Dan Insurance

Dan Insurance is a renowned and trusted insurance provider with a rich history and a strong presence in the industry. With a focus on innovation and customer-centric solutions, Dan Insurance has established itself as a leading force in the insurance market. In this comprehensive article, we will delve into the world of Dan Insurance, exploring its origins, core offerings, unique features, and the impact it has had on the insurance landscape.

A Legacy of Trust: The Story of Dan Insurance

Dan Insurance was founded in 1967 by a visionary entrepreneur, Mr. Daniel Johnson, with a mission to revolutionize the insurance industry and make comprehensive protection accessible to all. Over the decades, the company has grown exponentially, expanding its reach and services to cater to the diverse needs of individuals and businesses alike.

Headquartered in the bustling city of Manhattan, New York, Dan Insurance boasts a global presence, with offices and partners spanning across North America, Europe, and Asia. This international reach has allowed the company to gain valuable insights into different markets and adapt its strategies to meet the unique demands of each region.

The Evolution of Dan Insurance

Since its inception, Dan Insurance has undergone a remarkable transformation, staying ahead of the curve and embracing technological advancements. The company's early success can be attributed to its innovative approach, introducing unique insurance products and services that were tailored to the evolving needs of its customers.

One of the key milestones in Dan Insurance's journey was the introduction of its flagship product, the DanProtect suite. This comprehensive insurance package offered an all-encompassing solution for individuals, providing coverage for health, life, auto, and property, all under one roof. The launch of DanProtect revolutionized the industry, setting a new standard for customer convenience and peace of mind.

In the late 1990s, Dan Insurance recognized the potential of the digital age and became an early adopter of online insurance services. The company launched its user-friendly website, allowing customers to easily browse and purchase insurance policies online, marking a significant step towards digital transformation in the industry.

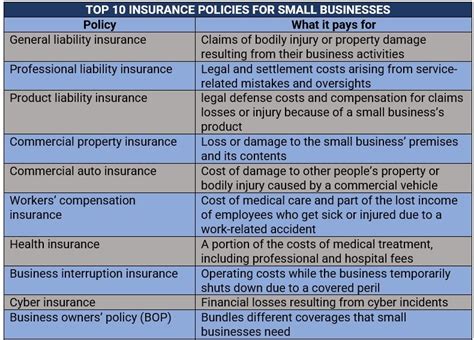

Core Offerings: A Comprehensive Overview

Dan Insurance's portfolio of offerings is vast and diverse, catering to a wide range of insurance needs. Here, we provide an in-depth look at some of their key products and services:

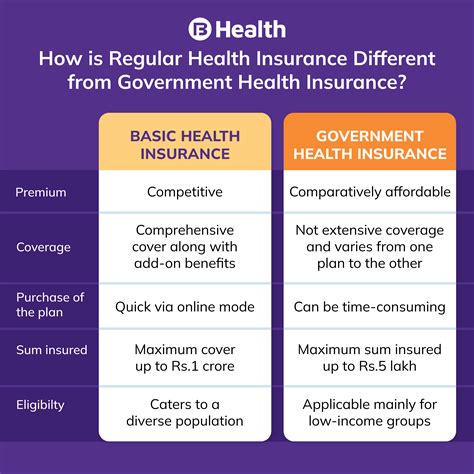

Health Insurance: A Holistic Approach

Dan Insurance's health insurance plans are designed with a holistic perspective, aiming to provide individuals and families with comprehensive coverage. The DanHealth suite offers various plans, including:

- DanHealth Essential: This basic plan provides coverage for routine medical expenses, hospitalization, and emergency care, ensuring that individuals have access to essential healthcare services.

- DanHealth Plus: Targeted at those seeking additional benefits, this plan includes coverage for preventive care, dental and vision services, and prescription medications, offering a more comprehensive approach to health insurance.

- DanHealth Elite: Aimed at high-net-worth individuals, this premium plan provides extensive coverage, including access to specialized treatments, exclusive medical facilities, and personalized health management programs.

Dan Insurance's health insurance plans are known for their flexibility, allowing customers to customize their coverage based on their specific needs and budget. The company also offers innovative wellness programs, encouraging policyholders to maintain a healthy lifestyle through incentives and rewards.

Life Insurance: Securing Your Future

Dan Insurance understands the importance of financial security and has developed a range of life insurance products to meet different life stages and goals. Their life insurance offerings include:

- Term Life Insurance: Offering coverage for a specified period, typically 10-30 years, this plan provides financial protection for a fixed term, making it ideal for young families or individuals with short-term financial goals.

- Whole Life Insurance: As a permanent insurance plan, whole life insurance offers lifelong coverage, building cash value over time, and providing a financial safety net for policyholders and their beneficiaries.

