Florida Car Insurance Quotes Online

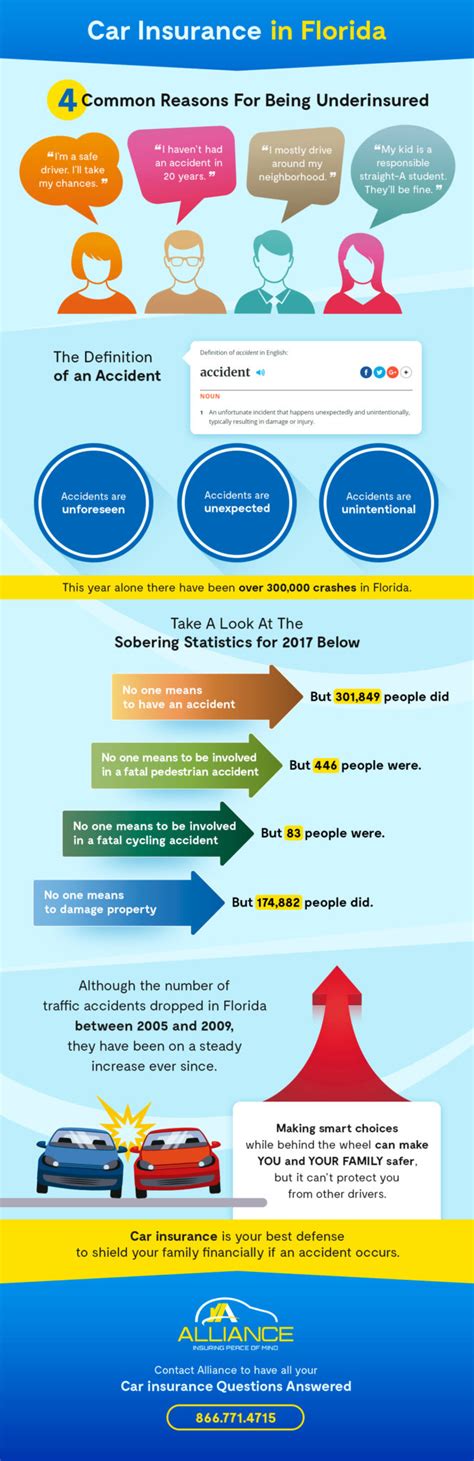

Navigating the world of car insurance can be a daunting task, especially when seeking quotes online. Florida, known for its sunny skies and vibrant culture, also boasts a unique insurance landscape due to its no-fault insurance laws. Understanding the specific requirements and options available in the Sunshine State is crucial for any driver seeking coverage.

Unraveling Florida’s Car Insurance Scene

Florida’s car insurance market is diverse and offers a range of options to cater to different driver needs. Whether you’re a seasoned Floridian or a newcomer to the state, grasping the nuances of local insurance policies is essential. Here’s a comprehensive guide to help you navigate the process of obtaining car insurance quotes online, tailored specifically to Florida’s regulations and practices.

Understanding Florida’s No-Fault Insurance

Florida is one of a handful of states that operates under a no-fault insurance system. This means that, regardless of who caused an accident, each driver’s insurance company is responsible for covering their own medical bills and a portion of lost wages. This system is designed to streamline the claims process and reduce litigation.

However, it's important to note that while no-fault insurance covers Personal Injury Protection (PIP), it does not cover property damage or liability for bodily injury to others. Therefore, additional coverage is necessary to protect yourself and your assets in the event of an accident.

Required Coverage in Florida

Florida law requires drivers to carry at least 10,000 in PIP coverage</strong> and <strong>10,000 in Property Damage Liability (PDL). While this may seem like a basic level of coverage, it’s important to assess your individual needs and consider purchasing additional coverage to ensure adequate protection.

| Coverage Type | Minimum Requirement |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

Additionally, Florida also mandates that drivers carry Bodily Injury Liability (BIL) coverage, although the minimum requirements vary depending on the date of your policy. For policies issued after January 1, 2013, the minimum BIL coverage is $10,000 per person and $20,000 per accident. For policies issued prior to this date, the minimum requirement is $10,000 per person and $20,000 per accident for Bodily Injury Liability (BIL).

Optional Coverage and Add-Ons

While the aforementioned coverages are mandatory, Florida drivers also have the option to purchase additional coverage to enhance their protection. Some common optional coverages include:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you in the event of an accident with a driver who either lacks insurance or has insufficient coverage to pay for the damages.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle due to non-collision events such as theft, vandalism, weather-related incidents, or animal collisions.

- Rental Car Reimbursement: Provides coverage for rental car expenses if your vehicle is being repaired after an insured loss.

It's important to carefully consider your individual circumstances and assess the value of these optional coverages. While they may increase your premium, they can provide essential protection in the event of an accident or other unexpected circumstances.

