What Is Auto Gap Insurance

Auto Gap Insurance, or Guaranteed Asset Protection (GAP) Insurance, is a specialized type of coverage designed to bridge the financial gap between the actual value of a vehicle and the remaining balance owed on an auto loan or lease. It steps in as a crucial safety net for vehicle owners, particularly those who have financed or leased their vehicles, offering protection against potential financial losses in specific circumstances. This comprehensive guide aims to explore the intricacies of Auto Gap Insurance, providing an in-depth understanding of its benefits, coverage, and relevance in the context of vehicle ownership.

Understanding the Need for Auto Gap Insurance

When you purchase a new or used vehicle, its value starts depreciating immediately. This means that if your vehicle is totaled or stolen within the first few years of ownership, the insurance settlement may not cover the entire amount you still owe on your loan or lease. This is where Auto Gap Insurance comes into play, ensuring that you’re not left with a significant financial burden.

Depreciation and Its Impact

Vehicle depreciation is a well-known phenomenon. On average, a new car can lose up to 20% of its value in the first year alone, and this depreciation continues over time. This means that if you were to make a claim on your standard auto insurance policy, the settlement amount might not be sufficient to cover the outstanding loan or lease balance.

| Depreciation Rate by Year | Average Depreciation |

|---|---|

| Year 1 | 20% |

| Year 2 | 10-15% |

| Year 3 onwards | 5-10% per year |

How Auto Gap Insurance Works

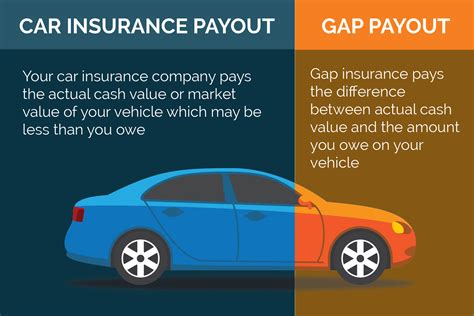

Auto Gap Insurance acts as a supplementary coverage, filling the gap between the vehicle’s actual cash value (ACV) and the outstanding loan or lease balance. It provides financial protection in specific scenarios, ensuring that policyholders are not left with a negative equity position.

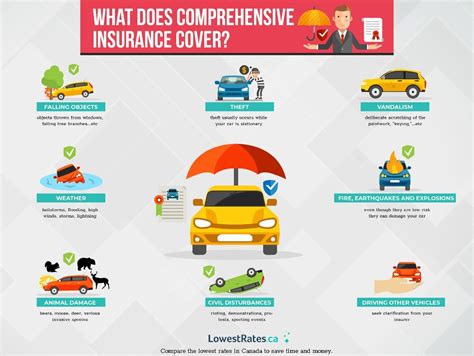

Covered Events

GAP Insurance typically covers the following situations:

- Total Loss: If your vehicle is deemed a total loss due to an accident or theft, GAP Insurance steps in to cover the difference between the ACV and the remaining loan or lease balance.

- Theft: In case of vehicle theft, GAP Insurance ensures that you’re not responsible for paying off a vehicle you no longer possess.

- Write-Off: If your vehicle is severely damaged and the insurer deems it a write-off, GAP Insurance provides coverage for the outstanding amount.

Policy Conditions

While Auto Gap Insurance offers valuable protection, it’s important to note that policies may have certain conditions and limitations. These can include:

- Vehicle Eligibility: GAP Insurance is often available for new or nearly new vehicles, with some policies extending coverage to used vehicles within a certain age or mileage range.

- Policy Term: GAP Insurance is typically valid for the duration of the loan or lease term, ensuring coverage for the entire period you owe money on the vehicle.

- Deductible: Like standard auto insurance, GAP policies may have a deductible that the policyholder is responsible for paying.

