Best Life Policy Insurance

Securing the financial well-being of your loved ones is a priority for many individuals. One of the most effective ways to achieve this is by investing in a comprehensive life insurance policy. Life insurance provides a safety net, ensuring that your family's financial stability remains intact, even in unforeseen circumstances. In this comprehensive guide, we will delve into the intricacies of life insurance, exploring the various types, key considerations, and the benefits they offer. By the end, you'll have a clear understanding of how to choose the best life insurance policy to protect your family's future.

Understanding Life Insurance: A Comprehensive Overview

Life insurance is a contract between an individual and an insurance company, where the insurer agrees to pay a designated beneficiary a sum of money upon the insured individual’s death. This financial protection ensures that the policyholder’s loved ones can maintain their standard of living and cover essential expenses, such as funeral costs, outstanding debts, and ongoing living expenses.

The primary purpose of life insurance is to provide a financial safety net for those who depend on the policyholder's income. It offers peace of mind, knowing that even in the event of an untimely demise, their loved ones will be taken care of. Moreover, life insurance can be a valuable tool for estate planning, providing a tax-efficient way to pass on wealth to future generations.

Types of Life Insurance Policies: Navigating the Options

The life insurance market offers a range of policy types, each designed to meet specific needs and preferences. Understanding these options is crucial to making an informed decision.

Term Life Insurance

Term life insurance is a popular choice for individuals seeking affordable coverage for a specific period. This type of policy provides protection for a set term, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiary receives a lump-sum payout. Term life insurance is ideal for covering temporary needs, such as providing for children’s education or paying off a mortgage.

| Key Feature | Description |

|---|---|

| Affordability | Term life insurance is known for its cost-effectiveness, making it accessible to a wide range of individuals. |

| Coverage Period | Policies can be customized to match specific needs, whether it's covering children's education or paying off debts. |

| Renewability | Many term policies offer the option to renew, allowing individuals to extend coverage as their needs change. |

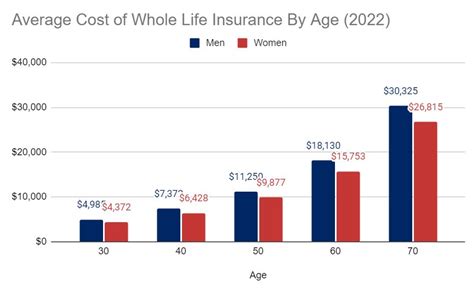

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire life. This type of policy offers a guaranteed death benefit and typically includes a cash value component that grows over time. The cash value can be borrowed against or withdrawn, providing flexibility in financial planning.

| Key Feature | Description |

|---|---|

| Lifetime Coverage | Whole life insurance ensures protection for the policyholder's entire life, regardless of age or health. |

| Cash Value | The policy builds cash value, offering a savings component that can be utilized during the policyholder's lifetime. |

| Stable Premiums | Whole life insurance policies often come with guaranteed, level premiums, providing long-term stability. |

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their coverage and premiums over time. It combines a death benefit with a cash value account, providing a customizable approach to life insurance. Policyholders can increase or decrease their coverage and premiums, making it adaptable to changing financial situations.

| Key Feature | Description |

|---|---|

| Flexibility | Universal life insurance offers the freedom to adjust coverage and premiums, making it suitable for evolving financial needs. |

| Cash Value | The policy builds cash value, which can be used for various financial goals, such as retirement planning. |

| Premium Payment Options | Policyholders can choose to pay premiums on a fixed schedule or make lump-sum payments when convenient. |

Variable Life Insurance

Variable life insurance is a type of permanent policy that allows policyholders to invest their premiums in different investment funds. The death benefit and cash value of the policy are directly tied to the performance of these funds. This type of policy offers the potential for higher returns but also carries more risk.

| Key Feature | Description |

|---|---|

| Investment Options | Policyholders can choose from a range of investment funds, allowing for customization based on risk tolerance and financial goals. |

| Growth Potential | Variable life insurance offers the opportunity for higher returns, making it attractive for those seeking growth in their life insurance policy. |

| Risk and Volatility | The policy's performance is tied to the chosen investment funds, which can fluctuate and carry market risks. |

Key Considerations: Finding the Right Policy

When selecting a life insurance policy, several factors come into play. It’s essential to consider your unique circumstances and financial goals to choose the best option.

