Insurance With Dog

In the ever-evolving landscape of modern life, pet ownership has become increasingly common, and with it, a rising awareness of the unique challenges and responsibilities that come with caring for a furry companion. One such challenge is ensuring the well-being and protection of your beloved pet, especially in unexpected situations. This comprehensive guide aims to shed light on the world of pet insurance, specifically tailored for dog owners, offering an in-depth exploration of its benefits, coverage options, and the peace of mind it provides.

The Importance of Insurance for Your Canine Companion

When you welcome a dog into your family, you commit to a lifetime of love, companionship, and responsibility. While the joy they bring is immeasurable, so too are the costs associated with their care. From routine check-ups and vaccinations to unforeseen accidents or illnesses, the financial burden can be substantial. This is where pet insurance steps in as a crucial tool to manage these costs effectively.

Consider the peace of mind that comes with knowing you're financially prepared for any veterinary emergency. Whether it's a sudden injury from a boisterous game of fetch or a more serious condition requiring specialized care, pet insurance ensures you can focus on your dog's health without the added stress of financial strain.

Moreover, the coverage offered by pet insurance extends beyond emergency situations. It includes preventive care, such as regular check-ups, vaccinations, and even dental procedures, ensuring your dog receives the best possible healthcare throughout their life. This proactive approach not only benefits your dog's health but also helps detect potential issues early on, often leading to more successful treatments and better long-term outcomes.

Understanding Pet Insurance Coverage

Pet insurance policies can vary significantly in their coverage and terms, so it’s essential to understand what’s included to make an informed decision. Here’s a breakdown of the key components:

Medical Expenses

This is the cornerstone of most pet insurance policies, covering a range of veterinary services and treatments. Typically, it includes:

- Accident and Illness Coverage: Provides reimbursement for unexpected injuries or illnesses, from broken bones to gastrointestinal issues.

- Surgery and Hospitalization: Covers the costs associated with surgical procedures and any necessary post-operative care.

- Medications: Includes prescription drugs and medications prescribed by your veterinarian.

- Diagnostic Tests: X-rays, MRIs, and other diagnostic procedures are often covered to help identify and treat conditions.

Wellness and Preventive Care

A comprehensive pet insurance plan often extends beyond emergency situations to include routine care, ensuring your dog stays healthy and happy. This can include:

- Annual Check-ups: Regular visits to the veterinarian for wellness examinations.

- Vaccinations: Coverage for essential vaccines to prevent common diseases.

- Parasite Control: Treatment and prevention of fleas, ticks, and other parasites.

- Spaying and Neutering: Procedures to sterilize your pet, often recommended by veterinarians.

- Dental Care: Coverage for routine dental procedures to maintain oral health.

Additional Benefits

Some pet insurance policies offer extra perks to enhance your coverage. These can include:

- Alternative Therapies: Coverage for treatments like acupuncture, chiropractic care, and hydrotherapy.

- Behavioral Therapy: Assistance for managing behavioral issues in your pet.

- Lost Pet Coverage: Helps with the costs of finding a lost pet, including advertising and reward expenses.

- Travel Assistance: Provides support and coverage if your pet requires emergency care while traveling.

Choosing the Right Insurance Provider

With a multitude of pet insurance providers in the market, selecting the right one can be daunting. Here are some key factors to consider:

Reputation and Financial Stability

Look for established providers with a solid track record of paying claims promptly and fairly. Check online reviews and seek recommendations from other pet owners.

Coverage Options and Customization

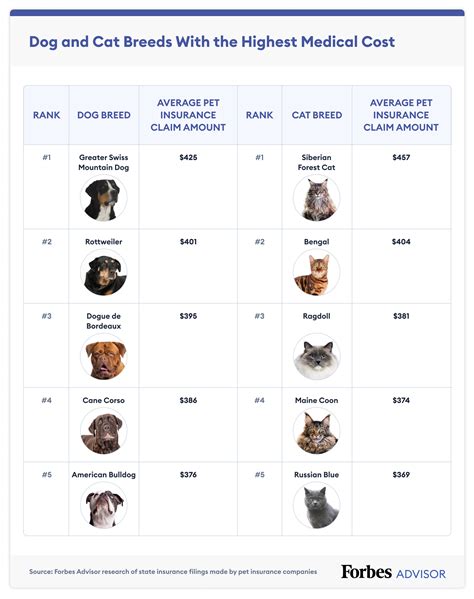

Evaluate the coverage options offered. Some providers offer comprehensive plans that cover a wide range of conditions, while others may have more limited coverage. Consider your dog’s breed, age, and any pre-existing conditions to find a plan that suits their specific needs.

Claim Process and Reimbursement

Understand how the claim process works, including any necessary documentation and the timeline for reimbursement. Some providers offer direct billing to veterinarians, streamlining the process and reducing your out-of-pocket expenses.

Cost and Value

Pet insurance premiums can vary significantly, influenced by factors such as your dog’s breed, age, and the level of coverage chosen. While cost is important, ensure you’re comparing providers based on the value they offer, considering the breadth of coverage and the overall customer experience.

