Renters Insurance Price

Renters insurance is a vital protection for those who lease their homes, offering coverage for personal belongings and liability. The cost of this coverage varies greatly based on factors like location, the value of possessions, and the level of liability protection needed. Understanding these variables is key to finding the right policy at the best price. This comprehensive guide explores the various aspects influencing renters insurance prices, providing an in-depth analysis to help renters make informed decisions about their coverage.

Factors Influencing Renters Insurance Prices

Several key factors come into play when determining the cost of renters insurance. These include the location of the rental property, the value of personal belongings, the amount of liability coverage required, and additional optional coverages chosen. Each of these elements plays a significant role in tailoring the policy to individual needs and, consequently, influences the overall price.

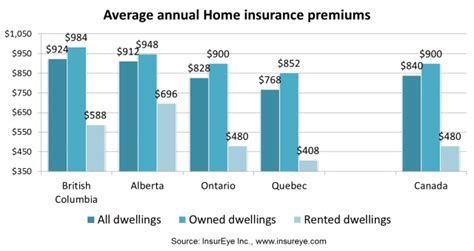

Location-Based Pricing

The geographical location of a rental property is a major determinant of renters insurance prices. This is due to the varying risks associated with different regions. For instance, areas prone to natural disasters like hurricanes, floods, or earthquakes typically command higher insurance premiums. Similarly, regions with high crime rates may also see elevated insurance costs due to the increased risk of property damage or theft.

| Region | Average Annual Premium |

|---|---|

| Southeast US | $150 - $250 |

| Northeast US | $200 - $300 |

| West Coast US | $250 - $350 |

The table above provides a rough estimate of average annual premiums in different regions of the United States. These prices can vary significantly within each region, depending on the specific location and other factors.

Value of Personal Belongings

The value of the items you own significantly impacts the cost of your renters insurance. Insurers typically offer coverage for personal property as a percentage of the overall liability coverage, often ranging from 50% to 70%. So, if you have valuable belongings, you may need to increase your liability coverage to ensure they’re adequately protected.

| Coverage Level | Estimated Cost |

|---|---|

| $10,000 in Personal Property Coverage | $100 - $150 annually |

| $20,000 in Personal Property Coverage | $150 - $200 annually |

| $30,000 in Personal Property Coverage | $200 - $250 annually |

The table above provides a general estimate of how the value of personal belongings can impact insurance costs. Keep in mind that these prices are influenced by other factors too, such as location and liability coverage.

Liability Coverage

Liability coverage is a critical aspect of renters insurance, as it protects you against claims for bodily injury or property damage that you or your guests may cause to others. The amount of liability coverage you choose will directly affect your insurance premium. Generally, higher liability limits result in higher premiums.

| Liability Coverage Level | Estimated Cost |

|---|---|

| $100,000 in Liability Coverage | $100 - $150 annually |

| $300,000 in Liability Coverage | $150 - $200 annually |

| $500,000 in Liability Coverage | $200 - $250 annually |

The table above gives a rough idea of how liability coverage levels can impact insurance costs. It's important to note that the actual cost will depend on various other factors as well.

Optional Coverages

Renters can also opt for additional coverages to tailor their insurance policy to their specific needs. These optional coverages can include things like personal property replacement cost coverage, which provides reimbursement for damaged or stolen items at their current replacement cost, rather than their depreciated value. Other optional coverages might include identity theft protection, valuables coverage for high-value items, or loss of use coverage to cover additional living expenses if your rental becomes uninhabitable due to a covered event.

These additional coverages can significantly increase the cost of your renters insurance, so it's important to carefully consider which options are necessary for your situation.

Tips for Finding Affordable Renters Insurance

Finding affordable renters insurance involves more than just understanding the factors that influence pricing. It requires a strategic approach to researching and comparing policies, as well as taking advantage of available discounts.

Research and Compare Policies

The insurance market is highly competitive, offering a wide range of policies with varying features and prices. Conduct thorough research and compare quotes from multiple insurers to find the best coverage at the most competitive price. Online insurance marketplaces can be a great starting point for this comparison process, providing easy access to quotes from various insurers.