Coverage Amount

Determining the appropriate coverage amount is crucial. Consider your current and future financial obligations, such as mortgage payments, children’s education expenses, and outstanding debts. Aim to choose a coverage amount that will adequately support your loved ones’ needs.

Premiums and Budget

Life insurance premiums can vary significantly depending on the type of policy, coverage amount, and your personal health and lifestyle factors. Assess your budget and choose a policy that aligns with your financial capabilities. Remember, it’s essential to strike a balance between affordability and adequate coverage.

Health and Lifestyle Factors

Your health and lifestyle can impact the cost and availability of life insurance. Individuals with pre-existing health conditions or high-risk hobbies may face higher premiums or even policy exclusions. It’s essential to be transparent about your health and lifestyle when applying for life insurance to ensure you receive an accurate quote.

Policy Features and Riders

Life insurance policies often come with optional riders or add-ons that can enhance your coverage. These riders can provide additional benefits, such as accelerated death benefits for terminal illnesses or waiver of premium if you become disabled. Understanding the available riders and their costs can help you tailor your policy to your specific needs.

The Benefits of Life Insurance: Protecting Your Legacy

Life insurance offers a multitude of benefits that extend beyond financial protection. It provides a sense of security and peace of mind, knowing that your loved ones will be taken care of, even in the face of unforeseen circumstances.

Financial Security for Loved Ones

The primary benefit of life insurance is ensuring the financial stability of your family or beneficiaries. The death benefit provided by the policy can cover immediate expenses, such as funeral costs, and provide long-term financial support for their daily needs and future goals.

Debt Repayment and Estate Planning

Life insurance proceeds can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This helps prevent financial strain on your loved ones and ensures that your estate is not burdened with significant debt. Additionally, life insurance can be a valuable tool for estate planning, providing a tax-efficient way to transfer wealth and assets to future generations.

Peace of Mind and Stress Reduction

Knowing that your loved ones are financially secure in the event of your untimely demise can bring immense peace of mind. Life insurance reduces the financial stress and burden that often accompanies the loss of a loved one, allowing your family to focus on healing and honoring your memory.

Conclusion: Empowering Your Future with Life Insurance

Investing in a life insurance policy is a responsible decision that demonstrates your commitment to the well-being of your loved ones. By understanding the different types of policies, key considerations, and the benefits they offer, you can make an informed choice that aligns with your unique circumstances.

Remember, life insurance is not a one-size-fits-all solution. It's essential to regularly review and update your policy as your life and financial situation evolve. Stay informed, seek professional advice when needed, and ensure that your life insurance coverage remains a solid foundation for your family's financial security.

How much life insurance coverage do I need?

+The coverage amount you need depends on your specific circumstances. Generally, experts recommend a coverage amount that is 10-15 times your annual income. However, this can vary based on your financial obligations, such as mortgage payments, children’s education expenses, and outstanding debts. It’s essential to assess your unique needs and consult with a financial advisor to determine the appropriate coverage amount.

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is affordable and suitable for covering temporary financial needs. Whole life insurance, on the other hand, provides coverage for the policyholder’s entire life and often includes a cash value component that grows over time. Whole life insurance is more expensive but offers lifetime protection and a savings element.

Can I change my life insurance policy once it’s in place?

+Yes, many life insurance policies offer the flexibility to make changes. You may be able to adjust your coverage amount, add or remove riders, or even switch to a different policy type. However, it’s important to note that any changes may impact your premiums and the overall cost of your policy. Consult with your insurance provider to understand your options and the potential implications.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on your policy type. For term life insurance, missing a payment may result in the policy lapsing, and you may need to reapply for coverage. Whole life and permanent policies often have a grace period, allowing you time to make the missed payment before the policy lapses. It’s crucial to stay up-to-date with your premium payments to maintain continuous coverage.

How can I find the best life insurance rates?

+To find the best life insurance rates, it’s essential to compare quotes from multiple insurance providers. Factors such as your age, health, lifestyle, and the type of policy you choose can impact the rates. Additionally, consider working with an independent insurance agent who can shop around for the best rates and help you understand the differences between policies. Shopping around and being transparent about your health and lifestyle can lead to more affordable options.