Mounjaro Covered By Insurance

The introduction of Mounjaro, a novel medication for the management of type 2 diabetes, has brought about a wave of interest and curiosity among patients and healthcare professionals alike. As the drug gains popularity for its effectiveness in controlling blood sugar levels, a common question arises: is Mounjaro covered by insurance plans? This article aims to provide an in-depth exploration of the topic, offering a comprehensive understanding of the insurance coverage landscape for Mounjaro.

Understanding Mounjaro and its Importance

Mounjaro, known generically as tirzepatide, is a groundbreaking medication that has shown exceptional promise in the treatment of type 2 diabetes. Developed by Eli Lilly and Company, it works by mimicking the actions of two hormones, GLP-1 and GIP, which are crucial in regulating blood sugar levels and promoting insulin production.

The significance of Mounjaro lies in its potential to revolutionize diabetes management. Clinical trials have demonstrated its remarkable efficacy, with many patients achieving significant reductions in HbA1c levels and even remission of diabetes. Additionally, Mounjaro has been found to promote weight loss, a crucial aspect of diabetes management, given the link between obesity and insulin resistance.

Given its potential to transform the lives of individuals with type 2 diabetes, understanding the insurance coverage for Mounjaro is of utmost importance. This knowledge empowers patients to make informed decisions about their treatment options and financial planning.

Insurance Coverage for Mounjaro: An Overview

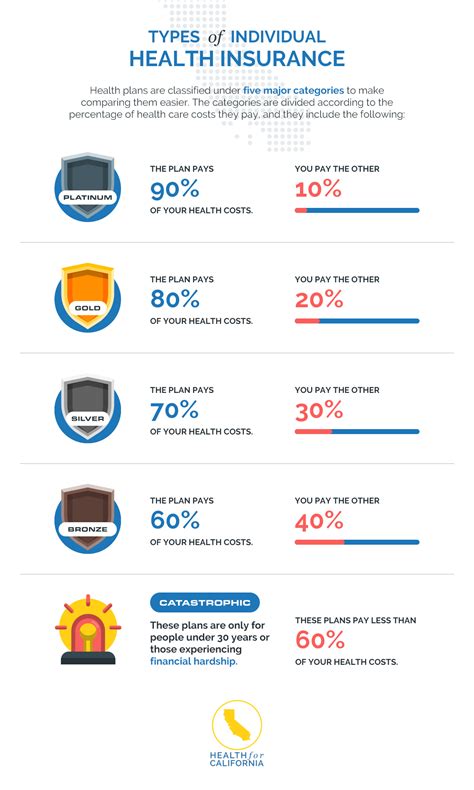

The landscape of insurance coverage for Mounjaro is intricate and varies depending on several factors, including the specific insurance plan, the patient’s location, and the prescription’s dosage and frequency.

Generally, Mounjaro is classified as a Tier 3 or Tier 4 medication on most insurance plans, indicating that it is a specialty or non-preferred drug. This classification often results in higher out-of-pocket costs for patients compared to traditional diabetes medications. However, the actual coverage and costs can differ significantly based on the patient's insurance provider and plan.

For instance, some insurance plans may cover Mounjaro at a certain percentage, typically ranging from 50% to 80%, while others may require patients to pay a fixed copay or coinsurance amount for each prescription. Additionally, certain plans may have a yearly or monthly limit on the number of prescriptions covered, which could impact long-term use.

Factors Influencing Insurance Coverage

Several factors play a crucial role in determining the insurance coverage for Mounjaro. These include:

- Insurance Provider and Plan: Different insurance companies and plans have varying coverage policies for specialty medications like Mounjaro. Some providers may offer more generous coverage, while others may have stricter guidelines.

- Dosage and Frequency: The prescribed dosage and frequency of Mounjaro can impact insurance coverage. Higher dosages or more frequent prescriptions may result in higher out-of-pocket costs for patients.

- Prior Authorization: Many insurance plans require prior authorization for specialty medications like Mounjaro. This means that the patient's doctor must provide documentation to the insurance company, justifying the need for the medication.

- Formulary Status: The formulary, or the list of drugs covered by an insurance plan, can vary. Some plans may include Mounjaro in their formulary, while others may not. In such cases, patients may need to explore alternative medications or appeal the decision.

- Location and State Laws: Insurance coverage can also vary based on the patient's location. Some states have specific laws or regulations regarding the coverage of diabetes medications, which can impact Mounjaro's coverage.

Understanding these factors is crucial for patients and healthcare providers to navigate the insurance coverage process effectively.

