Rents Insurance

In today's rapidly evolving real estate market, it's crucial to be aware of all the tools and resources at our disposal. One such often-overlooked tool is Renters Insurance, a vital financial safeguard for tenants and an essential component of the rental ecosystem. With the ever-increasing cost of living and the risks associated with property damage and theft, understanding the benefits and coverage of Renters Insurance is more important than ever.

This comprehensive guide aims to demystify Renters Insurance, providing an in-depth analysis of its coverage, benefits, and potential drawbacks. We'll explore real-world scenarios where Renters Insurance has made a significant difference, discuss the varying policies and premiums available, and offer expert insights on how to choose the right coverage for your specific needs.

By the end of this article, you'll have a thorough understanding of Renters Insurance and its role in protecting your assets and financial well-being as a tenant. So, whether you're a first-time renter or a seasoned tenant, read on to discover the world of Renters Insurance and how it can work for you.

The Essential Guide to Renters Insurance: Unlocking Peace of Mind for Tenants

Renters Insurance is a type of property insurance that specifically caters to the needs of tenants. It provides coverage for personal property, liability, and additional living expenses in the event of a covered loss. While it may not be a legal requirement in all jurisdictions, Renters Insurance is an essential consideration for anyone living in a rented property, be it an apartment, house, or even a student residence.

Understanding the Coverage: What Renters Insurance Offers

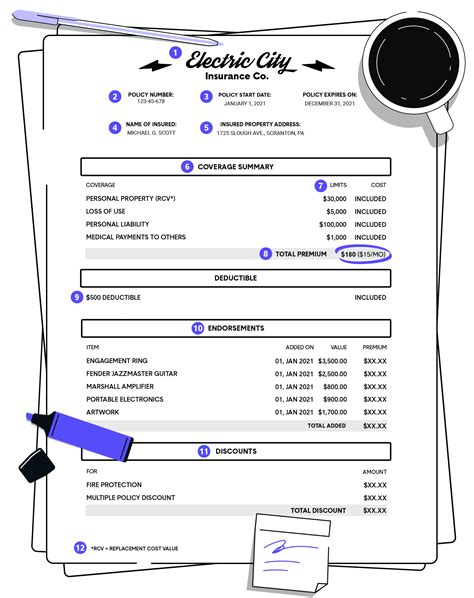

Renters Insurance is designed to protect your personal belongings and provide financial assistance in various situations. Here's a breakdown of the key coverages it typically offers:

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, clothing, and appliances, against damage or loss due to covered perils. Common perils include fire, lightning, windstorms, theft, and vandalism.

- Liability Coverage: Renters Insurance also includes liability protection, which can cover you if someone is injured on your rental property or if your actions cause damage to someone else's property. This coverage can provide financial assistance for legal fees and settlements.

- Additional Living Expenses: In the event of a covered loss that makes your rental property uninhabitable, this coverage helps with temporary living expenses, such as hotel stays or rental of temporary housing until your residence is repaired or rebuilt.

It's important to note that Renters Insurance typically does not cover certain types of losses, such as those caused by floods, earthquakes, or intentional acts. Additionally, it's essential to understand the limits and exclusions of your specific policy, as these can vary greatly between insurers and regions.

Real-Life Scenarios: The Impact of Renters Insurance

Renters Insurance has proven to be a vital safety net in numerous real-life situations. Consider these scenarios:

- Theft and Burglary: Imagine returning home to find your apartment has been broken into and valuable items like electronics and jewelry have been stolen. Renters Insurance can provide compensation for these losses, helping you replace your stolen items.

- Fire and Smoke Damage: A fire breaks out in your building, causing significant damage to your unit and rendering it uninhabitable. Renters Insurance can cover the cost of temporary housing and help replace damaged belongings, ensuring you have a place to stay and your possessions are replaced.

- Liability Claims: If a guest in your rental unit slips and falls, sustaining an injury, and decides to sue you, Renters Insurance's liability coverage can provide a financial safety net. It can cover legal fees and any settlements that may arise, protecting your personal finances.

These scenarios highlight the critical role Renters Insurance plays in safeguarding tenants against unexpected events and the potential financial devastation they can cause.