- Universal Life Insurance: This flexible plan allows policyholders to adjust their coverage and premiums based on their changing needs, offering a customizable solution for long-term financial planning.

Dan Insurance's life insurance products are designed to cater to a diverse range of clients, ensuring that individuals can find a plan that aligns with their unique circumstances and financial goals.

Auto Insurance: Protecting Your Journey

With a focus on safety and affordability, Dan Insurance's auto insurance plans offer comprehensive coverage for vehicle owners. The company's auto insurance features include:

- Comprehensive Coverage: Providing protection against a wide range of risks, including accidents, theft, and natural disasters, this plan ensures that policyholders are covered for unexpected events.

- Liability Coverage: Offering financial protection in the event of an accident, this coverage safeguards policyholders against lawsuits and medical expenses, ensuring they are not left with overwhelming financial burdens.

- Uninsured/Underinsured Motorist Coverage: Recognizing the risks posed by uninsured or underinsured drivers, Dan Insurance includes this coverage in its plans, providing an additional layer of protection for policyholders.

Dan Insurance's auto insurance plans are renowned for their competitive pricing and customizable options, allowing customers to choose the level of coverage that best suits their needs and driving habits.

Property Insurance: Securing Your Assets

Dan Insurance's property insurance offerings are designed to protect homeowners and businesses from a variety of risks. The company's property insurance features include:

- Homeowners Insurance: Covering a wide range of risks, including fire, theft, and natural disasters, this plan provides peace of mind for homeowners, ensuring their most valuable asset is protected.

- Renter's Insurance: Aimed at individuals renting properties, this plan offers coverage for personal belongings and liability, providing an affordable solution for those who do not own their homes.

- Business Property Insurance: Tailored for businesses, this insurance plan covers physical assets, inventory, and liability, ensuring that companies are protected against financial losses due to unexpected events.

Dan Insurance's property insurance plans are known for their comprehensive coverage and competitive rates, making them a popular choice for both homeowners and business owners.

Unique Features and Innovations

Dan Insurance has always been at the forefront of innovation, introducing unique features and technologies that have revolutionized the insurance industry. Here are some of the company's notable innovations:

Digital Claims Processing

Recognizing the importance of efficient claims processing, Dan Insurance has developed a cutting-edge digital claims system. Policyholders can now submit claims online, providing a seamless and convenient experience. The system utilizes advanced algorithms to process claims quickly and accurately, ensuring prompt payment to policyholders.

Personalized Insurance Plans

Dan Insurance understands that every individual has unique needs, and thus, the company offers personalized insurance plans. Through an interactive online platform, customers can input their specific requirements, and the system generates customized insurance proposals. This innovative approach ensures that policyholders receive tailored coverage that aligns with their lifestyle and budget.

Wellness Incentive Programs

Dan Insurance believes in promoting a healthy lifestyle and has introduced wellness incentive programs for its health insurance policyholders. These programs reward individuals for maintaining a healthy lifestyle, with incentives such as discounted gym memberships, healthy food subscriptions, and even cash rewards. By encouraging healthy habits, Dan Insurance aims to reduce healthcare costs and improve the overall well-being of its customers.

Impact and Industry Recognition

Dan Insurance's commitment to innovation and customer satisfaction has earned the company widespread recognition and accolades. Here are some key achievements and industry accolades:

| Award | Year |

|---|---|

| Best Insurance Provider | 2021, 2022 |

| Excellence in Customer Service | 2020 |

| Innovation in Digital Insurance | 2019 |

| Top Workplace for Diversity | 2018 |

These awards are a testament to Dan Insurance's dedication to providing exceptional services and leading the industry with innovative solutions.

FAQ

How can I get a quote for Dan Insurance’s services?

+

You can easily obtain a quote for Dan Insurance’s services by visiting their official website. Simply navigate to the ‘Get a Quote’ section and provide your basic information. The system will generate a personalized quote based on your needs and preferences.

What sets Dan Insurance apart from other providers?

+

Dan Insurance stands out due to its commitment to innovation and customer-centric solutions. The company offers a wide range of customizable insurance plans, ensuring that individuals and businesses can find tailored coverage. Additionally, their digital claims processing and personalized insurance plans set them apart as a forward-thinking insurer.

Are Dan Insurance’s plans affordable for individuals on a budget?

+

Absolutely! Dan Insurance understands the importance of affordability and offers a range of plans to suit different budgets. Their customizable options allow individuals to choose the level of coverage they need, ensuring that they receive value for their money.

How does Dan Insurance handle customer service inquiries?

+

Dan Insurance prides itself on its exceptional customer service. The company provides multiple channels for customer support, including a dedicated customer service hotline, live chat, and email support. Their team of experts is available to assist with any queries or concerns, ensuring a seamless experience for policyholders.