Real-World Examples of Insurance Coverage

To provide a clearer picture of insurance coverage for Mounjaro, let’s explore a few real-world examples:

| Insurance Provider | Plan Type | Coverage Details |

|---|---|---|

| Blue Cross Blue Shield | PPO Plan | Covers Mounjaro at 70% after a $50 copay. Annual limit of 12 prescriptions. |

| UnitedHealthcare | HMO Plan | Requires prior authorization. Covers Mounjaro at 60% with a $100 copay per prescription. |

| Aetna | EPO Plan | Includes Mounjaro in its formulary. Covers at 80% with a $75 copay for a 30-day supply. |

| Cigna | POS Plan | Covers Mounjaro at 50% after a $150 deductible. No annual limit on prescriptions. |

| Humana | PPO Plan | Excludes Mounjaro from its formulary. Patients may need to explore alternative medications or appeal the decision. |

These examples highlight the variability in insurance coverage for Mounjaro. It's essential for patients to carefully review their insurance plan's details and consult with their healthcare provider and insurance company to understand their specific coverage.

Navigating Insurance Challenges

Given the complexity of insurance coverage for Mounjaro, patients may encounter various challenges. Here are some strategies to navigate these challenges:

- Review Your Insurance Plan: Carefully review your insurance plan's summary of benefits and coverage. Understand the specifics of your plan, including any limitations, copays, or deductibles.

- Contact Your Insurance Provider: Reach out to your insurance company's customer service to discuss your coverage for Mounjaro. They can provide detailed information about your plan's coverage and any potential out-of-pocket costs.

- Prior Authorization Assistance: If your plan requires prior authorization, work closely with your healthcare provider to ensure all necessary documentation is provided. Many insurance companies offer assistance programs to guide patients through this process.

- Consider Cost-Saving Options: Explore cost-saving options such as manufacturer coupons, patient assistance programs, or generic alternatives. These can significantly reduce the out-of-pocket costs for Mounjaro.

- Appeal Denials: If your insurance company denies coverage for Mounjaro, consider appealing the decision. Provide additional medical information or documentation to support the need for the medication.

The Future of Insurance Coverage for Mounjaro

As Mounjaro continues to gain popularity and demonstrate its clinical effectiveness, its insurance coverage landscape is likely to evolve. Here are some potential future implications:

- Increased Coverage: With growing evidence of Mounjaro's benefits, insurance companies may be more inclined to offer broader coverage. This could lead to improved accessibility and reduced financial burden for patients.

- Formulary Changes: Insurance providers may review and update their formularies to include Mounjaro, especially as more clinical data becomes available. This could result in more favorable coverage terms for patients.

- Generic Alternatives: As with many medications, the development of generic versions of Mounjaro could drive down costs and increase accessibility. Patients may have more affordable options in the future.

- Patient Advocacy: Patient advocacy groups and organizations may play a pivotal role in influencing insurance coverage decisions. Their efforts could lead to more comprehensive coverage for Mounjaro and other diabetes medications.

Conclusion

The insurance coverage landscape for Mounjaro is complex and varies significantly depending on numerous factors. While challenges exist, patients can take proactive steps to navigate these hurdles and access this potentially life-changing medication. As the healthcare industry continues to evolve, the future of insurance coverage for Mounjaro looks promising, offering hope for improved accessibility and affordability.

How can I find out if Mounjaro is covered by my insurance plan?

+To determine if Mounjaro is covered by your insurance plan, review your insurance summary of benefits and coverage. Additionally, contact your insurance provider’s customer service to discuss your specific plan’s coverage details. They can provide information about copays, deductibles, and any limitations.

What if my insurance plan doesn’t cover Mounjaro or has limited coverage?

+If your insurance plan doesn’t cover Mounjaro or has limited coverage, consider exploring cost-saving options such as manufacturer coupons, patient assistance programs, or generic alternatives. Additionally, you can work with your healthcare provider to discuss alternative medications or appeal the insurance company’s decision.

Are there any patient assistance programs available for Mounjaro?

+Yes, there are patient assistance programs available for Mounjaro. These programs are designed to help patients who cannot afford the medication. You can contact the manufacturer or your healthcare provider for more information on these programs and how to apply.

Can I appeal my insurance company’s decision if they deny coverage for Mounjaro?

+Yes, you have the right to appeal your insurance company’s decision if they deny coverage for Mounjaro. Gather additional medical information or documentation to support the need for the medication and submit an appeal to your insurance provider. They will review your case and make a final decision.