Average Auto Insurance Price

The cost of auto insurance is a significant concern for many vehicle owners and prospective buyers. With a multitude of factors influencing insurance rates, it can be challenging to pinpoint an exact average price. However, understanding the key variables and their impact can provide valuable insights into the world of auto insurance pricing. This article aims to delve into the specifics, exploring real-world examples and data to offer a comprehensive analysis of average auto insurance costs.

Understanding Auto Insurance Rates

Auto insurance rates are tailored to individual drivers and their unique circumstances. While it is difficult to determine an exact average, we can examine the primary factors that influence these rates and provide a range of values based on real-world data.

Factors Affecting Auto Insurance Prices

Numerous elements come into play when insurance providers calculate premiums. Here are some of the key factors:

- Driver’s Age and Experience: Younger drivers, especially those under 25, often face higher insurance rates due to their lack of experience on the road. Conversely, senior drivers may also see increased premiums as they are statistically more prone to accidents.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a significant role. High-performance cars and expensive SUVs generally attract higher insurance costs. Additionally, the primary use of the vehicle, whether for personal, business, or pleasure, can impact insurance rates.

- Location and Driving Environment: The area where you reside and drive can affect insurance prices. Urban areas with higher traffic and crime rates often lead to increased premiums. Similarly, the frequency of natural disasters in your region can also influence insurance costs.

- Driving Record: A clean driving record is a significant factor in determining insurance rates. Traffic violations, speeding tickets, and especially at-fault accidents can substantially increase your insurance costs.

- Credit History: Surprisingly, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, with lower credit scores often resulting in higher premiums.

Average Auto Insurance Costs

Given the myriad of factors, it is challenging to provide an exact average insurance price. However, based on industry data and real-world examples, we can estimate a range of values.

According to the Insurance Information Institute, the average annual premium for liability-only coverage in the United States in 2021 was approximately $576. However, this average can vary significantly based on individual circumstances.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $576 |

| Full Coverage (Including Comprehensive and Collision) | $1,674 |

It's important to note that these averages are just a starting point. Your personal insurance rate could be significantly higher or lower based on your specific circumstances and the insurance company's risk assessment.

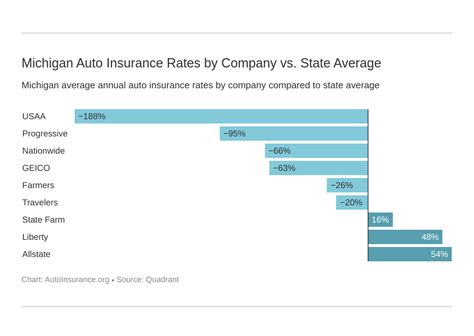

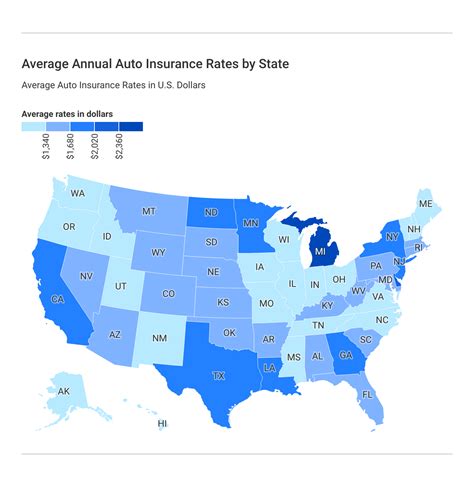

Regional Variations in Auto Insurance Costs

Auto insurance rates can vary greatly from one state to another, and even within different regions of the same state. Let’s take a look at some real-world examples to illustrate these variations.

California vs. Texas

California and Texas, two of the most populous states in the US, offer a good comparison of regional variations in auto insurance costs. According to a Consumer Reports analysis, the average annual premium for a 40-year-old driver with a clean record was approximately 1,848</strong> in California and <strong>1,008 in Texas.

Urban vs. Rural Areas

The urban-rural divide also plays a significant role in auto insurance rates. In urban areas, higher traffic volume, increased crime rates, and a higher likelihood of accidents can lead to higher insurance premiums. For instance, a driver in New York City might pay an average of 2,200</strong> annually, while a driver in a rural town in the same state could pay around <strong>1,500.

Strategies to Lower Auto Insurance Costs

While auto insurance rates can be influenced by numerous factors beyond your control, there are still strategies you can employ to potentially lower your premiums.

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly between companies, so it's worth your time to shop around.

- Bundle Policies: If you have multiple insurance needs, such as home and auto, consider bundling your policies with the same provider. Many insurers offer discounts for multiple policies.

- Improve Your Driving Record: Maintain a clean driving record by avoiding traffic violations and accidents. This can significantly reduce your insurance premiums over time.

- Raise Your Deductible: Increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your monthly premiums. However, this strategy requires careful consideration, as a higher deductible means you'll pay more if you do need to make a claim.

- Explore Discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Be sure to ask your insurer about any potential discounts you may qualify for.

Future Implications and Trends

The auto insurance industry is continually evolving, influenced by technological advancements, changing driving habits, and shifting regulatory landscapes. Here are some key trends and future implications to consider.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction in the industry. These innovative models use real-time data, often collected through devices installed in vehicles or smartphone apps, to assess driving behavior and set insurance rates accordingly. This shift towards pay-as-you-drive or pay-how-you-drive models could offer more tailored and potentially more affordable insurance options for drivers.

Impact of Autonomous Vehicles

The widespread adoption of autonomous vehicles could significantly impact auto insurance. With the potential for reduced accidents and improved road safety, insurance rates may decrease over time. However, the legal and liability implications surrounding autonomous vehicles are still being navigated, which could introduce new complexities to the insurance landscape.

Regulatory Changes and Their Impact

Regulatory changes at both the state and federal levels can influence auto insurance rates. For instance, changes in minimum liability requirements or the introduction of no-fault insurance systems can impact the overall cost of insurance. Staying informed about potential regulatory changes in your area can help you understand how these shifts might affect your insurance costs.

Conclusion

Understanding the average auto insurance price is complex due to the multitude of factors at play. While we’ve provided a range of averages based on real-world data, it’s important to remember that your personal insurance rate will depend on your unique circumstances. By being aware of the key factors influencing insurance rates and adopting strategies to potentially lower your premiums, you can make more informed decisions about your auto insurance coverage.

What is the average monthly cost of auto insurance?

+The average monthly cost of auto insurance can vary significantly based on individual circumstances. However, based on industry data, the average monthly premium for liability-only coverage in the US is approximately 48 (calculated as 576 divided by 12 months). This average can increase significantly with the addition of comprehensive and collision coverage, which may be necessary depending on your vehicle and personal circumstances.

How can I lower my auto insurance costs?

+There are several strategies you can employ to potentially lower your auto insurance costs. These include shopping around for quotes from different insurers, bundling your policies (such as home and auto) with the same provider, maintaining a clean driving record, increasing your deductible, and exploring discounts for which you may be eligible, such as good student or safe driver discounts.

Are there any regional differences in auto insurance costs?

+Yes, regional differences in auto insurance costs are significant. Factors such as the cost of living, population density, traffic congestion, and the frequency of natural disasters can all influence insurance rates. For instance, urban areas often have higher insurance premiums due to increased traffic and the potential for more accidents. Similarly, states with higher rates of natural disasters, such as hurricanes or earthquakes, may have higher insurance costs to account for the increased risk.