Benefits of Auto Gap Insurance

Auto Gap Insurance offers a range of advantages, making it an essential consideration for vehicle owners:

- Financial Protection: The primary benefit is financial security. GAP Insurance ensures that policyholders are not held responsible for paying off a vehicle they no longer own, protecting them from negative equity situations.

- Peace of Mind: With GAP Insurance, vehicle owners can drive with confidence, knowing they’re protected against potential financial losses due to depreciation.

- Leasing Advantages: For those leasing vehicles, GAP Insurance is especially beneficial, as it covers the higher depreciation rates typically associated with leased cars.

- No Out-of-Pocket Expenses: In the event of a total loss, theft, or write-off, GAP Insurance ensures that policyholders don’t have to pay out of pocket to cover the difference between the ACV and loan balance.

Obtaining Auto Gap Insurance

Auto Gap Insurance is typically offered by auto dealerships, finance companies, or insurance providers. When purchasing a new or used vehicle, it’s essential to inquire about GAP Insurance options and ensure that you understand the coverage and terms.

Cost Considerations

The cost of Auto Gap Insurance can vary based on several factors, including the vehicle’s make and model, the loan or lease term, and the coverage amount. It’s often a one-time fee, providing coverage for the entire duration of the policy. Some providers may offer flexible payment options, allowing policyholders to spread the cost over the loan or lease term.

Comparing Policies

When considering Auto Gap Insurance, it’s crucial to compare policies and providers. Look for policies that offer comprehensive coverage, clear terms, and competitive pricing. Ensure that you understand any exclusions or limitations before purchasing.

