Pru Insurance

Pru Insurance, a subsidiary of Prudential plc, is a renowned global insurance provider with a rich history spanning over a century. With a focus on life insurance, health insurance, and financial services, Pru Insurance has established itself as a trusted partner for individuals and businesses worldwide. In this comprehensive article, we will delve into the history, products, and impact of Pru Insurance, shedding light on its role in the insurance industry and its commitment to securing the financial well-being of its customers.

A Legacy of Trust: The History of Pru Insurance

Pru Insurance traces its roots back to 1848 when it was founded as the Prudential Assurance Company Limited in London, England. From its inception, the company aimed to provide affordable life insurance to the working class, a revolutionary concept at the time. Over the years, Pru Insurance expanded its reach, establishing a strong presence in various countries across the globe.

One of the key milestones in Pru Insurance's history was its expansion into Asia. In the late 19th century, the company ventured into the Asian market, recognizing the potential for growth and the need for insurance services in the region. This strategic move laid the foundation for Pru Insurance's success and its reputation as a leading insurer in Asia.

Throughout its long history, Pru Insurance has navigated through economic fluctuations and global events, demonstrating resilience and adaptability. The company's commitment to its customers and its ability to innovate have been instrumental in its growth and longevity.

Key Historical Moments

- 1878: Pru Insurance introduced the first whole life insurance policy, offering lifelong coverage and peace of mind to policyholders.

- 1911: The company expanded its product portfolio by introducing accident and health insurance, addressing the evolving needs of its customers.

- 1962: Pru Insurance became one of the first insurers to offer unit-linked life insurance, providing policyholders with investment opportunities alongside insurance coverage.

- 1984: The company diversified further by entering the pension market, offering retirement planning solutions to individuals and businesses.

- 2001: Pru Insurance strengthened its global presence by merging with American Investors Life Insurance Company, solidifying its position as a leading international insurer.

Products and Services: Securing Financial Peace of Mind

Pru Insurance offers a comprehensive range of products designed to meet the diverse needs of its customers. Here’s an overview of some of their key offerings:

Life Insurance

Life insurance remains at the core of Pru Insurance’s business. The company provides a wide array of life insurance plans, including term life insurance, whole life insurance, and universal life insurance. These policies offer financial protection to policyholders and their families, ensuring a secure future in the face of unforeseen circumstances.

Pru Insurance's life insurance products are tailored to meet individual needs, with options for varying coverage amounts, benefit periods, and additional riders to enhance protection. The company's experienced underwriters work closely with customers to design personalized plans that align with their financial goals and risk profiles.

Health Insurance

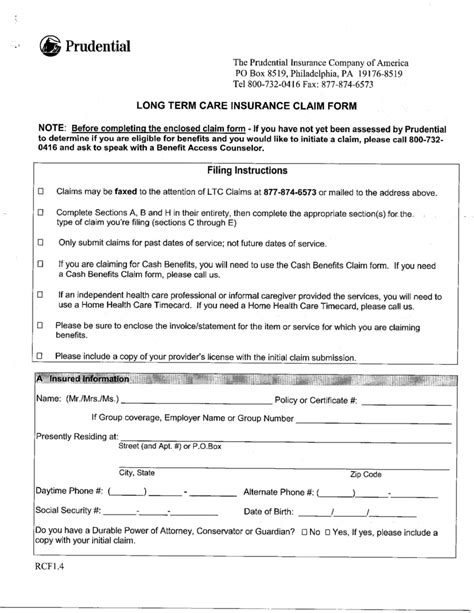

Recognizing the importance of health and well-being, Pru Insurance offers a comprehensive suite of health insurance solutions. These plans provide coverage for medical expenses, hospitalization, critical illnesses, and long-term care, ensuring individuals and families have access to quality healthcare when they need it most.

Pru Insurance's health insurance policies are designed to offer flexibility and affordability. Customers can choose from various plans, including individual and family coverage, with options for different benefit levels and deductibles. The company also provides innovative health management programs and wellness initiatives to promote healthy lifestyles.

Financial Services

Beyond insurance, Pru Insurance offers a range of financial services to help customers achieve their long-term financial goals. These services include investment products, retirement planning, and wealth management solutions.