Choosing the Right Renters Insurance Policy: Factors to Consider

When selecting a Renters Insurance policy, several factors come into play. Here are some key considerations:

- Coverage Limits: Ensure the policy provides sufficient coverage for your belongings. Consider the replacement cost of your possessions and choose a policy with adequate limits to cover these costs.

- Additional Coverages: Some policies offer optional coverages, such as coverage for high-value items like jewelry or artwork, or protection against identity theft. Assess your needs and choose a policy that offers the right balance of coverage for your situation.

- Premiums and Deductibles: Renters Insurance policies can vary greatly in cost. Compare premiums between insurers and consider the deductibles. While lower premiums may be attractive, ensure the policy still provides the necessary coverage and that the deductibles are manageable in the event of a claim.

- Reputation and Customer Service: Research the insurer's reputation and customer service record. Look for reviews and ratings to ensure the company is reliable and provides good support in the event of a claim.

It's always a good idea to shop around and compare policies from different insurers to find the best fit for your needs and budget.

Performance Analysis: How Renters Insurance Measures Up

Renters Insurance has proven to be an invaluable asset for tenants, offering financial protection and peace of mind. Here's a performance analysis highlighting its key benefits:

| Benefit | Description |

|---|---|

| Comprehensive Coverage | Renters Insurance provides coverage for a wide range of perils, including fire, theft, and liability claims, ensuring tenants are protected against various unexpected events. |

| Affordable Premiums | Compared to other types of insurance, Renters Insurance typically offers relatively affordable premiums, making it an accessible financial safeguard for tenants. |

| Additional Living Expenses | In the event of a covered loss that renders the rental property uninhabitable, Renters Insurance provides coverage for temporary living expenses, ensuring tenants have a place to stay during repairs or rebuilding. |

| Liability Protection | Renters Insurance includes liability coverage, which can provide financial assistance if someone is injured on the rental property or if the tenant's actions cause damage to someone else's property. |

Expert Insights: Maximizing Your Renters Insurance Experience

As an industry expert, I'd like to share some additional insights to help you make the most of your Renters Insurance coverage:

- Understand Your Policy: Take the time to thoroughly read and understand your policy. Know what is covered, what is not, and the specific limits and deductibles. This knowledge will empower you to make informed decisions and take advantage of all the benefits your policy offers.

- Regularly Review and Update Your Policy: Life circumstances and your possessions can change over time. Regularly review your policy to ensure it still aligns with your needs. Update your policy whenever you acquire new or valuable items to ensure they are adequately covered.

- Maintain Proper Documentation: Keep detailed records of your possessions, including photos, receipts, and descriptions. This documentation will be invaluable in the event of a claim, making the claims process smoother and ensuring you receive fair compensation.

- Utilize Policy Benefits: Don't overlook the additional benefits your policy may offer, such as identity theft protection or assistance with legal fees. These benefits can provide added value and further protect your financial well-being.

By following these expert tips, you can maximize the benefits of your Renters Insurance and ensure you are fully protected in the event of a covered loss.

FAQ

What is the difference between Renters Insurance and Homeowners Insurance?

+Renters Insurance and Homeowners Insurance differ in their scope and purpose. Renters Insurance is designed for tenants and covers personal belongings and liability within a rented property. Homeowners Insurance, on the other hand, is for homeowners and covers the structure of the home as well as personal belongings and liability.

Is Renters Insurance mandatory?

+While Renters Insurance is not legally mandatory in all jurisdictions, it is highly recommended. It provides essential protection for your personal belongings and can save you from significant financial losses in the event of a covered incident.

How much does Renters Insurance typically cost?

+The cost of Renters Insurance can vary based on several factors, including the value of your possessions, the location of your rental property, and the level of coverage you choose. On average, Renters Insurance policies range from 150 to 300 per year, making it an affordable option for tenants.

Can I get Renters Insurance if I rent a room in a shared house or apartment?

+Absolutely! Renters Insurance is designed to protect tenants, regardless of whether they rent an entire property or just a room. It’s essential to have your own policy to protect your personal belongings and liability, even if the landlord has insurance for the building.

What should I do if I need to make a claim on my Renters Insurance policy?

+If you experience a covered loss, contact your insurance provider as soon as possible to initiate the claims process. Have your policy details and documentation of the loss ready. Your insurer will guide you through the process and help you receive the compensation you’re entitled to.