Travel Insurance Through Aaa

In today's fast-paced and unpredictable world, having reliable travel insurance is more than just a smart idea; it's an essential safeguard for any journey, ensuring peace of mind and comprehensive coverage. For travelers, the allure of adventure and new experiences often comes with unforeseen circumstances. This is where the expertise of AAA (American Automobile Association) shines, offering a range of travel insurance plans tailored to meet diverse needs.

AAA, a stalwart in the world of automobile services, has expanded its horizons to provide comprehensive travel protection, catering to the needs of millions of travelers. With a rich history and an unwavering commitment to customer satisfaction, AAA's travel insurance division has become a trusted partner for those seeking secure and seamless travel experiences.

Understanding AAA’s Travel Insurance

AAA’s travel insurance offerings are designed to address a spectrum of travel-related concerns, from trip cancellations and interruptions to medical emergencies and baggage loss. These plans are crafted with an understanding of the unique challenges that travelers face, ensuring that every contingency is covered.

The organization's approach to travel insurance is characterized by its flexibility and customization. Whether you're embarking on a leisurely vacation, an adventure-filled getaway, or a business trip, AAA's plans can be tailored to your specific needs, offering personalized coverage that goes beyond the basics.

Key Features of AAA Travel Insurance

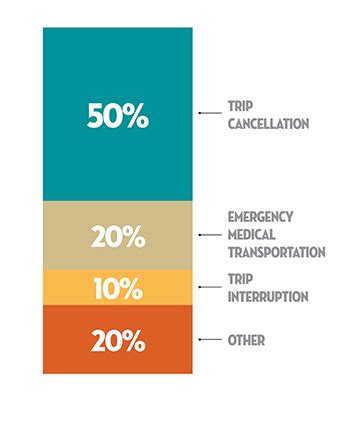

- Trip Cancellation and Interruption Coverage: This feature ensures that your travel investments are protected. In the event of unforeseen circumstances, such as severe weather, illness, or other covered reasons, AAA’s insurance plans provide reimbursement for non-refundable trip costs.

- Medical and Dental Coverage: Medical emergencies can be costly, especially when traveling abroad. AAA’s plans include coverage for emergency medical treatment, hospitalization, and even dental care, ensuring that you receive the necessary treatment without incurring substantial out-of-pocket expenses.

- Baggage and Personal Effects Protection: Lost or delayed baggage can disrupt your travel plans and incur unexpected expenses. AAA’s insurance covers these scenarios, reimbursing you for the cost of essential items you may need to purchase during your trip.

- Emergency Assistance and Concierge Services: Beyond insurance coverage, AAA offers a range of assistance services. This includes help with booking new flights, hotel reservations, and even arranging legal or interpreter services in case of an emergency.

Additionally, AAA's travel insurance plans often include benefits such as trip delay reimbursement, accidental death and dismemberment coverage, and identity theft protection, further enhancing the overall value of these policies.

How AAA’s Travel Insurance Works

Purchasing AAA travel insurance is a straightforward process. You can easily obtain a quote online, or if you prefer personalized assistance, AAA’s knowledgeable agents are available to guide you through the selection of the most suitable plan for your trip.

Once you've chosen your plan and made the payment, you'll receive a confirmation email with your policy details. It's crucial to review these details thoroughly, ensuring that you understand the coverage, limitations, and exclusions. If you have any questions, AAA's customer service team is readily accessible to provide clarifications.

Claim Process

In the event that you need to file a claim, AAA provides a simple and efficient process. You can start the process online or by calling their dedicated claims hotline. The claims team will guide you through the necessary steps, which typically involve submitting supporting documentation, such as receipts, medical reports, or police reports, depending on the nature of your claim.

AAA aims to process claims promptly, and in most cases, you can expect a decision within a reasonable timeframe. If your claim is approved, the reimbursement process will be initiated, ensuring that you receive the compensation you're entitled to.

Benefits and Advantages of AAA Travel Insurance

Choosing AAA’s travel insurance offers several distinct advantages. First and foremost, AAA’s reputation for reliability and customer service excellence extends to its travel insurance division. With AAA, you can trust that your policy will be administered fairly and efficiently.

The customization options available with AAA's plans allow you to create a policy that perfectly suits your travel needs and budget. Whether you're seeking comprehensive coverage for a lengthy trip or more basic protection for a short getaway, AAA can accommodate your requirements.

