Insurance Rating

The world of insurance is a complex and intricate system, designed to provide financial protection and peace of mind to individuals and businesses alike. At the heart of this system lies the concept of insurance rating, a fundamental process that determines the cost and availability of insurance coverage. Insurance rating is a critical aspect that influences the entire insurance landscape, from the premiums paid by policyholders to the risk assessment undertaken by insurers.

In this comprehensive exploration of insurance rating, we will delve into the intricacies of this essential process, uncovering its various dimensions, methodologies, and implications. By understanding insurance rating, we can gain valuable insights into the insurance industry's inner workings and the factors that shape the insurance experience for all stakeholders.

Understanding Insurance Rating: The Fundamentals

Insurance rating is the methodical process by which insurance companies assess the risk profile of an individual or entity seeking insurance coverage. This assessment is a crucial step in determining the premium, or the cost of the insurance policy. The rating process is a delicate balance between evaluating the risk associated with the insured and ensuring the financial viability of the insurance provider.

The fundamental objective of insurance rating is to calculate the appropriate premium for a given risk. This premium reflects the insurer's estimation of the likelihood and potential cost of a claim, as well as the expenses involved in administering the policy. By accurately rating risks, insurance companies can ensure that premiums are fair and sustainable, while also providing adequate coverage for policyholders.

Key Components of Insurance Rating

Insurance rating involves a meticulous evaluation of various factors, each contributing to the overall risk assessment. These components can be broadly categorized as follows:

- Personal or Business Characteristics: This includes factors such as age, gender, occupation, marital status, and financial stability for individuals, and business size, industry, and location for commercial entities. These characteristics provide a baseline understanding of the insured's risk profile.

- Historical Claims Data: Insurers analyze past claims data to identify patterns and trends. This information helps assess the likelihood of future claims and can indicate specific areas of risk, such as frequent accidents or illnesses.

- Risk Factors and Exposures: Certain activities or circumstances can increase the likelihood of claims. For instance, driving a high-performance sports car or engaging in extreme sports may result in higher insurance premiums due to the increased risk of accidents or injuries. Similarly, businesses operating in hazardous environments may face higher insurance costs.

- Creditworthiness: An individual's or business's credit history can impact insurance ratings. Insurers may use credit scores as an indicator of financial responsibility and stability, as it reflects the ability to manage financial obligations.

- Policy Features and Coverages: The scope and extent of coverage chosen by the insured can influence the premium. Additional coverages or higher policy limits typically result in higher premiums, as they provide broader protection.

Rating Methods and Approaches

Insurance companies employ a variety of methods and approaches to determine insurance ratings. These methodologies are designed to accurately assess risk and establish fair premiums. Some of the common rating methods include:

1. Manual Rating

In manual rating, underwriters assess each risk individually, considering all relevant factors and making a subjective judgment about the appropriate premium. This method is often used for unique or complex risks where a standardized rating may not be applicable.

2. Classification Rating

Classification rating involves grouping similar risks together based on shared characteristics. Insurers define classes or groups, such as “good drivers” or “high-risk occupations,” and assign a standard premium to each class. This method simplifies the rating process but may not account for individual variations within each class.

3. Experience Rating

Experience rating is a dynamic approach that adjusts premiums based on the insured’s actual claims experience. It takes into account the frequency and severity of past claims, allowing for more accurate pricing. Experience rating is commonly used for commercial insurance, where claims patterns can be predictive of future risks.

4. Actuarial Rating

Actuarial rating relies on statistical analysis and modeling to determine premiums. Actuaries use large datasets and complex algorithms to calculate the probability of claims and set premiums accordingly. This method is particularly effective for large pools of risks, such as auto or health insurance.

Rating Factors and Their Impact

The insurance rating process considers a wide range of factors, each playing a unique role in determining the final premium. Understanding these factors can help individuals and businesses make informed decisions about their insurance coverage and potentially influence their insurance costs.

1. Age and Gender

Age and gender are fundamental rating factors, especially in personal insurance lines such as auto and health insurance. Younger individuals, particularly teenagers, often face higher premiums due to their increased risk of accidents and lack of driving experience. Similarly, certain health conditions may be more prevalent in specific age groups, impacting health insurance premiums.

2. Occupation and Hobbies

An individual’s occupation and hobbies can significantly affect insurance ratings. High-risk occupations, such as firefighting or construction, may result in higher premiums due to the increased likelihood of injuries. Similarly, hobbies like skydiving or motorcycle racing can be seen as high-risk activities, leading to higher insurance costs.

3. Driving Record

In auto insurance, the driving record is a critical rating factor. A clean driving history with no accidents or violations typically leads to lower premiums. Conversely, multiple accidents or moving violations can result in significantly higher insurance costs, as they indicate a higher risk of future claims.

4. Credit Score

Creditworthiness, as indicated by a credit score, is increasingly used as a rating factor. A higher credit score suggests financial stability and responsibility, which can lead to lower insurance premiums. Insurers view individuals with good credit as less likely to default on their insurance obligations, making them a lower risk to insure.