Real-Life Examples of Pet Insurance Benefits

To illustrate the real-world impact of pet insurance, let’s explore a couple of scenarios:

Emergency Situation: Trauma and Surgery

Imagine your dog, an energetic Labrador, sustains a severe injury during a play session, requiring immediate veterinary attention. The diagnosis: a broken leg. The treatment plan involves surgery and a lengthy recovery period. Without insurance, the cost of this emergency procedure could be staggering, potentially running into thousands of dollars. However, with pet insurance, you can rest assured that a significant portion of these expenses will be covered, allowing you to focus on your dog’s recovery without the added financial stress.

Chronic Condition Management

Consider a scenario where your senior dog is diagnosed with a chronic condition, such as arthritis. This condition requires ongoing medication, regular veterinary check-ups, and specialized care. Over time, the costs can add up significantly. With pet insurance, you can manage these expenses more effectively, ensuring your dog receives the necessary care without straining your budget.

| Policy Type | Average Annual Cost |

|---|---|

| Accident-Only | $200 - $300 |

| Accident and Illness | $500 - $1,000 |

| Wellness and Preventive Care | $250 - $400 |

The Future of Pet Insurance

As the pet insurance industry continues to evolve, we can expect several key trends and developments:

Enhanced Digital Experiences

Insurance providers are increasingly leveraging technology to enhance the customer experience. This includes digital platforms for policy management, claim submissions, and real-time updates. Expect to see more providers offering mobile apps and online portals for convenient access to policy information and claim status.

Personalized Coverage

The future of pet insurance lies in personalized plans that cater to the unique needs of each pet. This could involve tailored coverage based on breed-specific health risks, age-related conditions, or even individual lifestyle factors. By offering more customizable options, providers can ensure that pet owners receive the coverage that best suits their pets.

Integrating Telemedicine

With the rise of telemedicine in human healthcare, it’s only natural that the pet insurance industry would follow suit. Expect to see more providers incorporating telemedicine services into their offerings. This could include virtual consultations with veterinarians, providing pet owners with convenient access to medical advice and potentially reducing the need for in-person visits for minor issues.

Focus on Preventive Care

The emphasis on preventive care is likely to continue, with more providers recognizing the long-term benefits of proactive healthcare for pets. This could involve increased coverage for preventive procedures, such as dental care, weight management programs, and behavioral training. By encouraging regular check-ups and early intervention, pet insurance providers can help reduce the incidence of more serious and costly health issues down the line.

Collaboration with Veterinary Professionals

A growing trend in the industry is the collaboration between insurance providers and veterinary professionals. This partnership can lead to more informed coverage decisions, ensuring that the policies offered are in line with the latest veterinary recommendations and best practices. It can also result in better support for pet owners, with veterinarians playing a more active role in guiding policyholders toward the most appropriate care options for their pets.

Improved Claim Processing

Efforts to streamline and expedite the claim process will likely continue. This could involve the use of advanced technology, such as automated claim submission and processing systems, to reduce the time and effort required from pet owners. Additionally, there may be a push for more standardized claim forms and processes across the industry, making it easier for policyholders to navigate the claims journey.

How much does pet insurance typically cost for dogs?

+

The cost of pet insurance for dogs can vary widely depending on factors like your dog’s breed, age, location, and the level of coverage you choose. On average, you can expect to pay anywhere from 200 to 1,000 per year for a basic policy, with the potential for higher premiums for more comprehensive coverage or for older dogs.

What are some key benefits of having pet insurance for my dog?

+

Pet insurance provides peace of mind by helping cover the costs of veterinary care, whether it’s for routine check-ups, unexpected illnesses, or emergency treatments. It can also include coverage for prescription medications, specialized procedures, and even alternative therapies. Having insurance ensures you can provide your dog with the best possible care without worrying about the financial burden.

Are there any limitations or exclusions I should be aware of with pet insurance policies?

+

Yes, it’s important to carefully review the policy’s fine print. Many policies exclude pre-existing conditions, so any condition your dog had before you purchased the insurance might not be covered. Additionally, some policies may have waiting periods for certain conditions or treatments, and there might be limits on the total amount payable for specific illnesses or injuries. It’s crucial to understand these limitations to manage your expectations and make informed decisions.

How do I choose the right pet insurance provider for my dog’s needs?

+

When selecting a pet insurance provider, consider factors like the breadth of coverage, the reputation of the company, the ease of claim submission and processing, and the overall customer service experience. Compare policies from different providers, paying attention to the specific needs of your dog and your budget. It’s also beneficial to read reviews from other pet owners to gauge the level of satisfaction and reliability.

Can I customize my pet insurance policy to fit my dog’s unique needs?

+

Absolutely! Many pet insurance providers offer customizable policies that allow you to tailor the coverage to your dog’s specific needs. This could include adding optional riders for certain conditions or treatments, adjusting the deductible and reimbursement levels, or choosing a plan that focuses on specific areas of care, such as accident-only coverage or comprehensive wellness plans.