Lemonade Insurance Quote

Welcome to the ultimate guide on Lemonade Insurance, a revolutionary force in the insurance industry. In this comprehensive article, we delve into the world of Lemonade, exploring its unique business model, the impact it has had on the traditional insurance landscape, and why it has become a go-to choice for many savvy consumers. With its innovative approach, Lemonade offers a refreshing take on insurance, making it more accessible, transparent, and socially responsible. So, grab a glass of lemonade, and let's dive in to discover why this company is making waves in the world of insurance.

The Lemonade Story: Disrupting the Insurance Norm

Lemonade, founded in 2015 by Daniel Schreiber and Shai Wininger, is an insurtech company headquartered in New York City. From its inception, Lemonade aimed to revolutionize the insurance industry by leveraging technology to create a more efficient and customer-centric experience. The company’s mission is to make insurance simple, transparent, and fair, with a strong focus on giving back to the community.

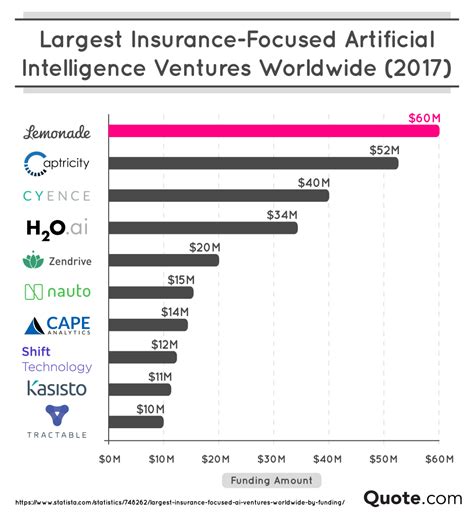

One of the key aspects that sets Lemonade apart is its commitment to using artificial intelligence (AI) and behavioral economics to streamline the insurance process. By employing AI chatbots and machine learning algorithms, Lemonade has automated many traditional insurance tasks, making it possible to provide quotes and process claims in a matter of minutes.

The Lemonade Model: How It Works

Lemonade operates on a unique business model, often referred to as “peer-to-peer” or “insurtech.” Here’s a breakdown of how it works:

- Customers' Premiums, Shared Risks: When a customer purchases an insurance policy from Lemonade, their premiums are pooled together with those of other policyholders. This collective fund is then used to pay out claims. The risks are shared among the group, which is a departure from the traditional insurance model where a single company assumes all risks.

- Instant Quotes and Claims: Lemonade's AI-powered platform allows for lightning-fast quotes. Customers can receive an accurate quote within minutes by providing basic information. Claims processing is equally swift; Lemonade prides itself on resolving claims within days, a stark contrast to the often lengthy processes of traditional insurers.

- Giveback Program: One of the most innovative features of Lemonade is its Giveback program. At the end of each year, any premiums left over after paying out claims and covering expenses are donated to a charity chosen by the policyholders. This unique approach ensures that customers' money is not only used for their protection but also for the greater good.

Comparative Analysis: Lemonade vs. Traditional Insurance

To understand the appeal of Lemonade, let’s compare it to traditional insurance companies:

| Category | Lemonade | Traditional Insurance |

|---|---|---|

| Quote Speed | Instant quotes | May take days or weeks |

| Claims Processing | Resolved within days | Often lengthy, averaging weeks |

| Transparency | AI-driven, no hidden fees | Complex policies, potential hidden costs |

| Social Responsibility | Giveback program, eco-friendly practices | May lack community-focused initiatives |

Getting Your Lemonade Insurance Quote: A Step-by-Step Guide

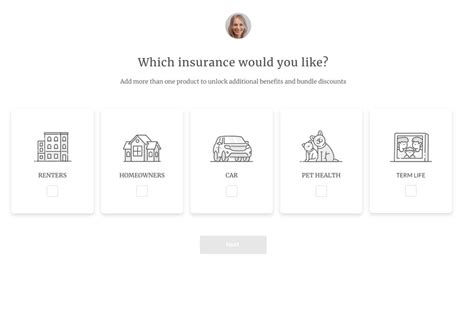

Now that we’ve explored the unique features of Lemonade, let’s walk through the process of obtaining an insurance quote. Lemonade offers a wide range of insurance products, including homeowners, renters, and pet insurance. For this example, we’ll focus on obtaining a homeowners insurance quote.

Step 1: Visit the Lemonade Website

Start by navigating to the Lemonade website (www.lemonade.com). Lemonade’s user-friendly interface makes it easy to find the insurance product you’re interested in. In this case, select “Homeowners Insurance” from the menu.

Step 2: Provide Basic Information

On the homeowners insurance page, you’ll be prompted to enter some basic details. This typically includes your name, email address, and the location of the property you want to insure. Lemonade’s AI system will use this information to provide an accurate quote.