Obtaining Online Car Insurance Quotes in Florida

Obtaining car insurance quotes online in Florida is a convenient and efficient process. With a plethora of insurance providers operating in the state, drivers have a wide range of options to choose from. Here’s a step-by-step guide to help you navigate the online quote process:

Step 1: Gather Necessary Information

Before you begin the quote process, ensure you have the following information readily available:

- Personal details: Name, date of birth, driver's license number, and Social Security number.

- Vehicle information: Make, model, year, VIN number, and estimated annual mileage.

- Current or previous insurance policy details: Coverage amounts, deductibles, and any recent claims.

- Driving record: Traffic violations, accidents, and any other relevant information.

Step 2: Compare Multiple Providers

Florida’s insurance market is highly competitive, so it’s beneficial to compare quotes from multiple providers. Utilize online comparison tools or directly visit the websites of reputable insurance companies to obtain quotes tailored to your needs.

Step 3: Provide Accurate Information

When filling out the quote forms, ensure that you provide accurate and complete information. Inaccurate details can lead to unexpected surprises when it comes time to purchase the policy. Be transparent about your driving record, as any discrepancies may impact your eligibility for certain discounts or coverage options.

Step 4: Evaluate Coverage and Pricing

Once you have obtained quotes from several providers, take the time to carefully evaluate the coverage and pricing offered. Compare the coverage limits, deductibles, and any additional features or benefits included in the policy. Ensure that you understand the terms and conditions of each quote, especially regarding any exclusions or limitations.

Step 5: Consider Discounts

Insurance providers in Florida offer a variety of discounts to help reduce the cost of coverage. Some common discounts include:

- Multi-Policy Discount: If you bundle your car insurance with other policies, such as homeowners or renters insurance, you may be eligible for a discount.

- Safe Driver Discount: Drivers with a clean driving record often qualify for discounts, as they pose a lower risk to insurance companies.

- Good Student Discount: Full-time students under the age of 25 with a certain GPA or academic standing may be eligible for a discount.

- Pay-in-Full Discount: Some insurers offer a discount if you pay your premium in full upfront instead of monthly installments.

Inquire about these and other potential discounts when obtaining quotes to ensure you are taking advantage of all available savings.

Finalizing Your Florida Car Insurance Policy

Once you have evaluated the quotes and chosen the policy that best suits your needs and budget, it’s time to finalize your Florida car insurance policy. Here’s what you can expect during the finalization process:

Step 1: Review the Policy

Before finalizing your purchase, carefully review the policy documents provided by the insurance company. Ensure that the coverage limits, deductibles, and any additional features or benefits match what you selected during the quote process. Pay close attention to any exclusions or limitations outlined in the policy.

Step 2: Understand Payment Options

Inquire about the available payment options and consider which method best suits your financial situation. Some insurers offer monthly, quarterly, or annual payment plans. Understand any potential fees associated with different payment methods, such as interest charges for monthly installments.

Step 3: Verify Coverage

Once you have paid your initial premium and received your policy documents, verify your coverage by reviewing your insurance card and policy declaration page. Ensure that all vehicle and driver information is accurate and that your coverage limits and deductibles match your expectations.

Step 4: Understand Claims Process

Familiarize yourself with the insurer’s claims process and understand how to report an accident or file a claim. Keep the insurer’s contact information readily available, along with any necessary forms or documents you may need to initiate a claim.

Frequently Asked Questions

How much does car insurance cost in Florida?

+

The cost of car insurance in Florida can vary widely based on individual factors such as driving record, vehicle type, and coverage options. On average, drivers in Florida can expect to pay around 1,500 to 2,000 per year for a standard policy. However, rates can be significantly higher or lower depending on personal circumstances.

What factors impact car insurance rates in Florida?

+

Several factors influence car insurance rates in Florida, including driving record, age, gender, marital status, credit score, and the type and value of the vehicle being insured. Additionally, the specific coverage options and deductibles chosen can significantly impact the overall cost of the policy.

Can I switch insurance providers in Florida?

+

Absolutely! Florida residents have the freedom to switch insurance providers at any time. If you find a more suitable policy with better coverage or lower rates, you can cancel your existing policy and switch to a new provider. Just ensure that you have continuous coverage to avoid any lapses in insurance protection.

What happens if I don’t have car insurance in Florida?

+

Driving without car insurance in Florida is illegal and can result in severe penalties. If caught, you may face fines, license suspension, and even jail time. Additionally, you will be financially responsible for any damages or injuries caused in an accident, which can be extremely costly.

How can I save money on car insurance in Florida?

+

There are several strategies to save money on car insurance in Florida. These include shopping around for quotes from multiple providers, bundling policies, maintaining a clean driving record, taking advantage of discounts, and increasing your deductible. It’s also important to regularly review and adjust your coverage to ensure you’re not overpaying for unnecessary features.

Navigating Florida’s car insurance landscape can be complex, but with the right information and a thorough understanding of your options, obtaining the best coverage at a competitive rate is achievable. Remember to compare quotes from multiple providers, assess your individual needs, and take advantage of any available discounts to make the most informed decision for your car insurance needs.