insurance is a cornerstone of responsible and sustainable business operations.

What is the difference between Business Auto Insurance and Personal Auto Insurance?

+Business Auto Insurance is designed specifically for vehicles used in business operations, whereas Personal Auto Insurance caters to private vehicle usage. Business Auto Insurance covers a broader range of risks and liabilities, taking into account the unique challenges faced by commercial transportation, such as liability claims and physical damage to vehicles.

How can businesses determine the appropriate level of Business Auto Insurance coverage?

+Determining the appropriate coverage level involves a comprehensive assessment of the business’s operations, including the nature of activities, the size of the fleet, and the geographical areas in which the vehicles operate. It’s crucial to work with an experienced insurance broker who can guide the business through this process, ensuring adequate coverage without unnecessary excess.

What factors influence the cost of Business Auto Insurance premiums?

+The cost of Business Auto Insurance premiums is influenced by various factors, including the business’s claims history, the type and value of vehicles insured, the geographical areas in which the vehicles operate, and the nature of operations. Additionally, the driver’s age, driving record, and experience can also impact premium costs.