Ratings For Insurance Companies

In the complex world of insurance, ratings play a pivotal role in shaping consumer decisions and industry dynamics. These ratings, issued by independent agencies and organizations, serve as a critical tool for assessing the financial strength, stability, and performance of insurance companies. For consumers, understanding these ratings is essential to making informed choices about their insurance providers. This article delves into the intricacies of insurance company ratings, exploring the agencies that issue them, the factors considered in the rating process, and the implications for both consumers and the industry.

Understanding the Role of Insurance Company Ratings

Insurance company ratings are akin to report cards, offering a comprehensive evaluation of an insurer’s financial health and performance. These ratings provide a valuable benchmark for consumers, helping them assess the stability and reliability of their chosen insurance provider. Moreover, they serve as a critical tool for industry stakeholders, influencing investment decisions, regulatory oversight, and market competition.

The Rating Agencies

Several independent agencies are renowned for their expertise in evaluating insurance companies. These include AM Best, a global credit rating agency specializing in the insurance industry, and Standard & Poor’s, which provides ratings for various sectors, including insurance. Other notable players are Moody’s Investors Service and Fitch Ratings, both of which offer comprehensive assessments of financial institutions, including insurers.

Factors Considered in Ratings

The rating process is a meticulous undertaking, involving the examination of numerous financial metrics and indicators. Key factors include an insurer’s financial strength, measured by its ability to meet policyholder obligations, and its financial flexibility, assessed through its liquidity and capital reserves. Additionally, ratings agencies consider operating performance, including profitability and efficiency, and business profile, which encompasses market position and competitive advantage.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aaa (Highest Quality) |

Implications for Consumers and the Industry

Insurance company ratings have far-reaching implications for both consumers and the industry as a whole. For consumers, these ratings serve as a vital guide, helping them choose insurers with strong financial stability and performance. This ensures that policyholders’ interests are protected and that claims can be paid out in a timely manner.

Consumer Confidence and Choice

Ratings provide consumers with a level of confidence and assurance when selecting an insurance provider. A highly rated insurer indicates a lower risk of insolvency, ensuring that policyholders can rely on the company’s financial stability over the long term. This confidence is particularly critical in the context of long-term policies, such as life insurance or annuity products.

Market Competition and Innovation

In the insurance industry, ratings act as a driving force for competition and innovation. Highly rated insurers often enjoy a competitive edge, attracting more customers and potentially commanding a higher market share. This competition spurs innovation, as insurers strive to maintain or improve their ratings by enhancing their financial stability, operational efficiency, and customer service.

Regulatory Oversight and Consumer Protection

Insurance company ratings also play a crucial role in regulatory oversight and consumer protection. Regulatory bodies often use these ratings as a tool to monitor the financial health of insurers and ensure compliance with industry standards. In some cases, regulators may intervene or take action if an insurer’s rating drops below a certain threshold, protecting consumers from potential financial harm.

The Future of Insurance Company Ratings

As the insurance industry continues to evolve, so too will the landscape of ratings and assessments. The increasing focus on technology, data analytics, and consumer-centric models is likely to shape the future of insurance company ratings. Here’s a glimpse into the potential directions and trends:

Embracing Technology and Data Analytics

The insurance industry is undergoing a digital transformation, with technology playing an increasingly central role. Rating agencies are likely to leverage advanced data analytics and machine learning to enhance their evaluation processes. This could involve more sophisticated risk modeling, real-time data analysis, and the integration of alternative data sources, such as social media and IoT devices, to provide a more comprehensive assessment of insurers’ financial health.

Focus on Consumer Experience and Satisfaction

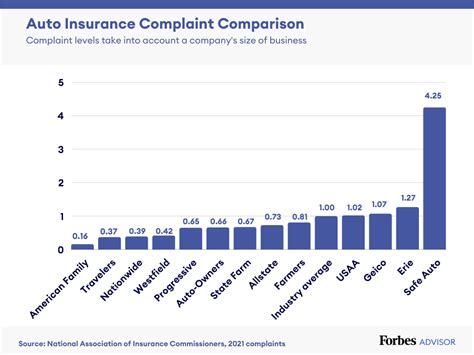

In an increasingly competitive market, consumer experience and satisfaction are becoming key differentiators. Rating agencies may begin to incorporate metrics and feedback related to customer service, claims handling, and overall consumer satisfaction into their assessments. This shift could lead to a more holistic view of an insurer’s performance, taking into account not just financial metrics but also the quality of the customer experience.

Adapting to Regulatory Changes

The insurance industry is subject to ongoing regulatory changes and reforms. Rating agencies will need to adapt their methodologies to align with evolving regulatory standards and expectations. This could involve incorporating new risk factors, such as climate-related risks or cyber threats, into their evaluations to ensure that insurers are adequately prepared for emerging challenges.

Collaborative Efforts and Standardization

To enhance consistency and transparency, there may be increased collaboration and standardization efforts among rating agencies. This could involve the development of common frameworks, methodologies, and data standards to ensure that ratings are comparable across different agencies. Such initiatives could foster greater trust and confidence in the ratings process among consumers and industry stakeholders.

Conclusion

Insurance company ratings are a vital tool for navigating the complex landscape of the insurance industry. They provide consumers with the information they need to make informed choices, ensure the financial stability of their chosen insurers, and protect their interests. For the industry, ratings serve as a driving force for competition, innovation, and regulatory compliance. As the insurance sector continues to evolve, the future of ratings looks set to embrace technology, data analytics, and a more holistic view of insurer performance, ensuring that ratings remain a trusted guide for consumers and a catalyst for industry progress.

How often are insurance company ratings updated?

+

Insurance company ratings are typically updated on an annual basis. However, some rating agencies may conduct reviews more frequently, especially if there are significant changes in an insurer’s financial performance or market position. These updates ensure that the ratings reflect the most current financial health and stability of the insurance companies.

What happens if an insurance company’s rating is downgraded?

+

A downgrade in an insurance company’s rating can have significant implications. It may lead to increased scrutiny from regulatory bodies, who may require the insurer to take corrective actions to improve its financial stability. Additionally, a downgraded rating can affect an insurer’s ability to attract new business and maintain customer confidence. In severe cases, a low rating may even prompt regulatory intervention or even the insurer’s exit from the market.

How can consumers access insurance company ratings?

+

Consumers can access insurance company ratings through various channels. Many rating agencies provide online platforms where users can search for and compare ratings. Additionally, insurance brokers and financial advisors often have access to these ratings and can provide guidance to consumers. Some insurers also publish their ratings on their websites as a sign of transparency and to build consumer trust.