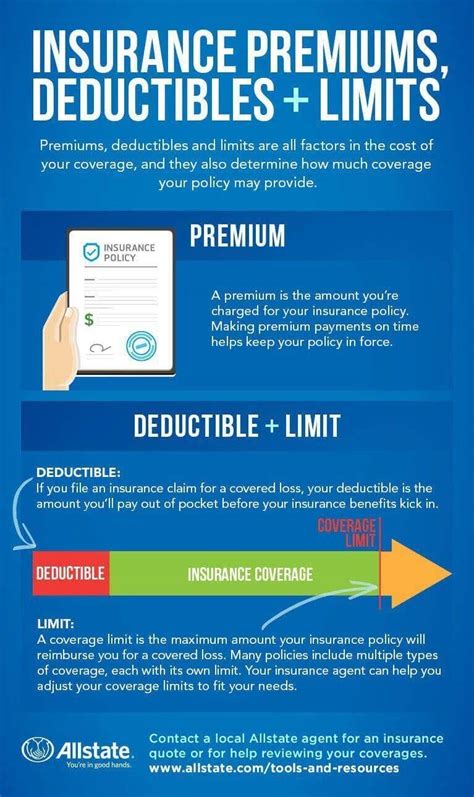

5. Policy Deductibles and Limits

The deductibles and policy limits chosen by the insured directly impact the premium. Higher deductibles, where the insured pays a larger portion of the claim, typically result in lower premiums. Conversely, selecting higher policy limits to provide broader coverage can lead to increased premiums.

Insurance Rating and Risk Management

Insurance rating is inherently linked to risk management, as it is the mechanism through which insurers assess and mitigate risks. By accurately rating risks, insurance companies can identify high-risk individuals or entities and implement strategies to manage those risks effectively.

For policyholders, understanding the rating process can be empowering. It allows individuals and businesses to make informed choices about their insurance coverage and take proactive steps to mitigate risks. For instance, improving driving habits, maintaining a healthy lifestyle, or implementing safety measures at a business can positively impact insurance ratings and lead to lower premiums over time.

Risk Mitigation Strategies

Insurance companies often provide guidance and resources to policyholders to help manage risks. These strategies can include:

- Driver Training Programs: Insurers may offer discounts to policyholders who complete approved driver training courses, especially for young or inexperienced drivers.

- Safety Measures: Businesses can reduce insurance costs by implementing safety protocols, such as installing fire suppression systems or conducting regular employee training on workplace hazards.

- Health and Wellness Programs: Health insurance providers may encourage policyholders to participate in wellness initiatives, offering discounts or incentives for maintaining a healthy lifestyle.

The Future of Insurance Rating

As technology advances and data analytics become more sophisticated, the future of insurance rating holds promising possibilities. Insurers are increasingly leveraging data-driven approaches and artificial intelligence to enhance the accuracy and efficiency of rating processes.

Data-Driven Rating

With the proliferation of data, insurers can access and analyze vast amounts of information to make more informed rating decisions. Telematics devices in vehicles, for example, provide real-time driving data, allowing insurers to offer usage-based insurance policies. These policies adjust premiums based on actual driving behavior, rewarding safe drivers with lower premiums.

Predictive Analytics

Predictive analytics utilizes historical data and advanced algorithms to forecast future claims patterns. By identifying trends and correlations, insurers can anticipate risks more accurately and price insurance products accordingly. This approach enables insurers to offer more tailored coverage options and potentially reduce premiums for low-risk policyholders.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize insurance rating by providing a secure and transparent platform for data sharing and contract execution. Smart contracts, self-executing contracts with predefined rules, can automate certain aspects of the insurance process, including rating and claims management. This technology enhances efficiency and reduces the administrative burden associated with traditional insurance processes.

Conclusion: A Dynamic and Evolving Process

Insurance rating is a dynamic and evolving process that underpins the entire insurance industry. It is a critical component that shapes the insurance landscape, influencing the cost and availability of coverage for individuals and businesses. By understanding the fundamentals, methodologies, and implications of insurance rating, stakeholders can make more informed decisions and navigate the insurance marketplace effectively.

As technology continues to advance and data becomes more accessible, the future of insurance rating looks promising. Insurers are embracing innovative approaches, leveraging data analytics and emerging technologies to enhance accuracy, efficiency, and personalization in the rating process. This evolution ensures that insurance remains a viable and accessible financial protection tool for all.

How do insurance companies determine my premium?

+Insurance companies use a combination of factors to determine your premium, including your age, gender, occupation, driving record, credit score, and the type of coverage you select. These factors are assessed through the insurance rating process, which helps insurers evaluate the risk associated with insuring you.

Can I negotiate my insurance premium?

+While insurance premiums are largely determined by the rating process, you may have some room for negotiation. Some insurers offer discounts for certain safety measures or loyalty programs. Additionally, comparing quotes from multiple insurers can help you find the best rates available for your specific risk profile.

What can I do to improve my insurance rating and lower my premiums?

+Improving your insurance rating often involves adopting safer behaviors and making informed choices. For example, maintaining a clean driving record, improving your credit score, and implementing safety measures at your business can all positively impact your insurance rating and potentially lower your premiums over time.