Insurance Car Company

The insurance industry is a vast and intricate landscape, offering a wide array of services to protect individuals and businesses from various risks. Among its many offerings, car insurance stands out as one of the most crucial and widely sought-after forms of coverage. With a global car population exceeding 1.4 billion and a steady growth rate, the demand for reliable car insurance is ever-increasing. This article delves into the intricacies of the insurance car company sector, exploring its key aspects, the evolving trends, and the critical role it plays in our modern world.

The Core of Car Insurance

At its essence, car insurance is a contract between an individual (the policyholder) and an insurance company. This contract provides financial protection against potential physical damage, bodily injury, or theft of a vehicle, as well as liability coverage for any legal claims that may arise from an accident. The importance of car insurance cannot be overstated, especially considering the potential financial burden and legal consequences that an accident can bring.

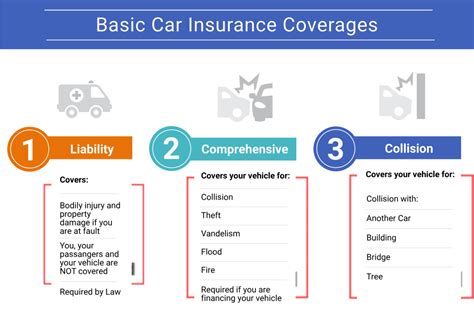

The coverage offered by insurance car companies is typically tailored to meet the specific needs of the policyholder. This can include comprehensive coverage, which protects against damage from events other than collisions, such as fire, theft, or natural disasters; collision coverage, which covers damage to the insured vehicle from a collision, regardless of fault; and liability coverage, which protects the policyholder against claims arising from bodily injury or property damage caused by the policyholder to others.

Understanding the Policy

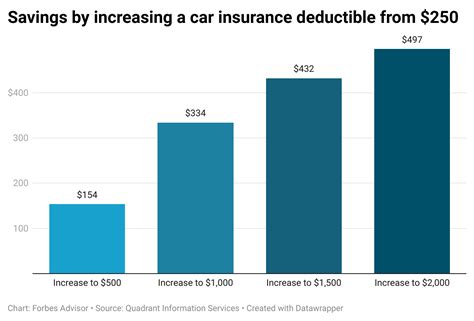

A car insurance policy is a legal document that outlines the terms and conditions of the agreement between the insurance company and the policyholder. It details the types of coverage, the limits of coverage, the deductible (the amount the policyholder pays out of pocket before the insurance kicks in), and any exclusions or limitations to the coverage. It’s essential for policyholders to thoroughly understand their policy to ensure they have the appropriate coverage for their needs.

The policy also includes information on the premium, which is the amount the policyholder pays to the insurance company for the coverage. The premium can vary widely depending on several factors, including the make and model of the car, the age and driving record of the driver, the location, and the level of coverage desired. Some insurance companies also offer discounts for various factors, such as safe driving records, multiple policies with the same company, or the installation of safety features in the car.

| Type of Coverage | Description |

|---|---|

| Comprehensive | Protects against non-collision events like fire, theft, or natural disasters. |

| Collision | Covers damage to the insured vehicle from collisions, regardless of fault. |

| Liability | Provides protection against claims arising from bodily injury or property damage caused by the policyholder. |

The Evolution of Car Insurance

The car insurance industry has undergone significant transformations over the years, driven by technological advancements, changing consumer preferences, and evolving regulatory environments. These changes have not only influenced the way insurance is provided but have also shaped the expectations and experiences of policyholders.

Digital Transformation

One of the most notable trends in the insurance car company sector is the shift towards digital platforms. With the rise of the internet and mobile technology, insurance companies have embraced digital transformation to enhance their services and reach a wider audience. Today, policyholders can easily compare quotes, purchase policies, file claims, and manage their accounts online or through mobile apps.