Moreover, AAA's network of travel partners and providers offers added value. As an AAA member, you may have access to exclusive travel deals and discounts, further enhancing the overall value of your travel experience.

Testimonials

“AAA’s travel insurance gave me the confidence to explore new destinations without worrying about unforeseen circumstances. The peace of mind it provided was invaluable, and the claims process was straightforward when I needed to use it.”

- John D., AAA Member

Comparing AAA Travel Insurance with Other Providers

When considering travel insurance, it’s beneficial to explore options from various providers. While AAA’s travel insurance division has garnered a strong reputation, it’s essential to compare plans and prices to find the best fit for your specific needs.

Other reputable travel insurance providers, such as Travel Guard, Allianz Travel, and Travelex, offer comprehensive plans with unique features and pricing structures. Comparing these options can help you make an informed decision, ensuring that you choose a plan that provides the coverage and value you desire.

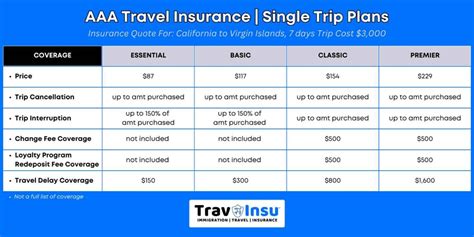

A Comparative Table

| Insurance Provider | Trip Cancellation Coverage | Medical Coverage | Baggage Protection | Additional Benefits |

|---|---|---|---|---|

| AAA | Up to 10,000</td> <td>100,000 medical, 250 dental</td> <td>Up to 1,000 | Trip interruption, emergency assistance | ||

| Travel Guard | Up to 20,000</td> <td>500,000 medical, 750 dental</td> <td>Up to 2,000 | 24⁄7 travel concierge, identity theft protection | ||

| Allianz Travel | Up to 15,000</td> <td>150,000 medical, 500 dental</td> <td>Up to 1,500 | Trip delay reimbursement, travel companion benefits | ||

| Travelex | Up to 12,000</td> <td>250,000 medical, 500 dental</td> <td>Up to 1,200 | Baggage delay benefits, optional adventure sports coverage |

Future Outlook and Innovations in Travel Insurance

The travel insurance industry is continually evolving, with providers like AAA at the forefront of innovation. As travel patterns and consumer needs change, AAA is committed to adapting its offerings to ensure that its members receive the most comprehensive and relevant coverage.

Looking ahead, we can expect to see further advancements in travel insurance. These may include enhanced digital tools for policy management and claims submission, as well as the integration of new technologies like blockchain for more secure and efficient processes.

Additionally, the focus on sustainability and eco-friendly travel is likely to influence the development of new insurance products. AAA and other providers may explore ways to incorporate environmental considerations into their plans, offering incentives for sustainable travel choices.

Conclusion

In an era of global travel and exploration, AAA’s travel insurance division stands as a beacon of reliability and innovation. With a commitment to customer satisfaction and a range of comprehensive plans, AAA ensures that travelers can embark on their journeys with confidence and peace of mind.

As the travel landscape continues to evolve, AAA remains dedicated to staying at the forefront, offering innovative solutions that meet the dynamic needs of its members. Whether you're a seasoned traveler or embarking on your first adventure, AAA's travel insurance is a trusted companion, providing the protection and support you need to make your travels memorable for all the right reasons.

Can I purchase AAA travel insurance if I’m not a member?

+Yes, AAA’s travel insurance plans are available to both members and non-members. However, AAA members may receive additional benefits or discounts on their travel insurance policies.

What is the cost of AAA travel insurance?

+The cost of AAA travel insurance varies depending on the plan and the length of your trip. Factors such as age, destination, and the level of coverage you choose can also influence the price. It’s best to obtain a quote tailored to your specific needs.

How soon should I purchase travel insurance for my trip?

+It’s generally recommended to purchase travel insurance as soon as you book your trip. This ensures that you’re covered for any unforeseen circumstances that may arise before your departure, such as a sudden illness or a trip cancellation.

What should I do if I need to file a claim with AAA’s travel insurance?

+If you need to file a claim, you can start the process online through AAA’s website or by calling their dedicated claims hotline. You’ll be guided through the necessary steps, which typically involve providing supporting documentation to substantiate your claim.