Can I Get Health Insurance Right Now

Health insurance is an essential aspect of financial planning and healthcare access. In many countries, the availability and accessibility of health insurance options vary, and understanding the process and requirements is crucial for individuals seeking coverage. This article aims to provide an in-depth analysis of the current landscape of health insurance and guide readers through the steps to obtain coverage promptly.

Understanding the Health Insurance Market

The health insurance market operates within a complex regulatory framework, and its dynamics can vary significantly between regions and countries. In most developed nations, a combination of public and private insurance systems exists, offering individuals a range of coverage options.

Public Health Insurance Systems

Many countries have established public health insurance programs that are often funded through taxes or mandatory contributions. These systems aim to provide universal coverage, ensuring that all citizens have access to essential healthcare services. Examples include the National Health Service (NHS) in the United Kingdom and Medicare in Australia.

To enroll in these public programs, individuals typically need to meet specific eligibility criteria. For instance, in the United States, Medicaid is a public insurance program for low-income individuals and families, while Medicare caters to the elderly and those with disabilities. Enrollment periods for such programs are often time-sensitive, and missing the deadline can result in delays in coverage.

Private Health Insurance Options

Alongside public systems, private health insurance companies offer a wide range of plans to cater to diverse needs and preferences. These plans can vary significantly in terms of coverage, premiums, and deductibles.

Private insurance is often more flexible, allowing individuals to choose their healthcare providers and customize their coverage. However, the cost of private insurance can be a significant factor, and understanding the benefits and limitations of different plans is crucial.

Assessing Your Health Insurance Needs

Before diving into the enrollment process, it’s essential to evaluate your specific healthcare needs and preferences. Consider the following factors:

- Coverage Requirements: Assess your current and potential future healthcare needs. Do you have any pre-existing conditions or require specialized treatments? Ensure that your insurance plan covers these adequately.

- Provider Network: Check if your preferred healthcare providers are within the insurance company’s network. Out-of-network care can result in higher out-of-pocket expenses.

- Premiums and Deductibles: Evaluate the cost of insurance plans, considering both monthly premiums and deductibles. Higher premiums might offer more comprehensive coverage, while lower premiums could come with higher deductibles.

- Benefit Packages: Review the benefit packages of different plans. Look for features like prescription drug coverage, mental health services, and coverage for preventive care.

- Flexibility and Customization: Some insurance plans offer more flexibility in terms of coverage limits and customization. Assess if you require such flexibility.

The Enrollment Process

The steps to enroll in health insurance can vary based on your location and the type of insurance you’re seeking. Here’s a general guide to help you through the process:

1. Research Insurance Options

Start by researching the available insurance plans in your area. Government websites often provide comprehensive information on public insurance programs and can direct you to private insurance marketplaces or brokers.

Compare the features, coverage, and costs of different plans to identify the ones that align with your needs and budget.

2. Check Eligibility

Determine your eligibility for the insurance plans you’re interested in. This step is crucial, especially for public insurance programs, as eligibility criteria can be stringent.

For private insurance, factors like age, health status, and pre-existing conditions can impact your eligibility and the cost of coverage.

3. Choose Your Plan

Once you’ve narrowed down your options, carefully review the details of each plan. Consider the trade-offs between premiums, deductibles, and coverage.

If you’re unsure, consult with an insurance broker or advisor who can provide expert guidance based on your specific circumstances.

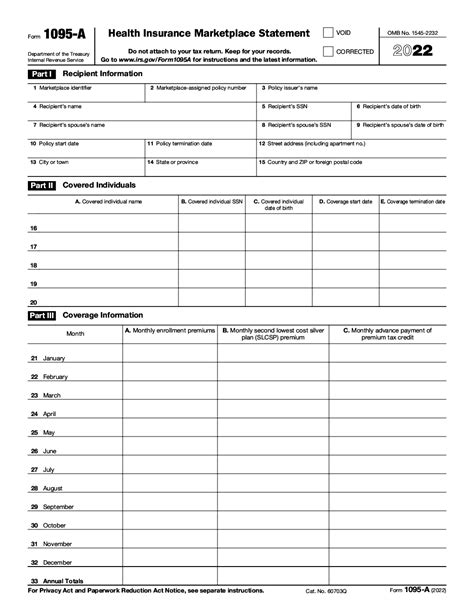

4. Complete the Application

Most insurance companies now offer online application processes, making it convenient to apply for coverage. Ensure you have all the necessary documentation, such as proof of identity, income, and any required medical records.

