At&T Insurance For Phone

Welcome to a comprehensive guide on AT&T Insurance for your phone. In today's fast-paced world, where our smartphones have become an integral part of our daily lives, protecting these devices against accidental damage, theft, or other unforeseen circumstances is more important than ever. AT&T, a leading telecommunications company, offers an insurance plan tailored specifically for its customers' mobile devices. This article aims to provide an in-depth analysis of AT&T's insurance offering, covering everything from its features and benefits to the claims process and customer experiences.

Understanding AT&T Insurance for Your Phone

AT&T’s insurance plan, often referred to as AT&T Mobile Insurance, is designed to provide peace of mind to smartphone owners. This insurance coverage safeguards your device against a wide range of unexpected events, ensuring that you’re not left with a hefty repair bill or the need to purchase a new device in case of an accident or theft.

The insurance plan covers a variety of incidents, including:

- Accidental Damage: From cracked screens to water damage, accidental damage is one of the most common smartphone mishaps. AT&T's insurance plan has you covered, ensuring your device can be repaired or replaced without breaking the bank.

- Theft or Loss: In the unfortunate event that your phone is stolen or lost, AT&T's insurance can provide a replacement, helping you stay connected without incurring additional costs.

- Mechanical or Electrical Breakdown: Internal issues with your device, such as battery failure or software malfunctions, are also covered by AT&T's insurance, ensuring comprehensive protection for your device.

AT&T's insurance plan is not just limited to smartphones; it also covers other mobile devices such as tablets and smartwatches, making it a versatile option for anyone with multiple devices.

Benefits and Features of AT&T Insurance

AT&T’s insurance plan offers a range of benefits and features that set it apart from other insurance providers in the market.

- Affordable Premiums: One of the key advantages of AT&T’s insurance is its competitive pricing. The monthly premiums are designed to be affordable, making it accessible to a wide range of customers.

- Quick Claims Process: In the event of a claim, AT&T aims to make the process as seamless as possible. Customers can file claims online or via the AT&T app, and the company promises a fast turnaround time, ensuring minimal disruption to your digital life.

- Replacement Devices: When a claim is approved, AT&T will provide a replacement device, ensuring you stay connected. In some cases, you may even be eligible for an upgrade, depending on the terms of your insurance plan.

- No Deductibles for Specific Claims: For certain types of claims, such as mechanical or electrical breakdowns, AT&T waives the deductible, making it even more cost-effective for customers.

- Extended Warranty: AT&T’s insurance plan also acts as an extended warranty, covering your device beyond the manufacturer’s warranty period. This ensures that your device remains protected even after the initial warranty expires.

Additionally, AT&T offers a Mobile Protection Pack, which includes not just insurance but also additional benefits such as device repair and technical support. This comprehensive package ensures that your device is not only protected but also well-maintained.

| Insurance Feature | Description |

|---|---|

| Accidental Damage Coverage | Protects against cracked screens, water damage, and other physical damage. |

| Theft and Loss Coverage | Replaces your device if it's stolen or lost, keeping you connected. |

| Mechanical and Electrical Breakdown | Covers internal issues like battery failure or software glitches. |

| No Deductibles for Some Claims | Waives deductibles for mechanical or electrical breakdowns, saving you money. |

The Claims Process: A Step-by-Step Guide

Understanding the claims process is crucial when considering any insurance plan. AT&T has streamlined its claims process to ensure it’s as hassle-free as possible for its customers.

Filing a Claim

To file a claim with AT&T, you have two convenient options:

- Online: Visit the AT&T Insurance Claims portal on their website. Here, you can initiate a claim by providing basic information about your device and the incident.

- Mobile App: If you prefer a more mobile approach, you can use the AT&T app. The app has a dedicated section for insurance claims, making it easy to file a claim on the go.

When filing a claim, you'll need to provide details such as the date and nature of the incident, as well as any supporting documentation. This may include photos of the damaged device or a police report in the case of theft.

Claims Assessment

Once you’ve filed your claim, AT&T’s dedicated claims team will assess the situation. They will review your claim, taking into consideration the type of incident, the extent of the damage, and the terms of your insurance plan.

AT&T aims to provide a swift assessment, typically within a few business days. During this time, they may request additional information or documentation to ensure a fair and accurate evaluation of your claim.

Claim Approval and Resolution

If your claim is approved, AT&T will guide you through the resolution process. This often involves providing you with a replacement device or arranging for repairs, depending on the nature of your claim.