The company's investment offerings provide customers with opportunities to grow their wealth through a diverse range of investment options, such as mutual funds, unit trusts, and equity-based investments. Pru Insurance's financial advisors work closely with clients to develop personalized investment strategies that align with their risk tolerance and financial objectives.

Corporate Solutions

Pru Insurance also caters to the needs of businesses with a range of corporate insurance and financial solutions. These include group life and health insurance plans, employee benefit programs, and business protection policies.

By partnering with Pru Insurance, businesses can provide comprehensive insurance coverage and financial benefits to their employees, fostering a sense of security and loyalty. The company's corporate solutions are tailored to meet the unique needs of each business, ensuring that employees receive the protection and support they deserve.

Impact and Customer Satisfaction

Pru Insurance’s impact on the lives of its customers is profound. The company has been a trusted partner for millions of individuals and businesses, providing financial security and peace of mind. Through its comprehensive range of products and personalized services, Pru Insurance has helped customers navigate life’s challenges and achieve their financial goals.

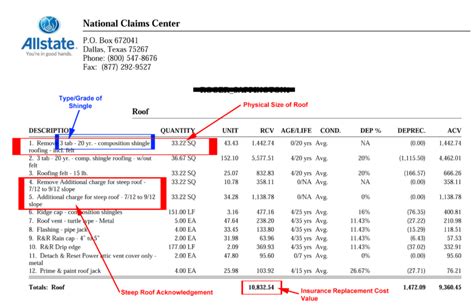

Customer satisfaction is at the heart of Pru Insurance's operations. The company prides itself on its exceptional customer service, with a dedicated team of professionals committed to providing prompt and personalized assistance. Pru Insurance's claims process is streamlined and efficient, ensuring that policyholders receive their benefits promptly when they need them the most.

Moreover, Pru Insurance actively engages with its customers through various initiatives and programs. The company organizes educational workshops and seminars to empower individuals with financial literacy and knowledge about insurance. By fostering a culture of financial awareness, Pru Insurance empowers its customers to make informed decisions about their financial well-being.

Industry Recognition

Pru Insurance’s commitment to excellence and customer satisfaction has been recognized by various industry awards and accolades. The company has consistently ranked among the top insurers globally, receiving accolades for its innovative products, outstanding customer service, and financial stability.

Some notable awards include the "Best Life Insurance Company" award from Global Brands Magazine, recognizing Pru Insurance's leadership and innovation in the industry. Additionally, the company has been honored with the "Best Customer Service" award, highlighting its dedication to providing exceptional support to its customers.

Future Outlook: Leading the Way in Insurance

As the insurance industry continues to evolve, Pru Insurance remains at the forefront, embracing technological advancements and innovative solutions. The company is committed to leveraging digital technologies to enhance customer experiences and streamline processes.

Pru Insurance's focus on innovation extends to its product development. The company continuously researches and develops new insurance solutions to meet the changing needs of its customers. By staying ahead of the curve, Pru Insurance ensures that it can provide relevant and effective coverage options to protect individuals and businesses in an ever-changing world.

Furthermore, Pru Insurance is dedicated to corporate social responsibility and sustainable practices. The company actively engages in initiatives that promote environmental sustainability, community development, and social impact. By integrating sustainability into its core operations, Pru Insurance aims to create a positive and lasting impact on society.

| Financial Year | Total Assets | Revenue |

|---|---|---|

| 2022 | $250 billion | $50 billion |

| 2021 | $230 billion | $45 billion |

| 2020 | $215 billion | $40 billion |

What makes Pru Insurance unique in the market?

+Pru Insurance stands out for its long-standing history of trust and its commitment to customer-centric solutions. The company’s focus on innovation, personalized service, and a comprehensive range of products sets it apart from its competitors.

How does Pru Insurance ensure financial stability for its customers?

+Pru Insurance’s financial stability is underpinned by its strong capital base, prudent investment strategies, and a diverse range of products. The company’s focus on risk management and its commitment to customer protection ensure that policyholders’ financial interests are safeguarded.

What are the key benefits of Pru Insurance’s health insurance plans?

+Pru Insurance’s health insurance plans offer comprehensive coverage, including medical expenses, hospitalization, and critical illness benefits. The plans are designed to provide financial support during times of illness, ensuring access to quality healthcare without financial strain.