Take Advantage of Discounts

Insurance companies often offer discounts to attract new customers and retain existing ones. Some common discounts include:

- Multi-Policy Discounts: If you bundle your renters insurance with other policies, such as auto insurance, you can often qualify for a discount.

- Safety Discounts: Installing security features like smoke detectors, fire extinguishers, or a home security system can sometimes lead to reduced premiums.

- Loyalty Discounts: Many insurers offer discounts to customers who've been with them for a certain period.

- Payment Method Discounts: Some insurers provide discounts for paying your premium in full rather than in installments.

It's worth exploring these discount options when shopping for renters insurance to see if you can lower your premium.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lead to a lower premium, as you’re taking on more financial responsibility in the event of a claim. However, it’s important to ensure that you choose a deductible amount that you can afford to pay if needed.

Understanding Renters Insurance Claims

Renters insurance is designed to provide financial protection in the event of various covered incidents. Understanding the claims process and the types of incidents typically covered can help you make more informed decisions about your insurance coverage.

The Claims Process

When making a claim, you’ll typically need to provide documentation to support your claim, such as police reports, photographs, or repair estimates. The insurance company will then assess the validity of the claim and determine the amount they’ll pay out, which will depend on the coverage limits and deductibles in your policy.

Types of Covered Incidents

Renters insurance typically covers a range of incidents, including:

- Fire: Damage caused by fire, including smoke damage, is often covered.

- Theft: Renters insurance can provide coverage for stolen items, although there may be limits on certain high-value items.

- Water Damage: Damage caused by plumbing issues or sudden water leaks is usually covered, but flood damage may require separate flood insurance.

- Vandalism: Damage caused by vandalism is typically covered, provided it's not the result of an excluded peril like an earthquake.

- Liability Claims: Renters insurance can provide coverage if someone is injured in your rental or their property is damaged, as long as you're not found to be at fault due to negligence.

The Importance of Renters Insurance

Renters insurance is an essential protection for anyone leasing a home. It provides financial security in the event of a range of covered incidents, helping to protect your personal belongings and offering liability protection. While the cost of renters insurance can vary significantly, it’s often a worthwhile investment to safeguard your financial well-being.

Peace of Mind

Having renters insurance can provide peace of mind, knowing that you’re protected in the event of an unexpected event. Whether it’s a fire, theft, or liability claim, renters insurance can help cover the cost of repairs, replacements, or legal fees.

Financial Protection

Renters insurance can also provide significant financial protection. For instance, if your rental becomes uninhabitable due to a covered event, loss of use coverage can help cover additional living expenses while you’re displaced. Similarly, liability coverage can protect you from large financial losses if you’re found legally responsible for an injury or property damage to others.

Asset Protection

Renters insurance can help protect your personal belongings, which is especially important for those with valuable items. It can also provide coverage for temporary living expenses if your rental becomes uninhabitable due to a covered incident.

Conclusion

Renters insurance is an essential coverage for anyone leasing a home. While the cost of this coverage can vary significantly, it’s often a worthwhile investment to safeguard your financial well-being. By understanding the factors that influence pricing and taking a strategic approach to shopping for insurance, you can find a policy that offers the right coverage at the right price.

What is the average cost of renters insurance?

+The average cost of renters insurance in the United States is around 150 to 300 annually. However, this can vary significantly based on factors such as location, the value of personal belongings, and the level of liability coverage required.

How can I lower my renters insurance premium?

+There are several ways to lower your renters insurance premium. You can compare quotes from multiple insurers, take advantage of available discounts (such as multi-policy or safety discounts), and consider increasing your deductible. Additionally, regularly reviewing and updating your coverage to match your current needs can help ensure you’re not paying for unnecessary coverage.

What should I do if I need to make a claim on my renters insurance policy?

+If you need to make a claim on your renters insurance policy, you should first contact your insurance company as soon as possible to report the incident. Gather any relevant documentation, such as photographs, repair estimates, or police reports, to support your claim. Your insurance company will then assess the claim and determine the payout based on your coverage limits and deductibles.