Step 3: Answer a Few Questions

After providing your basic information, Lemonade’s AI chatbot will guide you through a series of questions. These questions are designed to gather more specific details about your property and your insurance needs. For example, you may be asked about the age of your home, the type of roof it has, and any additional coverage you might require.

Step 4: Review Your Quote

Once you’ve provided all the necessary information, Lemonade’s system will generate a personalized quote for your homeowners insurance. This quote will include the cost of your premium, the coverage limits, and any additional features or discounts you may be eligible for. Take the time to review the quote thoroughly to ensure it meets your needs.

Step 5: Purchase Your Policy

If you’re satisfied with the quote, you can proceed to purchase your homeowners insurance policy from Lemonade. The process is straightforward and secure, and you’ll receive confirmation of your policy instantly. With Lemonade, you can have peace of mind knowing that you’ve chosen a reliable and socially responsible insurance provider.

The Benefits of Choosing Lemonade

Selecting Lemonade Insurance for your coverage needs comes with a host of advantages. Here are some key benefits that make Lemonade a compelling choice:

- Speed and Efficiency: Lemonade's use of AI and machine learning means that you can get a quote and have your claim processed in record time. No more waiting days or weeks for a response.

- Transparency: With Lemonade, there are no hidden fees or complex policies. The AI-driven platform ensures clarity and transparency throughout the entire insurance process.

- Social Responsibility: Lemonade's Giveback program sets it apart. By choosing Lemonade, you're not only protecting yourself but also contributing to positive social change through the company's charitable donations.

- Innovative Approach: Lemonade's focus on technology and innovation keeps it at the forefront of the insurance industry. This means you'll always have access to cutting-edge solutions and the latest insurance products.

Customer Testimonials

“I was amazed at how quick and easy it was to get my Lemonade insurance quote. The process was straightforward, and I had my policy in no time. Plus, knowing that my money is being used for good through their Giveback program is a bonus!” - Sarah, New York

"Lemonade's insurance quote process was a breath of fresh air. Their AI chatbot made it simple to understand my options, and I felt confident in my choice. I'm glad I made the switch to Lemonade!" - Robert, Los Angeles

The Future of Insurance: Lemonade’s Impact

Lemonade’s innovative business model and focus on technology have had a significant impact on the insurance industry. By disrupting traditional norms, Lemonade has paved the way for a more customer-centric and efficient insurance experience. Here’s a look at some of the key ways Lemonade is shaping the future of insurance:

Digitization and AI Integration

Lemonade’s success has highlighted the potential of digitization and AI in the insurance sector. Other insurance companies are now investing in technology to streamline their processes and enhance the customer experience. AI chatbots, like those used by Lemonade, are becoming increasingly common, offering customers instant support and guidance.

Enhanced Customer Experience

Lemonade’s focus on customer satisfaction has raised the bar for the entire industry. Customers now expect a more personalized and efficient experience when dealing with insurance providers. Lemonade’s commitment to speed, transparency, and social responsibility has set a new standard for what customers should demand from their insurance companies.

Social Responsibility in Insurance

Lemonade’s Giveback program has sparked a conversation about the role of insurance companies in society. More insurers are now exploring ways to give back to their communities, whether through charitable donations or by adopting eco-friendly practices. This shift towards social responsibility is a direct result of Lemonade’s influence.

Conclusion

In a world where insurance can often feel complicated and inaccessible, Lemonade Insurance offers a refreshing alternative. With its innovative use of technology, focus on customer satisfaction, and commitment to social responsibility, Lemonade has not only disrupted the insurance industry but has also set a new benchmark for what consumers should expect from their insurance providers. So, if you’re looking for a fast, transparent, and socially conscious insurance experience, Lemonade might just be the perfect fit.

How does Lemonade’s Giveback program work?

+

Lemonade’s Giveback program is a unique feature where any unused premiums after claims and expenses are donated to a charity chosen by policyholders. This program ensures that customers’ money is used for the greater good.

Is Lemonade Insurance available in my state/country?

+

Lemonade operates in most US states and has plans to expand globally. To check if Lemonade is available in your area, visit their website and enter your location details.

What types of insurance does Lemonade offer?

+

Lemonade offers a range of insurance products, including homeowners, renters, pet, and personal property insurance. They also provide life insurance and commercial insurance for small businesses.

How does Lemonade’s claims process compare to traditional insurers?

+

Lemonade’s claims process is significantly faster than traditional insurers. While traditional insurers may take weeks to process a claim, Lemonade aims to resolve claims within days, thanks to its AI-driven platform.

Is Lemonade Insurance reliable and trustworthy?

+

Yes, Lemonade Insurance is a licensed and regulated insurance company. They have received numerous accolades for their innovative approach and customer satisfaction. Additionally, their commitment to social responsibility and transparency has earned them a strong reputation in the industry.