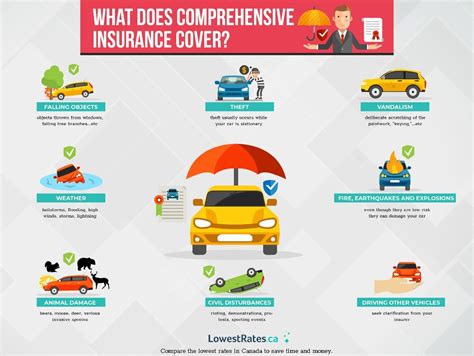

Comprehensive Meaning Insurance

Insurance, a cornerstone of financial planning, plays a pivotal role in safeguarding individuals and businesses against unforeseen events and financial losses. Within this landscape, the term "Comprehensive" stands out, often used to describe a robust and all-encompassing level of coverage. This article aims to demystify the concept of Comprehensive Meaning Insurance, exploring its nuances, benefits, and real-world applications.

Unraveling the Comprehensive Meaning Insurance Enigma

At its core, Comprehensive Meaning Insurance is an all-inclusive insurance policy designed to provide extensive coverage against a wide range of potential risks and liabilities. Unlike basic insurance policies that offer coverage for specific, predefined events, comprehensive insurance takes a holistic approach, aiming to protect policyholders from a multitude of unforeseen circumstances.

This type of insurance is particularly valuable in industries and situations where the potential for loss is high and diverse. By opting for comprehensive coverage, individuals and businesses can gain peace of mind, knowing they are protected from a broad spectrum of risks, both expected and unexpected.

Key Features of Comprehensive Insurance Policies

Comprehensive insurance policies are characterized by their breadth of coverage. They typically include:

- Property Coverage: Protects against damage or loss of physical assets, including buildings, equipment, and inventory.

- Liability Coverage: Shields policyholders from financial losses arising from claims of negligence or damage caused to others.

- Business Interruption Coverage: Provides financial support during periods when a business is unable to operate due to covered events, such as natural disasters or theft.

- Cyber Liability Coverage: A critical component in today's digital age, this covers losses resulting from cyber attacks, data breaches, and other online risks.

- Employee Benefits and Workers' Compensation: Comprehensive policies often include provisions for employee health and safety, as well as compensation for work-related injuries.

Additionally, comprehensive insurance policies often offer flexible customization options. Policyholders can tailor their coverage to align with their unique needs and risks, ensuring they are not overpaying for unnecessary coverage while still maintaining adequate protection.

Real-World Applications

The versatility of comprehensive insurance makes it applicable across various industries and scenarios:

| Industry | Comprehensive Insurance Coverage |

|---|---|

| Manufacturing | Comprehensive insurance for manufacturers can include property damage coverage, product liability, and business interruption coverage to safeguard against production disruptions. |

| Healthcare | Healthcare providers benefit from comprehensive insurance, covering medical malpractice, cyber attacks on patient data, and even employee benefits for their staff. |

| Construction | In the construction industry, comprehensive insurance protects against property damage, liability for accidents on the job site, and even coverage for specialized equipment. |

| Retail | Retail businesses often require comprehensive coverage for their stores, including property damage, liability for customer injuries, and even product recall coverage. |

These examples illustrate how comprehensive insurance can be tailored to meet the specific needs of different industries, ensuring that policyholders are protected from a wide range of potential risks.

The Benefits of Choosing Comprehensive Insurance

Opting for comprehensive insurance offers a multitude of advantages:

- Peace of Mind: With comprehensive coverage, policyholders can rest assured knowing they are protected from a broad spectrum of risks, reducing financial anxiety.

- Cost-Effectiveness: While comprehensive insurance may have a higher upfront cost, it can be more cost-effective in the long run, especially for high-risk industries, as it eliminates the need for multiple policies.

- Flexibility and Customization: Policyholders can tailor their comprehensive insurance to their specific needs, ensuring they are not overinsured and paying for unnecessary coverage.

- Quick Response and Claims Handling: Comprehensive insurance policies often come with dedicated claim handling services, ensuring prompt and efficient response to policyholders' needs.

However, it's important to note that comprehensive insurance may not be suitable for all businesses or individuals. The decision to opt for comprehensive coverage should be made after a thorough risk assessment and consultation with insurance professionals.

Performance Analysis and Case Studies

To illustrate the impact and effectiveness of comprehensive insurance, let’s delve into a few real-world case studies:

Case Study 1: Manufacturing Plant Fire

A manufacturing plant suffered a devastating fire, resulting in significant property damage and business interruption. The plant had comprehensive insurance coverage, which included property damage, business interruption, and liability coverage. The insurance company's swift response and comprehensive policy ensured that the plant received the necessary financial support to rebuild and resume operations within a reasonable timeframe.

Case Study 2: Healthcare Data Breach

A healthcare facility experienced a cyber attack, resulting in a data breach of patient records. The facility had comprehensive insurance coverage, which included cyber liability coverage. The insurance provider's specialized expertise in handling cyber risks ensured that the facility received the necessary support to mitigate the breach, manage legal and regulatory implications, and protect its reputation.

Case Study 3: Construction Site Accident

A construction site experienced a serious accident, resulting in injuries to multiple workers. The construction company had comprehensive insurance coverage, which included workers' compensation and liability coverage. The insurance company's prompt response and comprehensive policy ensured that the injured workers received the necessary medical care and compensation, while also providing legal defense and settlement support to the construction company.

Future Implications and Industry Insights

As industries continue to evolve and face new challenges, the role of comprehensive insurance is poised to become even more critical. With emerging risks such as cyber attacks, environmental hazards, and changing regulatory landscapes, comprehensive insurance policies will need to adapt and innovate to provide effective coverage.

Insurance providers will need to stay abreast of these evolving risks and develop innovative products and services to meet the changing needs of their clients. This may involve incorporating new technologies, such as AI and machine learning, to enhance risk assessment and claims handling processes.

Additionally, there is a growing trend towards personalized insurance, where policies can be tailored to an individual's or business's unique risk profile. This level of customization ensures that policyholders are not overpaying for unnecessary coverage while still maintaining robust protection.

FAQ

What is the main advantage of comprehensive insurance over basic insurance policies?

+Comprehensive insurance offers a wider range of coverage, protecting policyholders from a broader spectrum of risks compared to basic insurance policies. This all-inclusive approach ensures that policyholders are not left vulnerable to unexpected losses or liabilities.

How can I determine if comprehensive insurance is the right choice for my business or personal needs?

+Assessing your specific risks and consulting with insurance professionals is key. They can guide you in choosing the right coverage based on your unique needs, ensuring you’re not overinsured or underinsured.

Are there any industries or scenarios where comprehensive insurance is not recommended?

+While comprehensive insurance is beneficial for many, it may not be cost-effective for low-risk industries or individuals. In such cases, basic insurance policies may suffice. It’s always best to consult with experts to make an informed decision.