In the case of a replacement, AT&T will ensure you receive a device of similar specifications to your original one. If your device is repairable, they may arrange for authorized repairs, ensuring your device is restored to its pre-incident condition.

AT&T strives to provide a seamless resolution, keeping you informed throughout the process and ensuring your connectivity remains uninterrupted.

Customer Experiences and Reviews

Understanding how AT&T’s insurance plan has performed for real customers can provide valuable insights into its effectiveness and reliability.

Positive Experiences

Many AT&T customers have shared positive experiences with the insurance plan. Here are a few highlights:

- Quick Response: Several customers have praised AT&T’s prompt response to their claims, with some receiving replacements within a matter of days.

- Affordable Coverage: The affordability of AT&T’s insurance plan has been a significant selling point, with many customers appreciating the value it provides.

- Excellent Customer Service: AT&T’s customer service team has received acclaim for their helpfulness and efficiency in guiding customers through the claims process.

Real-life examples of positive experiences include customers who have had their devices replaced after theft or accidental damage, praising the insurance plan for its coverage and the ease of the claims process.

Potential Pitfalls and How to Avoid Them

While AT&T’s insurance plan has generally received positive reviews, there are a few potential pitfalls to be aware of:

- Claim Denials: Some customers have reported claim denials, often due to pre-existing damage or failure to provide adequate documentation. To avoid this, ensure you thoroughly understand the terms of your insurance plan and provide all necessary information when filing a claim.

- High Deductibles: While AT&T waives deductibles for certain claims, some customers have experienced high deductibles for other types of claims. It’s important to review your insurance plan and understand the deductible structure to manage expectations.

- Limited Coverage: AT&T’s insurance plan may have limitations on certain types of devices or incidents. Ensure you read the fine print and understand the scope of your coverage to avoid any unexpected surprises.

By being aware of these potential issues and taking proactive steps to mitigate them, you can ensure a smoother claims process and a more positive experience with AT&T's insurance plan.

AT&T Insurance: A Comprehensive Overview

AT&T’s insurance plan offers a robust and affordable solution for protecting your mobile devices. With its comprehensive coverage, quick claims process, and positive customer experiences, it stands out as a reliable option in the competitive world of device insurance.

As with any insurance plan, it's crucial to understand the terms and conditions, and to carefully review your coverage to ensure it meets your specific needs. By doing so, you can make an informed decision and enjoy the peace of mind that comes with knowing your devices are protected.

Frequently Asked Questions

What devices are eligible for AT&T Insurance?

+AT&T Insurance is available for a wide range of mobile devices, including smartphones, tablets, and smartwatches. The plan is designed to cater to various devices, ensuring comprehensive protection for your entire mobile ecosystem.

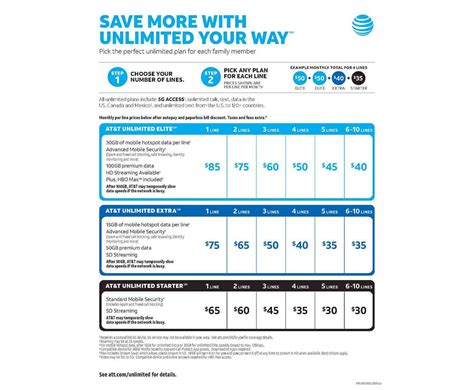

How much does AT&T Insurance cost?

+The cost of AT&T Insurance varies depending on the device you’re insuring. Generally, the premiums are affordable and designed to fit a range of budgets. You can check the specific cost for your device by visiting the AT&T Insurance website or contacting their customer support.

Can I add insurance to my existing AT&T plan?

+Yes, you can add insurance to your existing AT&T plan. Simply log into your AT&T account, navigate to the insurance section, and follow the prompts to add insurance to your eligible devices. It’s a straightforward process that ensures your devices are protected.

What is the claims process like with AT&T Insurance?

+AT&T has streamlined the claims process to make it as easy as possible. You can file a claim online or via the AT&T app, providing details about the incident and any supporting documentation. The claims team will assess your claim and guide you through the resolution process, ensuring a seamless experience.

Are there any limitations or exclusions with AT&T Insurance?

+Like any insurance plan, AT&T Insurance has certain limitations and exclusions. These may include pre-existing damage, intentional damage, or specific types of incidents. It’s important to carefully review the terms and conditions of your insurance plan to understand these limitations and ensure you’re aware of any potential exclusions.