Life Insurance Buy Online

In today's fast-paced digital world, buying life insurance has evolved to become a convenient and accessible process. The traditional method of meeting with an agent and discussing policies over coffee has been transformed by the rise of online platforms, offering a streamlined and efficient way to secure life insurance coverage. This article delves into the world of online life insurance, exploring its benefits, the process, and the key considerations for those seeking to protect their loved ones' financial future with a few clicks.

The Digital Evolution of Life Insurance

The insurance industry has undergone a remarkable transformation, and life insurance is no exception. With the advent of technology, consumers now have the power to take control of their financial planning, research, and purchase life insurance policies from the comfort of their homes. This digital shift has brought about numerous advantages, making life insurance more accessible, transparent, and tailored to individual needs.

One of the key advantages of buying life insurance online is the convenience it offers. No longer do individuals need to rely on set office hours or wait for an agent's availability. Online platforms provide 24/7 access, allowing users to compare policies, obtain quotes, and even purchase coverage at their own pace. This flexibility is particularly beneficial for busy individuals or those residing in remote areas, who may find it challenging to coordinate face-to-face meetings with agents.

A Transparent Process

Transparency is a cornerstone of the online life insurance experience. Reputable online platforms provide detailed information about various policies, their features, and the associated costs. Users can easily navigate through comprehensive guides, frequently asked questions, and educational resources to gain a deeper understanding of the different types of life insurance, their benefits, and how they align with their specific needs. This transparency empowers individuals to make informed decisions, ensuring they choose a policy that best suits their circumstances.

Additionally, online life insurance platforms often utilize clear and concise language, avoiding the complex jargon that may be present in traditional insurance documents. This simplicity ensures that policyholders fully comprehend the terms and conditions, fostering trust and confidence in the chosen coverage.

Tailored Coverage, Simplified

One of the most significant advantages of buying life insurance online is the ability to customize coverage. Online platforms offer a wide range of policy options, catering to various lifestyles, health conditions, and financial goals. Whether an individual seeks term life insurance for a specific period or whole life insurance for lifelong coverage, the online marketplace provides a diverse selection.

Through intuitive interfaces, users can input their personal details, such as age, health status, and desired coverage amount, to receive tailored policy recommendations. These recommendations are often based on advanced algorithms that consider individual circumstances, ensuring a precise match between the policyholder's needs and the chosen coverage. This level of customization ensures that individuals receive the right amount of coverage at an affordable price, without overpaying for unnecessary features.

| Policy Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified term, typically ranging from 10 to 30 years. Offers flexibility and affordability for those seeking temporary coverage. |

| Whole Life Insurance | Offers lifelong coverage, building cash value over time. Ideal for long-term financial protection and estate planning. |

| Universal Life Insurance | Combines permanent coverage with flexible premium payments and cash value accumulation. Provides versatility for those with changing financial needs. |

| Final Expense Insurance | Designed to cover funeral and burial expenses, ensuring financial peace of mind for loved ones during a difficult time. |

The Online Life Insurance Process

The process of buying life insurance online is straightforward and designed to be user-friendly. Here’s a step-by-step guide to help you navigate the journey:

Step 1: Research and Comparison

Begin by exploring reputable online insurance platforms. These platforms often provide a wealth of information about different insurers, policy types, and coverage options. Take the time to understand the distinctions between term, whole, and universal life insurance, and consider your specific needs and financial goals.

Compare policies based on factors such as coverage amounts, premium costs, and additional features like riders or benefits. Many platforms offer side-by-side comparisons, making it easier to evaluate and select the most suitable option.

Step 2: Obtain Quotes

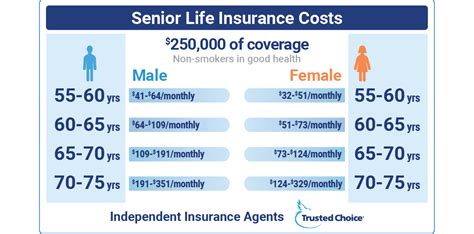

Once you’ve narrowed down your options, request quotes from the insurers you’re considering. Most online platforms allow you to input your personal details and receive personalized quotes within minutes. These quotes provide an estimate of the monthly or annual premium costs based on your age, health status, and coverage requirements.

Compare the quotes to ensure you're getting the best value for your money. Keep in mind that while price is important, it's not the sole factor to consider. The financial strength and reputation of the insurance company, as well as the policy's features and benefits, should also be taken into account.

Step 3: Apply Online

When you’ve found the policy that aligns with your needs, proceed to the application process. Online applications are typically straightforward and user-friendly, guiding you through the necessary steps. You’ll be asked to provide personal information, including your name, date of birth, contact details, and health history.

Depending on the policy and your health status, you may need to undergo a medical exam. This exam is usually conducted by a licensed paramedic who visits your home or office. The results of the exam help the insurer assess your risk and determine the final premium amount.

Step 4: Review and Purchase

After submitting your application, you’ll receive a policy review, outlining the coverage, terms, and conditions. Take the time to carefully read through the document, ensuring you understand the benefits and limitations of the policy. If you have any questions or concerns, reach out to the insurer’s customer support team for clarification.

Once you're satisfied with the policy, finalize the purchase by providing your payment details. Online platforms typically offer secure payment gateways, ensuring your financial information is protected. After the payment is processed, you'll receive a confirmation email, and your policy will be activated.

