Car Insurance Quotes Nationwide

Car insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind to drivers worldwide. Obtaining accurate and affordable car insurance quotes is essential to ensuring you have the right coverage for your needs. In this comprehensive guide, we will delve into the world of car insurance quotes, exploring the factors that influence them, the steps to secure the best deals, and the importance of choosing the right provider. We will also provide real-world examples and industry insights to help you navigate the complex landscape of car insurance with confidence.

Understanding Car Insurance Quotes: A Comprehensive Overview

Car insurance quotes are tailored estimates provided by insurance companies, outlining the cost of coverage for a specific vehicle and driver. These quotes are based on various factors, including the driver’s age, driving record, location, and the type of vehicle being insured. Understanding these factors and how they impact quotes is crucial to making informed decisions about your car insurance.

Factors Influencing Car Insurance Quotes

Several key elements come into play when insurance companies calculate car insurance quotes. Here’s a breakdown of the primary factors:

- Driver’s Profile: Age, gender, and driving history significantly impact insurance rates. Younger drivers, especially males under 25, tend to face higher premiums due to their higher risk profile. Similarly, a history of accidents or traffic violations can lead to increased quotes.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary purpose (commuting, business, or pleasure), can affect your insurance quote. High-performance cars or vehicles prone to theft may incur higher premiums.

- Location and Mileage: The area where you reside and the average number of miles you drive annually influence your insurance costs. Urban areas often have higher premiums due to increased traffic and potential accident risks.

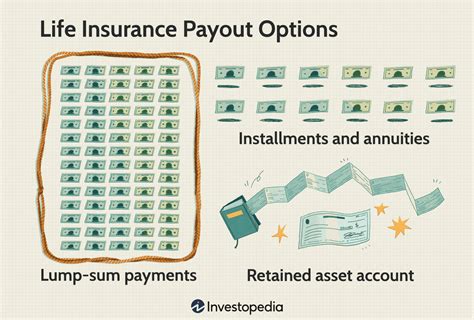

- Coverage Preferences: The level of coverage you choose, including liability, collision, comprehensive, and additional perks like rental car coverage, will impact your quote. Comprehensive coverage provides more protection but comes at a higher cost.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as safe driving records, multiple vehicles insured, or policy bundling with other insurance types (e.g., home and auto). Taking advantage of these discounts can significantly reduce your insurance costs.

To illustrate, let's consider the case of Sarah, a 30-year-old living in a suburban area. She drives a 2018 Toyota Camry primarily for commuting to work. With a clean driving record and no prior insurance claims, Sarah qualifies for a standard insurance package, including liability, collision, and comprehensive coverage. Her insurance company offers a 10% discount for safe driving and an additional 5% discount for bundling her auto insurance with her homeowner's policy. Based on these factors, Sarah receives a competitive insurance quote of $1,200 annually.

| Factor | Impact on Quote |

|---|---|

| Driver's Age | Younger drivers face higher premiums. |

| Vehicle Type | Sports cars or luxury vehicles may incur higher costs. |

| Location | Urban areas often have higher insurance rates. |

| Coverage Level | Comprehensive coverage offers more protection but costs more. |

| Discounts | Safe driving, policy bundling, and other discounts can reduce costs. |

Securing the Best Car Insurance Quotes: A Step-by-Step Guide

Navigating the car insurance landscape to find the best quotes can be daunting, but with a strategic approach, you can make the process more manageable. Here’s a step-by-step guide to help you secure competitive car insurance quotes:

Step 1: Research and Compare

Start by researching multiple insurance companies and comparing their offerings. Look for online reviews, customer testimonials, and financial stability ratings to assess the reliability and reputation of each provider. Consider factors like the range of coverage options, claims handling processes, and customer service quality.

Step 2: Gather Necessary Information

To obtain accurate quotes, you’ll need specific information about yourself and your vehicle. Gather the following details:

- Your personal information, including date of birth, gender, and driving history.

- Vehicle details such as make, model, year, and VIN (Vehicle Identification Number).

- The primary purpose of your vehicle (commuting, business, or pleasure) and estimated annual mileage.

- Any additional coverage preferences or discounts you’re eligible for.

Step 3: Use Online Quote Tools

Many insurance companies provide online quote tools that allow you to input your information and receive instant quotes. These tools are a convenient way to compare rates and coverage options quickly. However, keep in mind that these quotes are estimates and may not reflect the final cost.

Step 4: Contact Insurance Providers

While online quote tools are useful, it’s essential to speak directly with insurance providers to get a clearer picture of their offerings. Contact multiple companies and discuss your specific needs and circumstances. They can provide personalized advice and help you understand the fine print of their policies.

Step 5: Negotiate and Bundle

Don’t be afraid to negotiate with insurance providers. Explain your circumstances and any specific coverage requirements. Many companies are willing to offer discounts or adjust their quotes to retain customers. Additionally, consider bundling your auto insurance with other policies, such as homeowner’s or renter’s insurance, to potentially save more.

