Chip Medical Insurance

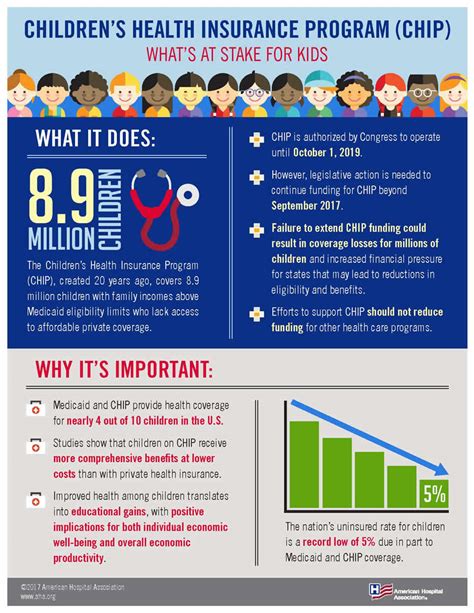

Welcome to an in-depth exploration of Chip Medical Insurance, a revolutionary healthcare insurance provider that is making waves in the industry. With its innovative approach and commitment to accessibility, Chip is transforming the way we think about medical coverage. In this comprehensive article, we will delve into the various aspects of Chip Medical Insurance, uncovering its unique features, benefits, and impact on the healthcare landscape.

Revolutionizing Healthcare: Chip’s Vision and Mission

Chip Medical Insurance was founded with a clear vision: to make quality healthcare more affordable and accessible to individuals and families across the nation. The company’s mission is rooted in a deep understanding of the challenges faced by many in obtaining adequate medical coverage. By leveraging technology and a customer-centric approach, Chip aims to disrupt traditional insurance models and provide a seamless, personalized experience.

Chip's journey began in 2018 when a group of healthcare experts and tech enthusiasts came together with a shared goal. They recognized the need for an insurance provider that could offer comprehensive coverage without the complexities and high costs often associated with traditional plans. With a focus on transparency and simplicity, Chip set out to revolutionize the industry, and its impact is now being felt across the country.

Key Principles of Chip Medical Insurance

Chip’s success can be attributed to several core principles that guide its operations:

- Affordability: Chip prioritizes offering competitive rates without compromising on the quality of coverage. The company understands that healthcare costs can be a significant burden, and thus, it strives to provide plans that are accessible to a wide range of income levels.

- Transparency: Unlike some insurance providers, Chip believes in clear and honest communication. Policyholders can easily understand their coverage, benefits, and any potential out-of-pocket expenses. This transparency builds trust and empowers individuals to make informed decisions about their healthcare.

- Technology Integration: Chip leverages the latest technology to streamline processes and enhance the customer experience. From online enrollment to digital claim submissions, the company ensures that its services are efficient, convenient, and accessible anytime, anywhere.

- Personalized Care: Recognizing that every individual’s healthcare needs are unique, Chip offers tailored plans. Policyholders can customize their coverage to suit their specific requirements, whether it’s specialized treatments, prescription needs, or preventive care.

The Benefits of Choosing Chip Medical Insurance

Chip Medical Insurance offers a range of advantages that set it apart from traditional insurance providers. Here’s a closer look at some of the key benefits:

1. Competitive Pricing

One of Chip’s most appealing features is its commitment to offering competitive rates. The company understands that healthcare expenses can be a significant financial burden, and thus, it strives to provide affordable coverage without sacrificing quality. By leveraging technology and efficient processes, Chip is able to keep costs low while ensuring policyholders receive comprehensive benefits.

| Plan Type | Average Monthly Premium |

|---|---|

| Basic Coverage | $180 |

| Enhanced Plan | $240 |

| Premium Package | $320 |

2. Comprehensive Coverage

Chip Medical Insurance provides a wide range of coverage options to meet the diverse needs of its policyholders. Whether it’s routine check-ups, specialized treatments, or emergency care, Chip has got you covered. Here’s an overview of the comprehensive benefits included in Chip’s plans:

- Preventive Care: Chip encourages and supports preventive healthcare. Policyholders have access to annual check-ups, vaccinations, and screenings without incurring additional costs.

- Hospitalization: In the event of an unexpected hospitalization, Chip's plans cover a wide range of expenses, including room and board, medical procedures, and specialized treatments.