This digital evolution has brought about several benefits. Policyholders now enjoy greater convenience, faster service, and more transparency. They can quickly obtain quotes from multiple providers, compare prices and coverage, and make informed decisions. Furthermore, the digital landscape has facilitated the use of telematics, where insurance companies can collect and analyze driving data in real-time, offering more personalized and accurate pricing.

Personalized Coverage

The traditional one-size-fits-all approach to car insurance is rapidly giving way to more personalized coverage options. Insurance companies are leveraging advanced analytics and data-driven insights to offer tailored policies that cater to the unique needs and circumstances of individual policyholders.

For instance, usage-based insurance (UBI) programs allow policyholders to pay premiums based on their actual driving behavior. This model takes into account factors such as miles driven, driving habits, and even the time of day the vehicle is used. By incentivizing safe driving practices, UBI programs can lead to significant cost savings for policyholders while also reducing the risk of accidents on the roads.

Telematics and AI Integration

The integration of telematics and artificial intelligence (AI) technologies is revolutionizing the way car insurance is assessed and provided. Telematics devices, which can be installed in vehicles or come built-in, collect real-time data on driving behavior, such as speed, acceleration, and braking patterns. This data is then analyzed by AI algorithms to assess the risk profile of the driver and determine the appropriate insurance premium.

AI is also being used to streamline the claims process. By automating certain tasks and leveraging machine learning algorithms, insurance companies can quickly assess the extent of damage, determine the appropriate payout, and speed up the overall claims settlement process. This not only benefits policyholders by reducing the time and effort required to process a claim but also helps insurance companies improve their operational efficiency.

The Role of Insurance Car Companies

Insurance car companies play a critical role in our society, providing a safety net for individuals and businesses in the event of an accident or other covered event. They offer peace of mind, knowing that financial and legal support is available in times of need. Moreover, the data and insights gathered by insurance companies contribute to a better understanding of risk factors and driving behaviors, which can lead to safer roads and reduced accident rates.

Community Engagement and Safety Initiatives

Beyond providing insurance coverage, many insurance car companies actively engage with their communities to promote road safety and educate drivers. They sponsor safety campaigns, support local initiatives, and collaborate with government bodies to implement safer driving practices. By doing so, they contribute to a culture of safety and responsibility on the roads, which benefits not only their policyholders but also the broader community.

Insurance companies also play a vital role in accident recovery and rehabilitation. In the aftermath of an accident, they provide financial support to policyholders for vehicle repairs, medical expenses, and other related costs. This assistance can be critical in helping individuals and families get back on their feet and resume their normal lives.

The Future of Car Insurance

Looking ahead, the future of car insurance is likely to be shaped by further technological advancements and changing mobility trends. The rise of autonomous vehicles, electric cars, and shared mobility services will present new challenges and opportunities for insurance companies.

With autonomous vehicles, the traditional liability model may need to be reevaluated, as the responsibility for accidents may shift from the driver to the vehicle or its manufacturer. Electric cars, with their unique charging and maintenance requirements, may also necessitate specialized insurance coverage. And with the growth of shared mobility services, insurance companies will need to adapt their models to cater to the needs of both traditional car owners and those who opt for shared transportation options.

What are the main types of car insurance coverage?

+The main types of car insurance coverage include liability coverage, comprehensive coverage, and collision coverage. Liability coverage is essential and covers damages you cause to others in an accident. Comprehensive coverage protects against non-collision events, while collision coverage covers damages to your vehicle from collisions, regardless of fault.

How do insurance companies determine my premium?

+Insurance companies use various factors to determine your premium, including your driving record, the make and model of your car, your age and gender, your location, and the level of coverage you desire. They may also offer discounts for safe driving records, multiple policies, or safety features in your car.

What is usage-based insurance (UBI)?

+Usage-based insurance (UBI) is a model where policyholders pay premiums based on their actual driving behavior. It takes into account factors like miles driven, driving habits, and the time of day the vehicle is used. UBI incentivizes safe driving practices and can lead to significant cost savings for policyholders.