Real-World Examples

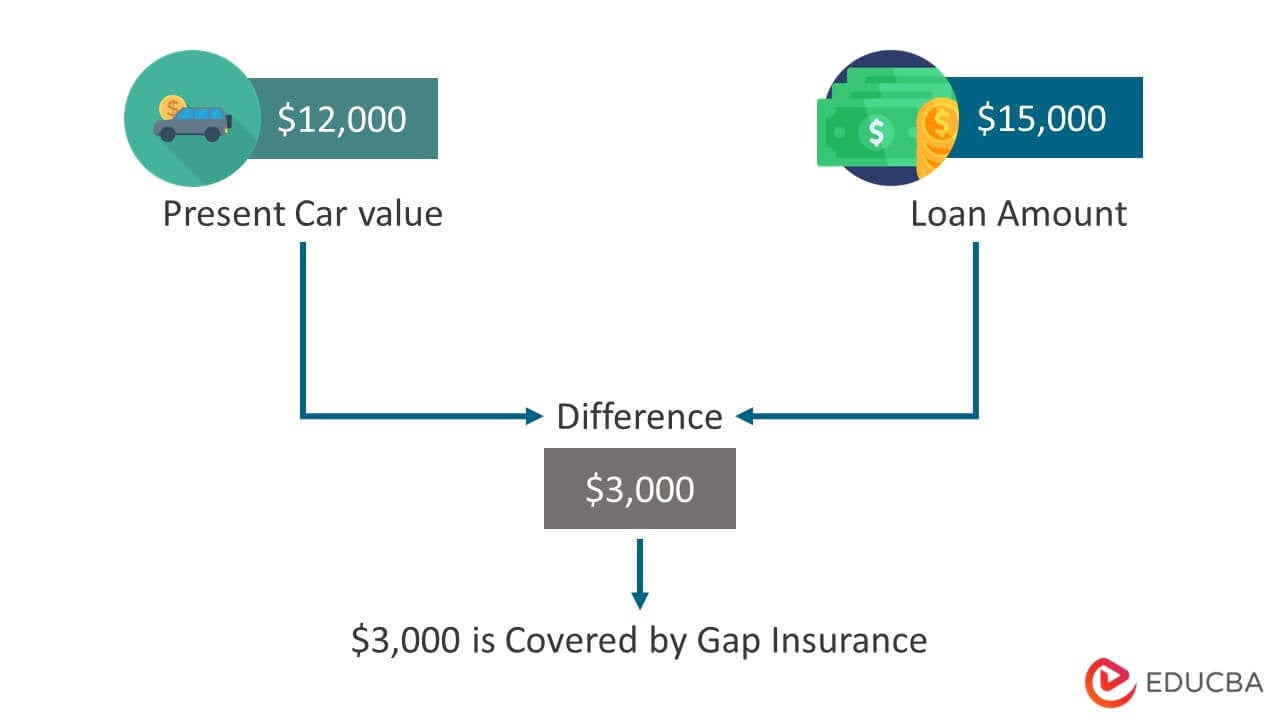

Let’s consider a real-life scenario to illustrate the value of Auto Gap Insurance:

Imagine you’ve purchased a new car for 30,000, and you've financed it with a loan. After a year, your car is involved in an accident and is declared a total loss. At the time of the accident, the ACV of your car is 25,000, but you still owe 28,000 on your loan. Without GAP Insurance, you would be responsible for paying the difference of 3,000 out of pocket. However, with GAP Insurance, the policy would cover this gap, ensuring you’re not left with a financial burden.

Future Implications and Industry Insights

The auto insurance industry is continually evolving, and the demand for specialized coverages like Auto Gap Insurance is on the rise. As more individuals choose to lease vehicles or finance their purchases, the need for GAP Insurance becomes increasingly apparent. Additionally, with the rising costs of vehicles and the rapid depreciation rates, GAP Insurance provides a crucial safety net for vehicle owners.

Furthermore, the advent of electric vehicles (EVs) and their unique depreciation patterns has highlighted the importance of GAP Insurance. EVs often experience higher depreciation rates due to factors like battery degradation and technological advancements. As a result, GAP Insurance is becoming an essential consideration for EV owners, ensuring they're protected against potential financial losses.

Industry Trends

The insurance industry is also witnessing a shift towards digital transformation, with many providers offering online policy management and claims processes. This trend is expected to continue, making it easier for vehicle owners to access and understand their insurance coverage, including Auto Gap Insurance.

In conclusion, Auto Gap Insurance is a vital component of comprehensive vehicle protection, providing financial security and peace of mind for vehicle owners. With the ever-changing landscape of the auto industry, GAP Insurance remains a crucial consideration, offering protection against the financial pitfalls of vehicle ownership.

What is the typical cost of Auto Gap Insurance?

+

The cost of Auto Gap Insurance can vary based on several factors, including the vehicle’s make and model, the loan or lease term, and the coverage amount. It’s often a one-time fee, providing coverage for the entire duration of the policy. Some providers may offer flexible payment options, allowing policyholders to spread the cost over the loan or lease term.

Can Auto Gap Insurance be purchased at any time?

+

While it’s ideal to purchase Auto Gap Insurance at the time of vehicle purchase or lease, some providers may offer coverage even after the fact. However, it’s important to note that the availability and terms of late-purchase GAP Insurance may vary, and it might not cover the full loan or lease term.

Does Auto Gap Insurance cover all types of vehicles?

+

Auto Gap Insurance is typically available for new or nearly new vehicles, with some policies extending coverage to used vehicles within a certain age or mileage range. It’s important to check with your provider to understand the specific eligibility criteria for your vehicle.

Are there any exclusions or limitations to Auto Gap Insurance coverage?

+

Yes, Auto Gap Insurance policies may have certain exclusions and limitations. These can include conditions like maintaining comprehensive and collision coverage on your vehicle, keeping up with loan or lease payments, and ensuring the vehicle is not used for commercial purposes. It’s crucial to carefully review the policy terms and conditions to understand any potential exclusions.

How do I make a claim on my Auto Gap Insurance policy?

+

To make a claim on your Auto Gap Insurance policy, you’ll need to contact your insurance provider and provide the necessary documentation, such as the vehicle’s registration, proof of ownership, and the loan or lease agreement. The claims process may vary depending on your provider, so it’s important to understand the steps involved before an incident occurs.