Key Considerations for Online Life Insurance

While buying life insurance online offers numerous advantages, there are a few key considerations to keep in mind to ensure a smooth and successful experience:

Understanding Policy Types

Familiarize yourself with the different types of life insurance policies available. Term life insurance provides coverage for a specified period, making it ideal for those with short-term needs or budget constraints. On the other hand, whole life insurance offers lifelong coverage and builds cash value, making it a suitable option for long-term financial planning.

Consider your financial goals, the duration of coverage required, and your ability to pay premiums over the long term when deciding between these policy types.

Assessing Your Needs

Before purchasing life insurance, assess your specific needs. Determine the amount of coverage required to support your loved ones’ financial well-being in the event of your passing. This amount should consider factors such as outstanding debts, funeral expenses, ongoing living costs, and future financial goals.

Additionally, evaluate your health status. If you have pre-existing health conditions, certain policies may be more suitable than others. Some insurers offer specialized policies for individuals with health concerns, ensuring they can obtain the coverage they need.

Financial Strength of Insurers

When comparing insurers, pay close attention to their financial strength and stability. Reputable online platforms often provide ratings and reviews from independent financial institutions, such as A.M. Best or Standard & Poor’s. These ratings indicate the insurer’s ability to meet their financial obligations and pay out claims.

Choosing an insurer with a strong financial rating ensures peace of mind, knowing that your policy will be backed by a stable and reliable company.

Customer Support and Claims Process

Evaluate the insurer’s customer support services and claims process. Look for platforms that offer easy access to customer support representatives, either through phone, email, or live chat. This ensures you can quickly resolve any queries or concerns you may have during the policy application or claims process.

Inquire about the claims process and the average time it takes to process and pay out claims. A streamlined and efficient claims process is essential to provide financial support to your loved ones during a challenging time.

Policy Riders and Benefits

Explore the additional riders and benefits offered by different policies. Riders are optional add-ons that can enhance your coverage and provide extra protection. For example, an accelerated death benefit rider can provide access to a portion of the death benefit if you’re diagnosed with a terminal illness.

Consider your unique circumstances and needs when evaluating riders. Some riders may be more relevant to your situation, providing added peace of mind and financial protection.

The Future of Life Insurance: Digital Innovation

The digital transformation of the insurance industry is an ongoing process, with continuous innovations shaping the way life insurance is purchased and managed. Here’s a glimpse into the future of online life insurance:

Enhanced Personalization

Advanced algorithms and data analytics are expected to further enhance the personalization of life insurance policies. By analyzing an individual’s lifestyle, health data, and financial goals, insurers can offer highly tailored coverage options. This level of customization ensures that policyholders receive the precise protection they need, without unnecessary costs.

Simplified Claims Process

The claims process is a critical aspect of life insurance, and insurers are investing in digital solutions to streamline and simplify this process. Online platforms may utilize digital documentation, real-time verification, and automated systems to expedite the claims journey. This ensures that beneficiaries receive the financial support they need in a timely manner, reducing the stress and uncertainty associated with traditional claims processes.

Incorporating Health Data

With the increasing availability of health data and wearable technology, insurers are exploring ways to integrate this information into the life insurance experience. By analyzing health metrics and lifestyle choices, insurers can offer incentives and discounts to policyholders who maintain healthy habits. This approach not only encourages a healthier lifestyle but also provides a more accurate assessment of an individual’s risk profile, leading to more precise and affordable coverage.

Seamless Policy Management

Online life insurance platforms are likely to evolve to offer more comprehensive policy management tools. Policyholders will be able to access their policies, view coverage details, make payments, and update personal information through secure online portals. This seamless management experience ensures that policyholders stay informed and engaged, fostering a stronger relationship with their insurer.

Conclusion

The rise of online life insurance has revolutionized the way individuals protect their loved ones’ financial future. With convenience, transparency, and customization at its core, the digital evolution of life insurance has made it more accessible and tailored to individual needs. As technology continues to advance, the future of online life insurance promises even greater personalization, streamlined processes, and enhanced engagement between insurers and policyholders.

Whether you're a first-time buyer or seeking to review and update your existing coverage, exploring the world of online life insurance is a wise step towards securing your family's financial well-being.

Can I buy life insurance online without a medical exam?

+Yes, some insurers offer no-exam policies, allowing you to obtain coverage without undergoing a medical exam. These policies typically have lower coverage amounts and may have specific eligibility criteria. However, it’s important to note that no-exam policies may have higher premiums or limited coverage options compared to traditional policies.

How do I choose the right life insurance policy for my needs?

+Consider your financial goals, the duration of coverage required, and your ability to pay premiums. Evaluate your needs, including outstanding debts, funeral expenses, and ongoing living costs. Compare different policy types, such as term life or whole life insurance, and assess your health status to determine the most suitable option for your circumstances.

What happens if my health status changes after purchasing life insurance online?

+If your health status significantly deteriorates, it’s important to inform your insurer. Depending on the nature of your condition, the insurer may review your policy and adjust the coverage or premiums accordingly. It’s crucial to maintain open communication with your insurer to ensure your policy remains aligned with your changing needs.

Can I cancel my life insurance policy if I change my mind?

+Yes, you have the right to cancel your life insurance policy at any time. However, it’s important to understand the implications of cancellation. Depending on the policy type and the length of time you’ve had the coverage, you may receive a partial refund of your premiums. It’s advisable to carefully consider your decision and discuss any concerns with your insurer before canceling your policy.