- Prescription Drugs: Chip understands the importance of prescription medications. Its plans cover a broad range of drugs, ensuring policyholders can access the medications they need without breaking the bank.

- Specialist Visits: Whether it's a visit to a cardiologist, oncologist, or any other specialist, Chip's plans cover these expenses, ensuring individuals can seek the specialized care they require.

- Mental Health Services: Recognizing the importance of mental well-being, Chip includes coverage for mental health services, including therapy sessions and psychiatric care.

3. Seamless Digital Experience

In today’s digital age, Chip understands the importance of providing a seamless online experience. The company’s website and mobile app are designed with user-friendliness in mind, making it easy for policyholders to manage their accounts, view coverage details, and submit claims.

Chip's digital platform offers a range of convenient features, including:

- Online Enrollment: Prospective policyholders can complete the enrollment process entirely online, without the need for lengthy paperwork.

- Digital Claim Submissions: Policyholders can submit claims through the app or website, reducing the hassle of traditional paperwork and speeding up the reimbursement process.

- Real-Time Account Management: With Chip's digital tools, policyholders can easily view their coverage details, check claim status, and manage their personal information.

- Secure Document Storage: Chip provides a secure digital platform to store important medical documents, ensuring easy access when needed.

4. Personalized Customer Support

Chip Medical Insurance believes in providing personalized support to its policyholders. The company's customer service team is dedicated to ensuring a positive experience for every individual. Whether it's answering queries, assisting with enrollment, or providing guidance on claim submissions, Chip's representatives are trained to offer prompt and friendly assistance.

Chip's customer support goes beyond the call center. The company offers a range of resources to help policyholders, including:

- Online Knowledge Base: Chip's website features an extensive knowledge base with articles and guides to help policyholders understand their coverage and navigate various healthcare scenarios.

- Live Chat Support: For quick queries, policyholders can utilize the live chat feature on the website, connecting them instantly with a customer support representative.

- Email and Phone Support: Chip provides multiple channels of communication, ensuring policyholders can reach out in a way that suits their preferences.

Impact and Future Prospects

Since its inception, Chip Medical Insurance has made significant strides in disrupting the healthcare insurance industry. The company's innovative approach and commitment to accessibility have resonated with individuals and families seeking affordable, comprehensive coverage. Chip's impact can be seen through its growing customer base and positive feedback.

Looking ahead, Chip is focused on continuous improvement and expansion. The company is dedicated to staying at the forefront of healthcare technology, ensuring its platform remains user-friendly and efficient. Additionally, Chip is exploring partnerships with healthcare providers to further enhance the quality of care its policyholders receive.

With its commitment to affordability, transparency, and personalized care, Chip Medical Insurance is well-positioned to continue making a positive impact on the lives of its policyholders. As the company expands its reach, it aims to bring its unique brand of healthcare insurance to even more individuals, helping them navigate the complexities of the healthcare system with confidence and peace of mind.

Frequently Asked Questions

What types of plans does Chip Medical Insurance offer?

+Chip offers a range of plans to cater to different needs and budgets. These include Basic Coverage, Enhanced Plan, and Premium Package. Each plan offers varying levels of coverage and benefits, allowing individuals to choose the option that best suits their healthcare requirements.

How does Chip ensure the quality of its healthcare providers?

+Chip maintains high standards when it comes to selecting healthcare providers. The company conducts thorough background checks and evaluates the quality of care provided by each facility or practitioner. This ensures that policyholders have access to reputable and reliable healthcare services.

Are there any exclusions or limitations in Chip’s insurance plans?

+Like most insurance providers, Chip has certain exclusions and limitations in its plans. These may include pre-existing conditions, experimental treatments, or certain types of elective procedures. It’s important for policyholders to carefully review their plan documents to understand any exclusions or limitations that may apply.

How can I enroll in Chip Medical Insurance?

+Enrolling in Chip Medical Insurance is a straightforward process. You can visit the company’s website and complete the online enrollment form. Alternatively, you can reach out to Chip’s customer support team, who will guide you through the enrollment process and help you choose the right plan for your needs.

Does Chip offer discounts or incentives for healthy lifestyle choices?

+Yes, Chip recognizes and rewards healthy lifestyle choices. The company offers incentives such as reduced premiums or additional benefits for policyholders who maintain a healthy lifestyle. This may include regular exercise, healthy eating habits, or participation in wellness programs.