Double-check your application for accuracy, as errors can lead to delays or even rejection of your application.

5. Wait for Approval

After submitting your application, the insurance company will review your details and make a decision. This process can take anywhere from a few days to a few weeks, depending on the complexity of your application and the insurer’s workload.

If your application is approved, you’ll receive a confirmation, and your coverage will typically start on a specified date.

Special Considerations

When navigating the health insurance landscape, keep these additional factors in mind:

Open Enrollment Periods

Many insurance plans, particularly public programs, have designated open enrollment periods. During these periods, anyone can enroll in or switch insurance plans without requiring a qualifying event. Missing these periods can result in having to wait until the next open enrollment or experiencing a coverage gap.

Qualifying Life Events

Outside of open enrollment periods, you might be able to enroll in or change insurance plans if you experience a qualifying life event. These events can include marriage, divorce, birth or adoption of a child, loss of job-based coverage, or moving to a new area.

Each event has specific rules and timelines for enrollment, so stay informed and act promptly when these changes occur in your life.

Pre-Existing Condition Coverage

If you have a pre-existing medical condition, it’s crucial to understand how different insurance plans handle such conditions. Some plans may have waiting periods or exclusions for pre-existing conditions, while others might offer more comprehensive coverage.

Review the plan’s details carefully to ensure your condition is adequately covered, and consider seeking advice from healthcare professionals or patient advocacy groups.

The Future of Health Insurance

The health insurance landscape is continually evolving, influenced by technological advancements, policy changes, and shifting demographics. Here are some trends and developments to watch:

Digital Health Insurance Platforms

The rise of digital health insurance platforms is transforming the industry. These platforms offer users a more accessible and convenient way to compare plans, enroll, and manage their insurance. They also provide real-time updates on coverage and claim status.

Value-Based Care Models

The traditional fee-for-service model is being challenged by value-based care models, which focus on the quality and outcomes of care rather than the quantity of services provided. This shift aims to improve patient outcomes and reduce healthcare costs.

Telehealth and Remote Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Remote care offers patients convenient access to healthcare professionals, especially for non-emergency issues.

Preventive Care Emphasis

Many insurance companies are placing a greater emphasis on preventive care to reduce long-term healthcare costs and improve overall population health. This shift encourages individuals to prioritize regular check-ups, screenings, and healthy lifestyle choices.

Conclusion

Navigating the health insurance landscape can be complex, but with the right information and resources, obtaining coverage promptly is achievable. By understanding your needs, researching your options, and staying aware of the latest developments, you can make informed decisions about your healthcare coverage.

Remember, health insurance is an investment in your well-being, and choosing the right plan can provide peace of mind and access to essential healthcare services when you need them most.

What if I have a pre-existing condition? Can I still get health insurance?

+Yes, you can still obtain health insurance with a pre-existing condition. However, the coverage and terms may vary depending on your location and the insurance company. Some plans may have waiting periods or exclusions for certain conditions, while others might offer comprehensive coverage. It’s essential to review the plan’s details carefully and consult with healthcare professionals or patient advocacy groups for guidance.

Are there any financial assistance programs for health insurance?

+Yes, many countries and regions offer financial assistance programs to help individuals afford health insurance. These programs often provide subsidies or tax credits based on income and family size. Research government websites or consult with local healthcare authorities to understand the eligibility criteria and available options.

Can I switch health insurance plans during the year?

+In most cases, you can only switch health insurance plans during designated open enrollment periods or if you experience a qualifying life event. These events can include marriage, divorce, birth or adoption of a child, loss of job-based coverage, or moving to a new area. Each event has specific rules and timelines, so it’s crucial to stay informed and act promptly when these changes occur.

How can I compare health insurance plans effectively?

+Comparing health insurance plans can be done effectively by considering several key factors. These include coverage limits, provider networks, out-of-pocket costs (premiums and deductibles), benefit packages, and flexibility. Government websites often provide comparison tools or resources to help you evaluate different plans. Additionally, consulting with insurance brokers or advisors can provide personalized guidance based on your specific needs.