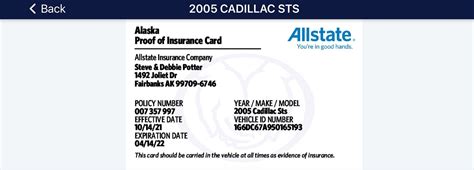

Allstate Insurance Auto

In today's fast-paced world, where accidents and unforeseen events can happen in the blink of an eye, having reliable auto insurance is more crucial than ever. Among the myriad of insurance providers, Allstate stands out as a trusted name in the industry, offering comprehensive coverage and a customer-centric approach. This article delves into the world of Allstate Insurance Auto, exploring its unique features, benefits, and the reasons why it is a popular choice for vehicle owners across the nation.

The Allstate Advantage: A Comprehensive Overview

Allstate Insurance, a leading name in the insurance sector, has built its reputation on a foundation of trust and innovation. With a rich history spanning decades, Allstate has consistently adapted to the evolving needs of its customers, offering an extensive range of insurance products, including auto, home, life, and business insurance.

When it comes to auto insurance, Allstate takes a comprehensive approach, tailoring its policies to meet the unique needs of individual drivers. Whether you're a young driver just starting out, a seasoned motorist, or a business owner with a fleet of vehicles, Allstate has a policy designed to provide the coverage you need at a price that fits your budget.

A Suite of Coverage Options

Allstate understands that every driver’s situation is unique, which is why they offer a wide array of coverage options to choose from. Here’s a glimpse into some of the key features that make Allstate’s auto insurance stand out:

- Liability Coverage: This essential coverage protects you against bodily injury and property damage claims made by others in an accident where you're at fault. Allstate offers customizable limits to ensure you have adequate protection.

- Collision Coverage: This optional coverage pays for repairs or replacement of your vehicle if it's damaged in an accident, regardless of fault. It's a valuable addition for those who want peace of mind on the road.

- Comprehensive Coverage: This coverage protects against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It's a crucial component for comprehensive protection.

- Uninsured/Underinsured Motorist Coverage: In the event of an accident with a driver who lacks sufficient insurance, this coverage steps in to protect you and your passengers. It's a critical safeguard to have in today's uncertain driving environment.

- Medical Payments Coverage: This coverage helps cover the medical expenses for you and your passengers in the event of an accident, regardless of fault. It's a quick and straightforward way to ensure you're not left with a pile of medical bills.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs covered by your policy, this coverage helps cover the cost of a rental car, ensuring you can continue your daily routine without disruption.

Allstate's coverage options don't stop there. They also offer additional endorsements and packages, such as:

- Custom Equipment Coverage: Protects the accessories and modifications you've added to your vehicle, ensuring your investments are covered.

- Emergency Roadside Assistance: Provides 24/7 support for situations like flat tires, dead batteries, or towing needs, giving you added peace of mind on the road.

- Accident Forgiveness: A unique feature that ensures your rates won't increase after your first at-fault accident, offering a second chance to keep your record clean.

Customer-Centric Features

Allstate’s commitment to its customers goes beyond just offering a wide range of coverage options. They also prioritize customer satisfaction and convenience with a host of additional features and services, including:

- Online and Mobile Services: Allstate provides a user-friendly digital platform and mobile app, allowing customers to manage their policies, file claims, and access important documents with ease.

- Claim Satisfaction Guarantee: Allstate stands behind its claims service, offering a satisfaction guarantee that ensures customers will be happy with the claim settlement process.

- Accident Assistance Hotline: Available 24/7, this hotline provides expert guidance and support to policyholders in the immediate aftermath of an accident, helping to navigate the often-stressful claims process.

- Discounts and Savings: Allstate offers a variety of discounts to help customers save on their premiums, including multi-policy discounts, safe driver discounts, and discounts for students and seniors.

Allstate’s Unique Features: A Competitive Edge

In a highly competitive insurance market, Allstate sets itself apart with a number of innovative features and initiatives. These include:

- Drivewise Program: This unique program rewards safe driving habits with potential discounts. Participants install a small device in their vehicle that tracks driving behavior, with safer driving leading to potential savings on premiums.

- Claim Service Excellence: Allstate is known for its excellent claims service, with a dedicated team of professionals who work tirelessly to ensure claims are processed efficiently and fairly. Their goal is to make the claims process as stress-free as possible for policyholders.

