Fl Auto Insurance Quote

Florida, the Sunshine State, is known for its vibrant culture, stunning beaches, and, unfortunately, its high auto insurance rates. For residents and visitors alike, understanding the ins and outs of Florida auto insurance is crucial to navigating the state's unique insurance landscape. This comprehensive guide aims to shed light on the key aspects of Florida auto insurance, from understanding coverage options to exploring factors that influence rates.

Understanding Florida Auto Insurance

Florida is a no-fault state, which means that, in the event of an accident, drivers are required to file a claim with their own insurance company regardless of who is at fault. This system is designed to expedite the claims process and provide injured parties with faster access to medical care and compensation. However, it also means that Florida drivers must carry a minimum level of Personal Injury Protection (PIP) coverage.

Mandatory Coverage Requirements

The state of Florida mandates that all registered vehicles have the following minimum coverages:

- Personal Injury Protection (PIP): 10,000 per person for medical expenses and 60% of lost wages.</li> <li><strong>Property Damage Liability (PDL):</strong> 10,000 per accident for damage to others’ property.

While these are the minimum requirements, it's important to note that many drivers opt for higher coverage limits to protect themselves adequately. The cost of medical treatment and vehicle repairs can quickly exceed these minimums, leaving drivers with significant out-of-pocket expenses.

Optional Coverage Add-ons

Beyond the mandatory coverages, Florida drivers have the option to purchase additional coverage to enhance their protection. These optional coverages include:

- Bodily Injury Liability (BI): Covers the cost of injuries sustained by others in an accident for which you are at fault.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides coverage if you are involved in an accident with a driver who has no insurance or insufficient coverage.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, natural disasters, and animal collisions.

- Collision Coverage: Pays for repairs to your vehicle after a collision, regardless of fault.

- Rental Car Reimbursement: Provides a daily allowance for a rental car while your vehicle is being repaired after an insured incident.

The decision to purchase these optional coverages depends on individual risk tolerance and financial circumstances. For instance, drivers who frequently travel or live in areas prone to natural disasters might find comprehensive coverage particularly beneficial.

Factors Influencing Auto Insurance Rates in Florida

Like in most states, auto insurance rates in Florida are influenced by a combination of personal and vehicle-related factors. Understanding these factors can help drivers make informed decisions about their coverage and potentially save money on their premiums.

Personal Factors

Several personal characteristics play a role in determining insurance rates:

- Age and Gender: Younger drivers, particularly those under 25, often face higher premiums due to their lack of driving experience. Gender-based pricing is prohibited in Florida, ensuring that rates are gender-neutral.

- Driving History: A clean driving record can lead to significant discounts, while violations, accidents, and DUI convictions can increase rates. In Florida, certain violations remain on your record for 3 to 7 years.

- Credit History: Insurance companies in Florida are permitted to use credit-based insurance scores to assess risk. A good credit history can lead to lower rates, while poor credit can result in higher premiums.

- Marital Status: Married individuals may benefit from lower rates, as insurance companies view them as less risky due to their lower accident rates.

Vehicle-Related Factors

The characteristics of your vehicle can also impact your insurance rates:

- Vehicle Type and Usage: Sports cars and luxury vehicles often have higher insurance rates due to their higher repair costs. Additionally, vehicles used for business purposes or driven frequently may be more expensive to insure.

- Vehicle Safety Features: Vehicles equipped with advanced safety features like lane departure warnings, automatic emergency braking, and adaptive cruise control may qualify for discounts.

- Vehicle Age and Value: Older vehicles with lower market values may be cheaper to insure, as they often have lower repair and replacement costs.

Location and Geographic Factors

The geographic location where a vehicle is primarily garaged can significantly influence insurance rates. Florida is divided into several geographic zones, each with its own rate structure. Urban areas, for instance, tend to have higher rates due to increased traffic and a higher likelihood of accidents and theft.

| Geographic Zone | Average Annual Premium |

|---|---|

| Zone 1 (Miami-Dade, Broward, Palm Beach) | $2,200 |

| Zone 2 (Central Florida, including Orlando) | $1,850 |

| Zone 3 (North Florida, including Jacksonville) | $1,600 |

Getting the Best FL Auto Insurance Quote

With a comprehensive understanding of Florida’s auto insurance landscape, drivers can take steps to secure the best possible insurance quote. Here are some key strategies:

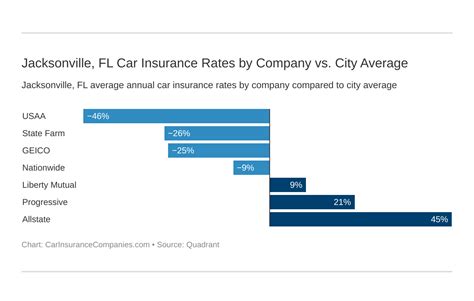

Shop Around and Compare Rates

Florida’s insurance market is highly competitive, with numerous carriers offering a wide range of policies. By comparing quotes from multiple insurers, drivers can identify the best coverage options at the most competitive prices. Online quote comparison tools can be particularly useful for this purpose.

Consider Bundle Discounts

Many insurance companies offer discounts to policyholders who bundle multiple insurance products, such as auto and home insurance. Bundling can result in significant savings, so it’s worth exploring this option, especially if you’re in the market for other types of insurance.

Explore Discounts for Safe Driving

Insurance companies often reward safe driving with discounts. These can include discounts for accident-free periods, good student discounts, and even discounts for completing defensive driving courses. Be sure to inquire about all available discounts when shopping for insurance.

Maintain a Good Credit Score

As mentioned earlier, credit-based insurance scores play a role in determining rates in Florida. By maintaining a good credit score, you can potentially qualify for lower premiums. Regularly review your credit report and take steps to improve your score if necessary.

Choose the Right Coverage Limits

While it’s tempting to opt for the minimum coverage levels to save money, it’s important to consider your individual risk tolerance and financial situation. Insufficient coverage can leave you vulnerable to significant out-of-pocket expenses in the event of an accident. Work with an insurance agent to determine the coverage limits that best suit your needs.

Conclusion: Navigating Florida’s Auto Insurance Landscape

Understanding Florida’s unique auto insurance requirements and the factors that influence rates is the first step toward securing the best possible coverage. By comparing quotes, exploring discounts, and making informed decisions about coverage limits, Florida drivers can find policies that offer both comprehensive protection and competitive rates.

What is the average cost of auto insurance in Florida?

+The average cost of auto insurance in Florida is around $2,000 per year. However, this can vary significantly based on individual factors such as driving history, credit score, and the type of vehicle insured.

Can I lower my insurance rates if I have a poor driving record?

+Improving your driving record can certainly help lower insurance rates over time. This includes maintaining a clean driving record for an extended period and, in some cases, completing a defensive driving course. However, the impact of a poor driving record on rates can vary depending on the severity of the violations and the insurer’s policies.

Are there any discounts available for senior drivers in Florida?

+Yes, many insurance companies offer discounts to senior drivers in Florida. These discounts may be based on age, driving experience, or completion of a mature driver improvement course. It’s always worth inquiring about senior discounts when shopping for insurance.