Step 6: Review and Analyze Quotes

Once you’ve gathered quotes from several providers, take the time to review and analyze them carefully. Compare not only the prices but also the coverage limits, deductibles, and any additional perks or exclusions. Ensure you understand the terms and conditions of each policy before making a decision.

The Importance of Choosing the Right Car Insurance Provider

Selecting the right car insurance provider is just as crucial as securing a competitive quote. A reputable insurance company offers more than just affordable rates; it provides reliable coverage, excellent customer service, and efficient claims handling. Here’s why choosing the right provider matters:

Financial Stability

Opting for a financially stable insurance company ensures that they will be able to pay out claims even in the event of a large-scale disaster or financial crisis. Financial ratings from independent agencies like AM Best or Standard & Poor’s can help assess an insurer’s financial health.

Customer Service and Claims Handling

Excellent customer service is a hallmark of a top-notch insurance provider. Look for companies with a strong track record of prompt and courteous service, especially when it comes to claims handling. Efficient claims processing can make a significant difference during stressful situations.

Policy Features and Coverage Options

Different drivers have unique needs, and a good insurance provider should offer a range of coverage options to cater to these needs. From basic liability coverage to more comprehensive packages, the right provider will offer customizable policies to fit your requirements.

Discounts and Rewards

Many insurance companies offer discounts and rewards programs to incentivize customer loyalty. These can include safe driving discounts, multi-policy discounts, or even loyalty bonuses for long-term customers. Such incentives can significantly reduce your insurance costs over time.

Digital Tools and Convenience

In today’s digital age, insurance providers that offer convenient online tools and mobile apps can enhance your overall experience. Features like policy management, claims reporting, and payment options can make insurance administration more accessible and less time-consuming.

Real-World Examples: Navigating Car Insurance Quotes

Let’s explore a few real-world scenarios to illustrate how different drivers can navigate the car insurance quote process and make informed decisions:

Scenario 1: Young Driver

John, a 22-year-old student, recently purchased his first car. With a limited budget and a need for comprehensive coverage, John focused on finding the best value. He researched online reviews and financial stability ratings, narrowing down his options to three reputable insurance providers. After comparing quotes and coverage details, he chose a provider offering a competitive rate with excellent customer service reviews.

Scenario 2: Experienced Driver

Emily, a 45-year-old professional, has an impeccable driving record and owns a mid-range sedan. She aims to secure the best deal without compromising on coverage. Emily contacted several insurance companies, negotiating her coverage needs and requesting personalized quotes. By comparing quotes and reviewing the fine print, she selected a provider offering comprehensive coverage at a reasonable price, with the added benefit of excellent claims handling.

Scenario 3: Family with Multiple Vehicles

The Smith family has two vehicles and is looking to save on insurance costs. They researched insurance providers offering discounts for multiple vehicles and found a company that provided a significant bundle discount. By consolidating their auto insurance policies, the Smiths not only saved money but also gained the convenience of having all their policies under one roof.

Future Implications and Industry Insights

The car insurance industry is constantly evolving, and keeping up with the latest trends and insights can help you make more informed decisions. Here are a few key points to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from onboard sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs offer discounts to drivers who exhibit safe driving habits, as monitored by telematics devices. This trend may incentivize safer driving practices and provide more personalized insurance rates.

Digital Transformation

The insurance industry is undergoing a digital transformation, with more providers offering online quote tools, mobile apps, and paperless documentation. This shift towards digital convenience can simplify the insurance process and make it more accessible to customers.

Regulatory Changes

Keep an eye on regulatory changes in the insurance industry, as these can impact the availability and cost of coverage. Changes in state laws or federal regulations may affect the types of coverage required or the pricing structures insurance companies can employ.

Industry Consolidation

The consolidation of insurance companies through mergers and acquisitions is an ongoing trend. This consolidation can lead to larger, more financially stable entities, but it may also reduce competition and limit customer choices. Stay informed about industry mergers to understand the landscape better.

How often should I review my car insurance policy and quotes?

+It’s recommended to review your car insurance policy and quotes annually or whenever your circumstances change significantly. Life events like getting married, buying a new car, or moving to a different location can impact your insurance needs and rates.

Can I negotiate my car insurance quote?

+Absolutely! Negotiating with insurance providers is a common practice. Explain your circumstances, any safety features on your vehicle, or your excellent driving record to potentially secure a better deal.

What factors can I control to lower my car insurance costs?

+You can control factors like your driving behavior (avoiding accidents and traffic violations), choosing a safe vehicle, and maintaining a good credit score. Additionally, consider raising your deductibles to lower your premiums, but be cautious, as higher deductibles mean you’ll pay more out of pocket in the event of a claim.