- Community Engagement: Allstate is committed to giving back to the communities it serves. Through various initiatives and partnerships, they support local causes and contribute to a better society.

Performance Analysis: Allstate’s Track Record

Allstate’s success and popularity in the auto insurance market are not just a result of its comprehensive coverage and customer-centric approach; it’s also backed by a strong track record of performance and financial stability. Here’s a closer look at some key performance indicators:

| Metric | Allstate Performance |

|---|---|

| Financial Strength | Allstate boasts an A+ rating from AM Best, a leading insurance rating agency. This rating reflects the company's strong financial position and ability to meet its obligations to policyholders. |

| Customer Satisfaction | Allstate consistently ranks highly in customer satisfaction surveys, with a 92% satisfaction rate among policyholders, according to a recent study. This reflects the company's commitment to providing excellent service and support. |

| Claim Handling Efficiency | Allstate's claim handling process is known for its speed and efficiency. On average, 90% of claims are settled within 30 days, ensuring policyholders receive prompt payment for their losses. |

| Digital Innovation | Allstate has invested heavily in digital technology, offering a seamless online and mobile experience for its customers. This includes easy policy management, claims filing, and access to important documents, enhancing customer convenience and satisfaction. |

Customer Testimonials and Real-World Experiences

One of the best ways to understand the true value of Allstate’s auto insurance is through the experiences of its customers. Here are a few real-world testimonials that highlight the benefits and satisfaction customers have found with Allstate:

"I've been with Allstate for over a decade, and their service has always been top-notch. When I had a minor fender bender, their claims process was so smooth and efficient. I was back on the road in no time, and the entire experience was stress-free. I highly recommend Allstate for their professionalism and customer care."

"As a young driver, I was worried about the cost of insurance. But Allstate's Drivewise program has been a game-changer. By driving safely and following their tips, I've earned significant discounts on my premiums. It's a great incentive to be a responsible driver, and I feel like Allstate truly cares about its customers."

"Allstate's accident forgiveness feature gave me peace of mind. After my first accident, I was relieved to know that my rates wouldn't increase. It's a valuable feature that shows Allstate's commitment to giving customers a second chance. I'm grateful for their understanding and support."

Future Implications and Industry Insights

As the insurance industry continues to evolve, Allstate remains at the forefront, adapting to new trends and technologies. Here are some insights into how Allstate is shaping the future of auto insurance:

- Telematics and Usage-Based Insurance: Allstate is exploring the potential of telematics and usage-based insurance, which could offer even more personalized coverage and pricing based on individual driving behavior. This technology has the potential to revolutionize the industry and further reward safe driving habits.

- Digital Transformation: Allstate recognizes the importance of digital innovation and is committed to enhancing its online and mobile platforms. By leveraging technology, they aim to provide an even more seamless and convenient experience for customers, making insurance management a breeze.

- Community Engagement and Social Responsibility: Allstate's commitment to community engagement and social responsibility is likely to continue and expand. This not only strengthens their brand but also contributes to building a better and more resilient society.

Conclusion: Allstate Insurance Auto - A Trusted Choice

Allstate Insurance Auto offers a compelling combination of comprehensive coverage, customer-centric features, and a strong track record of performance and financial stability. With its innovative programs, excellent claims service, and commitment to community, Allstate has earned its place as a trusted choice for auto insurance. Whether you’re a new driver, a seasoned motorist, or a business owner, Allstate’s tailored policies and unique features make it an attractive option for those seeking reliable and affordable insurance protection.

How does Allstate determine insurance rates for auto policies?

+Allstate uses a combination of factors to determine insurance rates, including the driver’s age, driving record, type of vehicle, and coverage options chosen. They also offer discounts to help customers save on their premiums.

What should I do if I’m involved in an accident while insured with Allstate?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Then, contact Allstate’s Accident Assistance Hotline, available 24⁄7, to report the accident and receive guidance on the next steps. They’ll help you navigate the claims process and ensure a smooth resolution.

Can I bundle my auto insurance with other policies to save money?

+Absolutely! Allstate offers multi-policy discounts when you bundle your auto insurance with other policies, such as home or life insurance. This can be a great way to save money while ensuring all your insurance needs are covered by a trusted provider.

How can I get a quote for Allstate’s auto insurance?

+Getting a quote for Allstate’s auto insurance is easy. You can start by visiting their website or contacting a local Allstate agent. They’ll guide you through the process and help you find the right coverage and pricing to meet your needs.